A Performance Analysis on Key Players Operating in the Global Early Toxicity Testing Industry

16-Feb-2025

Our analysis indicates substantial growth in the global early toxicity testing market by 2030. The market is expected to reach USD 8.39 billion by 2030, reflecting an increase of over 60% compared to 2022. This growth is driven by the accelerated research and development (R&D) activities in the pharmaceuticals and biotechnology sectors. Additionally, growing concerns regarding product safety in the food processing and cosmetics industries are further fueling demand for early toxicity testing services.

Early Toxicity Testing Market Overview

Early toxicity testing is a crucial process in drug development that evaluates potential toxicity using in vitro or animal models before human trials. It aims to identify safety concerns and determine if further development is safe. The testing involves assays such as cell viability, genotoxicity, and pharmacokinetic studies. This industry has emerged as a vital step, allowing researchers to identify toxic effects early, avoid investing in unsuccessful drugs, and bring safe treatments to patients faster. Governments around the world are investing more money in R&D to develop new treatments for serious illnesses. Thus, we are expecting to see a lot more innovative drugs in the coming years. As per the Pharmaprojects, the preclinical pipeline surged from 10,223 in 2021 to 11,351 in 2022, an increase of 11% within just one year which highlights the increasing importance of early toxicity testing worldwide.

The introduction of 3D cell culture enables more accurate in vitro toxicity testing while reducing animal studies, and combined with bioinformatics, identifies biomarkers to predict drug effects, streamlining development and creating opportunities for personalized medicine to revolutionize drug discovery and patient outcomes.

Leading companies in the early toxicity testing industry includes Eurofins Scientific, Wuxi Apptec., Danaher Corporation, Thermo Fisher Scientific Inc., Perkinelmer, Inc., Charles River Laboratories, Bio-Rad Laboratories Inc., Labcorp Drug Development, Agilent Technologies, Inc., Evotec AG and others.

For the latest market share analysis and in-depth early toxicity testing industry insights, you can reach out to us at: https://www.nextmsc.com/early-toxicity-testing-market/request-sample

Highlights of Eurofins Scientific

Eurofins Scientific, based in Luxembourg, is a leading provider of analytical and testing services with a presence in 62 countries. With over 900 laboratories and approximately 61,798 employees, the company conducts more than 450 million tests annually, offering over 200,000 analytical methods to ensure the safety and quality of various products. The drug discovery market is rapidly expanding due to increased R&D spending, a shift towards outsourcing, advancements in big data and AI, and the growing demand for reliable partners from global pharmaceutical and biotech firms.

Eurofins' in vitro toxicology services evaluate potential toxicity or adverse effects of drugs, chemicals, or other substances at an early stage, using in vitro or animal models before human trials. By identifying potential issues early, Eurofins helps researchers and pharmaceutical companies avoid investing in drugs unlikely to succeed, saving time and money while bringing safe treatments to patients faster.

Revenues for the year 2023 were USD 7.19 billion, a 2.9% decline year-on-year due to a sharp decrease in COVID-19 testing and reagents. Core business organic growth in Europe was 6.2%, driven by environment testing and improved food testing. In North America, core business organic growth was 8.7%, supported by environment testing, food testing, and biopharma services. Growth in the Rest of the World was 6.0%, led by strong performance in China, expansion of biopharma services in India, and new laboratories in Australia and New Zealand.

Despite economic and geopolitical uncertainties, Eurofins remained cautious with its acquisition strategy, focusing on value-driven bolt-on deals, closing 40 business combinations with proforma revenues of USD 132.68 million at a cost of USD 171.83 million. Eurofins Discovery launched DiscoveryAI, an AI tool that accelerates drug discovery by leveraging a proprietary dataset of over 2,500 compounds and over 1 million records, potentially reducing drug-to-market time by at least 20%.

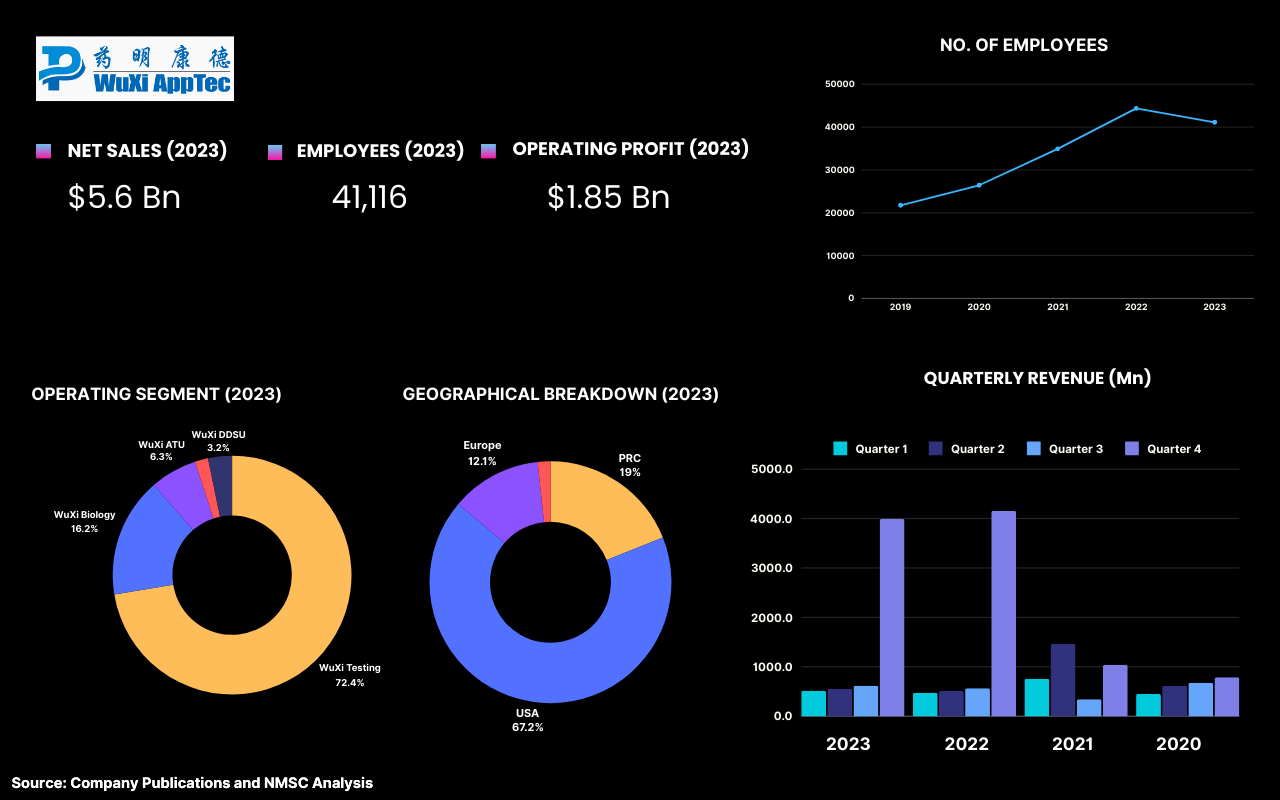

Highlights of Wuxi Aptech Co., Ltd.

WuXi AppTec Co., Ltd. is one of the leading global providers of pharmaceutical, biopharmaceutical, and medical device testing services, with a specialization in early toxicity testing. Established in 2000 in Shanghai, the company has become one of the crucial companies in the life sciences sector, offering a comprehensive range of research and development (R&D) services. WuXi AppTec provides extensive early toxicity testing capabilities, including in vitro and in vivo assessments, helping clients identify safety concerns early in the drug development process to minimize risks and resource expenditures.

With a robust network of facilities across Asia-Pacific, Europe, and North America, and a workforce of over 40,000 employees, the company is committed to innovation and quality. WuXi AppTec continuously invests in advanced technologies and bioinformatics to enhance data analysis and biomarker identification, positioning itself to meet the growing demand for early toxicity testing in the pharmaceutical and biotechnology industries. WuXi AppTech serves all of the top 20 pharmaceutical companies worldwide. In 2023, the top 20 global pharmaceutical companies accounted for approximately 40% of the company’s overall revenue.

In 2023, WuXi AppTec reported revenue of USD 5.68 billion, reflecting a 2.5% increase from 2022 and a remarkable 213% rise compared to 2019. The company's operating profit also saw significant growth, reaching USD 1.87 billion, a 22% increase from the previous year and a 431% increase since 2019. Looking ahead, WuXi AppTec announced plans for a new R&D and manufacturing site in Singapore, set to become operational by 2027, which will enhance its global platform and create 1,600 jobs, further supporting healthcare innovation from discovery to commercialization.

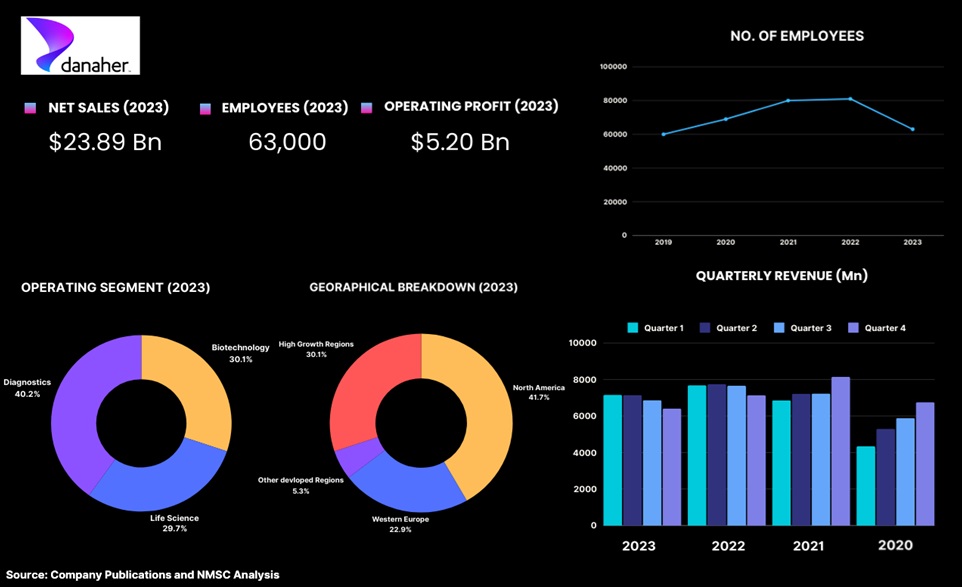

Highlights of Danaher Corporation

Danaher Corporation, headquartered in Washington, D.C., is one of the leading global conglomerates specializing in life sciences and diagnostics, with a strong focus on early toxicity testing. Established in 1984, Danaher has become a key player in the industry by offering a comprehensive range of products and services that support toxicology assessments, including advanced analytical instruments and laboratory solutions. The company leverages cutting-edge technologies and the Danaher Business System (DBS) to help pharmaceutical and biotechnology firms identify potential safety concerns early in the drug development process, thereby minimizing the risk of late-stage failures. Recently, Danaher launched a strategic collaboration with Cincinnati Children's Hospital to enhance liver organoid technology for drug toxicity screening, further demonstrating its commitment to improving patient safety and advancing healthcare innovation.

With a robust global presence and a workforce of approximately 63,000 employees, Danaher is well-positioned to meet the increasing demand for early toxicity testing and contribute to the development of safe and effective therapeutics. In 2023, Danaher Corporation acquired Abcam plc for approximately US$ 5.6 billion, enhancing its position in the early toxicity testing industry. Abcam, a global supplier of protein consumables, generated revenues of around US$ 475.04 million in 2022 and is now part of Danaher’s Life Sciences segment, providing additional sales and earnings opportunities in the proteomics sector.

In 2023, Danaher Corporation reported a revenue of US$ 23.89 billion, reflecting a 10% decrease compared to the previous year. This decline also affected the company's operating profit, which fell to US$ 5.20 billion, marking a -31% decrease from 2022. The decline was seen primarily due to the decreasing demand for COVID-19-related products, and to a lesser extent declines in demand for other products and services. In 2023, total sales in the Biotechnology segment fell by 18.0%, primarily due to decreased core sales from COVID-19 vaccines and therapeutics, as well as lower demand in the bioprocessing business. The company anticipates continued reduced demand and inventory adjustments into the first half of 2024, with core revenue in bioprocessing expected to decline for the full year. However, R&D expenses (consisting principally of internal and contract engineering personnel costs) as a percentage of sales increased in 2023 as compared with 2022, primarily due to the year-over-year sales decline, and to a lesser extent the timing of new product development initiatives.

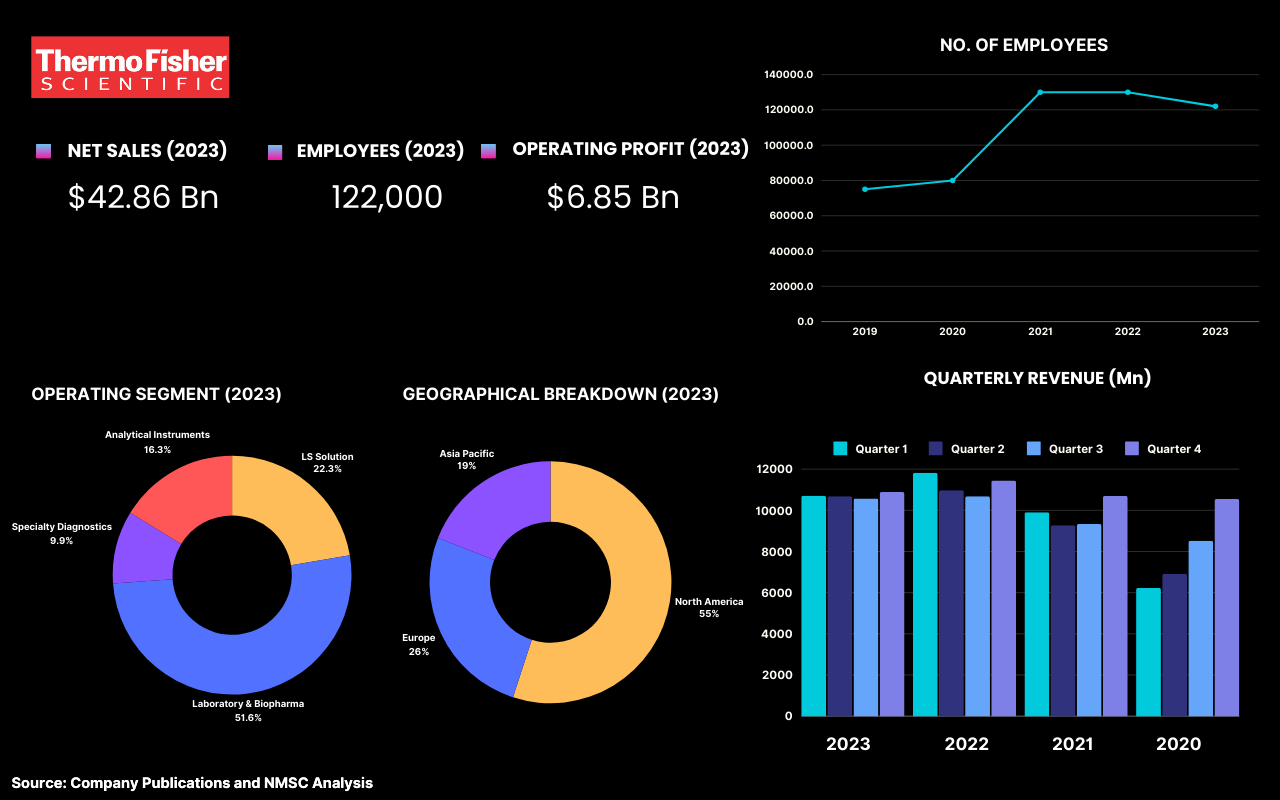

Highlights of Thermos Fisher Scientific Inc.

Thermo Fisher Scientific Inc. is one of the leading global life sciences companies that is renowned for its innovative products and services in the early toxicity testing industry. With a strong emphasis on scientific excellence and customer-focused solutions, Thermo Fisher provides a comprehensive portfolio that includes advanced analytical instruments, high-quality consumables and reagents, and robust software for data management and analysis. The company also offers contract research services through an extensive network of CROs, facilitating both in vitro and in vivo toxicology assessments. With over 90,000 employees and a commitment to continuous innovation, Thermo Fisher is well-equipped to meet the growing demand for early toxicity testing, contributing significantly to the development of safe and effective therapeutics. In 2023, the company reported revenues of $42.86 billion, reflecting its strong position in the life sciences market.

Thermo Fisher Scientific faced financial challenges in 2023 as its revenue decreased by 5% to US$ 42.85 billion in 2023 from US$ 44.91 billion in 2022. Since 2020, the Life Sciences Solutions and Specialty Diagnostics segments have supported COVID-19 diagnostic testing, adapting their molecular diagnostics and consumables businesses to meet pandemic demands. However, in 2023, sales related to COVID-19 testing declined significantly to US$ 0.33 billion from US$ 3.11 billion in 2022, as overall demand for vaccines and therapies decreased, although strong commercial execution helped mitigate some of the impact.

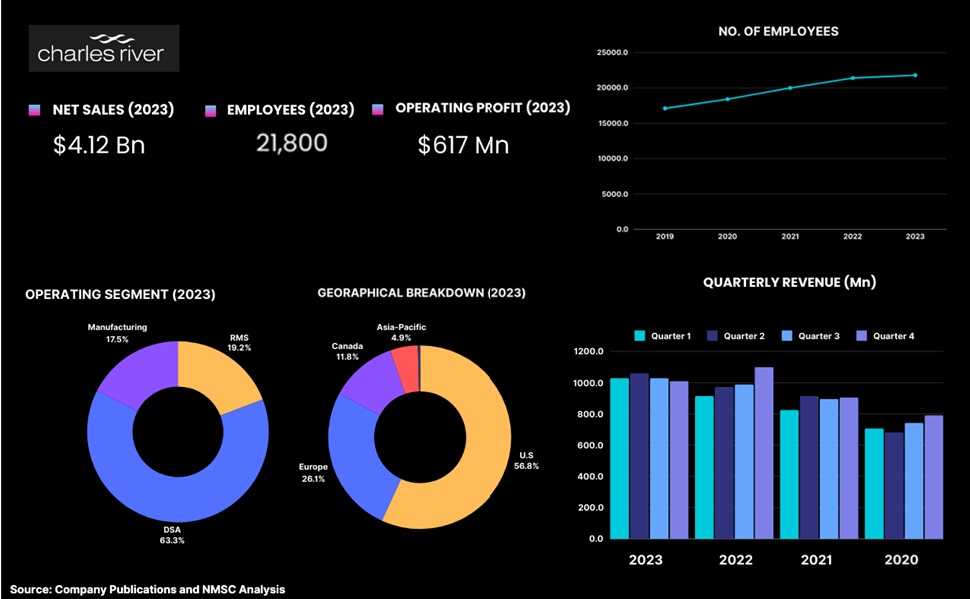

Highlights of Charles River Laboratories

Charles River Laboratories is one of the leading global providers of preclinical and clinical laboratory services, specializing in early toxicity testing to support new therapeutic development. The company offers a comprehensive range of toxicology services, including general, genetic, and immunotoxicology, as well as specialized studies such as ocular and inhalation toxicology. With a focus on scientific excellence and animal welfare, Charles River employs experienced toxicologists and regulatory specialists who utilize advanced methodologies to identify safety concerns early in the drug development process. Operating a network of AAALAC-accredited facilities, the company conducts both in vitro and in vivo studies while continuously innovating to enhance testing capabilities and reduce animal use. With over 21,800 employees and a presence in more than 20 countries, Charles River is well-positioned to meet the growing demand for early toxicity testing and contribute to the development of safe and effective therapeutics.

Charles River has worked on more than 80% of the drugs that were approved by the U.S. Food and Drug Administration (FDA) over the past five years. Despite moderating demand trends in the broader life sciences sector in 2023 due to an uncertain funding environment and more cautious spending by biopharmaceutical clients, Charles River Laboratories delivered solid financial performance. The company reported revenue of US$ 4.12 billion, a 3.9% increase over the previous year on a reported basis. Charles River's Discovery and Safety Assessment (DSA) segment, which represented 63% of total company revenue, generated revenue of $2.6 billion in 2023, a 7.9% organic increase from the prior year. Revenue growth in the Safety Assessment business was driven by higher pricing and study volume, although it moderated compared to the unprecedented levels in recent years, as a result of the more cautious spending by many biopharmaceutical companies.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/early-toxicity-testing-market/inquire-before-buying

Summary of Early Toxicity Testing Industry

The early toxicity testing industry is experiencing significant growth, driven by increasing regulatory demands for safety and efficacy assessments in drug and chemical development. As pharmaceutical and biotechnology companies focus on minimizing risks and ensuring compliance, the demand for comprehensive toxicology services, including in vitro and in vivo studies, continues to rise. Innovations in testing methodologies, such as the development of animal-free testing methods and advanced predictive toxicology technologies, are shaping the industry's future, enhancing the ability to identify potential safety concerns early in the drug development process.

About the Author

Shyam Gupta is a passionate and highly enthusiastic researcher with more than four years of experience. He assists clients in overcoming difficult business challenges by providing actionable insights through exhaustive research. He has closely monitored several industries, such as Healthcare, ICT & Media, Robotics, and Electric Vehicles. He has a keen interest in writing articles and uses blogs as a medium to share his thoughts. He spends his time reading and painting when not keeping up with industry news. The author can be reached at shyam.gupta@nextmsc.com

Shyam Gupta is a passionate and highly enthusiastic researcher with more than four years of experience. He assists clients in overcoming difficult business challenges by providing actionable insights through exhaustive research. He has closely monitored several industries, such as Healthcare, ICT & Media, Robotics, and Electric Vehicles. He has a keen interest in writing articles and uses blogs as a medium to share his thoughts. He spends his time reading and painting when not keeping up with industry news. The author can be reached at shyam.gupta@nextmsc.com

.jpg)