How Siemens, Emerson, and Honeywell Shape Distributed I/O

Published: 2025-09-11

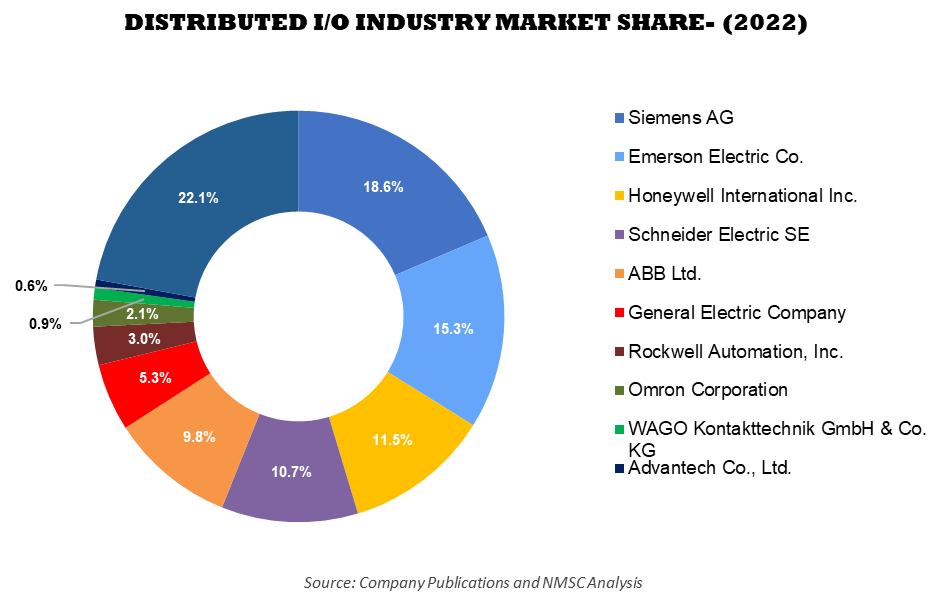

The global Distributed I/O Market, valued at USD 3.52 billion in 2023, is expected to expand to USD 5.73 billion by 2030. This growth represents a CAGR of 6.6% from 2024 to 2030, fueled by the rising adoption of industrial automation across the globe.

Distributed I/O Market Overview

The Distributed I/O market refers to the segment of industrial automation and control systems that involve the distribution of input and output signals across various remote locations rather than centralizing them. This approach improves system scalability, flexibility, and efficiency by allowing localized processing of data. Distributed I/O systems are crucial in applications where extensive wiring and centralized control would be impractical or costly, such as in large manufacturing plants, utilities, and transportation networks. These systems enhance real-time data acquisition, monitoring, and control, thus optimizing operational performance.

The growing adoption of industrial automation worldwide drives the growth of the distributed I/O market. As industries increasingly seek to enhance efficiency, reduce costs, and improve productivity, the need for advanced automation solutions becomes more critical. Distributed I/O allow for scalable and flexible system designs, making them essential for industries such as manufacturing, utilities, and transportation, where centralized control is less feasible.

For the latest market share analysis and in-depth report on Distributed I/O industry insights, Request for a Sample PDF Report

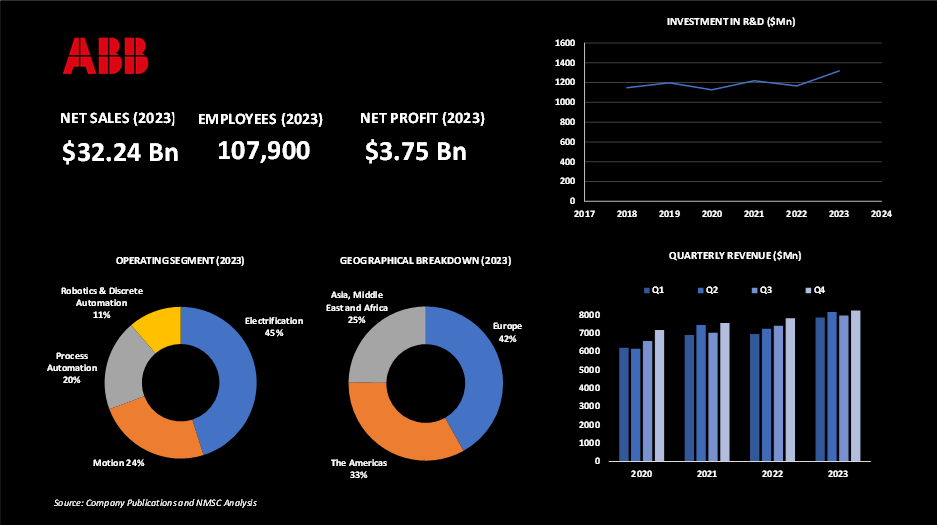

Highlights of ABB Ltd.

ABB Ltd is a global leader in electrification and automation, dedicated to fostering a sustainable and resource-efficient future through its advanced technological solutions. With over 130 years of expertise, ABB seamlessly blends engineering proficiency with cutting-edge software to enhance manufacturing, power, and operational processes. In 2023, ABB reported net revenue of USD 2.24 billion and a net profit of USD 3.75 billion. The company employs approximately 107,900 people worldwide, all committed to driving innovations that accelerate industrial transformation. ABB's operations are divided into four major segments: Electrification, Motion, Industrial Automation, and Robotics & Discrete Automation. The Electrification segment contributes the largest share, accounting for more than 40% of the company's revenue. Europe remains ABB's primary revenue-generating region, underscoring its strong market presence on the continent.

In the distributed I/O market, ABB offers a wide array of products, including the AI Series, AO Series, DI Series, DO Series, and DP Series. These solutions are specifically designed to optimize data collection and control in industrial applications, enabling real-time monitoring and significantly enhancing operational efficiency. ABB's reliable and scalable distributed I/O systems are critical in helping manufacturers implement more flexible and automated processes, ultimately boosting productivity and reducing downtime. The company's innovative approach positions it at the forefront of the ongoing evolution of smart manufacturing and industrial automation.

ABB is actively advancing its industrial automation product line through increased investment and innovation. A key development is the launch of a new I/O series in July 2023, specifically designed to meet the digital demands of oil and gas fields. This series enhances efficiency, reliability, and connectivity in harsh environments, supporting advanced data analytics and real-time decision-making. It is tailored to modernize automation infrastructure in the oil and gas sector, allowing operators to improve both operational performance and safety.

In addition, ABB launched its Distributed Control System (DCS) in February 2023, aimed at bolstering digital transformation in process automation. This updated system includes enhanced cybersecurity, seamless integration with third-party systems, and advanced control features. It also offers improved connectivity by leveraging real-time data to optimize operations and minimize downtime. This DCS release is designed to help industries such as energy, pharmaceuticals, and chemicals achieve greater efficiency and sustainability in their automation processes.

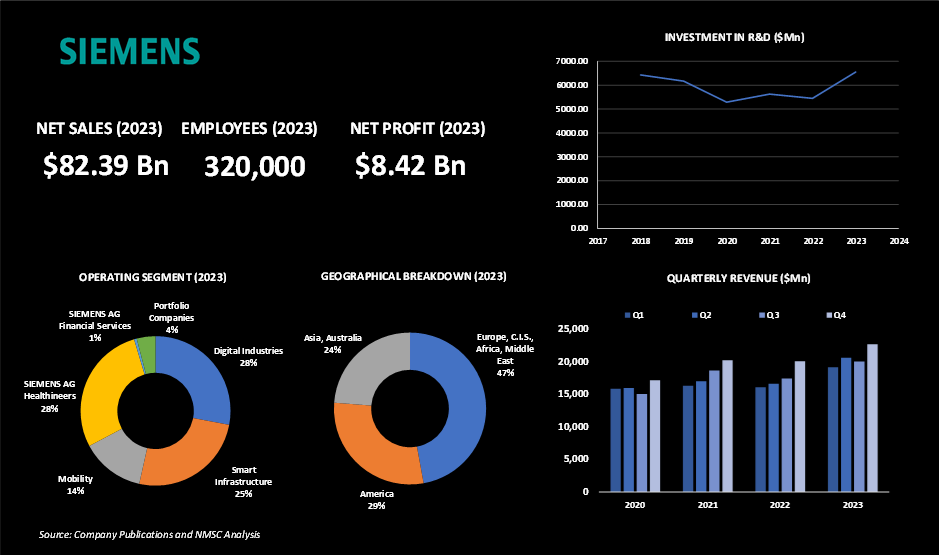

Highlights of Siemens AG

Siemens AG, a global leader in industrial process automation, reported a revenue of USD 82.39 billion in 2023, marking an 8% increase from the previous year. The company achieved a net profit of USD 8.42 billion, reflecting its strong financial performance.

In the Europe, C.I.S., Africa, and Middle East region, order intake surged across all four industrial businesses. Digital Industries and Mobility led this growth with substantial increases, while Smart Infrastructure and Siemens Healthineers also experienced strong year-over-year order growth. Notably, in Germany, Mobility saw significant growth due to rising orders for high-speed trains, and both Digital Industries and Smart Infrastructure posted double-digit growth. However, orders for Siemens Healthineers declined, primarily due to a reduced volume from rapid coronavirus antigen tests.

Among its product offerings, Siemens provides advanced distributed I/O solutions, including the SIMATIC ET 200MP, SIMATIC ET 200SP, SIMATIC ET 200SP HA, and SIMATIC ET 200iSP. These solutions play a crucial role in enhancing automation and control in industrial applications, subtly contributing to greater operational efficiency and flexibility within the market.

Siemens actively invests in research and development, reporting R&D expenses of around USD 5.45 billion in fiscal 2022, up from about USD 5.29 billion in fiscal 2020. The company continuously innovates and launches new products. In May 2024, Siemens introduced the Simatic Automation Workstation, a new software-based solution that integrates a PLC, HMI, and edge device into one platform. This innovation provides centralized control over factory automation, enhancing operational efficiency and security. Ford Motor Company will be the first to implement this technology, which is designed to meet the demands of modern manufacturing environments by enabling faster and more flexible automation processes.

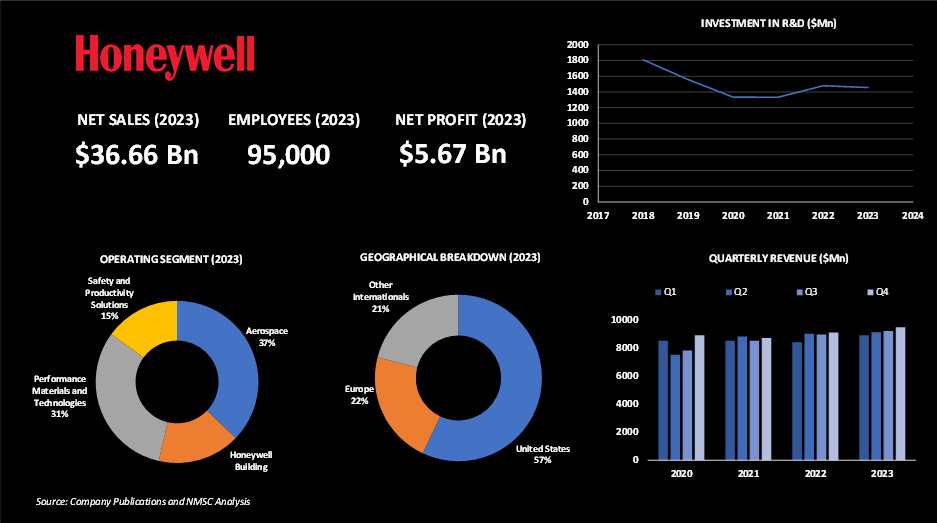

Highlights of Honeywell International Inc.

Honeywell International Inc., a global leader in industrial automation, operates across numerous countries, with over 60% of its revenue generated from the U.S. The company reported revenue of USD 36.66 billion in 2023, accompanied by a net profit of USD 5.67 billion. Honeywell's diverse portfolio spans several business areas, including Aerospace, Honeywell Building Technologies, Performance Materials and Technologies, and Safety and Product Solutions, with Aerospace being the largest segment.

In the distributed I/O solutions, Honeywell offers a comprehensive range of products, such as the Control Network Module, CIOM-A I/O Family, Process Manager I/O, Rail A I/O System, Rail H I/O Family, Series C I/O Module, Universal I/O Module, and Universal Marshalling Solution. These products enhance automation and system integration, significantly improving operational efficiency across various industries.

Honeywell remains committed to innovation and supporting its customers' goals. In 2023, the company introduced the C300PM controller, a modern and unified process control platform designed to enhance industrial operations. This flexible and cost-effective controller facilitates seamless technology evolution, allowing users to benefit from advanced features while retaining familiar hardware. The C300PM is engineered to help industrial operations reduce costs, boost production rates, manage risks, extend system life, and improve responsiveness to evolving customer demands.

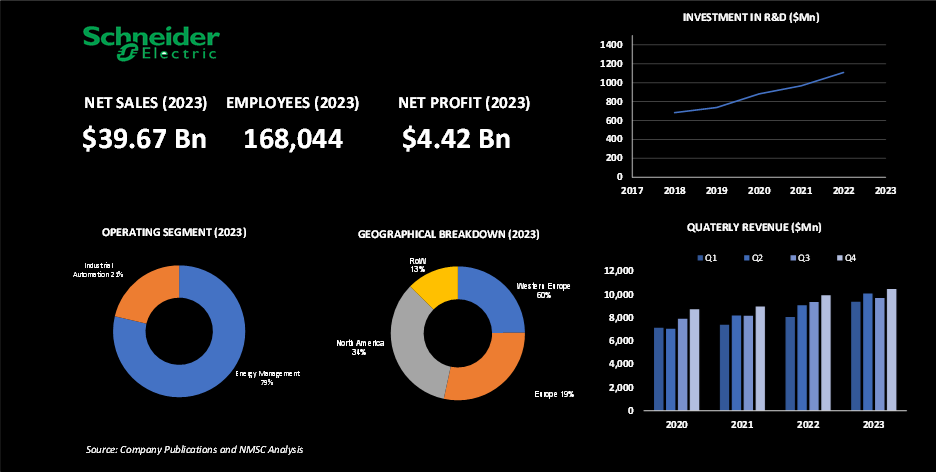

Highlights of Schneider Electric SE

Schneider Electric SE is a global leader in energy management and automation solutions, operating primarily in two segments: Energy Management, which accounts for 77% of its revenue, and Industrial Automation. In 2023, Schneider Electric reported a revenue of USD 39.67 billion, reflecting a substantial increase from the previous year. The company's net profit for the year stood at USD 4.42 billion.

Consolidated revenue for the 12 months ending December 31, 2023, totalled USD 39.67 billion, marking a 12.7% organic growth and a 5.1% increase on a reported basis. This growth was driven by strong performance across various end-markets, fuelled by trends in electrification, automation, and digitization, despite some stabilization in consumer-linked areas due to higher interest rates. The company’s strategic focus on "More Products, More Software, More Services, and More Sustainability" supports its transition into a hybrid digital enterprise. In 2022, 80% of its product sales were labeled as Green Premium, demonstrating its commitment to sustainability. That same year, Schneider Electric significantly advanced its digital capabilities by acquiring the entire share capital of AVEVA. The company reported an net profit of USD 4.92 billion, reflecting strong financial health and a commitment to innovation.

In support of its automation initiatives, Schneider Electric offers a diverse range of distributed I/O solutions, including the TM3AI Series, TM3AM Series, TM3AQ Series, TM3T Series, TM3DI Series, TM3DM Series, and TM3DQ Series. These products enhance automation and control, significantly improving operational efficiency across various industries.

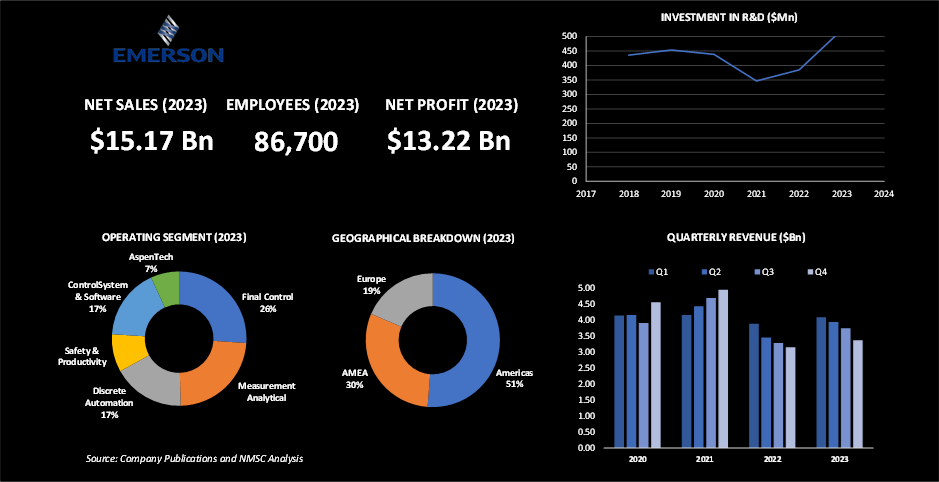

Highlights of Emerson Electric Co.

Emerson Electric Co., a globally recognized leader in industrial automation and control solutions, excels in the distributed I/O (Input/Output) segment, significantly enhancing industrial processes across various sectors. Established in 1890, Emerson has a storied history of innovation and growth, establishing itself as a trusted partner in the industry. In the latest financial reports, the company generated a revenue of USD 15.17 billion and a net profit of USD 13.22 billion. Emerson operates on a global scale, with the American region contributing over 50% of its revenue.

The company's Control Systems & Software segment offers advanced solutions designed to optimize plant processes. These systems collect and analyze data from measurement devices to adjust control hardware—such as valves, pumps, motors, and drives—to ensure superior product quality, process efficiency, and safety. Emerson’s solutions in this segment include distributed control systems, safety instrumented systems, SCADA systems, application software, digital twins, asset performance management, and cybersecurity.

Emerson’s Control Systems & Software offerings are predominantly utilized by process and hybrid manufacturers and are marketed under well-known brands, including AMS, DeltaV, and Ovation. These products underscore Emerson’s dedication to advancing industrial processes through state-of-the-art technology and continuous innovation.

Have questions? Inquire Before Purchasing

Summary of Distributed I/O Industry

The distributed I/O market is experiencing significant growth due to the rising adoption of automation and control systems across various industries. By decentralizing input/output functions, these systems offer advantages such as improved scalability, flexibility, and reduced wiring costs. Key drivers include increased demand for industrial automation, technological advancements, and the need for efficient control systems in manufacturing, energy, and utilities. The integration of distributed I/O with the industrial Internet of Things (IIoT) enhances real-time data collection and decision-making capabilities. Notably, regions such as North America, Europe, and Asia-Pacific are seeing substantial growth, with leading companies continuously innovating to meet evolving industry needs. Overall, the market is well-positioned for ongoing expansion, supported by technological advancements and the demand for scalable control solutions.

About the Author

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics.

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment