How Leading Brands Rule 50% of the Electric Shaver Market

Published: 2025-09-11

The global Electric Shaver Market is growing at a compound annual growth rate (CAGR) of 6.9% and is expected to reach USD 33.72 billion by 2030, representing a 64% increase from its 2023 valuation. This growth is primarily driven by the increasing awareness and emphasis on personal grooming, along with the expansion of e-commerce platforms that offer consumers easy access to a wide range of electric shavers.

Electric Shaver Market Overview

The electric shaver market refers to the production, distribution, and sale of electric shaving devices designed for personal grooming. This industry caters to a diverse range of personal grooming needs by offering efficient and convenient shaving solutions for both men and women. Electric shavers are widely utilized for daily shaving, beard maintenance, and skincare, with a variety of devices available to accommodate different preferences and skin types. The market features various types of electric shavers, including foil and rotary models, each designed to deliver efficient and comfortable shaving experiences.

The market has seen significant advancements in recent years, driven by a combination of technological breakthroughs and evolving consumer preferences. The integration of smart technologies, including Bluetooth connectivity, expanded the capabilities of modern electric shavers. This innovation enables shavers to synchronize with mobile applications, providing users with real-time insights into their grooming habits. These apps offer personalized tips, maintenance reminders, and product recommendations based on the user's shaving patterns.

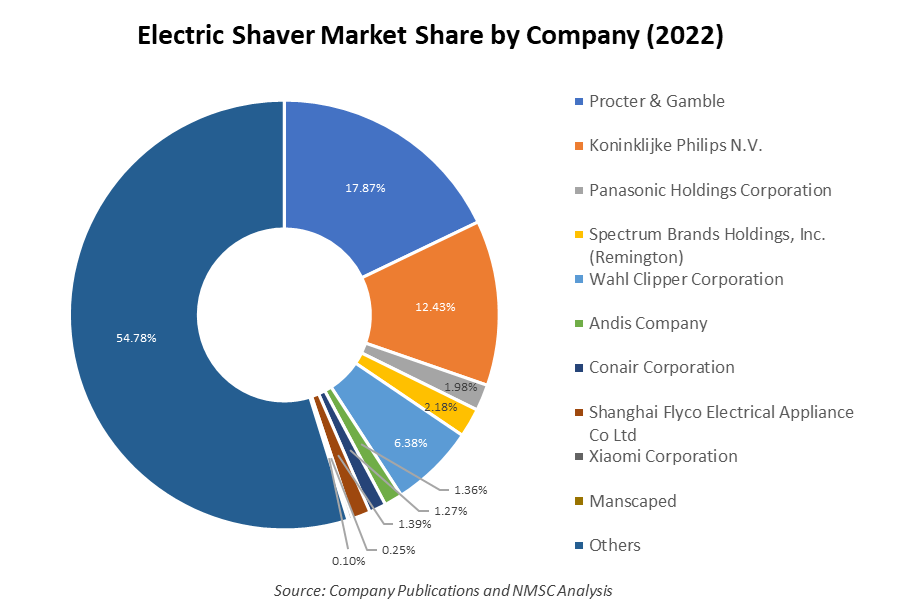

Leading companies in the electric shaver industry include Procter & Gamble (Braun), Koninklijke Philips N.V., Panasonic Holdings Corporation, Spectrum Brands Holdings, Inc. (Remington), Wahl Clipper Corporation, Andis Company, Conair Corporation, Xiaomi Corporation, Shanghai Flyco Electrical Appliance Co Ltd, Manscaped, and others.

For the latest market share analysis and in-depth electric shaver industry insights: Get FREE Sample

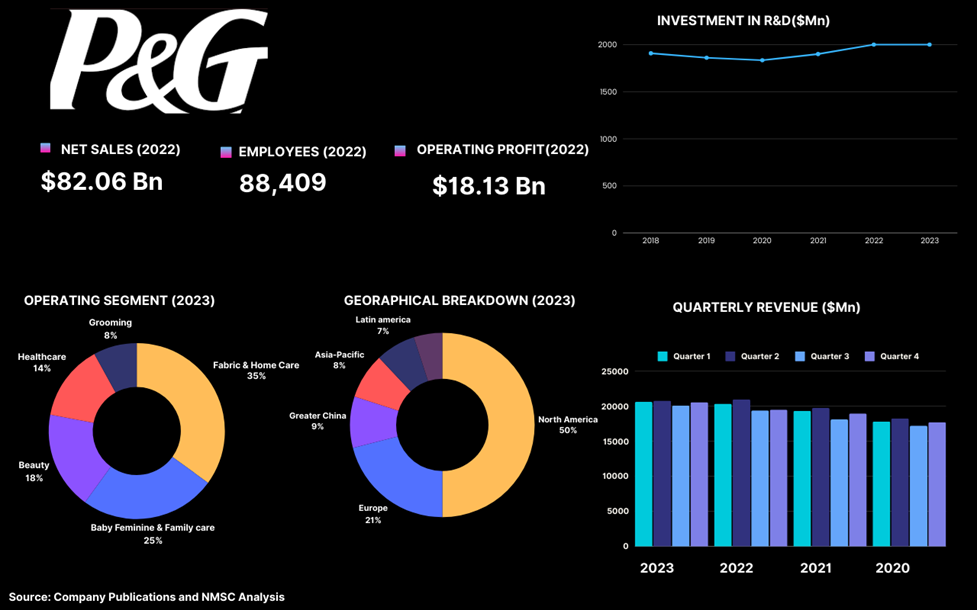

Highlights of P&G (Braun)

Procter & Gamble (P&G) is an American multinational consumer goods corporation, founded in 1837 and headquartered in Cincinnati, Ohio. The company is the global market leader in the blades and razors market, with major brands in its grooming segment including Braun, Gillette, and Venus. P&G holds a market share of over 60% in the global blades and razors market, primarily driven by its Gillette and Venus brands. Additionally, P&G’s appliances, such as electric shavers and epilators, are sold primarily under the Braun brand in numerous markets worldwide, where they compete against both global and regional competitors. P&G holds nearly 25% of the male electric shaver market and over 50% of the female epilators market.

The company operates through five reportable segments and has a portfolio of daily-use products across ten categories: fabric care, home care, baby care, feminine care, family care, hair care, skin and personal care, oral care, personal health care, and grooming. In 2023, the company saw a 2% increase in net sales, reaching USD 82.06 billion compared to 2022. The fabric and home care segment generated the highest net sales at 35%, followed by the baby, feminine, and family care segment, the beauty segment, the health care segment, and the grooming segment. Net sales from the grooming segment accounted for 8% of the total in 2023.

The increase in net sales was primarily driven by a 9% rise in product prices and a favourable sales mix that contributed an additional 1%. This favourable mix indicates that the company sold a higher proportion of products in regions including North America, where selling prices are higher, compared to regions including Europe, where prices are lower. However, this growth was partially offset by a 5% negative impact from unfavourable foreign exchange rates and a 3% decrease in unit volume compared to the prior year.

P&G’s operating income increased to USD 18.13 billion in 2023, up from USD 17.81 billion in 2022, reflecting a 2% surge from the previous year. Additionally, the company’s research and development costs were USD 2.0 billion in both 2023 and 2022, up from USD 1.9 billion in 2021, marking a 5% increase over this period. Moreover, the geographic breakdown of revenue indicates that North America holds a 50% share in net sales, highlighting the region's significant contribution to the company's overall revenue. P&G's commitment to quality and consumer satisfaction positions it as a dominant player in the personal care industry, with its products widely available across global markets

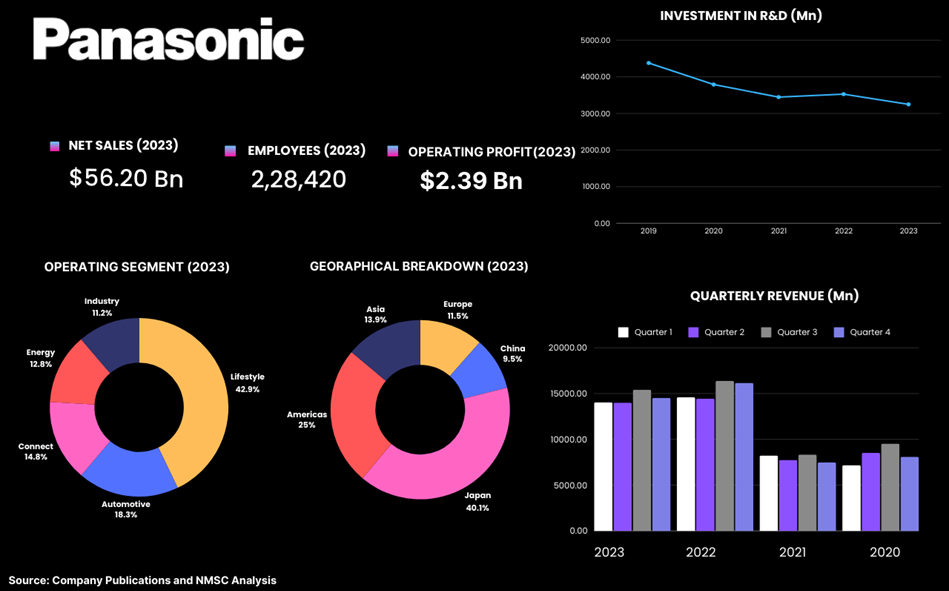

Highlights of Panasonic Holding Corporation

Panasonic Holding Corporation is a prominent multinational electronics company renowned for its diverse range of consumer products, including electric shavers. Panasonic's electric shavers are recognized for their advanced technology, such as multi-blade systems and flexible heads that adapt to facial contours, providing a close and comfortable shave. The company emphasizes innovation, incorporating features such as automatic cleaning stations and sensors that adjust power based on stubble thickness. This focus on advanced technology contributed to its strong financial performance.

For the financial year ending March 2024, Panasonic earned net sales of USD 56.20 billion, marking a 1.4% increase from March 2023. This growth was driven by increased sales in the automotive and connect segments, as well as favourable currency translation effects. Additionally, operating profit rose to USD 2.39 billion in 2024 from USD 1.91 billion in 2023, representing a 25% increase. This surge was primarily due to price revisions, rationalization efforts, favourable exchange rates, and a tax credit under the U.S. Inflation Reduction Act.

The company's expenditure on research and development (R&D) amounted to USD 3.25 billion in the fiscal year 2024. Looking ahead to fiscal 2025, the company expects overall net sales to further increase, driven by growth in the lifestyle, connect, and industry segments, despite a decline in the automotive and energy segments. Adjusted operating profit is anticipated to rise across all segments due to increased sales and continued efforts in price revisions and rationalization. Consequently, operating profit and profit before income taxes are also expected to increase.

In October 2023, Panasonic launched its latest grooming device, the Panasonic ARC3 3-Blade Shaver (ES-SWLT2W), inspired by the classic Star Wars trilogy. This shaver can be used wet or dry for added convenience and includes a pop-up trimmer for edging and detailing. Panasonic's commitment to quality and user-friendly design has solidified its position as a significant player in the grooming market, appealing to consumers seeking high-performance shaving solutions.

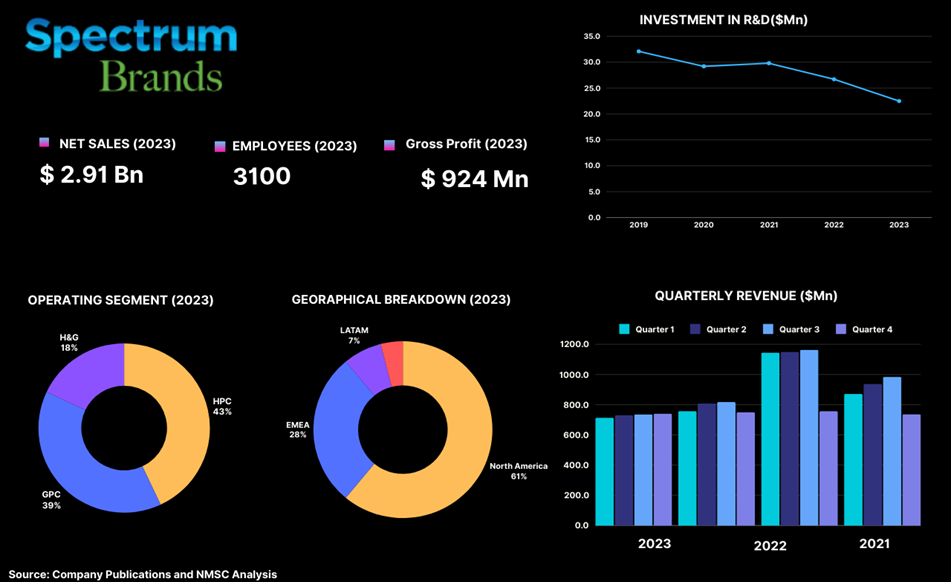

Highlights of Spectrum Brands Holdings, Inc. (Remington)

Spectrum Brands Holdings, Inc. is one of the leading manufacturers and marketer of consumer products, including electric shavers under its Remington brand. Renowned for its commitment to quality, affordability, and advanced technology, Remington offers a wide range of grooming products, including rotary and foil electric shavers, body groomers, and trimmers.

To effectively manage its diverse product offerings, Spectrum Brands operates through three product-focused segments: Global Pet Care (GPC), Home and Garden (H&G), and Home and Personal Care (HPC). The company manufactures, markets, and distributes its products globally across North America (NA), Europe, the Middle East & Africa (EMEA), Latin America (LATAM), and Asia-Pacific (APAC). In 2023, Spectrum Brands reported total net sales of USD 2.91 billion, representing a 7% decrease from 2022. The HPC segment accounted for 43% of total net sales, while North America contributed the largest regional share at 61%. This reduction in net sales was driven by lower aquatics sales, adverse weather conditions, unfavourable foreign exchange rates, increased competition, and operational changes.

Additionally, from 2021 to 2023, Spectrum Brands' research and development (R&D) expenditures were USD 29.8 million, USD 26.7 million, and USD 22.5 million, respectively. The company's R&D strategy focuses on developing new products and enhancing the performance of existing products to provide greater value to consumers through innovative designs and improved functionality. However, R&D spending significantly decreased as a substantial portion of the company’s cash flow was allocated to paying down its debt. Despite facing challenges in sales and R&D expenditure, the company remains a significant player in the industry.

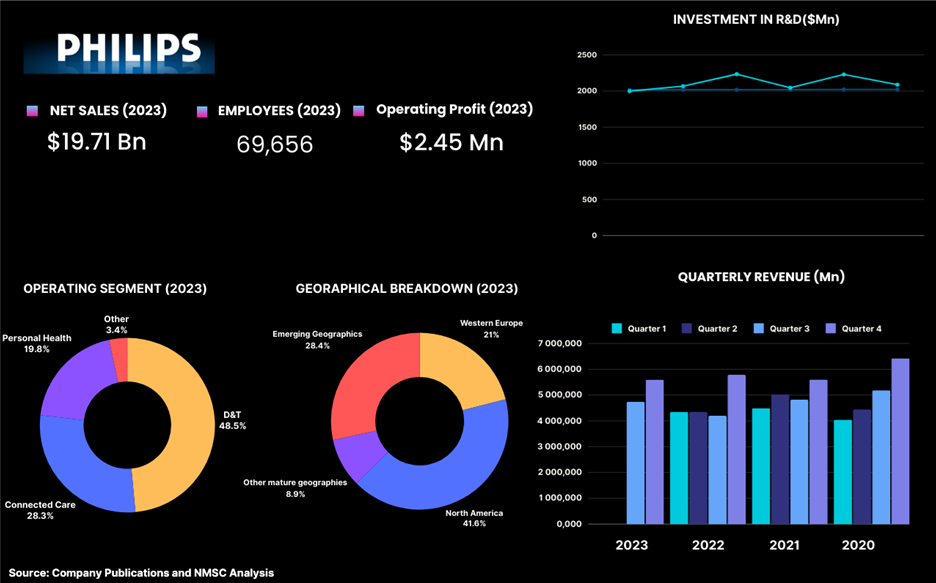

Highlights of Philips Norelco

Philips Norelco is a leading brand in electric shavers, renowned for its innovative technology and personalized shaving experience. The brand offers a range of rotary electric shavers equipped with SenseIQ technology, which adapts to each user's unique skin and hair type. Philips Norelco's electric shavers feature dual steel precision self-sharpening blades that make up to 150,000 cutting actions per minute, ensuring a fast and efficient shave. The protective skin glide coating reduces friction on the skin by 25%, minimizing irritation. Many models are designed for both wet and dry use, allowing users to shave with gel or foam, even in the shower.

Philips Norelco has a rich history of innovation, having launched the first fully cordless razor in the early 1960s. Today, the brand continues to innovate and deliver high-performance electric shavers, including the top-rated Philips Norelco 9800 model. This commitment to quality and performance has positively impacted their financial performance.

In 2023, the company’s sales reached USD 19.71 billion, a 1.9% increase from 2022, driven by supply chain improvements. Research and development expenses were USD 2.09 billion in 2023, down from USD 2.23 billion in 2022. This 14% decrease in R&D expenditure was primarily due to lower restructuring and acquisition-related charges and a favourable foreign currency impact. Despite these advancements, the company's income from operations was a loss of USD 127 million in 2023, compared to a loss of USD 1690 million in 2022. This is a brief overview of Philips Norelco, highlighting its commitment to innovation and high-performance shaving solutions.

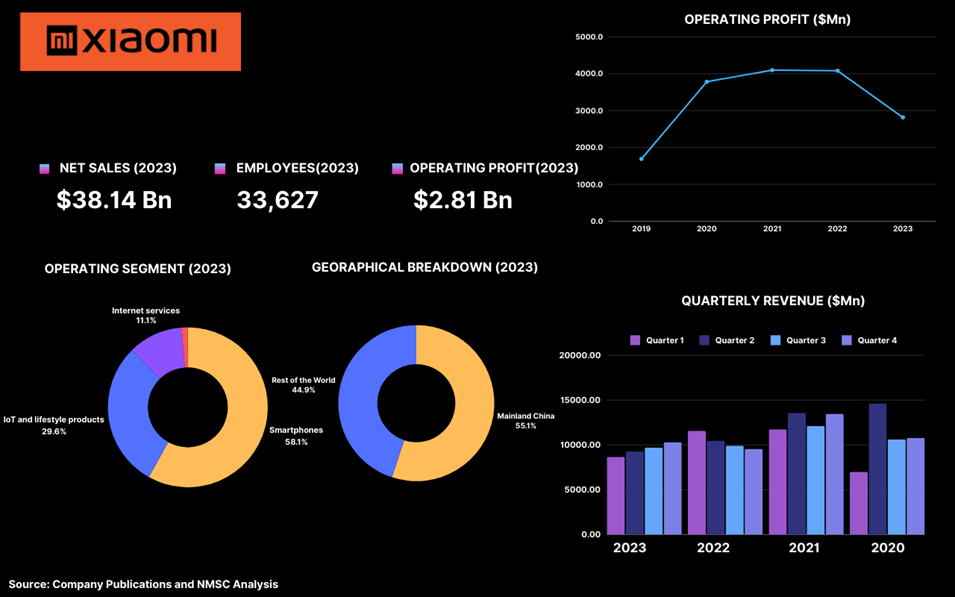

Highlights of Xiaomi Corporation

Xiaomi Corporation is one of the leading Chinese technology companies known for designing, manufacturing, and selling a diverse range of products. The company operates in three main business segments: smartphones, IoT and lifestyle products, and internet services. Recently, Xiaomi has expanded its product lineup to include personal care items, offering consumers innovative solutions for their grooming needs. One notable product is the Mijia Electric Shaver S200, launched in March 2024. This affordable electric shaver combines intelligent features with a user-friendly design, featuring a dual-ring arc blade net for smooth skin contact and a floating structure that adapts to the contours of the face.

In 2023, Xiaomi Corporation reported a revenue of USD 38.14 billion, a 6% decrease from 2022. However, the company increased its research and development expenses by 19.2%, from USD 2.32 billion in 2022 to USD 2.69 billion in 2023, primarily due to investments in their smart EV business and other new initiatives. The operating profit reported by the company was USD 2.81 billion in 2023, compared to USD 408 million in 2022 and USD 4.1 billion in 2021. This rise in R&D expenditure and operating profit highlights Xiaomi Corporation's commitment to innovation and its significant presence in the technology and personal care markets.

Have questions? Inquire before purchasing the full report

Summary of Electric Shaver Industry

The electric shaver industry is highly competitive, led by major companies such as Procter & Gamble, Panasonic, Spectrum Brands, Philips Norelco, and others. These firms dominate male and female grooming markets with innovative, user-friendly products, ensuring steady growth and market expansion. Their advanced technology, including self-sharpening blades, drives significant sales and maintains their strong market positions. This industry thrives on consumer-centric designs and strategic market operations, solidifying its leadership in personal grooming.

About the Author

Sreeparna Das is a researcher with over two years of experience specializing in market trend analysis, trend forecasting, and competitive analysis across various industries. She has worked on many comprehensive reports while offering actionable recommendations that help businesses make informed decisions, ensuring clients stay ahead in their respective markets. With a keen interest in writing, she shares her insights through blogs and articles. She spends her time in reading, cooking and photography when not keeping up with industry news.

Sreeparna Das is a researcher with over two years of experience specializing in market trend analysis, trend forecasting, and competitive analysis across various industries. She has worked on many comprehensive reports while offering actionable recommendations that help businesses make informed decisions, ensuring clients stay ahead in their respective markets. With a keen interest in writing, she shares her insights through blogs and articles. She spends her time in reading, cooking and photography when not keeping up with industry news.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment