Why Dentsply, Philips, and Vatech Lead the CBCT Industry

Published: 2025-09-11

Next Move Strategy Consulting predicts a significant growth of more than two-fold in the global Cone Beam Computed Tomography (CBCT) Systems Market by 2030. The market, valued at USD 1.59 billion in 2023, is expected to reach USD 3.45 billion by 2030. This growth is driven by the rising incidence of oral diseases such as dental caries and oral infections. Additionally, the expanding geriatric population worldwide and the increasing application of CBCT systems in various medical conditions, including orthopedics, lung cancer, and brain tumors, are further propelling the market.

CBCT Systems Market Overview

Cone beam computed tomography (CBCT) systems are advanced imaging technologies used primarily in dentistry, but also in various other medical fields such as orthopedics, otolaryngology, and oncology. These systems provide three-dimensional (3D) images of the structures being examined, offering significant improvements over traditional two-dimensional (2D) imaging techniques.

The integration of artificial intelligence (AI) into CBCT software is transforming imaging by significantly improving both precision and efficiency. AI algorithms automatically identify and segment anatomical structures, lesions, and abnormalities, offering clinicians valuable insights that enhance diagnostic accuracy and treatment planning.

Furthermore, AI-driven CBCT software helps to simulate and visualize potential treatment outcomes, facilitating personalized patient care and optimizing workflows. This integration minimizes manual tasks, thereby increasing the efficiency and accuracy of CBCT imaging in both medical and dental settings.

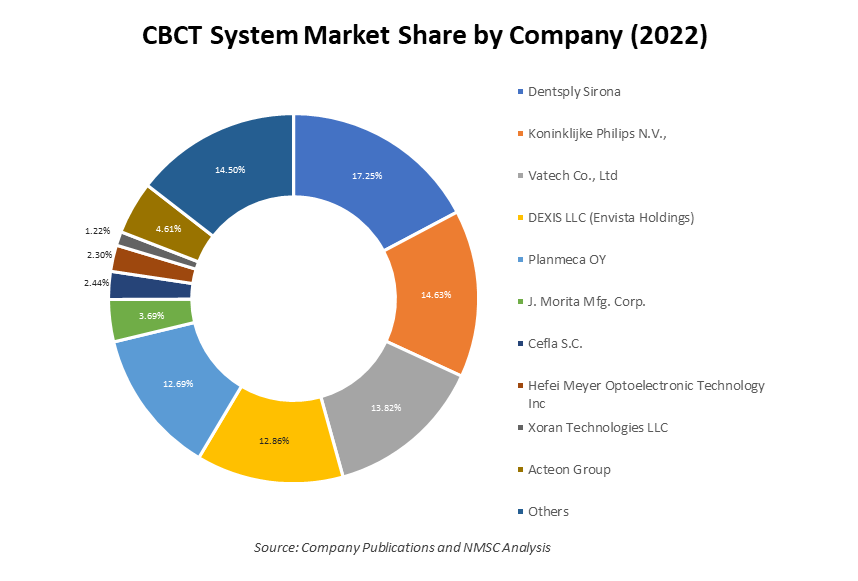

Leading companies in the CBCT systems industry, such as Dentsply Sirona, Koninklijke Philips N.V., Vatech Co., Ltd., DEXIS LLC (Envista Holdings), Planmeca OY, J. Morita Mfg. Corp., Cefla S.C., Hefei Meyer Optoelectronic Technology Inc., Xoran Technologies LLC, Acteon Group and others.

For the latest market share analysis and in-depth CBCT systems industry insights, download a free sample

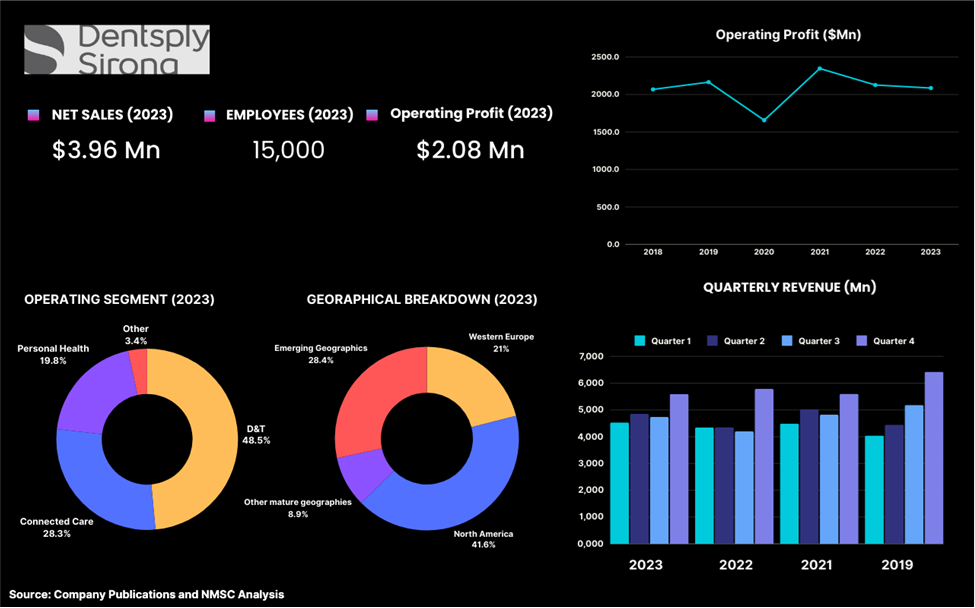

Dentsply Sirona Inc. is one of the prominent global manufacturers of dental products and technologies, boasting a 137-year legacy of innovation aimed at enhancing oral health and continence care worldwide. The company develops and markets a wide range of solutions, including advanced dental equipment and healthcare consumables in urology and enterology, all under a portfolio of renowned brands.

Dentsply Sirona's products are designed to improve patient care and deliver efficient, high-quality dental services. The company has a history of groundbreaking innovations, such as the first dental electric drill and the first CAD/CAM system, and continues to invest heavily in research and development. Headquartered in Charlotte, North Carolina, Dentsply Sirona is publicly traded on Nasdaq under the symbol XRAY.

Dentsply Sirona achieved a 1.1% increase in net sales in 2023, reaching USD 3.9 billion compared to 2022. However, this marks a 6.4% decline from the 2021 revenue. The revenue drop has negatively impacted the gross profit, which decreased by 1.9% in 2023 compared to 2022.

Factors affecting the company's financials include global supply chain constraints, variable growth rates, interest rate changes, labor and energy costs, and geopolitical conflicts, all impacting manufacturing costs and product demand. Despite weak financial performance over the last two years, Dentsply research and development (R&D) investment increases from USD 174 million in 2022 to USD 184 million in 2023, indicating a positive outlook for the company's future.

Highlights of Koninklijke Philips N.V.

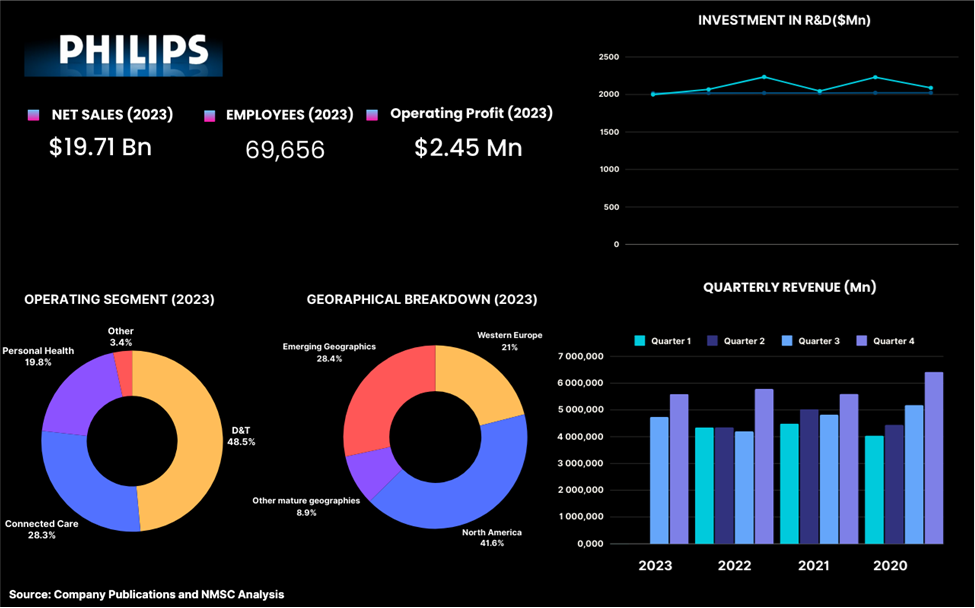

Koninklijke Philips N.V. (Royal Philips), established in 1891 and headquartered in the Netherlands, is a prominent global health technology company operating in over 100 countries. The company focuses on three main business segments such as Diagnosis & Treatment, Connected Care, and Personal Health, offering a diverse range of products including diagnostic imaging systems and patient monitoring solutions.

Philips is a significant player in the cone beam computed tomography (CBCT) system market, delivering high-quality imaging solutions specifically for dental and maxillofacial applications. Their CBCT systems, enhanced by advanced software such as Ingenia Elition and Ingenia Ambition, improve diagnostic accuracy and treatment planning.

Additionally, Philips collaborates with companies such as Carestream Dental to provide integrated imaging solutions, demonstrating its commitment to innovation through substantial investments in research and development. In 2023, Philips achieved around 2% increase in overall revenue compared to 2022, however the company witnessed a negative impact on the net income by more than USD 500 million.

In 2023, several factors impacted the company's performance such as simplified operating model, workforce reductions, improved supply chain resilience, and geopolitical factors. Global economic growth slowed to 2.7%, affecting consumer spending. Philips streamlined its operations to cut costs, announced additional workforce cuts totaling 8,000 roles, and improved supply chain resilience.

Geopolitical issues, especially the Russia-Ukraine conflict, continued to impact global supply chains and commodity prices, with Philips' operations in these regions being minimal. In addition, in 2023, R&D costs amounted to USD 2055 million, representing 10.4% of sales, down from USD 2321 million, or 11.7% of sales, in 2022. This USD 266 million decrease was primarily due to lower restructuring, acquisition-related charges, and favorable foreign currency effects, while 2022 included impairment charges for R&D projects.

Highlights of Vatech Co., Ltd

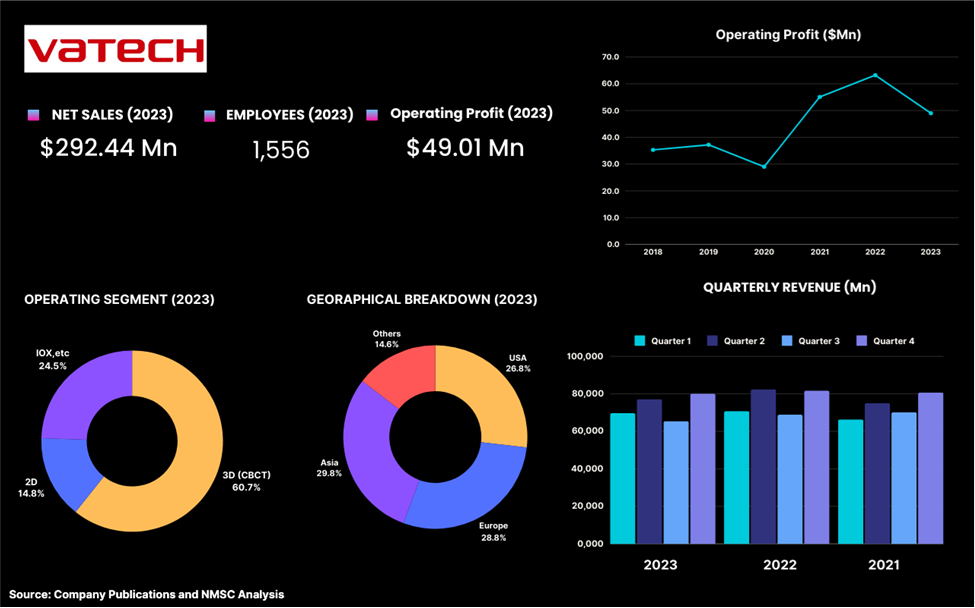

Vatech Co. is one of the leading companies in the dental imaging sector, specializing in the development and production of advanced technologies, particularly cone beam computed tomography (CBCT) systems. Established in South Korea, Vatech has gained a strong reputation for its innovative solutions that enhance diagnostic capabilities for dental professionals globally. The company's CBCT systems provide high-resolution 3D imaging, enabling detailed visualization of complex anatomical structures, which is crucial for accurate diagnosis and effective treatment planning in various dental applications such as implantology and orthodontics.

Vatech is committed to continuous innovation, investing significantly in research and development to advance its imaging technologies and software solutions. By integrating cutting-edge technology into its CBCT systems, Vatech enhances the efficiency of dental practices and improves patient outcomes, solidifying its position as a key player in the CBCT industry.

In 2023, Vatech Co. Ltd. reported a revenue of USD 291.4 million, reflecting a 2.6% decrease compared to the previous year. This decline also affected the company's operating profit, which fell to USD 49.01 million, marking a 20.0% decrease from 2022. Despite these challenges, Vatech remains committed to advancing its cone beam computed tomography (CBCT) systems, investing approximately 25% of its revenue in research and development.

This significant investment underscores the company's dedication to innovation and maintaining a competitive edge in the dental imaging market. By focusing on enhancing the capabilities of its CBCT systems, Vatech aims to improve diagnostic accuracy and treatment planning, positioning itself for future growth in a rapidly evolving industry.

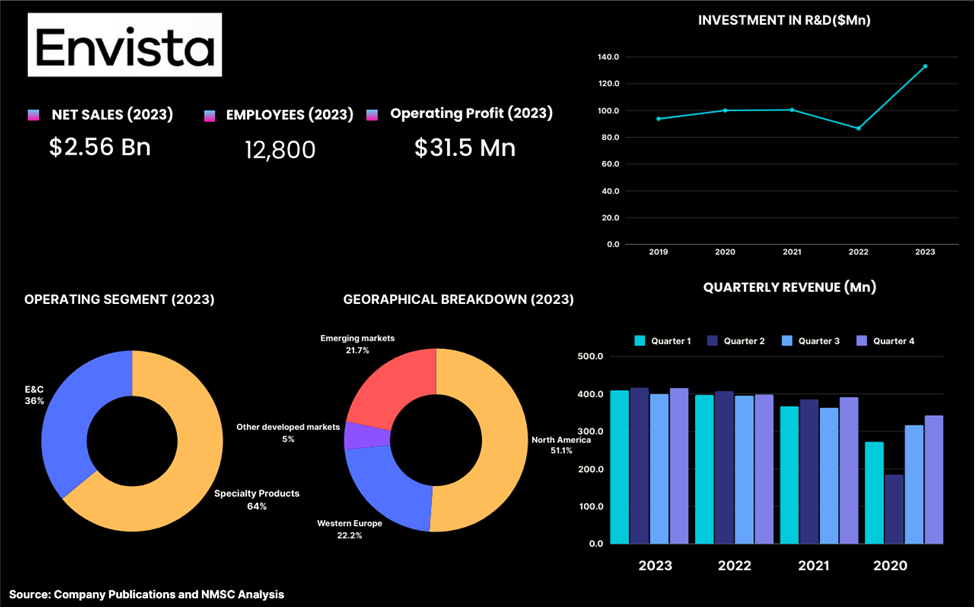

Highlights of Envista Holdings Corporation

Envista Holdings Corporation is a one of the leading global dental products companies that provides innovative solutions for dental professionals. Founded in 2019 as a spin-off from Danaher Corporation and headquartered in Brea, California, with more than 30 trusted dental brands, including Nobel Biocare, Ormco, DEXIS and Kerr united. The company offers a comprehensive range of products, including dental equipment, consumables, and digital solutions.

In the cone beam computed tomography systems market, Envista is a significant player, delivering advanced imaging solutions that enhance diagnostic accuracy and treatment planning. Their CBCT systems provide high-quality 3D imaging, crucial for applications such as implantology and orthodontics. Committed to innovation, Envista invests in research and development to continually improve its imaging technologies and software, ensuring that dental practitioners have the tools needed for effective patient care.

Envista Holdings faced financial challenges in 2023 as its revenue decreased by 0.10% compared to the previous year. This decline significantly impacted the company's operating profit, which plummeted by 90% during the same period and undermined confidence in the company's R&D investments. Envista's financial performance was highly sensitive to economic factors such as inflation, rising interest rates, and supply chain disruptions, which collectively hindered growth and affected stakeholders.

Furthermore, geopolitical tensions, government policy changes, and the lingering effects of the COVID-19 pandemic exacerbated Envista's financial woes. These external factors, combined with the company's vulnerability to economic conditions, contributed to its overall financial performance in 2023.

Have questions? Inquire before purchasing the full report

Summary of Surgical Instrument

The global cone beam computed tomography (CBCT) systems market is set for substantial growth, projected to more than double by 2030. This expansion is driven by the increasing prevalence of oral diseases, a growing geriatric population, and broader applications in medical fields such as orthopedics and oncology. Key players in this market, including Dentsply Sirona, Koninklijke Philips N.V., Vatech Co., and Envista Holdings, are making significant contributions to advancements in CBCT technology through ongoing innovation and considerable investments in research and development.

Despite facing economic challenges such as inflation, supply chain disruptions, and geopolitical tensions, these companies remain dedicated to improving diagnostic accuracy and treatment planning. Their commitment ultimately enhances patient care and propels advancements in both dental and medical imaging technologies. As the demand for high-quality imaging solutions continues to rise, the CBCT systems market is well-positioned for future growth and innovation.

About the Author

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment