How Honeywell and KION are Transforming Intralogistics

Published: 2025-09-11

The intralogistics sector is set to experience substantial growth, with Next Move Strategy Consulting estimating an increase from USD 54.05 billion in 2022 to USD 107.69 billion in 2030. This growth trajectory, reflecting a CAGR of 9.8%, is driven by the rise of automation technologies.

Intralogistics Market Overview

The intralogistics market, a crucial component of supply chain management, focuses on optimizing the internal flow of goods within warehouses, distribution centers, and manufacturing facilities. This sector is witnessing robust growth driven by technological advancements, such as automation, robotics, and data analytics. These innovations are reshaping traditional material handling processes, improving efficiency, accuracy, and throughput in logistics operations.

The rise of automation technologies is a central factor propelling market growth. Automated guided vehicles (AGVs), robotic picking systems, and automated storage and retrieval systems (AS/RS) are becoming increasingly prevalent, offering enhanced operational efficiency and reduced labor costs. Additionally, the integration of data analytics and the Internet of Things (IoT) allows for real-time monitoring and optimization of inventory levels, equipment performance, and supply chain activities. This connectivity facilitates more informed decision-making and streamlined operations.

Despite these advancements, the intralogistics market faces several challenges. The integration of new technologies with existing systems often presents complexity and can disrupt ongoing operations. High upfront costs associated with advanced intralogistics solutions can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). The rapid pace of technological change also means that businesses must continually adapt and invest in the latest innovations to remain competitive. Furthermore, the increased reliance on interconnected systems raises cybersecurity concerns, necessitating robust protections to safeguard sensitive data and ensure operational integrity.

Looking ahead, the market offers numerous opportunities for growth and development. The continued advancement of automation technologies promises further improvements in efficiency and cost-effectiveness. The adoption of AI and machine learning can enhance predictive maintenance, optimize inventory management, and improve supply chain forecasting. The growing trend towards integrated and end-to-end supply chain solutions also presents opportunities for enhanced connectivity and operational synergy.

For the latest market share analysis and in-depth report on Intralogistics industry insights, Request for a Sample PDF

Highlights of Kion Group AG (Dematic)

The KION Group stands as a major player in the intralogistics market, offering a comprehensive range of solutions that align perfectly with the industry's needs. As one of the leading global suppliers of industrial trucks and supply chain solutions, KION's portfolio includes advanced forklift trucks and warehouse trucks, which are crucial for efficient material handling and logistics operations. In 2023, the company achieved a revenue of USD 12.63 billion and a net income of USD 347.41 million. Their operations are segmented into three segments with industrial trucks and services accounting for 74% of their business. With a workforce of 42,000, KION Group operates worldwide, with the EMEA region contributing the largest share of 67% in 2023.

KION Group is elevating its status as a leader in the intralogistics sector by advancing integrated, automated warehouse solutions and sustainable technology. Key developments include the establishment of a new plant in Jinan, China, set to create over 300 jobs by the end of 2024, and an expanded facility in Summerville, South Carolina, which will generate approximately 450 new positions by spring 2024. The company is driving innovation through partnerships and strategic projects such as ARIBIC, a Canadian-German initiative creating digital twins of warehouses, and CampusOS, which explores open 5G networks to enhance logistics technology.

KION's increased R&D spending, up by 15.6%, supports its focus on automation and sustainability. Notable AI projects include AIGV, in collaboration with the University of Edinburgh, which coordinates autonomous robots with human workers, and AGENC, researching AI for modeling cyber-physical systems. Additionally, the LernFFZ project aims to refine autonomous forklift steering through AI analysis of driver behavior. The company’s strategic investments and innovative projects position it as a leading force in the intralogistics sector, driving future growth and technological advancement.

Highlights of Honeywell International Inc.

Honeywell International Inc. stands out in the intralogistics market with its advanced solutions, including robotics, conveyor systems, and warehouse management software. These technologies are pivotal in streamlining warehouse operations, which is crucial for optimizing supply chains and improving overall performance. By integrating Honeywell’s innovations, businesses can significantly enhance their intralogistics processes, driving greater efficiency and accuracy in managing their supply chains. In 2022, the company reported impressive financial results with revenue reaching USD 35.46 billion and an operating profit of USD 6.43 billion. The company is organized into four primary segments: Aerospace, Honeywell Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. Aerospace remains the largest segment, contributing 34% of the total revenue. With a global workforce of 99,000, Honeywell's operations are heavily concentrated in the U.S., which accounts for 60% of its revenue. In 2023, Honeywell allocated USD 1,317 million to research and development, marking a 13% increase from the previous year and representing about 4.1% of its consolidated revenues. This investment underscores Honeywell's commitment to innovation and its role in advancing technology across its diverse sectors.

Honeywell recently announced two significant acquisitions. On December 8, 2023, the company agreed to acquire Carrier Global Corporation's Global Access Solutions business for USD 5.0 billion, with the deal expected to close by the end of Q3 2024. This business will be integrated into the Honeywell Building Technologies segment. Additionally, on August 25, 2023, Honeywell purchased SCADAfence for USD 52 million. SCADAfence, now part of the Performance Materials and Technologies segment, focuses on cybersecurity for operational technology and IoT. This acquisition includes USD 17 million in intangible assets and USD 42 million in non-deductible goodwill, with final purchase accounting pending adjustments.

Highlights of Midea Group

Midea, a leading global technology group, excels in various sectors, including Smart Home, Energy Solutions, Industrial Technology, Intelligent Building Technology, Robotics & Automation, and other innovative areas. In 2023, Midea achieved total revenue of USD 52.36 billion and a net profit of USD 5.68 billion. The company earned a spot at No. 278 on the Fortune Global 500 list and was recognized on the Fortune China ESG Impact list and the Fortune Most Admired Chinese Companies list. Forbes also named Midea an Industry Benchmark for Sustainable Development Industrial Enterprises in China, highlighting its commitment to sustainability and excellence.

The company’s operations span three primary business segments: Heating, Ventilation, and Air Conditioning (HVAC); Consumer Appliances; and Robotics and Automation Systems. The HVAC segment is the largest revenue generator, followed by consumer electronics. The company’s innovative approach extends to logistics robotics, which are used in industries like healthcare, warehousing, and manufacturing, demonstrating Midea’s leadership in industrial automation.

Though Midea’s revenue is predominantly from China, the company is expanding its global presence through strategic acquisitions and joint ventures. Notably, Midea's overseas original brand manufacture (OBM) business grew significantly, with OBM revenue surpassing 40% of its overseas smart home revenue in 2023. Midea's strategic focus includes “Technology Leadership, Direct to Users, Digitization & Intelligence Driven, and Global Impact.” The company is advancing technology leadership through substantial R&D investments and has joined the United Nations Global Compact (UNGC) to support global sustainable development. By integrating robotics and automation into its offerings, Midea is well-positioned to impact the intralogistics market, enhancing efficiency and innovation across supply chains.

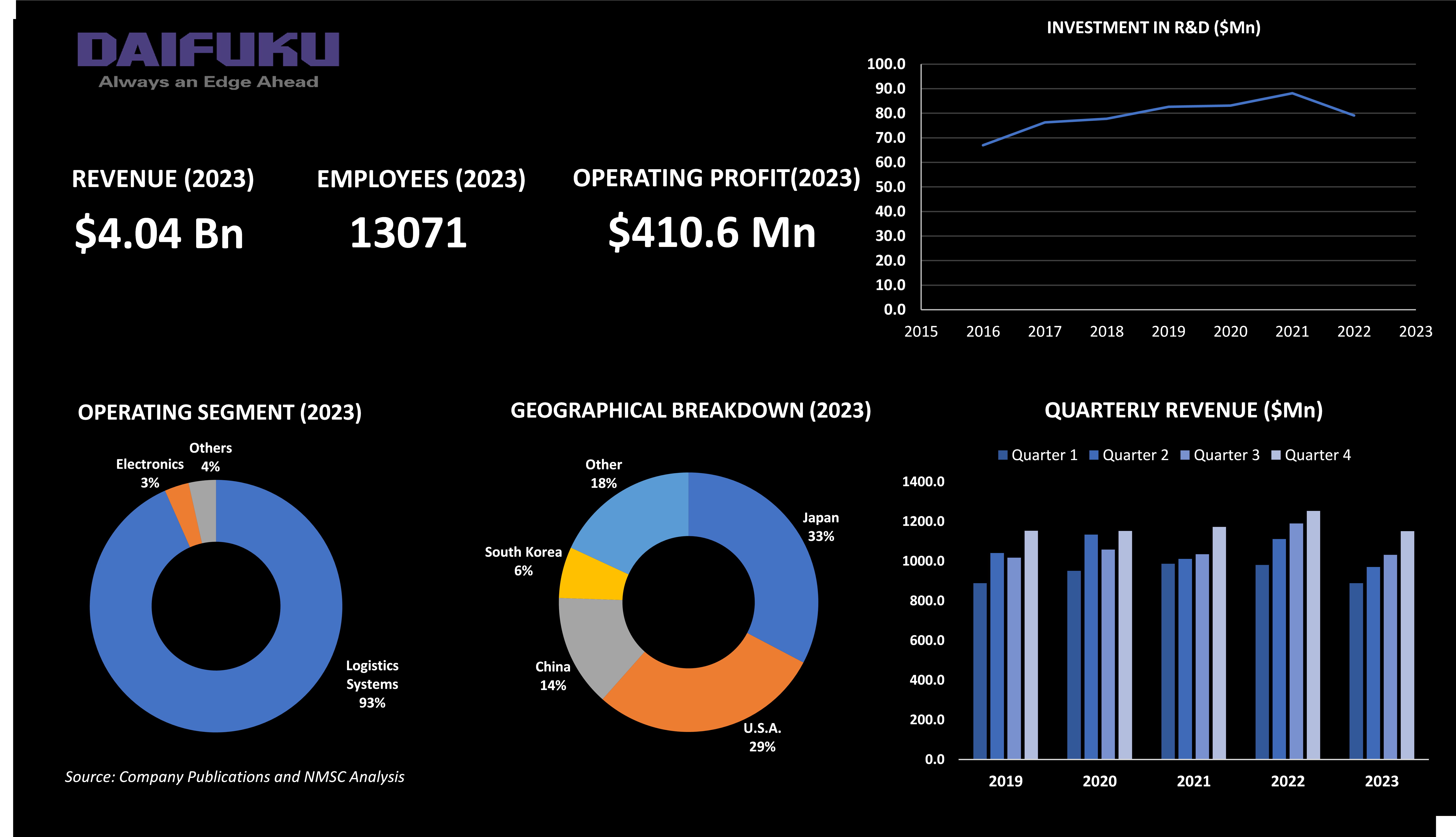

Highlights of Daifuku Co. Ltd.

Daifuku Co., Ltd., a leading name in material handling, excels in providing comprehensive solutions for the movement of goods and work-in-progress. The company reported a robust revenue of USD 4,044.3 million and an operating profit of USD 4.04 billion in 2023. Known for its world-class systems, Daifuku integrates conveying, storage, sorting, and picking technologies to serve diverse industries, including food and beverage, pharmaceuticals, machinery and metal processing, and electrical appliances. With a strong global presence, Daifuku’s advanced logistics solutions cater to various manufacturing and distribution needs, making it a key player in optimizing supply chain operations.

The company stands out as a global leader in material handling and automation, with a dedicated workforce of 13,020 employees. The company’s largest share of operations is in the United States, contributing 35% of its global presence, followed by Japan at 30%. Daifuku’s robust performance is fueled by trends in automation, the expansion of e-commerce, and continuous technological advancements. The company is strategically positioned to address the growing demand for efficient material handling solutions, advancements in warehouse automation, and global supply chain optimization, which are central to its ongoing success.

In 2022, Daifuku’s North American division bolstered its capabilities with the inauguration of a new USD 26 million manufacturing plant in Boyne City, Michigan. Spanning 225,000 square feet, this state-of-the-art facility consolidates operations from three previous locations. Operated by Jervis B. Webb Company, a Daifuku subsidiary, the plant focuses on producing advanced airport baggage handling systems and automatic guided vehicles, thereby enhancing production capacity to meet the rising demand in these critical sectors. This expansion underscores Daifuku's commitment to innovation and efficiency within the intralogistics market.

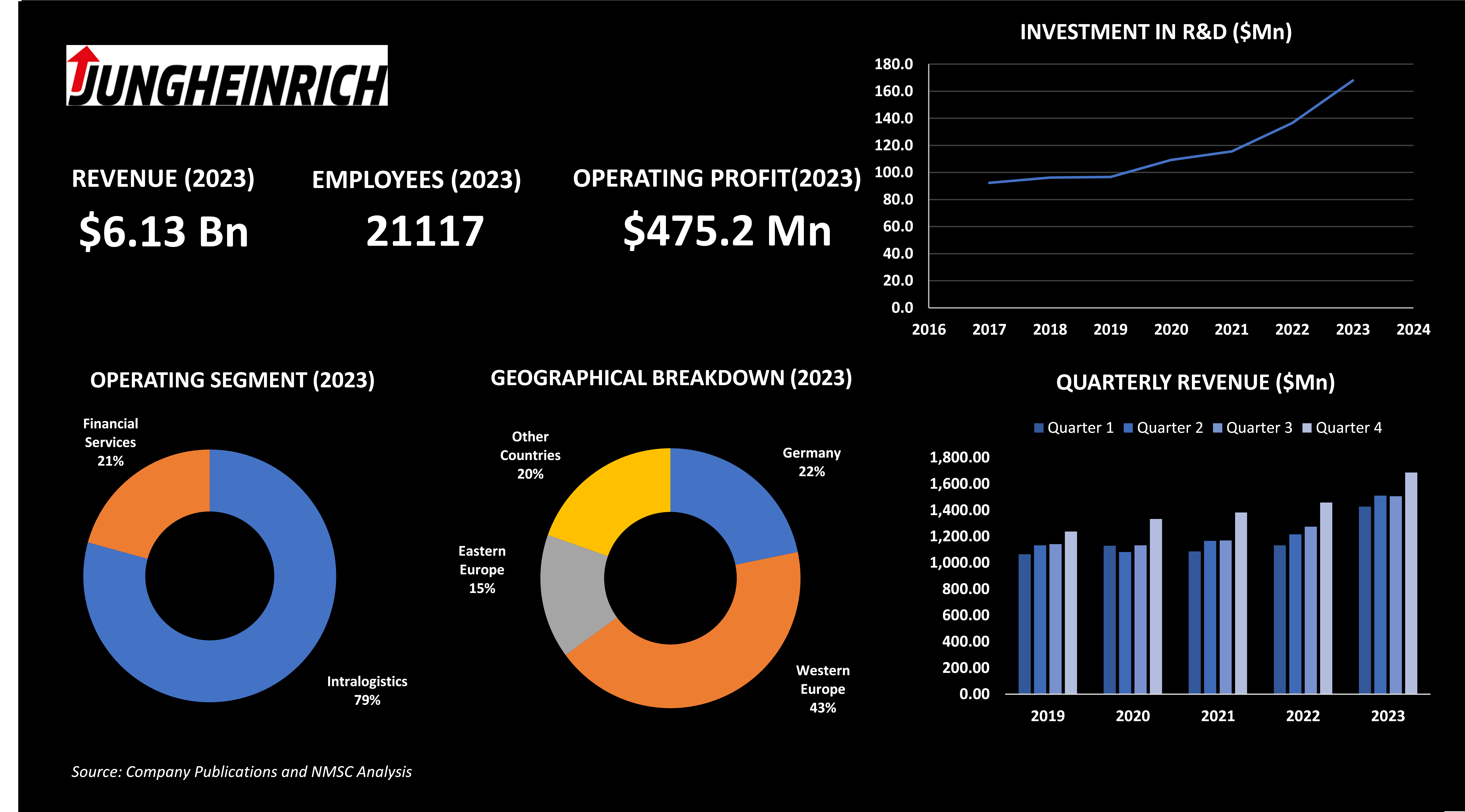

Highlights of Jungheinrich AG

Jungheinrich AG is a leading provider in the intralogistics industry, specializing in the manufacturing of industrial trucks, warehousing technology, and material flow solutions. With a history dating back to 1953, the company established itself as a key player in the global market by delivering innovative products and solutions that enhance warehouse efficiency and logistics operations. In 2023, Jungheinrich reported a revenue of USD 5.5 billion and a net profit of USD 8 million, reflecting its strong market presence.

The company operates through two main segments such as intralogistics and financial service with Intralogistics being the most significant contributor to its revenue, accounting for 79% of the total business. Jungheinrich contains a global workforce of 94,605 employees, with Western Europe being its largest market, contributing to 43% of its overall revenue.

Jungheinrich’s product portfolio includes electric and diesel-powered forklifts, automated guided vehicles (AGVs), racking systems, and comprehensive warehouse management software. These solutions are crucial for optimizing warehouse operations, reducing downtime, and improving overall supply chain performance. The company is committed to sustainability and innovation, investing heavily in research and development to create energy-efficient products and technologies that align with the growing demand for environmentally friendly solutions in the logistics sector.

With its strategic focus on automation and digitalization, Jungheinrich is well-positioned to capitalize on the trends in e-commerce growth, the shift towards Industry 4.0, and the increasing need for efficient intralogistics solutions worldwide.

Have questions? Inquire Before Purchasing

Summary of Acne Medication Market

The intralogistics market is being dynamically shaped by key players such as Kion Group AG (Dematic), Honeywell International Inc., Midea Group, Daifuku Co. Ltd., and Jungheinrich AG, that are driving growth through strategic investments in automation and smart technologies. These companies are leading the way in developing advanced solutions that optimize warehouse operations, enhance material handling, and improve supply chain efficiency. Thus, by leveraging cutting-edge innovations such as robotics, AI-driven systems, and IoT-enabled devices, they are meeting the increasing global demand for efficient and scalable intralogistics solutions. Their strategic collaborations, acquisitions, and dedication to technological advancements are strengthening their market positions and also setting new benchmarks for the intralogistics industry. With a strong focus on sustainability and operational excellence, these key players are self-assured to lead the market into a new era of efficiency and innovation. Their efforts are essential in addressing the growing need for streamlined intralogistics operations across industries, ensuring that businesses worldwide to achieve greater productivity and competitiveness. The ongoing advancements in intralogistics driven by these companies underscore the market's dynamic nature and highlight the potential for continued growth and transformation in supply chain management.

About the Author

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics.

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment