How Industry Leaders Are Shaping the Expanding TPA Market

Published: 2025-09-11

The Insurance TPA Market is experiencing strong growth, with its value expected to achieve a notable 2x increase from USD 350.89 billion in 2023 to USD 511.49 billion by 2030. This expansion, driven by a CAGR of 4.6% from 2024 to 2030, is fueled by the increasing complexity of claims, heightened demand for effective risk management, and the adoption of advanced technologies such as AI and machine learning.

Insurance Third Party Administrator (TPA) Market Overview

The Insurance Third Party Administrator (TPA) market is expanding as insurers and businesses increasingly outsource administrative functions to enhance efficiency and reduce costs. TPAs manage a variety of insurance-related services, including claims processing, policy administration, and customer service. Key drivers of market growth include the rising demand for cost-effective insurance management solutions, the increasing complexity of insurance products, and the need for improved operational efficiency.

Additionally, technological advancements are significantly influencing the market, with TPAs adopting advanced data analytics, automation, and digital platforms to streamline operations and improve service delivery. These technologies enable TPAs to offer more accurate and timely claims processing, enhanced customer support, and better risk management.

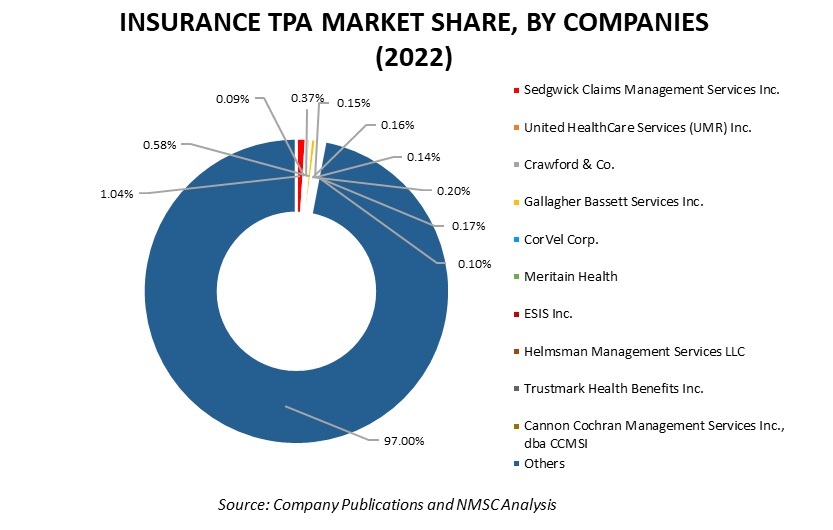

Another important factor driving market growth is the increasing focus on regulatory compliance. TPAs help insurance companies navigate complex regulatory environments, ensuring adherence to industry standards and reducing the risk of non-compliance penalties. The presence of major players such as Sedgwick Claims Management Services Inc., United HealthCare Services (UMR) Inc., Crawford & Co., CorVel Corp., and Gallagher Bassett Services Inc. highlights the competitive landscape of the insurance TPA market. These companies are leveraging their expertise and technological capabilities to meet the evolving needs of insurers and businesses, thereby shaping the future of the TPA market.

For the latest market share analysis and in-depth insurance TPA industry insights: Download FREE Sample

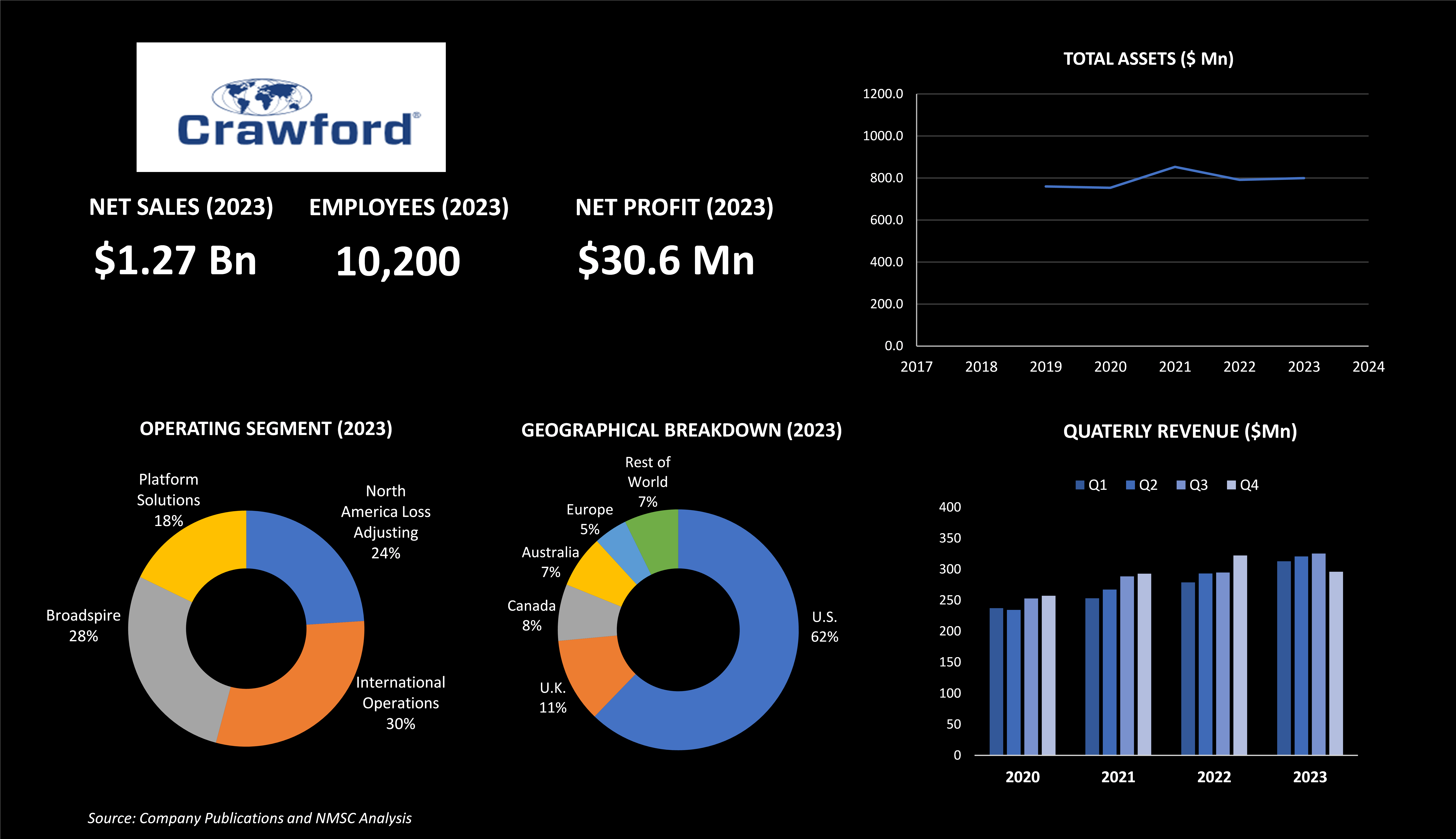

Highlights of Crawford & Company

Crawford & Company, headquartered in Atlanta, Georgia, is one of the leading global providers of claims management and outsourcing solutions in the insurance TPA market. Established in 1941, Crawford is the largest publicly listed independent provider in this sector, with nearly 10,200 employees spread across more than 70 countries. The company reported total revenues of USD 1.27 billion in 2023, an increase from USD 1.23 billion in 2022 and USD 1.13 billion in 2021.

Under the leadership of CEO Rohit Verma and President Joseph Blanco, Crawford & Company made significant strides in expanding its service offerings and global presence. For instance, in 2020, the company introduced the industry's first smart water-detection product and established the Office of Diversity, Equity, and Inclusion, while also integrating HBA Legal into Crawford Legal Services. Celebrating its 80th anniversary in 2021, Crawford further enhanced its global reach with the acquisitions of Praxis Consulting, adjuster, and BosBoon Expertise Group B.V., solidifying its insurance TPA capabilities and expanding its service network.

Building on this momentum, Crawford continued its growth trajectory in 2022 with additional strategic acquisitions. The company acquired R.P. van Dijk B.V., a Dutch firm specializing in bodily injury loss adjusting, which bolstered its service offerings in the Netherlands. Concurrently, Crawford expanded its international footprint by acquiring BosBoon Expertise Group B.V. and HBA Group in Australia. These moves significantly broadened Crawford's global expertise and service capabilities.

As a result of these strategic expansions, the company's International Operations segment reported operating earnings of USD 11.2 million in 2023, a notable improvement from the USD 12.9 million operating loss in 2022, driven by increased revenues and effective cost management. Crawford operates through four main segments: North America Loss Adjusting, which serves the property and casualty market in the U.S. and Canada; International Operations, covering global markets outside North America; Broadspire, which provides third-party administration for various types of insurance in the U.S.; and Platform Solutions, which includes Contractor Connection, Networks, and Subrogation services.

Crawford’s advancements in the insurance TPA market are marked by its innovative approach to integrating technology and expanding its global network. The company's strategic acquisitions and investments in advanced products and services underscore its commitment to enhancing the efficiency and effectiveness of claims management and insurance administration worldwide.

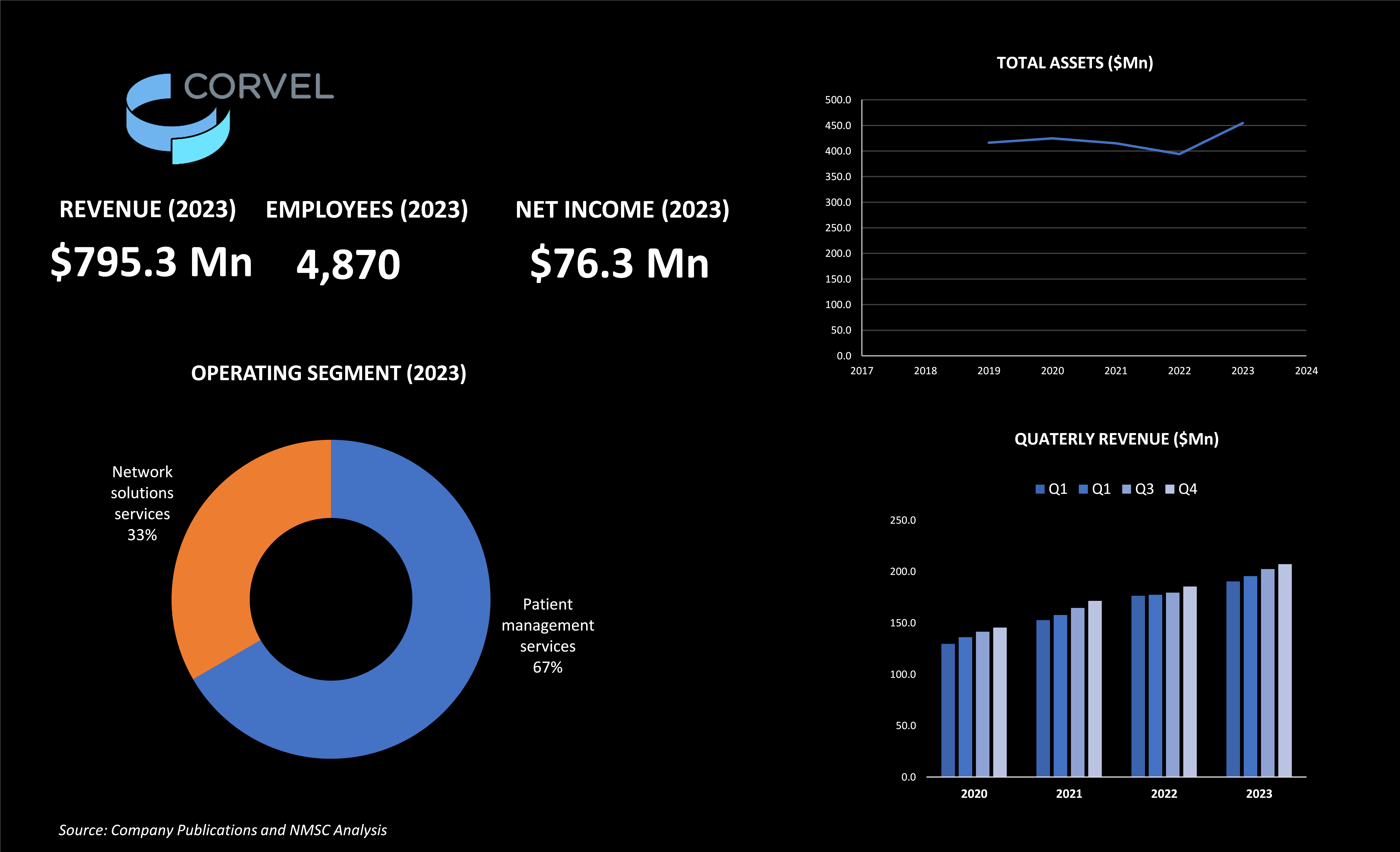

Highlights of Covel Corporation

CorVel Corporation, based in Irvine, California, is one of the prominent providers of claims management and managed care services with over 30 years of industry experience. The company, led by CEO Michael Combs, is dedicated to delivering risk management solutions that improve outcomes for its partners. CorVel applies advanced technologies such as artificial intelligence, machine learning, and natural language processing to manage episodes of care and related healthcare costs effectively.

CorVel partners with a diverse range of entities including employers, third-party administrators, insurance companies, and government agencies to manage workers' compensation, health, auto, and liability services. The company's approach combines integrated technologies with a human touch, offering customized services supported by a national team.

In fiscal 2023, CorVel reported revenues of USD 795.3 million, reflecting a substantial increase from USD 719 million in fiscal 2022 and USD 646 million in fiscal 2021. This growth represents an 11% rise from the previous year. Notably, patient management services saw a significant increase, rising to USD 479 million from USD 424 million, an improvement of 13%. This increase was primarily driven by higher revenue from the company’s TPA and related services. Additionally, total new claims rose by 5% during fiscal 2023 compared to the previous fiscal year.

CorVel operates under one reportable segment, managed care, and serves a broad array of customers including insurers, self-administered employers, government agencies, and municipalities. No single customer accounted for more than 10% of revenues in fiscal 2023, although one customer represented 10% or more of accounts receivable as of March 2023. This diversified client base reflects CorVel's extensive reach within the managed care sector.

The company also invests in research and development, with capitalized expenditures totaling USD 2.5 million. CorVel’s focus on integrating technology with personalized service enhances its ability to deliver effective and efficient risk management solutions. In December 2021, CorVel launched Comp AI, an innovative product designed to enhance the efficiency of workers' compensation claims management by automating routine tasks, improving decision-making, and reducing administrative burdens.

Furthermore, the introduction of Comp AI in 2021 reflects a broader trend within the Insurance Third Party Administrator (TPA) market towards integrating cutting-edge technology to optimize claims management and operational efficiency. By leveraging AI, CorVel is positioning itself as a forward-thinking leader in the TPA sector, responding to the growing demand for sophisticated solutions that enhance service delivery and client satisfaction. This strategic move underscores CorVel’s dedication to advancing its service offerings and maintaining its competitive edge in the industry.

Highlights of Sedgwick Claims Management Services Inc.

Sedgwick Claims Management Services Inc., established in 1969 and headquartered in Memphis, Tennessee, is one of the prominent players in the Insurance TPA market. With over 50 years of experience, Sedgwick is committed to providing high-quality claims administration, managed care, program management, worker's compensation, and liability services. The company operates globally, with a workforce of 33,000 employees spread across 80 countries.

Notably, Sedgwick holds a 1.04% market share in the TPA sector and achieved a product revenue of USD 3.2 billion as per our analysis. The company is recognized for its dedication to core values such as empathy, accountability, inclusion, collaboration, and growth. These values underpin its approach to managing complex insurance processes and delivering exceptional service.

Under the leadership of CEO Mike Arbour, Sedgwick has been acknowledged for its innovation, receiving the 2024 CIO 100 Award from Foundry’s CIO for the Sidekick application. This accolade highlights Sedgwick’s role as a forward-thinking leader in the TPA market, leveraging technology to improve claims management and support clients worldwide.

Sedgwick expanded its global footprint in the Insurance TPA market in September 2020 by launching a new TPA center in Malaysia. This strategic move aims to enhance its service capabilities across Asia, aligning with the company's broader initiative to strengthen its presence in key international markets.

The new center will offer comprehensive claims management and administrative services, furthering Sedgwick's commitment to delivering efficient and high-quality support in the insurance industry. This expansion highlights Sedgwick's ongoing efforts to leverage its global network and expertise to meet the growing demand for innovative TPA solutions in the region.

Building on this global expansion, Sedgwick continued to innovate by introducing Sidekick in May 2024. Sidekick is an AI-powered care guidance application that integrates OpenAI’s generative artificial intelligence with its claims management platforms. This new tool is designed to enhance the efficiency and accuracy of claims processing by offering real-time, AI-driven insights to claims professionals.

The launch of Sidekick reflects a broader trend in the insurance TPA market toward leveraging advanced technology to improve service delivery and operational efficiency. By integrating such cutting-edge solutions, Sedgwick reinforces its position as a leader in the industry, continuously adapting to the evolving demands of the market.

Sedgwick is reshaping the insurance TPA market with its strategic expansions and AI integration. By enhancing claims management processes and expanding globally, Sedgwick sets new standards in efficiency and service quality. In April 2023, Sedgwick launched Sidekick, an application powered by OpenAI’s GenAI, to streamline claims management. This innovation underscores Sedgwick's commitment to leveraging cutting-edge technology, reinforcing its position as a leader in the TPA sector and meeting the evolving needs of its global clients.

Highlights of United Healthcare Services (UMR) Inc.

UnitedHealthcare Services Inc., headquartered in Minnetonka, Minnesota, is one of the leading entities in the insurance Third-Party Administrator (TPA) services sector. Established in 1974, UnitedHealthcare is a division of UnitedHealth Group, which is dedicated to building a modern, high-performing health system by improving access, affordability, outcomes, and experiences in healthcare. UnitedHealth Group also encompasses Optum, a subsidiary that leverages technology and data to enhance care delivery and health outcomes. Brian Thompson serves as the CEO of UnitedHealthcare.

UnitedHealthcare operates in multiple countries, supported by a substantial workforce of over 399,000 team members. The company has received numerous accolades for its workplace environment and corporate achievements. It was ranked first in the health care (insurance and managed care) sector on Fortune’s 2023 “World’s Most Admired Companies” list for the 14th consecutive year, excelling in all nine key attributes of reputation assessed by Fortune.

Additionally, UnitedHealth Group was listed No. 32 on Fortune's 2024 “America’s Most Innovative Companies” list and No. 5 among the largest UnitedHealth Group ranked among the top U.S. corporations based on 2022 revenues, securing a global ranking of No.10 in 2023.

Financially, the company reported revenues of USD 98.9 billion, reflecting an increase of nearly USD 6 billion year-over-year, largely driven by its subsidiary, Optum. UnitedHealth Group's cash flows from operations amounted to USD 6.7 billion, with second-quarter earnings of USD 4.54 per share. These earnings were affected by a cyberattack and the reclassification of South American operations as held for sale. Adjusted earnings, accounting for business disruption impacts, stood at USD 6.80 per share.

UnitedHealthcare advanced its digital strategy by launching UHC Hub in January 2024, streamlining healthcare navigation and boosting member engagement through personalized tools. This follows the August 2022 rebranding of its platform Bind to Surest, reflecting enhanced capabilities in delivering user-friendly, tech-driven health insurance solutions. These moves underscore UnitedHealthcare's leadership in driving digital innovation within the Insurance TPA market.

Highlights of Gallagher Bassett Services Inc.

Gallagher Bassett Services Inc., established in 1962 and headquartered in Itasca, Illinois, is one of the leading global providers of claims management and risk solutions. As a part of Arthur J. Gallagher & Co., Gallagher Bassett is renowned for its extensive expertise in the insurance TPA market, serving clients seeking to manage and mitigate risk effectively.

Under the leadership of CEO Mike Hessling, Gallagher Bassett offers a comprehensive suite of services designed to reduce the total cost of risk, shorten claim durations, and enhance safety. The company's approach integrates a deep understanding of industry nuances with a commitment to delivering exceptional outcomes through a blend of expertise, innovation, and superior service tailored to each client's unique needs.

Gallagher Bassett’s reputation for excellence is further highlighted by its consistent recognition in the industry. Fortune Magazine has listed Arthur J. Gallagher & Co. on the Fortune 500 list for nine consecutive years, highlighting the company's robust performance and significant role in the global claims and risk management sector.

Additionally, Gallagher Bassett was featured in Insurance Business Magazine in January 2023 for its dedication to innovation and excellence in the insurance TPA market. The company emphasized its commitment to superior claims and risk management services, driven by a passionate and skilled workforce. This focus on enhancing client outcomes, combined with advanced technology integration, underscores Gallagher Bassett’s leadership in the insurance TPA sector, supporting its mission to reduce the total cost of risk and improve service quality.

Building on this foundation of excellence, Gallagher Bassett further advanced its offerings in June 2024 by introducing new capabilities to its Waypoint platform. Waypoint Connect and Waypoint Insights are designed to streamline claims management and provide deeper analytics for better decision-making. Waypoint Connect enhances communication between clients and claims adjusters, ensuring more efficient and transparent interactions. Meanwhile, Waypoint Insights leverages advanced data analytics to optimize risk management strategies, reflecting Gallagher Bassett’s ongoing commitment to integrating technology with its core services. This strategic enhancement of the Waypoint platform reinforces the company’s position as a leader in the insurance TPA sector, continuously evolving to meet the needs of its clients through innovative solutions.

These advancements reflect Gallagher Bassett’s commitment to leveraging technology for more efficient and effective insurance TPA services, aligning with industry trends toward greater digital integration and data-driven solutions. Through its wide range of insurance TPA services, Gallagher Bassett supports clients across various industries, ensuring they are well-equipped to handle the complexities of risk management and claims processing.

Have questions? Inquire before purchasing the full report

Summary of Insurance Tpa Market

The Insurance TPA market is experiencing a profound transformation driven by digital advancements that boost operational efficiency and enhance customer experience. Automation and artificial intelligence (AI) streamline claims processing, reduce manual errors, and provide deeper insights into risk management. These technologies enable TPAs to process claims faster and more accurately while offering personalized services. The use of big data analytics allows for better risk assessment and decision-making, while digital platforms improve real-time data access and communication among insurers, TPAs, and clients. Mobile apps and self-service portals enhance customer engagement by allowing users to manage their policies and track claims easily. As digital tools continue to evolve, the Insurance TPA market will see further innovations in predictive analytics, blockchain, and telematics, driving enhanced service delivery and operational efficiencies, and reshaping industry standards in the coming years.

About the Author

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Healthcare, Manufacturing, Insurance &Claims Management, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, and filming, often drawing inspiration from these activities for her creative writing endeavours.

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Healthcare, Manufacturing, Insurance &Claims Management, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, and filming, often drawing inspiration from these activities for her creative writing endeavours.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment