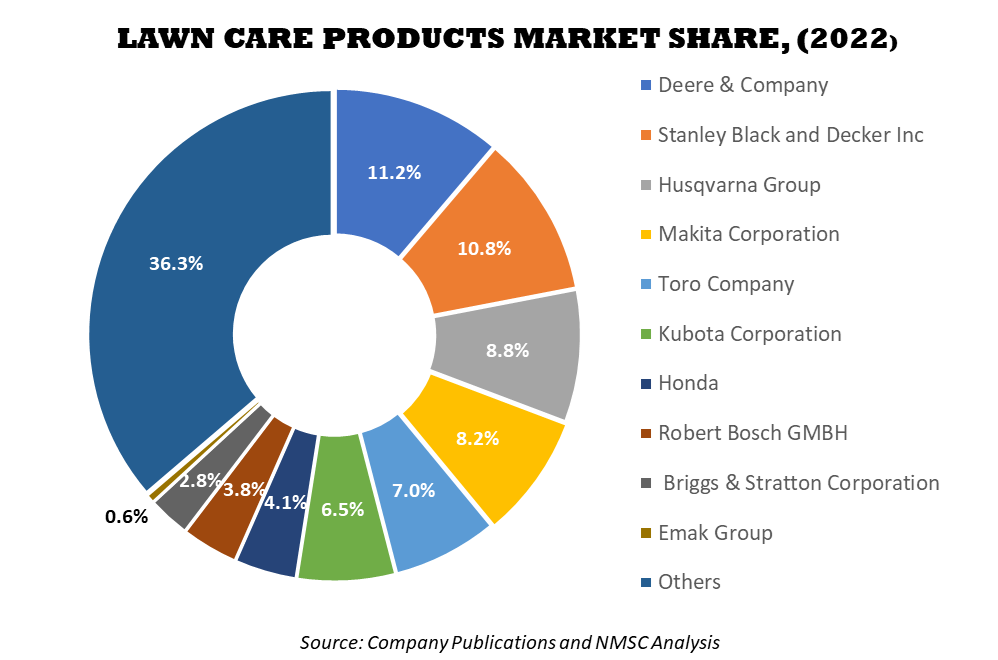

Deere and Company Leading The Lawn Care Products Market With Around 11.2 percent Share- Know The Reason Why

15-Feb-2025

According to Next Move Strategy Consulting report the global Lawn Care Products Market is expected to surge from USD 44.17 billion in 2023 to USD 66.96 billion by 2030, driven by the rising urbanization.

LAWN CARE PRODUCTS MARKET OVERVIEW

The lawn care products market is a dynamic and growing industry, driven by increasing consumer demand for well-maintained outdoor spaces. This market encompasses a wide range of products including lawn mowers, trimmers, fertilizers, and pest control solutions. Innovations in product efficiency, eco-friendliness, and user-friendliness are continuously being introduced. The market growth is fuelled by rising urbanization, increasing disposable incomes, and a growing trend towards home improvement and gardening activities.

Additionally, advancements in battery technology and the development of robotic lawn mowers are further propelling market expansion. With a strong focus on sustainability and smart technology, the lawn care products market is poised for significant growth in the coming years.

Within this growing market, several leading companies stand out for their innovation, market reach, and commitment to sustainability. Among them Deere & Company, Stanley Black and Decker Inc., Husqvarna Group, Makita Corporation, and Toro Company are prominent players, each contributing significantly to the industry's evolution.

For the latest market share analysis and in-depth lawn care products industry insights, you can reach out to us here

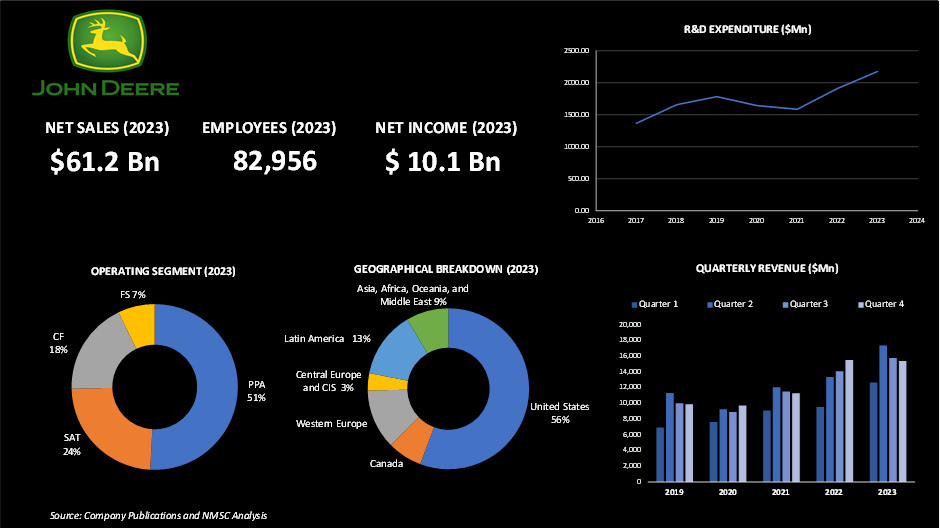

HIGHLIGTS OF DEERE & COMPANY

Deere & Company, a leader in the production of agricultural, turf, construction, and forestry equipment, reported an impressive revenue of USD 61.2 billion and a net income of USD 10.1 billion in 2023. Deere & Company operates through various segments, including production and precision agriculture (PPA), small agriculture and turf (SAT), construction and forestry (CF), and financial services. John Deere Financial plays a critical role in providing financing for equipment, parts, services, and other inputs essential for customers' operations, enhancing the overall customer experience and market reach.

In recent years, Deere & Company has consistently increased its research and development (R&D) expenditure, reflecting its commitment to innovation and product development. This ongoing investment in R&D has led to advancements in its lawn care products, ensuring they meet the evolving needs of customers and maintain high standards of performance and reliability.

Despite the strong financial performance, Deere & Company anticipates a decline in large agricultural equipment sales in North America, Europe, and South America in 2024. This projection indicates potential challenges ahead, but the company's diversified operations and strategic focus on innovation provide a solid foundation for continued growth and resilience.

In March 2022, Deere & Company acquired full ownership of three former Deere-Hitachi joint venture factories and established new licensing and supply agreements with Hitachi. This strategic move has strengthened Deere's manufacturing capabilities and supply chain, further bolstering its position in the global market. Deere & Company's commitment to innovation, strong financial performance, and strategic acquisitions position it well in the lawn care products market, ensuring continued leadership and growth in the industry.

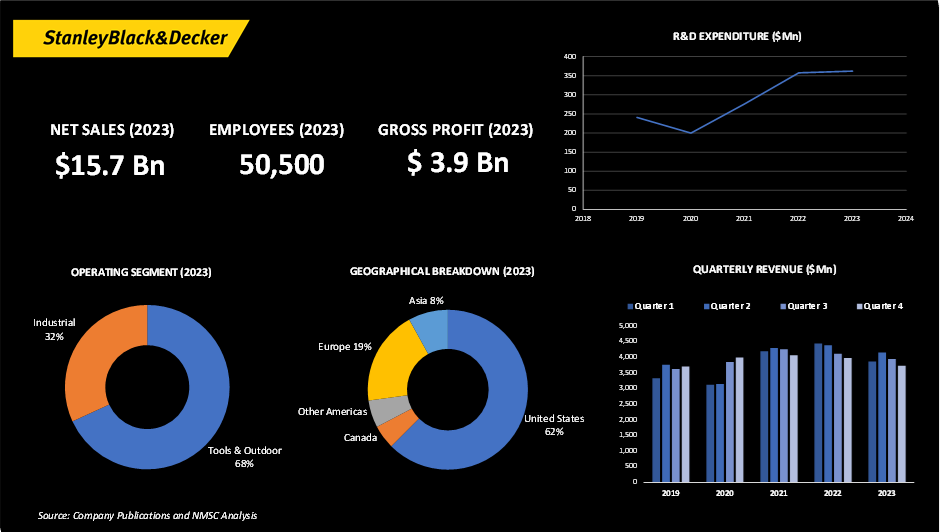

HIGHLIGTS OF STANLEY BLACK AND DECKER INC..

Stanley Black & Decker Inc., a renowned player in the tools and storage, industrial, and security sectors, has a significant presence in the lawn care products market. In 2023, the company reported revenue of USD 15.7 billion and a gross profit of USD 3.9 billion. Despite these strong financial figures, the net sales in 2023 were USD 15.781 billion, down 7% from USD 16.947 billion in 2022. This decline was primarily due to a 7% decrease in volume and a 1% decrease from the Oil & Gas divestiture, which offset a 1% increase in price.

Stanley Black & Decker's gross profit in 2023 was USD 3.933 billion, representing 24.9% of net sales, compared to USD 4.284 billion or 25.3% of net sales in 2022. This slight decrease in gross profit margin reflects the challenges faced by the company in maintaining its profitability amidst fluctuating market conditions.

The company's Outdoor product line is a critical component of its operations, offering a wide range of corded and cordless electric lawn and garden products. These include hedge trimmers, string trimmers, lawn mowers, pressure washers, and related accessories. Additionally, Stanley Black & Decker provides gas-powered lawn and garden products, such as lawn tractors, zero-turn ride-on mowers, walk-behind mowers, snow blowers, residential robotic mowers, utility terrain vehicles (UTVs), handheld outdoor power equipment, garden tools, and various parts and accessories. These products are marketed to both professionals and consumers under well-known brand names such as Dewalt, Craftsman, Cub Cadet, Black+Decker, and Hustler.

The diverse range of products and strong brand portfolio positions Stanley Black & Decker well within the lawn care products market, catering to a broad spectrum of customer needs from DIY enthusiasts to professional landscapers. The company's continued focus on innovation and quality ensures its products remain competitive and relevant in an evolving market landscape.

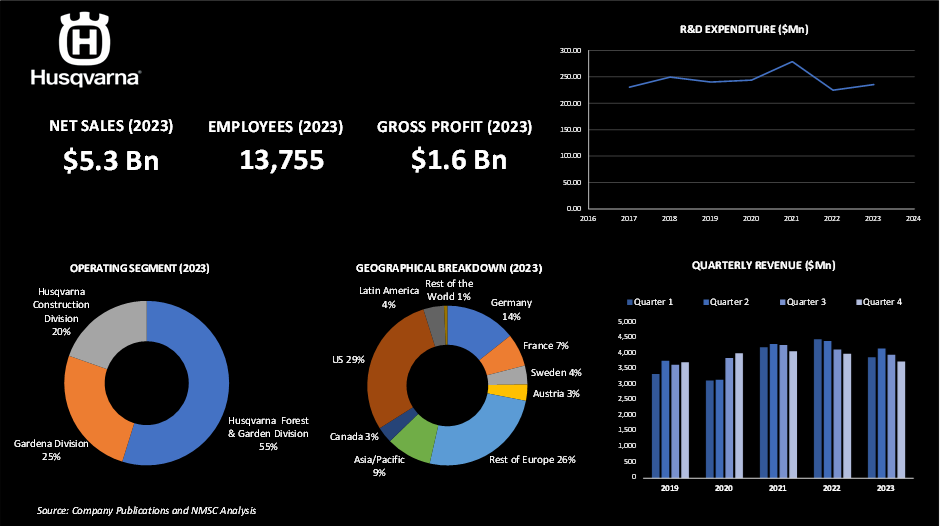

HIGHLIGTS OF HUSQVARNA GROUP

Husqvarna Group, a global company specializing in forest, lawn, and garden products and services, reported a revenue of USD 5.3 billion in 2023. Net sales saw a slight decrease of 1%, amounting to USD 5,304 million, influenced by a 5% positive contribution from changes in exchange rates and a -1% impact from planned exits.

Husqvarna Group caters to around 25,000 dealers and leading retailers worldwide, as well as selling directly to end users. The company's extensive product line includes forest and garden tools, where the Husqvarna Forest & Garden and Gardena divisions are particularly active. The market for these products is valued at approximately USD 24.9 billion. Beyond the current market size, there is significant untapped potential in converting professional lawn mowing from a manual task to an automated process, estimated to be worth USD 9.96 billion.

Europe and North America are the largest markets for Husqvarna Group, accounting for about 85% of the global market value. These regions play a crucial role in the company's sales, reflecting the high demand for Husqvarna's products and services.

Forest and garden products and services represent around 85% of Husqvarna Group's total sales, characterized by strong seasonality due to end-user buying patterns. The company continues to innovate and expand its product offerings to meet the evolving needs of its customers.

One of Husqvarna Group's notable innovations is the Automower NERA, a range of robotic mowers featuring satellite-based technology. These mowers are controlled through the Automower Connect app, allowing users to establish virtual boundaries, define flexible work areas, and set temporary restricted zones for efficient and customizable lawn maintenance. For the 2024 gardening season, the Automower NERA range has been expanded with additional models, further enhancing Husqvarna's position in the market.

Husqvarna Group's commitment to innovation and quality ensures that it remains a key player in the lawn care products market, offering advanced solutions that cater to both professional and consumer needs. The company's strong presence in major markets and its focus on expanding its product range underscore its leadership in the industry.

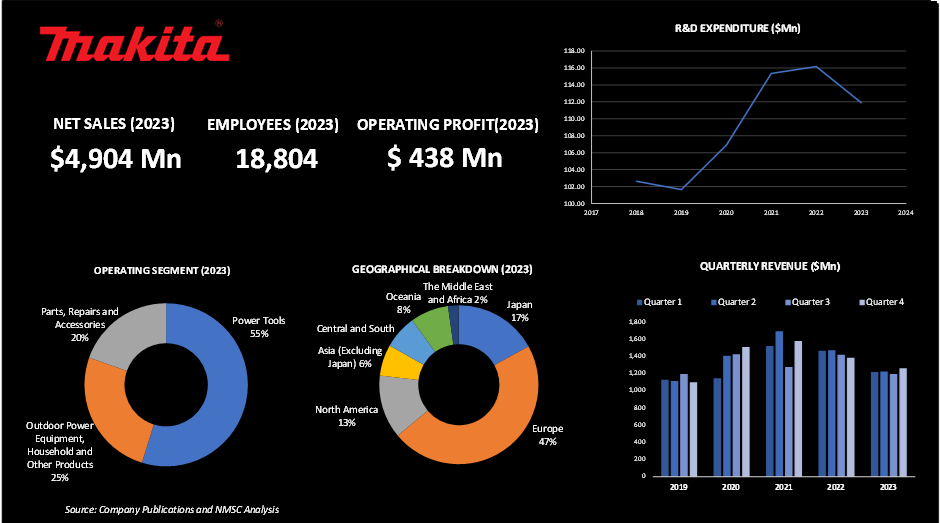

HIGHLIGTS OF MAKITA CORPORATION

Makita Corporation, a renowned manufacturer of power tools and outdoor power equipment, has established a significant presence in the lawn care products market. In 2023, Makita generated a revenue of USD 108.5 million from its lawn care products segment, marking a 16% increase from the previous year. The company's operating profit for this segment stood at USD 17.1 million, showcasing its strong financial performance despite broader market challenges.

For the fiscal year, Makita Corporation reported a consolidated revenue of USD 4,903.75 million, reflecting a 3.0% decline year over year. This decrease was primarily attributed to weak demand for housing caused by monetary tightening in overseas markets and restrained investment in the building and construction sectors. However, the company achieved a significant improvement in operating profit, which soared by 134.3% to USD 437.66 million, driven by reduced transportation costs and favourable foreign exchange rates.

Amid these market conditions, Makita has strategically focused on expanding its lineup of cordless products. The introduction of the durable high-power, long-life “40Vmax Lithium-ion Battery” (XGT) series has been a key initiative, featuring advanced power tools and outdoor power equipment. The company's lawn care product range has been enhanced with innovative solutions such as robotic lawnmowers and cordless sweepers, positioning Makita as a leader in the lawn care market. These products cater to the growing demand for efficient, eco-friendly, and easy-to-use lawn maintenance solutions, solidifying Makita's commitment to driving growth through innovation and customer-centric product development.

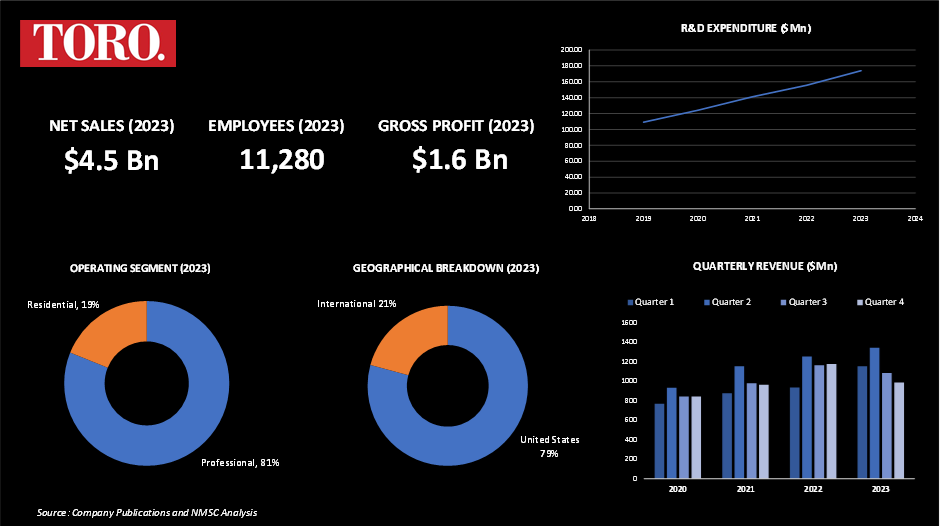

HIGHLIGTS OF TORO COMPANY

The Toro Company, a prominent provider of outdoor solutions, reported robust financial performance in its 2023 annual report. With net sales of USD 4.55 billion, up 0.2% from 2022, and adjusted net earnings of USD 443.5 million, up 0.9% from the previous year, Toro showcased its resilience and ability to navigate a dynamic market. Adjusted diluted EPS was USD 4.21, reflecting a 0.2% increase, while cash dividends paid were USD 142 million, maintaining the same growth rate. Additionally, the company executed share repurchases worth USD 60 million.

Toro experienced strong performance across its professional segments, including underground/specialty construction and golf/grounds. However, the company faced headwinds in homeowner demand for residential and professional lawn care products during the second half of the year. To enhance operational efficiency, Toro launched the "Amplifying Maximum Productivity" (AMP) initiative, aiming for over USD 100 million in annual cost savings by 2027.

The company also welcomed new strategic leaders in the roles of VP of strategy/sustainability and general counsel, and expanded its partnerships by becoming the official provider for prestigious golf events such as the Ryder Cup and Solheim Cup.Looking ahead, Toro is confident in its ability to capitalize on growth opportunities within the industry. The company remains focused on accelerating profitable growth, driving productivity and operational excellence, and empowering its people. Toro expects continued strength in the underground/specialty construction, golf, and grounds markets while monitoring the residential/commercial irrigation and snow/ice management markets.

Despite challenges, Toro demonstrated agility and resilience, positioning itself for long-term success through strategic investments, cost savings, and leadership additions. The company's diverse product offerings and commitment to innovation make it a key player in the lawn care products market, serving both professional and residential needs.

Have questions? Inquire before purchasing the full report

SUMMARY OF LAWN CARE PRODUCTS INDUSTRY

The lawn care product industry is a dynamic and growing sector, driven by increasing consumer demand for efficient, innovative, and environmentally friendly solutions. The industry encompasses a broad range of products including lawn mowers, trimmers, blowers, and other essential equipment for maintaining lawns and gardens.

Key trends influencing the market include the adoption of cordless and electric tools, advancements in automation and robotics, and a rising emphasis on sustainability. Consumers are looking for products that offer ease of use, durability, and advanced features such as smart connectivity and battery efficiency. The lawn care products industry is poised for continued growth, fuelled by technological advancements and increasing consumer awareness of environmental issues.

About the author

Saurav Sarkar is an accomplished researcher and writer with over three years of experience in conducting thorough research. His passion for exploring various subjects and delving into in-depth analysis has led him to develop a keen understanding of research nuances. He remains committed to staying current with the latest market trends, recognizing their impact on businesses and society. The author can be reached info@nextmsc.com.

Saurav Sarkar is an accomplished researcher and writer with over three years of experience in conducting thorough research. His passion for exploring various subjects and delving into in-depth analysis has led him to develop a keen understanding of research nuances. He remains committed to staying current with the latest market trends, recognizing their impact on businesses and society. The author can be reached info@nextmsc.com.

Add Comment

Related Blogs

Deep Dive into Germany's Intralogistics Market: TAM, SAM, VAM Insights

Introduction The Germany intralogistics market is poised...

Revolutionizing Logistics: The Automated Truck/Trailer Loading System Market's Latest Trends and Developments

Introduction The global logistics industry is in the mids...

Smart Building Solutions: Transforming Commercial HVAC Systems with IoT

In today's dynamic commercial real estate landscape, the...