Why Apple & Samsung Dominate 25% of Mobile Accessories

Published: 2025-09-11

The NMSC analysis shows that the mobile phone accessories market, valued at USD 302.59 billion in 2023, is anticipated to grow substantially, reaching USD 426.78 billion by 2030. This projected growth is primarily attributed to the increasing adoption of smartphones, which has become integral to modern communication and internet use. As consumers continue to rely heavily on mobile devices for various functions, from social networking to business communication, the demand for complementary accessories such as cases, chargers, and headphones is expected to rise significantly. This trend underscores the expanding role of mobile technology in daily life and the corresponding need for a diverse range of accessories to enhance and personalize user experience.

Mobile Phone Accessories Market Overview

The mobile phone accessories market is a dynamic and rapidly evolving sector that supports the functionality, protection, and personalization of smartphones and other mobile devices. It includes a wide array of products such as protective cases, screen protectors, chargers, power banks, headphones, and stylus pens. The market's growth is fueled by the continuous advancements in smartphone technology and the increasing consumer desire for customized and enhanced mobile experiences. Protective accessories such as cases and screen protectors are essential for safeguarding devices from damage and wear, while chargers and power banks address the need for extended battery life and convenience. Audio accessories, including wireless and wired headphones, cater to the demand for high-quality sound and hands-free communication. Additionally, products such as smartwatches and fitness trackers extend the functionality of mobile devices by integrating with them for health monitoring and notifications. The market is characterized by rapid innovation, with manufacturers regularly introducing new products that incorporate the latest technologies, such as wireless charging, noise-cancelling capabilities, and enhanced durability. Consumer trends, including the shift towards wireless accessories and the growing popularity of personalized and fashion-forward designs, drive the development of new accessory types and features. Key players operating in mobile phone accessories industry includes Samsung Electronics Co. Ltd., Apple Inc., Sony Corporation, Bose Corporation, Imagine Marketing, Skullcandy, Xiaomi Corporation, Huawei Technologies Co., Ltd., Amazon.com Inc, and Google LLC each contributing significantly to the industry's evolution.

For the latest market share analysis and in-depth mobile phone accessories industry insights, you can reach out to us at: https://www.nextmsc.com/mobile-phone-accessories-market/request-sample

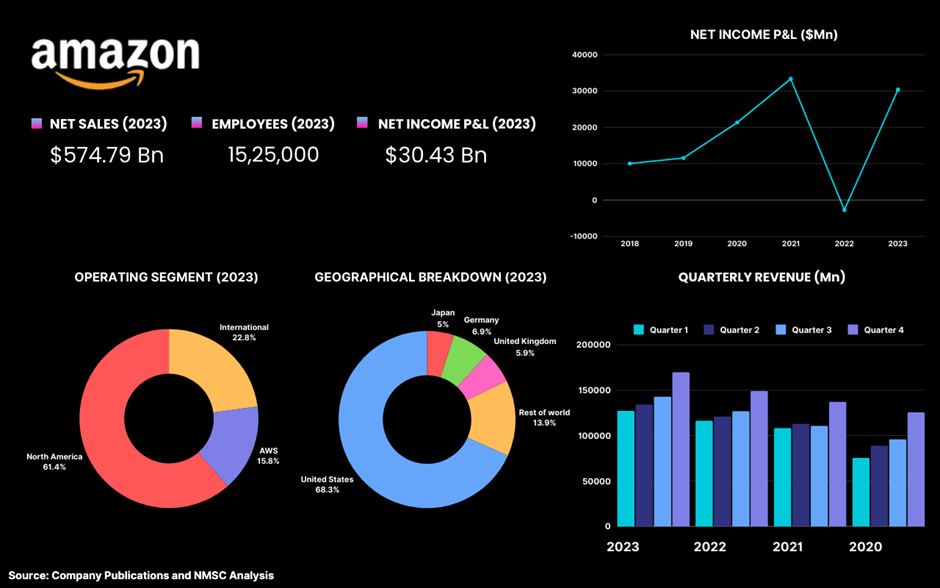

Highlights Of Amazon.com Inc

Amazon.com Inc., headquartered in Seattle, Washington, is one of the global leaders in the mobile phone accessories market, leveraging its vast e-commerce infrastructure and comprehensive logistics network to deliver an extensive range of products. In 2023, Amazon achieved a revenue of USD 574.79 billion, marking an impressive 11.8% increase from USD 513.99 billion in 2022. This significant revenue growth underscores Amazon's strong performance and its continued expansion across various market segments, including mobile phone accessories, where it offers a diverse portfolio encompassing chargers, cases, screen protectors, and other essential gadgets.

The company's financial performance in 2023 also saw a remarkable turnaround, with a net income of approximately USD 30.43 billion, a substantial recovery from the loss of around USD 2.72 billion recorded in 2022. This recovery highlights Amazon's effective strategies in managing its operations and optimizing its market presence. In terms of operational performance, Amazon's revenue was segmented into North America, contributing USD 315.88 billion, International markets, which generated USD 118.00 billion, and Amazon Web Services (AWS), which added USD 80.09 billion. These segments reflect Amazon's broad business scope and its capacity to leverage multiple revenue streams.

Geographically, Amazon's revenue is distributed with substantial contributions from the United States, totalling USD 395.64 billion. Other key markets include Germany with USD 37.59 billion, the United Kingdom at USD 33.60 billion, and Japan at USD 26.02 billion. The remaining regions across the world collectively generated USD 81.97 billion, demonstrating Amazon's global reach and market penetration.

With a workforce of approximately 1,525,000 employees, Amazon continues to expand its operations and enhance its service offerings. The company's strategic investments in technology and infrastructure, combined with its expansive product range and innovative solutions, reinforce its dominant position in the mobile phone accessories market and its broader business domains.

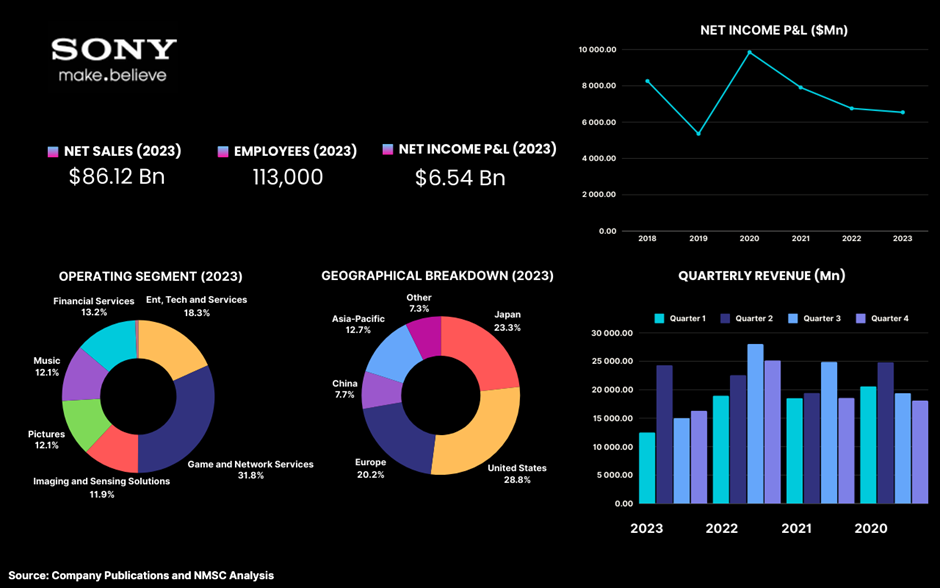

Highlights Of Sony Corporation

Sony Corporation, one of the global leaders headquartered in Tokyo, Japan, has firmly established itself as a major force in the mobile phone accessories market, leveraging its strong brand presence and extensive technological expertise. In 2023, Sony achieved a revenue of USD 86.12 billion, marking a significant 4.5% increase from the USD 82.40 billion recorded in 2022. This growth underscores the company’s resilience and ability to adapt to market trends, although it experienced a slight decline in net income, which stood at approximately USD 6.54 billion, down from USD 7.60 billion in the previous year.

Sony’s diversified portfolio spans multiple segments, each contributing to its robust financial performance. The game & network services division is the largest, generating USD 28.22 billion, driven by Sony’s playstation ecosystem and associated services. The entertainment, technology & services segment, which includes mobile phone accessories, accounted for USD 15.62 billion, reflecting the company’s innovation in consumer electronics and its commitment to enhancing the user experience through high-quality accessories such as headphones, chargers, and protective cases. The music division contributed USD 10.70 billion, while the pictures division, responsible for Sony’s film and television production, brought in USD 9.51 billion. Additionally, the imaging & sensing solutions segment, which includes cutting-edge camera sensors used in smartphones, added USD 10.20 billion, showcasing Sony’s technological leadership. The financial services division generated USD 11.27 billion, highlighting the company’s diversification beyond traditional electronics, while the other category, which includes various smaller ventures, contributed USD 569 million.

Sony's global reach is evident in its geographical revenue breakdown. The United States remains its largest market, contributing USD 23.90 billion, followed closely by Japan with USD 19.28 billion. Europe generated USD 16.77 billion, reflecting Sony's strong foothold in these key regions. China, another critical market, accounted for USD 6.37 billion, while the Asia-Pacific region contributed USD 10.57 billion. Other areas collectively added USD 6.04 billion, underscoring Sony’s extensive global operations.

With a workforce of approximately 113,000 employees, Sony continues to drive innovation across its diverse business segments. In the mobile phone accessories market, Sony leverages its expertise in technology and entertainment to develop products that resonate with consumers worldwide. From high-quality audio equipment such as wireless headphones and earphones to advanced charging solutions and protective cases, Sony’s accessories are designed to enhance the functionality and style of modern smartphones. The company’s commitment to quality, innovation, and customer satisfaction ensures its strong position in the competitive landscape of mobile phone accessories and consumer electronics at large.

Sony’s strategic initiatives, such as expanding its product offerings and entering new markets, are key to maintaining its growth trajectory. The company’s ability to integrate its technological advancements across different business units allows it to create synergies that benefit its overall market presence, particularly in the fast-evolving mobile phone accessories sector. As Sony continues to innovate and adapt to changing consumer demands, it remains a pivotal player in shaping the future of mobile technology and consumer electronics.

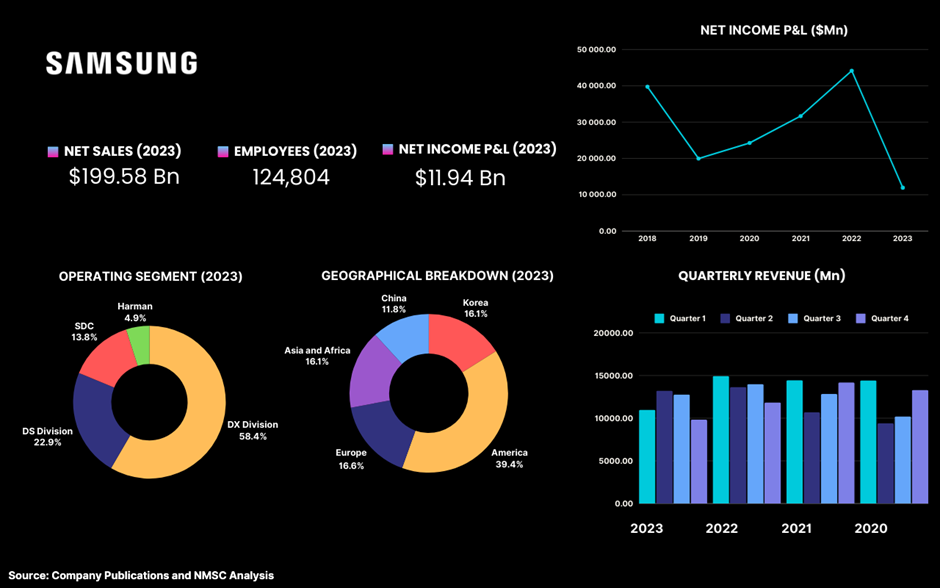

Highlights of Samsung Electronics Co. Ltd.

Samsung Electronics Co., Ltd., headquartered in Suwon, South Korea, stands as a global leader in technology, with a particularly strong presence in the mobile phone accessories market. In 2023, the company generated a revenue of USD 199.58 billion, though this marked a decline from the previous year’s USD 239.84 billion, reflecting the broader challenges within the electronics sector. The company’s net income also saw a significant decrease, coming in at approximately USD 11.94 billion in 2023, a sharp drop from USD 44.16 billion in 2022. This downturn in financial performance underscores the volatile nature of the global market, especially within the consumer electronics segment.

Samsung’s operations are segmented into several key divisions, each contributing significantly to its overall revenue. The device eXperience (DX) division, which includes mobile devices and their associated accessories, was the largest contributor, bringing in USD 131.02 billion. This highlights Samsung's continued dominance in the consumer electronics space, particularly in smartphones and related accessories. The device solutions (DS) segment, responsible for semiconductor and memory products, contributed USD 51.32 billion, while Samsung display corporation (SDC), focusing on display technologies, added USD 23.87 billion. Additionally, harman, known for its connected car systems and premium audio products, brought in USD 11.09 billion, further diversifying Samsung’s revenue base and reinforcing its position in the technology and automotive sectors.

The company employs a substantial global workforce, with 124,804 employees as of 2023, operating across various regions. The Americas remain Samsung’s largest market, generating USD 71.01 billion in revenue, followed by Europe with USD 37.08 billion. In Asia and Africa, Samsung earned USD 34.54 billion, while its home market of Korea contributed USD 35.14 billion. Revenue from China stood at USD 21.80 billion, reflecting Samsung's extensive global market penetration and influence.

In 2023, Samsung made significant strategic investments to bolster its global presence and capabilities. Notably, in March 2023, the company invested in smart manufacturing and research and development (R&D) initiatives in India, aiming to enhance its production capabilities and capitalize on the growing demand for electronics in this key market. This investment aligns with Samsung's broader strategy to expand its footprint in emerging markets and leverage local growth opportunities.

Within the mobile phone accessories market, Samsung continues to lead with a comprehensive range of products designed to enhance the user experience of its flagship smartphones. The company’s accessory lineup includes wireless chargers, protective cases, earbuds, smartwatches, and other complementary devices. These products are engineered to integrate seamlessly with Samsung’s mobile devices, offering features such as fast charging, advanced connectivity, and premium design, which cater to the evolving needs of consumers.

Samsung’s dedication to innovation extends beyond product development to include strategic collaborations and investments that reinforce its market position. The company’s focus on developing smart, connected accessories that complement its broader ecosystem of devices ensures that it remains a key player in the competitive mobile phone accessories market. As the demand for advanced mobile accessories continues to grow, driven by the proliferation of smartphones and wearable technology, Samsung is well-positioned to capture a significant share of this market, supported by its extensive global reach, innovative product offerings, and commitment to quality.

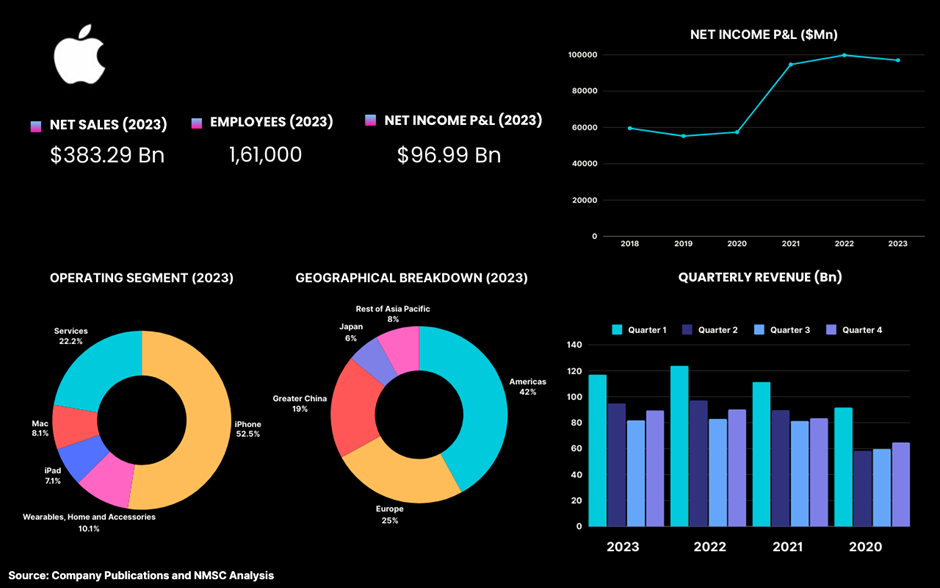

Highlights of Apple Inc.

Cupertino-based Apple Inc. remains one of the dominant forces in the mobile phone accessories market, utilizing its extensive ecosystem to offer a wide array of products that seamlessly integrate with its flagship devices. In 2023, the company reported a revenue of USD 383.29 billion, a slight decrease from USD 394.33 billion in 2022, with a net income of approximately USD 96.99 billion. Despite this modest decline, Apple continues to lead the industry, driven by its innovative product portfolio and strategic approach to technology.

The company's revenue is predominantly generated from its core product segments, with the iPhone leading the charge at USD 200.58 billion in 2023. The wearables, home, and accessories segment, which includes popular products such as AirPods, Apple Watch, and various iPhone accessories, contributed USD 39.84 billion, showcasing the importance of these accessories in Apple's overall business strategy. This segment is not only a significant revenue stream but also a crucial element in reinforcing Apple's ecosystem, where the seamless integration of devices enhances user experience and brand loyalty.

Apple's global market presence is reflected in its geographical revenue distribution. The Americas remain the largest market, generating USD 162.57 billion, followed by Europe with USD 94.30 billion, and Greater China contributing USD 72.55 billion. Japan and the Rest of Asia Pacific added USD 24.25 billion and USD 29.61 billion, respectively, highlighting Apple's strong international footprint. The company employs 161,000 people worldwide, whose collective efforts drive innovation and sustain Apple's market leadership.

In March 2024, Apple further solidified its position in the mobile phone accessories market by launching a new range of accessories alongside its M3-powered MacBook Air models. These new offerings include vibrant spring colours for iPhone 15 silicone cases, new Apple Watch bands, and luxury accessories from Hermès, as well as a unique collaboration with Belkin. These launches underscore Apple's commitment to combining cutting-edge technology with stylish design, catering to a diverse consumer base that values both functionality and fashion.

Apple's ability to consistently deliver high-quality accessories that enhance the user experience is a key factor in its success. The company's strategic focus on integrating hardware, software, and services ensures that each accessory not only complements its devices but also adds value to the overall user experience. Whether through its own branded accessories or partnerships with luxury brands such as Hermès, Apple continues to set industry standards, maintaining its dominance in the mobile phone accessories market and reinforcing its reputation as a global leader in technology and innovation.

Highlights of Google LLC

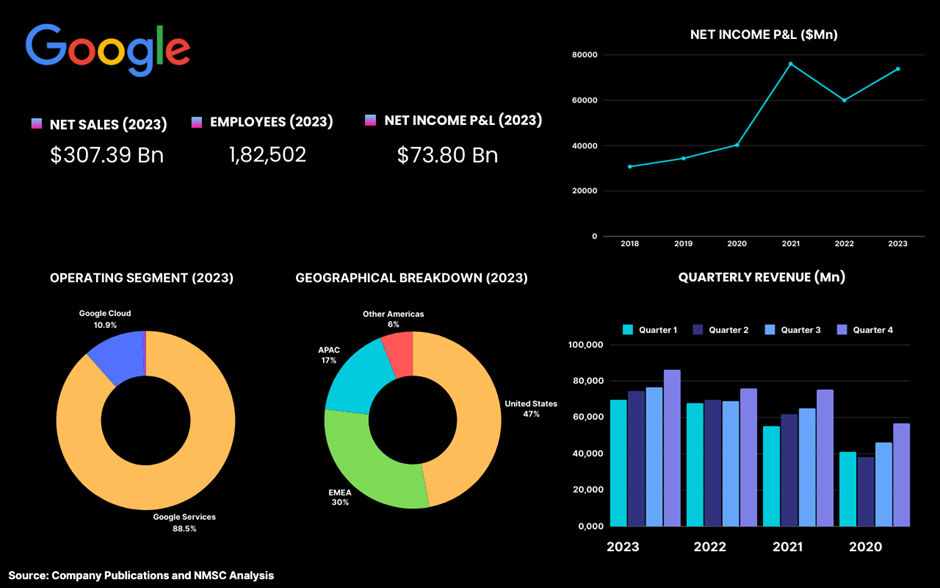

Google LLC, one of the global leaders in technology and innovation, achieved impressive financial results in 2023, reporting a revenue of USD 307.39 billion in 2023, marking an 8.7% increase from the previous year's USD 282.83 billion. This revenue growth reflects the company's continued dominance and expansion across various technology sectors. Google's net income surged to approximately USD 73.80 billion in 2023, a notable increase from USD 59.98 billion in 2022, highlighting its robust financial performance and effective operational strategies. With a global workforce of 182,502 employees, Google operates through a diverse array of business segments that drive its success.

The company’s revenue is primarily generated from its core segments. Google services, encompassing advertising, search, and other consumer products, contributed USD 253.53 billion. Google Cloud, which includes cloud computing and enterprise services, generated USD 26.28 billion, reflecting its growing importance in the digital infrastructure market. The others segment, which includes various other businesses and investments, added USD 3.03 billion to the overall revenue.

Geographically, Google's market presence is strongest in the United States, which remains its largest market with contributions of USD 146.29 billion. The EMEA (Europe, the Middle East, and Africa) region follows with USD 91.04 billion, indicating significant international engagement. The Asia-Pacific (APAC) region generated USD 51.51 billion, and Other Americas (excluding the U.S.) contributed USD 18.32 billion, demonstrating Google’s extensive global reach and influence.

In August 2024, Google made a notable advancement in the mobile phone accessories market with the launch of the Pixel Buds Pro 2. Priced at USD 229, these advanced earbuds represent a significant upgrade over previous models. They feature a more compact design, enhanced noise cancellation driven by the Tensor A1 chipset, and an extended battery life of up to 30 hours with the charging case. The Pixel Buds Pro 2 are equipped with adaptive noise cancellation, spatial audio capabilities, and seamless integration with Google’s Gemini AI assistant, reflecting Google's commitment to integrating cutting-edge technology with consumer-friendly design.

Google LLC’s strategic focus on innovation and its expansive range of products and services continue to solidify its leadership position in the technology sector. The company’s ability to enhance user experience through its diverse offerings, from cloud services to advanced consumer electronics, underscores its role as a major player in shaping the future of technology and connectivity.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/mobile-phone-accessories-market/inquire-before-buying

Summary of Mobile Phone Accessories

The mobile phone accessories market is set to grow significantly, driven by the increasing use of smartphones and the rising demand for products such as cases, chargers, and headphones. Major players in the industry, including Amazon, Sony, Samsung, Apple, and Google, are leveraging their technological expertise and extensive product ranges to cater to consumer needs. Amazon has seen a notable recovery in financial performance, while Sony continues to be a significant player despite a slight decline in net income. Samsung's comprehensive accessory lineup remains strong, even amid market challenges. Apple maintains its dominance by integrating accessories into its ecosystem, and Google's ongoing innovation reflects its commitment to advancing mobile technology. The market is characterized by rapid innovation and evolving consumer preferences, highlighting the essential role of accessories in enhancing smartphone experiences.

About the Author

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments.

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment