Top 5 Innovators Revolutionizing Acne Treatment Today

Published: 2025-09-11

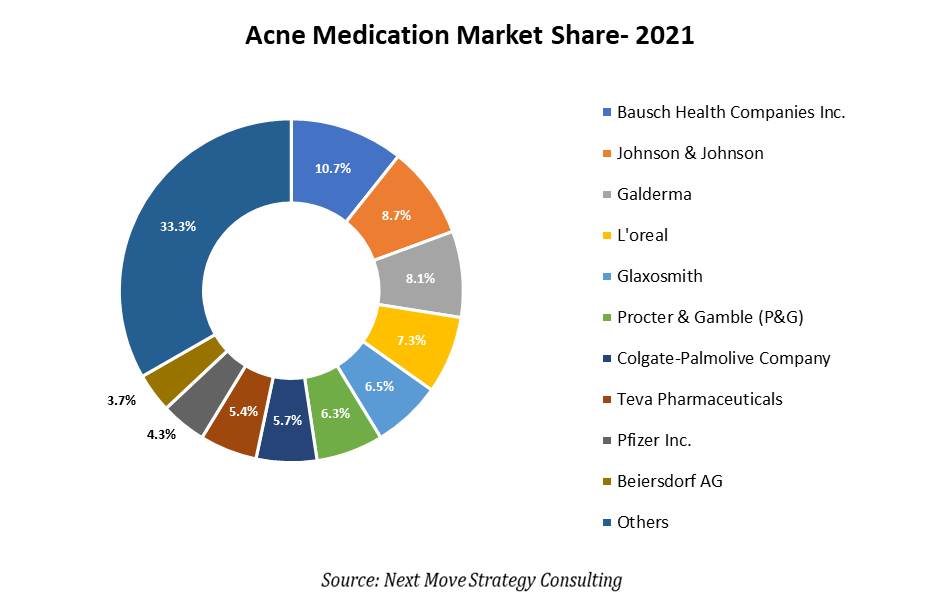

Next Move Strategy Consulting projects that the Acne Medication Market will grow from USD 10.70 billion in 2023 to USD 13.18 billion by 2030, reflecting a CAGR of 3.0%, largely due to the rising focus on health, skincare, and hygiene.

Acne Medication Market Overview

The Acne Medication Market refers to the segment of the pharmaceutical and skincare industries focused on the development, production, and sale of products designed to treat and manage acne, a common skin condition characterized by the presence of pimples, blackheads, and cysts. This market includes a wide range of treatments, from over-the-counter topical solutions such as retinoids and benzoyl peroxide to prescription oral medications such as antibiotics and hormonal therapies. The goal of these treatments is to reduce inflammation, decrease oil production, combat bacterial infections, and improve overall skin health.

The market is witnessing significant growth, driven by a combination of factors including rising global prevalence of acne, particularly among adolescents and adults, and increasing consumer awareness of skincare and personal grooming. Technological advancements and innovations in dermatological research are also propelling the market forward. The development of novel drug formulations, including those with improved delivery systems and fewer side effects, is expanding the range of available treatment options. Additionally, the market is seeing a growing interest in natural and organic acne treatments, as consumers become more health-conscious and aware of the potential risks associated with synthetic ingredients.

However, the market faces challenges, including concerns over the long-term use of certain medications, which may lead to antibiotic resistance or other adverse effects. Additionally, the high cost of prescription treatments and the variability in individual skin responses to different medications can limit access for some consumers.

Despite these challenges, the market presents significant growth opportunities, particularly in the development of personalized acne treatments and the integration of artificial intelligence (AI) in dermatology for more accurate diagnosis and treatment recommendations. As the industry continues to evolve, the focus on innovative, effective, and safer acne medications is expected to drive sustained market expansion in the coming years.

For the latest market share analysis and in-depth acne medication industry insights, Request for a Sample PDF

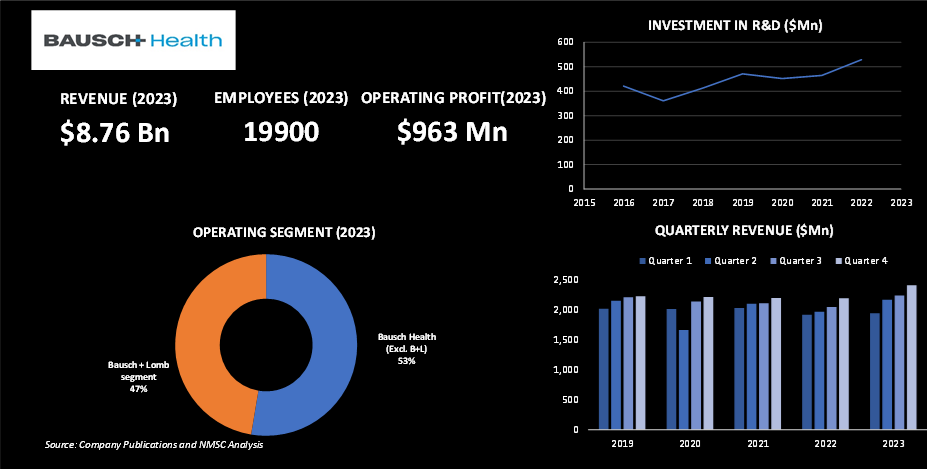

Highlights of Bausch Health Companies Inc.

Bausch Health Companies Inc. is a global diversified pharmaceutical company dedicated to improving healthcare outcomes through the development, manufacturing, and marketing of a wide range of products. These products span several therapeutic areas, including gastroenterology, hepatology, neurology, dermatology, medical aesthetic devices, international pharmaceuticals, and eye health.

In 2023, the company reported a revenue of USD 8.76 billion, marking an 8% increase from the USD 8.12 billion reported in 2022. This growth was driven by several segments within the company. The Salix segment, which includes notable products like Relistor, Xifaxan, and Trulance, contributed USD 2,250 million to the full-year revenue, showing a consistent 8% growth year over year. Similarly, the international segment reported revenues of USD 1,071 million, an 8% increase from the previous year, with a strong performance in the fourth quarter.

The Solta Medical segment, focused on medical aesthetic devices, also experienced significant growth, with revenues rising by 16% to reach USD 347 million in 2023. This increase highlights the growing demand for medical aesthetic solutions. On the other hand, the Diversified segment saw a slight decrease in overall revenue for the year but managed a small increase in the fourth quarter, indicating resilience in a competitive market.

Bausch Health continues to emphasize innovation, particularly in research and development. In 2023, the company invested heavily in R&D USD 604 million, leading to significant milestones. One of the key developments was Amiselimod, an oral treatment for mild to moderate ulcerative colitis, which completed Phase 2 trials in July 2023, with positive results announced later in the year. Additionally, the company launched CABTREO™, a triple-combination topical treatment for acne vulgaris, in the U.S. in January 2024 following its FDA approval in October 2023. These advancements reflect Bausch Health's commitment to expanding its product portfolio and enhancing patient care through continuous innovation. Further strengthening its position in the eye health sector, Bausch + Lomb, a subsidiary of Bausch Health, completed the acquisition of XIIDRA® (lifitegrast ophthalmic solution) 5% on September 29, 2023. XIIDRA® is a non-steroid eye drop specifically approved to treat the signs and symptoms of dry eye disease, focusing on inflammation associated with dry eye.

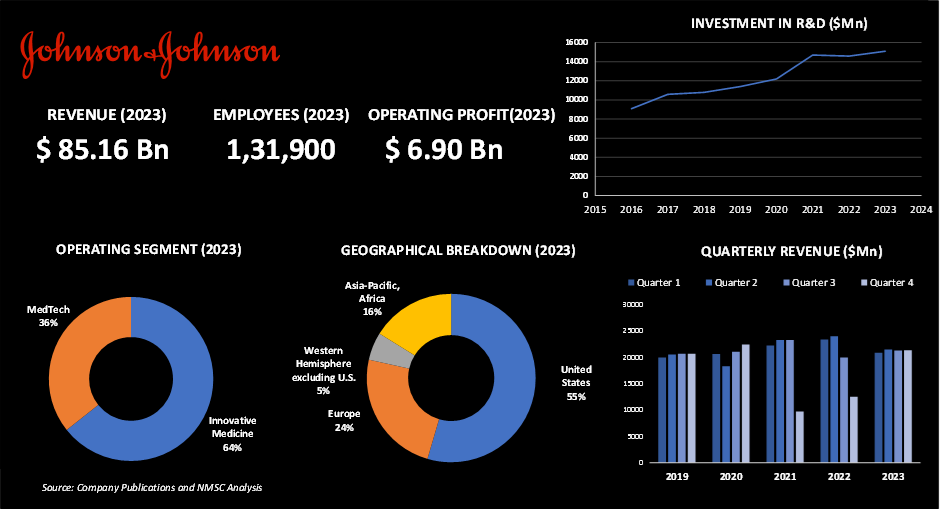

Highlights of Johnson & Johnson

Johnson & Johnson stands out as a global healthcare giant with an extensive portfolio spanning pharmaceuticals, medical devices, and consumer health. With approximately 131,900 employees worldwide, the company is well-positioned to impact the acne medication market with its innovative dermatological solutions. Known for its trusted acne treatments and skincare products, Johnson & Johnson continues to drive advancements in the field. By focusing on effective solutions and leveraging its broad expertise, the company remains a key player in addressing acne and enhancing skin health for millions.

In 2023, Johnson & Johnson achieved total revenue of USD 85,159 million. The company's U.S. market held the largest size, valued at USD 46.4 billion, while its Innovative Medicine segment led with a market size of USD 54.8 billion. The segment's sales increased by 4.2% from the previous year, despite a negative currency impact of 0.6%.

The company is highly committed to research and development, investing USD 15,085 million in 2023, marking a 6.7% increase from the prior year. Johnson & Johnson is highly committed to research and development, investing USD 15,085 million in 2023, marking a 6.7% increase from the prior year. This is a substantial rise from the USD 11,355 million spent in 2019, reflecting a 32.8% increase over the five-year period. This investment has led to a strategic focus on the most promising medicines, resulting in the exit of certain R&D programs, particularly in infectious diseases and vaccines. Notably, the company discontinued its respiratory syncytial virus (RSV) adult vaccine program and halted development in hepatitis and HIV.

The company is taking various initiatives, including acquisition of companies to remain dominant in the acne medication market. One notable example is the acquisition of Ambrx Biopharma, Inc. for approximately USD 2.0 billion in 2024. This acquisition, which involves an all-cash merger transaction, aims to enhance the company’s capabilities in developing next-generation antibody drug conjugates, reflecting its ongoing commitment to innovation and advancement in biopharmaceuticals.

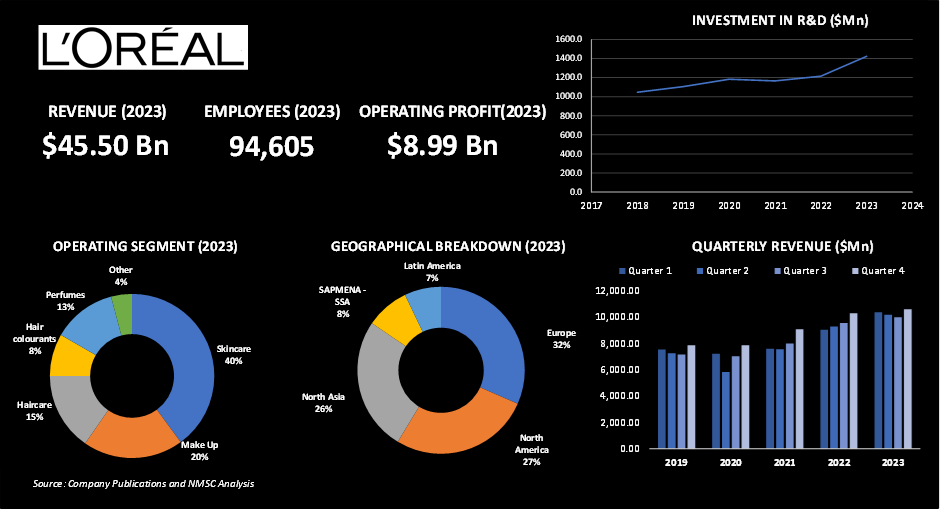

Highlights of L’ORÉAL S.A.,

Established in 1909, L’Oréal a prominent leader in the global beauty and personal care industry, renowned for its diverse range of skincare solutions, including effective acne treatments recorded impressive revenue of USD 45.5 billion in 2023, reflecting an 11% increase in consolidated sales. With over a century of expertise, the company integrates cutting-edge research and innovation into its acne medication offerings. Notable skincare brands under L’Oréal, such as La Roche-Posay and Vichy, provide targeted acne solutions formulated with advanced ingredients and technologies. These products address various aspects of acne management, from prevention to treatment, reflecting L’Oréal’s commitment to improving skin health.

With a global workforce exceeding 90,000 employees and a portfolio of 37 brands, the company operates across four main segments. The Consumer Products segment leads with a 36.8% market share, while Europe remains the largest domestic market, contributing 31.6% to the company’s revenue in 2023. The company is committed to addressing global challenges through strategic drivers focused on climate, water, biodiversity, and resources. Its sustainability initiatives include investing in the circular economy, nature regeneration, and promoting inclusivity.

In 2023, significant investment of USD 1,423.24 million was made in research and innovation, representing 3% of sales. This funding supports 20 cosmetics research centers, 13 assessment centers, and one advanced research center, backed by a research team of 4,194 employees. The company filed 610 patents in 2023 and earned accolades such as the CES Innovation Awards 2024 for the AirLight Pro technology.

In recent developments, an agreement was signed on April 3, 2023, to acquire Aēsop, a prestigious Australian luxury beauty brand known for its premium skin, hair, and body products. Additionally, in January 2024, an agreement was reached to acquire the remaining shares in Gjosa, a Swiss startup specializing in water fractioning technology, enhancing the innovative Water Saver showerhead. These strategic moves underscore the company’s dedication to expanding its portfolio and advancing its technology, reinforcing its leadership in the beauty industry while continuing to drive innovation and sustainability.

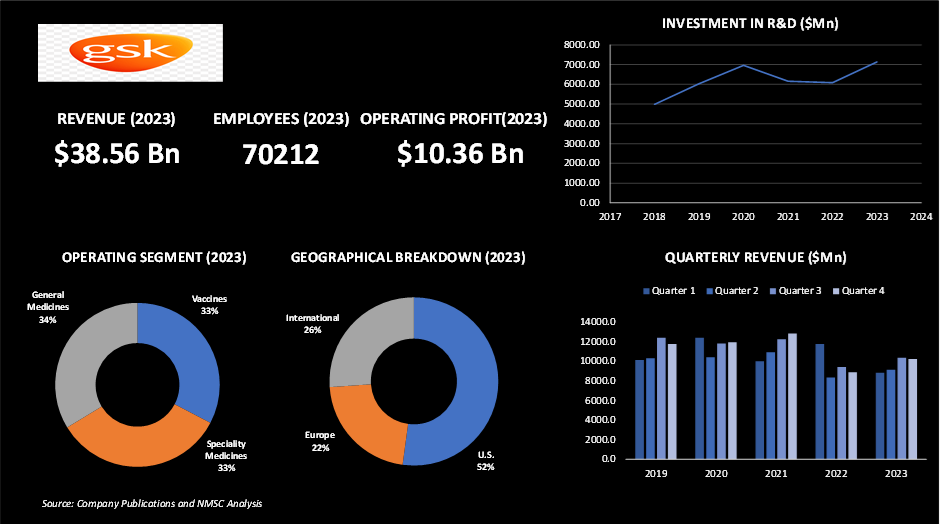

Highlights Of Glaxosmithkline (GSK)

GlaxoSmithKline (GSK) is a global biopharma leader with a mission to unite science, technology, and talent to stay ahead of diseases. In 2023, GSK achieved a revenue of USD 38.56 billion, marking a 5% increase, bolstered by a 14% rise in sales from Vaccines and HIV treatments, excluding COVID-19 solutions. Operating profit grew by 10% to USD 8.58 billion, with adjusted operating profit climbing 12% to USD 11.17 billion, benefiting from favorable contingent consideration liabilities.

A standout achievement for GSK in 2023 was the launch of Arexvy, the world’s first RSV vaccine for older adults, which gained approvals in the US, EU, Japan, and several other countries. This innovative vaccine represents a significant advancement in combating respiratory syncytial virus (RSV), which has eluded effective prevention or treatment for over 60 years, marking a major breakthrough in vaccine technology.

GSK’s strategic initiatives include the development of new therapies and technologies across various medical fields. Although the company has not specifically highlighted acne medication, its established expertise in dermatological research through its subsidiary, Galderma, indicates a potential future focus on acne treatments. GSK’s track record in pioneering treatments and its substantial R&D capabilities suggest that advancements in dermatology, including acne care, could be a significant area of exploration. With a global presence and a strong commitment to addressing diverse healthcare challenges, GSK continues to drive innovation and improve patient outcomes across a wide range of medical areas. The company’s advancements in vaccine technology and its extensive R&D efforts underscore its potential for future breakthroughs in dermatological treatments.

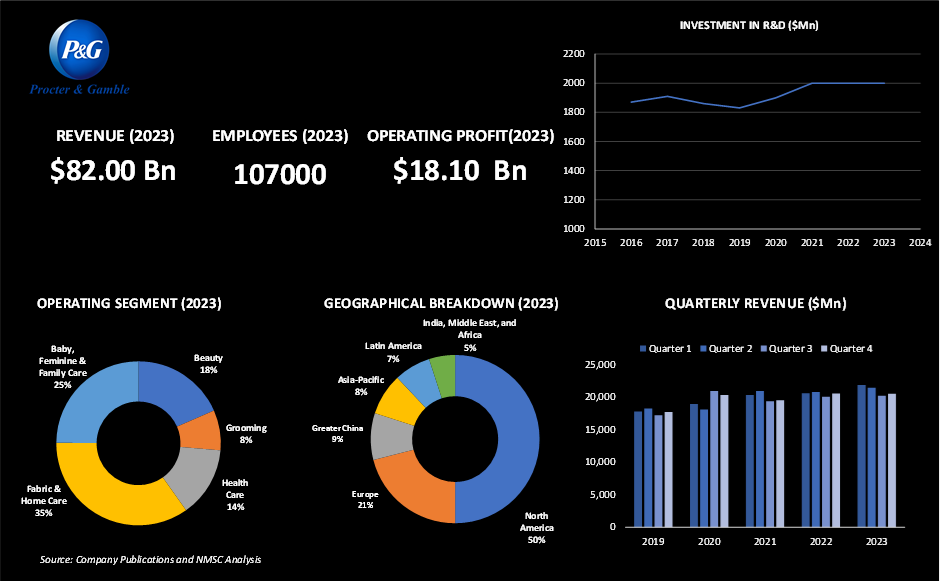

Highlights of Procter & Gamble

In 2023, Procter & Gamble (P&G) reported a revenue of USD 82.01 billion, reflecting a 2% increase from the previous year. This growth was driven by mid-single-digit rises in Health Care and low single-digit gains across Fabric & Home Care, Baby, Feminine & Family Care, and Beauty segments, while the Grooming segment experienced a slight decline. Organic sales, excluding acquisitions, divestitures, and currency impacts, grew by 7%, with significant performance in Health Care and Fabric & Home Care. Operating income rose by USD 321 million to USD 18.1 billion, despite a slight decrease in operating margin. Among its six business segments, Fabric & Home Care led with a market size of USD 28.37 billion.

As of June 30, 2023, the company employed approximately 107,000 people, a 1% increase from the previous year due to business expansion. The company operates in around 70 countries, with products sold in about 180 countries and territories. Over half of its annual net sales come from international markets, with notable contributions from Greater China, the UK, Canada, Japan, and Germany, collectively accounting for over 20% of total sales. P&G’s strategic investments included USD 765 million in acquisitions in 2023, primarily focused on expanding its Beauty segment. This move highlights the company’s ongoing commitment to growth and innovation.

The company serves a diverse customer base, including mass merchandisers, e-commerce channels, grocery stores, membership clubs, drug stores, department stores, distributors, wholesalers, specialty beauty stores, high-frequency stores, pharmacies, electronics stores, and professional channels. Direct sales to consumers are also a key component. Notably, sales to Walmart Inc. and its affiliates represented approximately 15% of total sales in 2023, 2022, and 2021. No other customer exceeded 10% of total sales, and the top ten customers collectively accounted for 40% of total net sales in 2023, up from 39% in the previous two years.

Among its standout brands, Vicks—ranked as the 1 OTC cough, cold, and flu brand globally—demonstrates remarkable market performance. With products like NyQuil and DayQuil Honey, Vicks achieved over 25% organic sales growth in fiscal 2023. Its innovative offerings and compelling advertising, emphasizing both effective relief and appealing formulas, have established Vicks as a preferred choice for millions, contributing to double-digit growth in the category worldwide.

Have questions? Inquire Before Buying

Summary of Acne Medication Market

The acne medication market is set for a significant transformation, driven by advancements in personalized medicine, innovative therapies, and technology integration. Future trends point towards highly personalized treatments, where therapies are tailored to individual genetic profiles and specific acne causes, enhancing effectiveness and reducing side effects. Emerging therapies, including biologics and targeted treatments, are poised to address severe and resistant acne more effectively. The integration of digital health tools, such as AI-powered diagnostic apps and telemedicine, will streamline acne management and improve patient outcomes. Additionally, there is a growing demand for sustainable and natural products, reflecting a shift towards eco-friendly and safer treatment options. The market is also seeing a rise in combination therapies that integrate various treatment modalities for comprehensive solutions. Overall, these trends suggest a future where acne treatments are more precise, innovative, and aligned with modern consumer preferences.

About the Author

Arunav Dutta is a dedicated Secondary Research Associate with a year of experience in the field. Known for his keen analytical skills and meticulous attention to detail, he excels in distilling complex data into actionable insights. Arunav combines a passion for research with a commitment to delivering high-quality, accurate information. His proactive approach and enthusiasm for continuous learning make him a valuable asset in understanding market trends and driving informed decision-making.

Arunav Dutta is a dedicated Secondary Research Associate with a year of experience in the field. Known for his keen analytical skills and meticulous attention to detail, he excels in distilling complex data into actionable insights. Arunav combines a passion for research with a commitment to delivering high-quality, accurate information. His proactive approach and enthusiasm for continuous learning make him a valuable asset in understanding market trends and driving informed decision-making.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment