How Allstate & AXA Are Revolutionizing Extended Warranties

Published: 2025-09-11

According to NMSC analysis, the global extended warranty market was valued at USD 140.04 billion in 2023 and is projected to nearly double, reaching USD 255.9 billion by 2030. This substantial growth is primarily driven by consumers' rising demand for extended warranty coverage, as they seek protection against the increasingly expensive repair and replacement costs associated with advanced products. High-end and expensive items such as smartphones, laptops, home appliances, and other electronics are particularly contributing to this trend. As technology evolves, these products are becoming more sophisticated, with intricate parts and enhanced features that make repairs more complex and costly. For instance, modern smartphones now incorporate advanced screens, processors, and sensors, which significantly raise repair expenses. Similarly, home appliances are integrating smart technology, making them harder to fix. In response, more consumers are opting for extended warranties to safeguard their investments, especially as the repair market struggles to keep pace with the innovation in consumer electronics. This shift in consumer behavior is expected to continue, further driving the growth of the extended warranty market over the next decade.

Extended Warranty Market Overview

The extended warranty services market is experiencing robust growth as consumers increasingly seek additional protection for their purchases beyond the standard manufacturer warranties. This market includes a wide range of products, including automobiles, consumer electronics, home appliances, and various other goods, providing coverage that extends beyond the original warranty period for repairs, replacements, and maintenance. The rising complexity and cost of these products, coupled with consumers' desire to avoid unexpected repair expenses is a key driver of market expansion. Technological advancements are also reshaping the extended warranty services market. Companies are leveraging predictive analytics to anticipate product failures and tailor warranty plans accordingly. Artificial intelligence is being used to streamline claims processing, improve customer service, and provide more personalized warranty options. The market is highly competitive, with key players continuously innovating to offer flexible, consumer-friendly plans that are customized to meet specific needs. Moreover, the shift towards e-commerce opened new avenues for warranty providers, enabling them to reach a broader audience and offer digital-first services, including online claims management and real-time support.

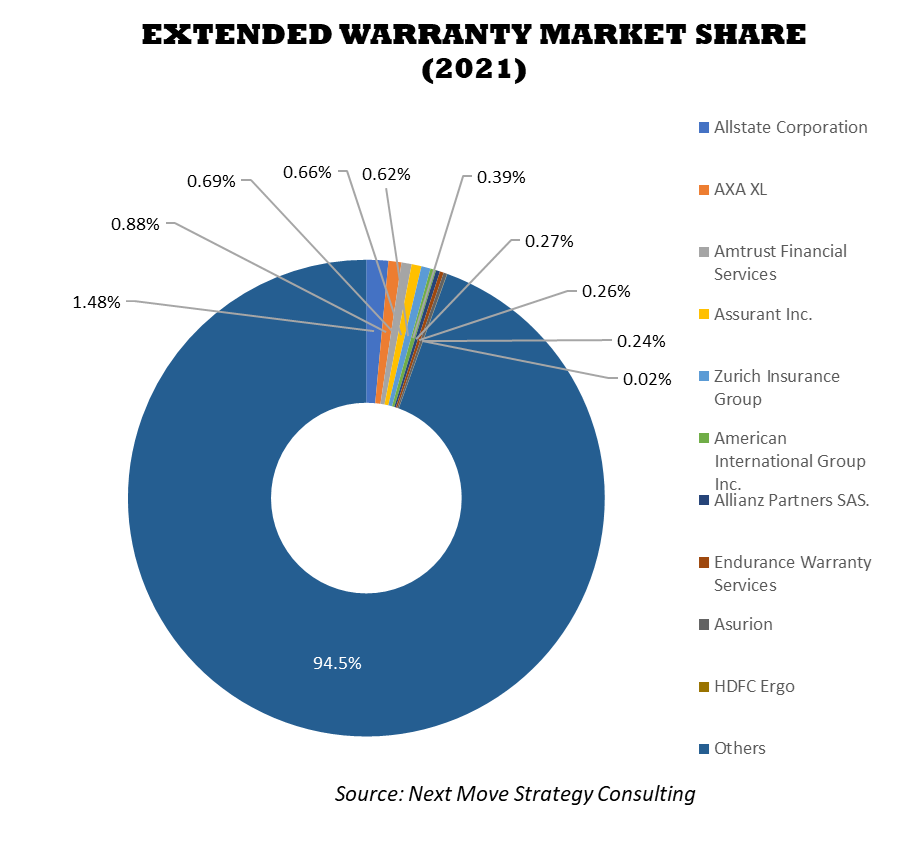

Leading companies operating in the extended warranty includes Allstate Corporation, AXA XL, Amtrust Financial Services, Assurant Inc., Zurich Insurance Group, American International Group Inc., Allianz Partners SAS., Endurance Warranty Services, Asurion, and HDFC Ergo each contributing significantly to the industry's evolution.

For the latest market share analysis and in-depth extended warranty industry insights, you can reach out to us at- https://www.nextmsc.com/extended-warranty-market/request-sample

Highlights of American International Group Inc.

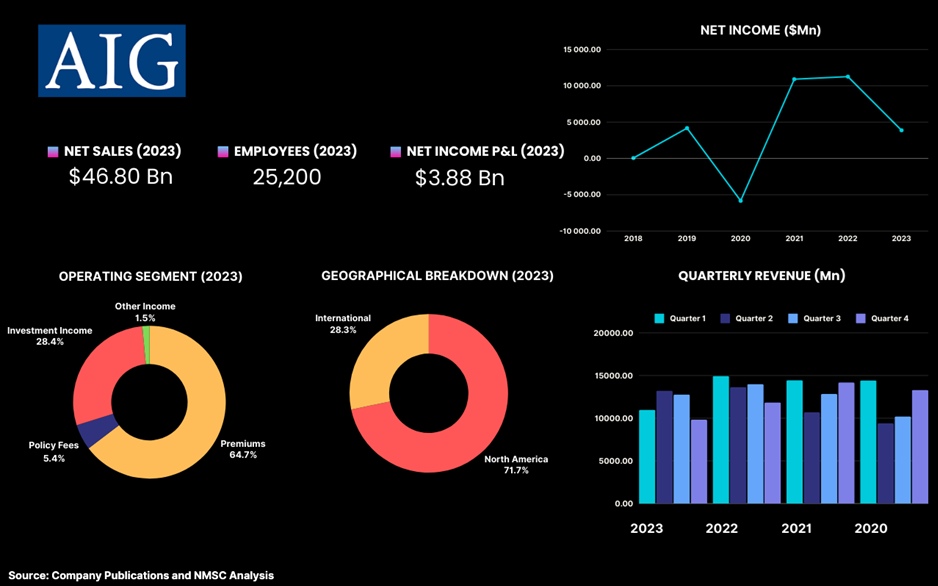

American International Group, Inc. (AIG), headquartered in New York City, is one of the major players in the extended warranty market, providing a comprehensive suite of insurance products and services designed to meet the diverse needs of its global customer base. In 2023, AIG reported revenue of USD 46.80 billion, a decline from USD 54.45 billion in 2022, reflecting a challenging year for the company. The company’s net income for 2023 was approximately USD 3.88 billion, down significantly from USD 11.27 billion the previous year, indicating a substantial shift in financial performance.

AIG's revenue is primarily derived from premiums, which totalled USD 33.25 billion in 2023. Policy fees contributed an additional USD 2.80 billion, while net investment income amounted to USD 14.60 billion. Other income sources brought in USD 767 million, adding to the company's overall financial portfolio.

Geographically, AIG’s revenue distribution highlights its strong market presence: North America generated USD 33.56 billion, underscoring the region's importance to its operations, while international markets contributed USD 13.23 billion, reflecting AIG’s global reach. The company employs around 25,200 individuals, who support its extensive network of insurance services across various regions.

Despite experiencing a 14.0% decrease in sales compared to 2022, AIG remains a significant entity in the extended warranty sector. The company continues to focus on delivering innovative and customer-centric solutions, aiming to enhance its market position and adapt to evolving industry demands. AIG's commitment to excellence in warranty services is reflected in its strategic investments and efforts to improve service quality and customer satisfaction, ensuring it remains a competitive and reliable choice for consumers and businesses seeking extended warranty protection.

Highlights of Zurich Insurance Group

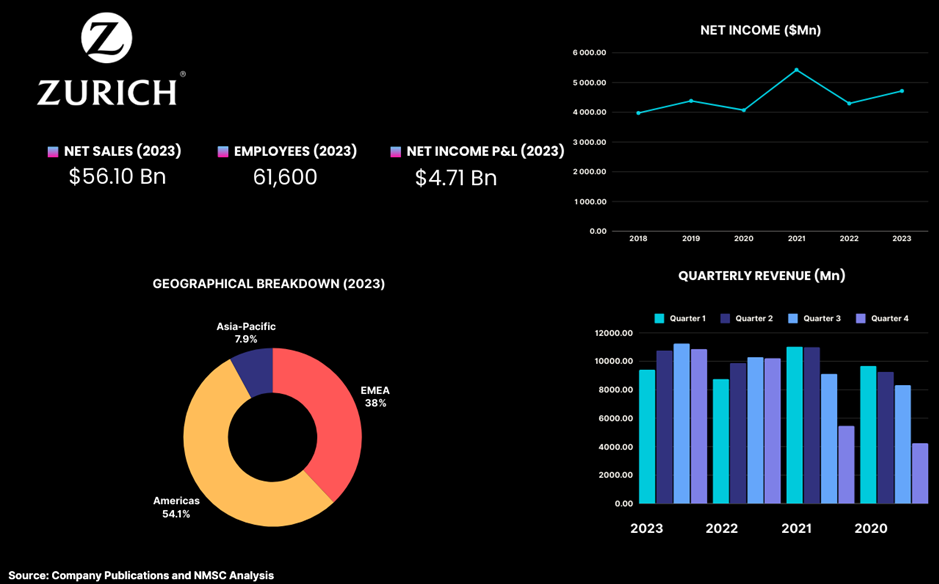

Zurich Insurance Group, headquartered in Zurich, Switzerland, is one of the leading global insurers with a strong focus on extended warranty services, providing comprehensive protection solutions across a wide range of sectors. In 2023, the company achieved a revenue of USD 56.10 billion, marking an increase from USD 50.80 billion in 2022, which represents a notable growth of 10.4% compared to the previous fiscal year. This growth reflects Zurich’s robust performance in the extended warranty market and its ability to effectively manage and expand its service offerings.

The company's net income for 2023 was approximately USD 4.71 billion, an improvement over the USD 4.30 billion recorded in 2022. This increase in profitability highlights Zurich’s operational efficiency and successful implementation of its strategic initiatives. Zurich’s insurance revenue, including its extended warranty services, was USD 56.10 billion in 2023, showcasing its extensive portfolio and significant market presence.

Zurich Insurance Group operates globally, with substantial revenue contributions from various regions. North America generated USD 20.09 billion, reflecting its strong market presence in this key region, EMEA contributed USD 16.06 billion, Asia-Pacific provided USD 3.35 billion, and Latin America added USD 2.82 billion. This geographical breakdown demonstrates Zurich’s wide-reaching impact and its ability to cater to diverse market needs.

With a workforce of approximately 61,600 employees, Zurich Insurance Group is well-positioned to support its extensive operations and continue its growth trajectory. The company’s commitment to expanding its market presence was further evidenced by its acquisition of a 70% stake in Kotak General Insurance in June 2024. This strategic move strengthens Zurich’s foothold in key markets and enhances its capability to deliver high-quality extended warranty services.

Overall, Zurich Insurance Group’s significant revenue growth, increased net income, and strategic acquisitions underscore its prominent role in the extended warranty market and its dedication to providing valuable protection solutions on a global scale.

Highlights of Allstate Corporation

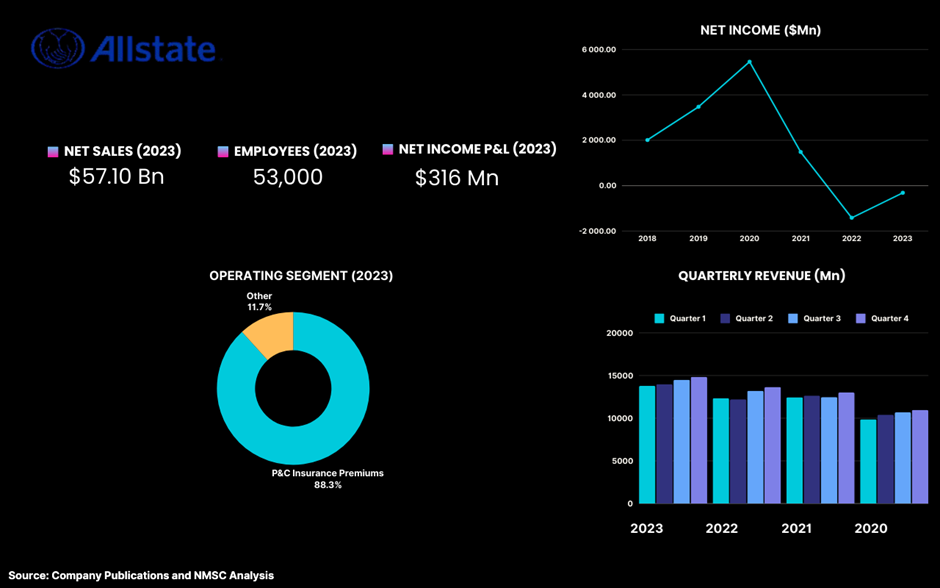

Founded in 1931, Allstate Corporation, headquartered in Northbrook, Illinois, stands as a prominent entity in the extended warranty market. For the fiscal year 2023, Allstate achieved revenue of USD 57.10 billion, marking an 11.1% increase from USD 51.41 billion in 2022. This growth underscores the company's expanding footprint in the insurance sector. Despite this revenue increase, Allstate encountered financial difficulties, resulting in a net loss of approximately USD 316 million in 2023, a significant improvement over the previous year’s loss of around USD 1.41 billion.

In terms of operational segments, Allstate's revenue is heavily driven by property and casualty insurance premiums, which totalled USD 50.67 billion in 2023. Additional revenue from other sources contributed USD 6.72 billion. This diversified revenue stream highlights Allstate's extensive involvement in various insurance products and services, including extended warranties, which play a critical role in their portfolio.

The company operates with a workforce of about 53,000 employees, reflecting its significant operational scale and capacity to manage a vast array of insurance offerings. Allstate's continued focus on expanding its market presence and improving financial performance underscores its commitment to providing comprehensive insurance solutions, including extended warranties, to its diverse customer base.

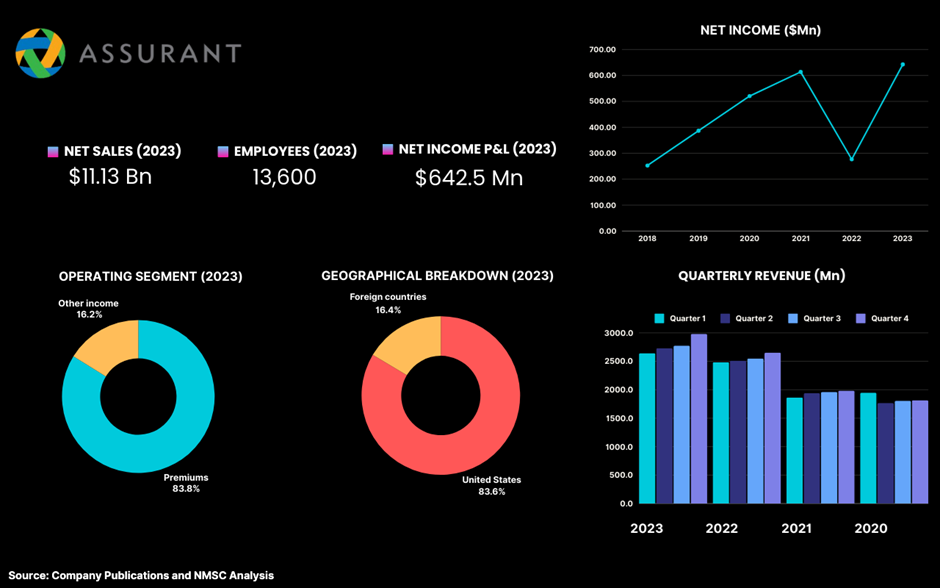

Highlights of Assurant Inc.

Assurant Inc., one of the prominent players in the extended warranty market, exhibited notable financial performance in 2023, with a revenue of USD 11.13 billion, marking a substantial increase from USD 10.13 billion in 2022. This 9.2% growth in sales reflects Assurant's strategic initiatives aimed at expanding its market presence and diversifying its service offerings. The company's net income also saw a significant rise, reaching approximately USD 642.5 million in 2023, compared to USD 276.6 million in the previous year. This sharp increase in profitability underscores the effectiveness of Assurant's operational strategies and its ability to adapt to market demands.

Assurant's business is primarily driven by its net earned premiums, which totalled USD 9.39 billion in 2023. Additionally, the company generated USD 1.32 billion in fees and other income, alongside USD 489.1 million in net investment income. These figures highlight the company's strong financial foundation and diversified revenue streams, which contribute to its stability and growth.

Geographically, Assurant's operations are concentrated in the United States, where it generated USD 9.30 billion in revenue in 2023. The company's international operations also made a significant contribution, bringing in USD 1.83 billion from foreign markets. This global presence enables Assurant to capitalize on growth opportunities in various regions, further solidifying its position in the extended warranty market.

In January 2023, Assurant took a significant step towards enhancing its product offerings with the launch of Assurant Vehicle Care, a comprehensive suite of vehicle protection products. This new offering is designed to cater to the needs of both traditional and electric vehicle owners, reflecting the company's commitment to innovation and staying ahead of industry trends. By introducing products that address the evolving needs of consumers, Assurant continues to strengthen its market leadership and expand its customer base.

With a workforce of 13,600 employees, Assurant remains dedicated to providing high-quality service and innovative solutions. The company's continued focus on customer-centric offerings and strategic expansion initiatives underscores its commitment to maintaining its leadership position in the extended warranty market and driving long-term growth.

Highlights Of AXA Xl

AXA XL, a prominent division of the AXA Group, was established in 1986 by industry pioneers Bob Clements and John T. Sinnott. Over the years, AXA XL has grown into a leading global insurance and reinsurance provider, known for its comprehensive and innovative risk management solutions. The company has made significant strides in the extended warranty market, offering a variety of tailored products that help businesses protect against the financial risks associated with product repairs, replacements, and servicing.

AXA XL's extended warranty solutions are carefully crafted to address the unique needs of different industries, providing businesses with the flexibility to choose coverage that best fits their operational requirements. The company leverages its extensive global network and deep expertise in underwriting to offer programs that not only cover standard risks but also adapt to emerging trends and challenges in the market. This ability to innovate and customize warranty solutions ensures that AXA XL remains a trusted partner for businesses looking to mitigate potential liabilities effectively.

The company's strong presence in the extended warranty market is further bolstered by its commitment to customer-centric service and a forward-thinking approach to risk transfer. By integrating advanced data analytics and market insights into its offerings, AXA XL is able to provide more precise and reliable coverage options that evolve with the changing landscape of the industries it serves.

Under the leadership of CEO Scott Gunter, AXA XL continues to enhance its global operations, focusing on strategic growth and the development of new solutions that meet the evolving needs of its clients. Gunter's vision and direction have played a crucial role in solidifying AXA XL's reputation as a leader in the extended warranty market, positioning the company as a key player in helping businesses navigate the complexities of risk management in today's dynamic environment.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/extended-warranty-market/inquire-before-buying

Summary of Extended Warranty Industry

The global extended warranty market is set to witness substantial growth, driven by rising consumer demand for coverage against the increasing repair costs of advanced products such as smartphones, laptops, and home appliances. As these technologies evolve, repairs become more complex and expensive, leading more consumers to opt for extended warranties to protect their investments. Key industry players are leveraging technological advancements including predictive analytics and AI to innovate and offer tailored, customer-centric warranty solutions, further fueling the market's expansion.

About the Author

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments.

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment