How Kion, Honeywell, & ABB Lead Warehouse Automation Trends

Published: 2025-09-11

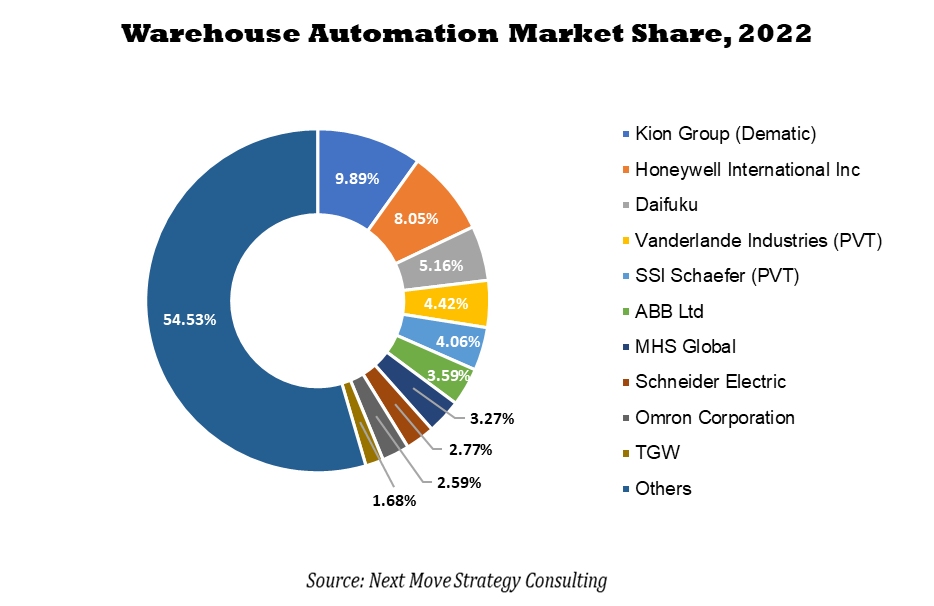

Next Move Strategy Consulting forecasts that the Warehouse Automation Market will grow from USD 23.84 billion in 2023 to USD 54.60 billion by 2030, with a CAGR of 11.7% during this period, due to advancements in robotics technology.

Warehouse Automation Market Overview

The warehouse automation market encompasses technologies and systems designed to streamline and optimize warehouse operations. This market includes a range of automated solutions such as robotic systems (including autonomous mobile robots (AMRs), robotic arms, and automated guided vehicles (AGVs)), conveyor systems, sortation systems, and warehouse management software. These technologies are integrated to enhance efficiency in inventory management, order picking, packing, sorting, and material handling.

The market focuses on solutions that improve operational productivity, accuracy, and speed by reducing manual labor and minimizing errors. It serves various industries including retail, e-commerce, manufacturing, and logistics, aiming to address the growing demand for faster and more reliable supply chain processes. The market is driven by rapid advancements in robotics and artificial intelligence (AI), alongside a growing need for real-time data and analytics. These technologies are revolutionizing operational efficiency, minimizing human error, and accelerating fulfillment processes.

However, the market faces challenges such as high initial costs, complex integration processes, and ongoing maintenance requirements. However, significant opportunities lie ahead with advancements in robotics and AI, expected to enhance system capabilities and reduce costs. Growing demand for efficient supply chains and the expansion of e-commerce offer promising prospects for innovation and increased automation adoption.

For the latest market share analysis and in-depth report on warehouse automation industry insights, you can reach out to us here

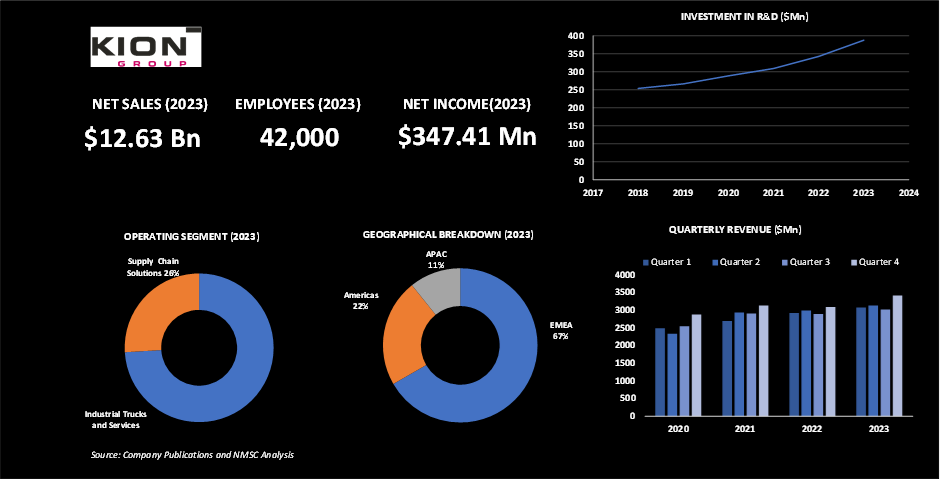

Highlights of Kion Group

KION Group is a global leader in industrial trucks and supply chain solutions, offering a range of products including forklifts, warehouse trucks, and advanced automation technology. In 2023, the company achieved a revenue of USD 12.63 billion and a net income of USD 347.41 million. Their operations are divided into three segments with industrial trucks and services accounting for 74% of their business. With a workforce of 42,000, KION Group operates worldwide, with the EMEA region contributing the largest share of 67% in 2023.

The company is committed to research and development (R&D), with investment rising from USD 254 million in 2018 to USD 388 million in 2023. This investment supports the company's efforts to simplify its product range, shorten development times, and develop solutions that meet customer needs. Several innovative projects underscore their dedication to enhancing warehouse automation.

For instance, the ARIBIC project aims to create a digital twin of a warehouse using data from truck sensors, while the CampusOS project is exploring the use of open 5G networks in logistics to improve connectivity and efficiency, and the IMOCO4.E initiative focuses on advancing mobile robots for better performance in warehouses and factories.

In addition to these projects, the KI. FABRIK initiative is working on developing robots that can autonomously supply assembly lines, while the GRASS project is investigating mobile robotic arms for efficient pallet picking. Artificial intelligence (AI) research is also a priority, with the AIGV project applying AI to coordinate autonomous robots, and the AGENC project exploring AI for modeling cyber-physical systems.

The LernFFZ project, launched in December 2023, aims to analyze forklift driver behavior to refine steering models for autonomous trucks. Through these initiatives and substantial R&D investments, KION Group continues to set new standards in warehouse automation, driving efficiency and productivity across global supply chains.

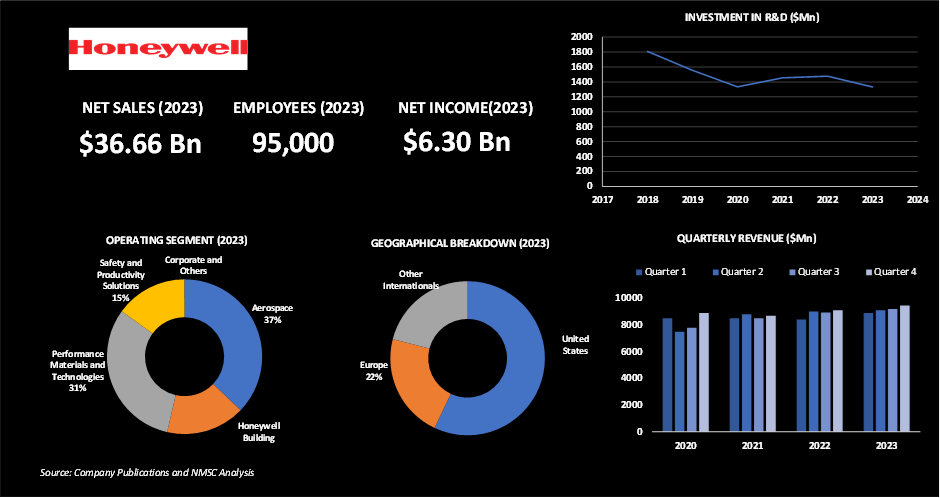

Highlights of Honeywell International Inc.

Honeywell International Inc. is a prominent name in warehouse automation, providing cutting-edge solutions such as robotics, conveyor systems, and warehouse management software. Their advanced technologies are designed to streamline warehouse operations, boosting efficiency and accuracy while helping businesses optimize their supply chains and enhance overall performance.

In 2023, Honeywell International Inc. achieved a revenue of USD 36.66 billion and a net income of USD 6.30 billion. The company operates across four main segments: Aerospace, Honeywell Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions, with Aerospace contributing the largest share at 37%. Honeywell's global workforce of 95,000 has a significant presence, particularly in the U.S., which accounts for more than 55% of its revenue.

Honeywell's commitment to innovation is evident in its substantial investment in research and development (R&D). In 2023, the company invested USD 1,317 million in R&D activities, representing approximately 4.1 percent of its consolidated revenues and reflecting a 13% increase year on year.

Additionally, Honeywell spent USD 55 million on order-related development activities. These investments underscore the company's dedication to driving technological advancements and maintaining its leadership in the warehouse automation industry. Honeywell International Inc. continues to invest strategically in the growth of the warehouse automation market. One notable example is on March 2023, when Honeywell introduced the Honeywell Universal Robotics Controller (HURC) to address automation interoperability in warehouses.

The HURC integrates various robotics and automation systems, enhancing efficiency and supporting the development of highly automated "dark warehouses." Showcased at ProMat 2023, Honeywell's solutions, including the Smart Flexible Depalletizer and Automated Storage and Retrieval System (AS/RS), are designed to boost productivity and address labor shortages, helping companies adapt to rising order volumes and workforce challenges.

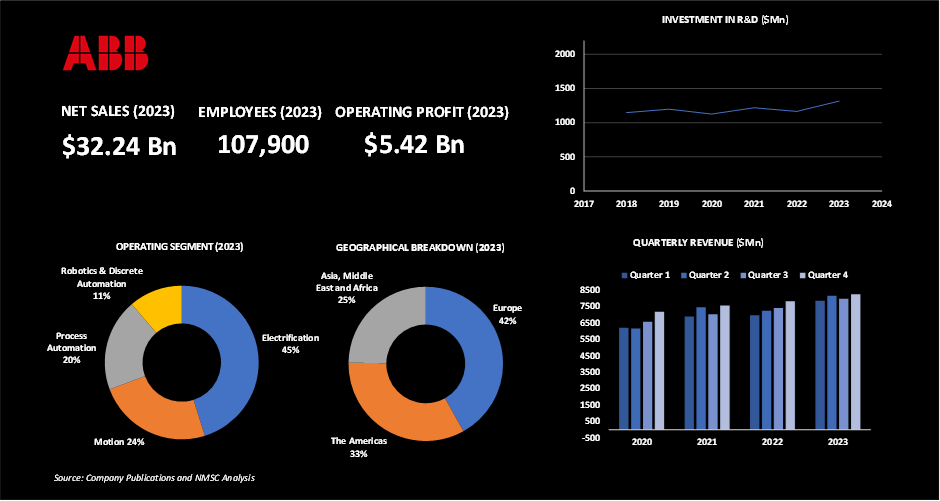

Highlights of ABB Ltd.

ABB Ltd, a major player in warehouse automation, reported impressive growth in 2023, with revenue reaching USD 32.23 billion, a 9% increase from the previous year, and an operating profit of USD 5.42 billion, with a workforce of 107,900 worldwide. This growth is fueled by strategic investments and expansions aimed at addressing the rising demand for advanced warehouse automation solutions. ABB’s portfolio includes cutting-edge robotics and integrated systems designed to enhance efficiency and accuracy in warehouse operations. These innovations are crucial for modernizing industrial environments and highlight ABB’s commitment to advancing warehouse automation.

ABB’s R&D efforts are driven by 19 divisions focused on advancing technologies crucial for future growth. As of December 31, 2023, approximately 7,500 people are involved in R&D across over 30 countries, with about 55% concentrated on digital and software development. The company invested USD 1,317 million, or roughly 4.1% of its 2023 revenue, in R&D.

ABB is exploring the potential of generative AI with more than 100 AI-focused projects. For example, its Robotics division is developing AI-enabled robots with an integrated vision for safe and autonomous warehouse operations. The company’s continuous investment in innovation and capacity expansion positions it as a key player in driving the future of warehouse automation, helping industries worldwide to achieve greater operational excellence and sustainability.

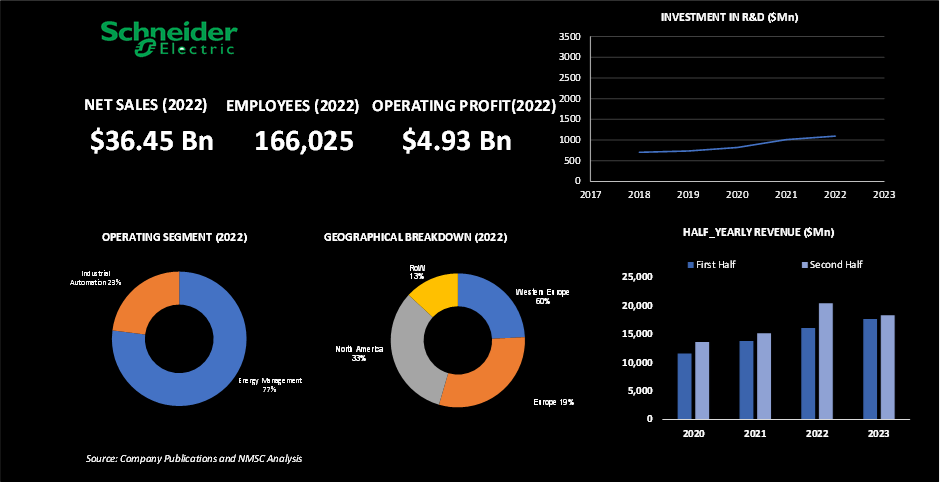

Highlights of Schneider Electric

Schneider Electric, a global leader in digital transformation and energy management, excels in providing integrated solutions for various industries, including warehouse automation. The company’s innovative technologies, such as advanced robotics and energy-efficient systems, enhance operational efficiency and sustainability in warehouse environments, supporting modern logistics and supply chain optimization. In 2023, Schneider Electric achieved impressive financial results, reporting revenue of USD 39.67 billion and an operating profit of USD 4.42 billion.

The company’s global workforce of 168,000 employees supports its worldwide presence, with North America contributing the largest share at 34%. Strong performance across various sectors drove this growth, fueled by trends in electrification, automation, and digitization. Schneider Electric identifies five major megatrends poised to drive market expansion and align with its strategic goals including Digitization and AI, Climate Change, Energy Transition, Evolution of Wealth, and New Global Equilibrium. These trends are central to Schneider Electric's approach to navigating future opportunities and challenges.

Schneider Electric topped the Gartner Supply Chain Top 25 in 2023, rising from second place the previous year and marking its fourth consecutive year in the top five. The company also opened a new manufacturing plant in Texas, part of a USD 300 million investment in U.S. manufacturing to support energy transition and infrastructure development. Additionally, Schneider Electric announced a USD 3 billion agreement with Compass Data Centers to enhance supply chain integration for prefabricated modular data centers and introduced CONNECT, an industrial intelligence software platform that integrates data, AI, and domain expertise for agile and sustainable operations.

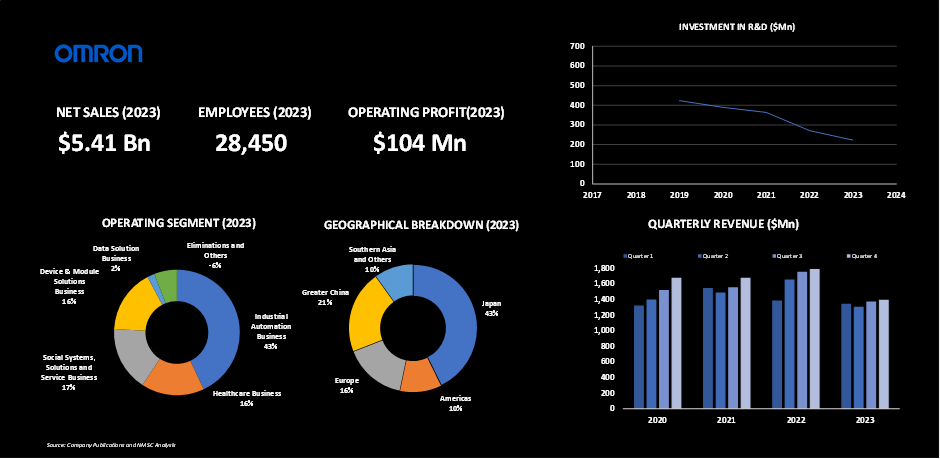

Highlights of Omron Corporation

Omron Corporation, a leader in warehouse automation, achieved USD 5.41 billion in revenue in 2023, driven by its advanced logistics robots and solutions for industries including warehouses and logistics centers. With over 28,000 employees globally, and a significant portion of revenue from the Asia-Pacific region, Omron’s innovations in automation have led to a 112% increase in customer adoption. The company’s strategic focus on AI and robotics highlights its commitment to enhancing warehouse operations and advancing the future of automation.

In 2023, Omron experienced a remarkable 112% increase in customers adopting its innovative automation solutions compared to the previous year, showcasing significant market acceptance and satisfaction. The company is focused on becoming a digital industry leader by advancing its capabilities in AI and robotics, aligning with its vision for a technologically driven future.

The company focused on strengthening its warehouse automation sector by advancing strategic initiatives within its Industrial Automation Business, aimed at enhancing efficiency and functionality. It improved marketing strategies to better highlight its automation solutions and invested in human resources to drive innovation. Omron’s investment in 23 startups also demonstrated its commitment to integrating cutting-edge technologies into warehouse automation, reinforcing its market position and setting the stage for continued growth and leadership in the industry.

Have questions? Inquire before purchasing the full report

Summary Of Warehouse Automation Market

The warehouse automation sector is experiencing significant growth, propelled by advancements in robotics, AI, and integrated systems. This expansion is driven by the need for greater efficiency and accuracy in supply chain operations, with technologies such as autonomous mobile robots, conveyor systems, and warehouse management software playing key roles.

While the industry faces challenges such as high costs and complex integration, the continual evolution of technology and the growing demand for streamlined, reliable processes are creating opportunities for further development. As companies invest in innovation and embrace automation, the warehouse automation market is poised for substantial progress and transformation.

About the Author

Baishali Sengupta is a dedicated Secondary Research Associate with a year of experience in the field. Known for her keen analytical skills and meticulous attention to detail, she excels in distilling complex data into actionable insights. Baishali combines a passion for research with a commitment to delivering high-quality, accurate information. Her proactive approach and enthusiasm for continuous learning make her a valuable asset in understanding market trends and driving informed decision-making.

Baishali Sengupta is a dedicated Secondary Research Associate with a year of experience in the field. Known for her keen analytical skills and meticulous attention to detail, she excels in distilling complex data into actionable insights. Baishali combines a passion for research with a commitment to delivering high-quality, accurate information. Her proactive approach and enthusiasm for continuous learning make her a valuable asset in understanding market trends and driving informed decision-making.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment