Tech Titans Transforming Ai Robots: Ibm, Intel, and Microsoft's Influence

16-Sep-2024

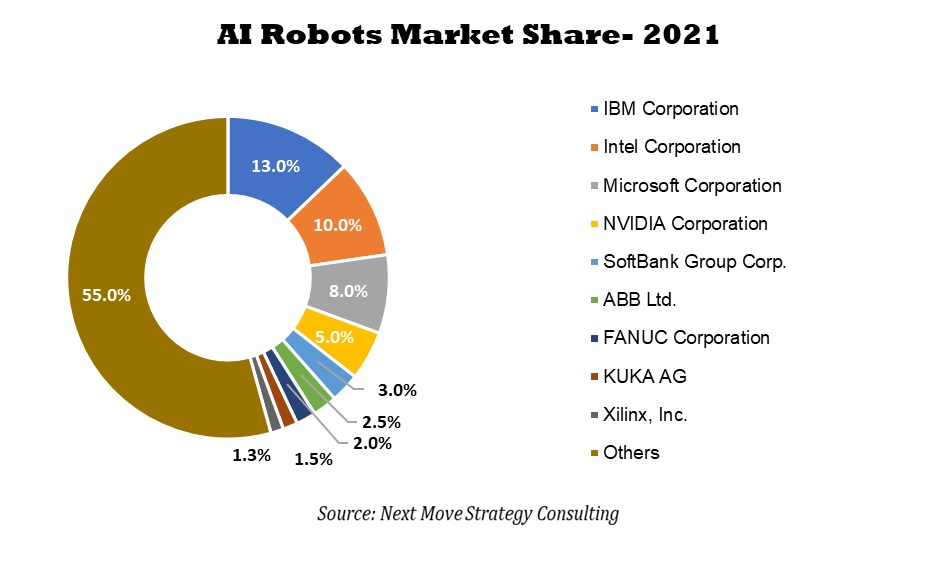

According to Next Move Strategy Consulting, the AI Robots Market is expected to grow from USD 12.83 Bn in 2023 to USD 77.73 Bn in 2030, with a CAGR of 28.3% during the forecast period, due to increasing advancements in AI and machine learning technologies.

AI ROBOTS MARKET OVERVIEW

The AI robots market encompasses the sector that is focused on the integration of artificial intelligence technologies to enhance the capabilities of robots in performing various tasks autonomously or semi-autonomously. These robots, equipped with sensors, actuators, and AI algorithms and can learn from their environment, make decisions, and execute complex actions accordingly.

AI robots are utilized across various sectors including manufacturing, healthcare, logistics, and agriculture for performing dynamic tasks with increased operational efficiency. It also helps these sectors with reducing operational costs, enhancing safety by handling dangerous tasks, and improving precision in task performance.

The AI robots market is driven by various factors including increasing advancements in AI, machine learning, and robotics technology, labour shortages, adoption of automation across various industries, and rising consumer demand. Though the market faces challenges such as high initial costs, technical complexity, security concerns, and integration difficulties, opportunities such as advancements in AI technology, the rise of collaborative robots, edge computing, and sustainability initiatives are set to drive the market forward in the upcoming years.

For the latest market share analysis and in-depth report on AI robots industry insights, you can reach out to us at: https://www.nextmsc.com/ai-robots-market/inquire-before-buying

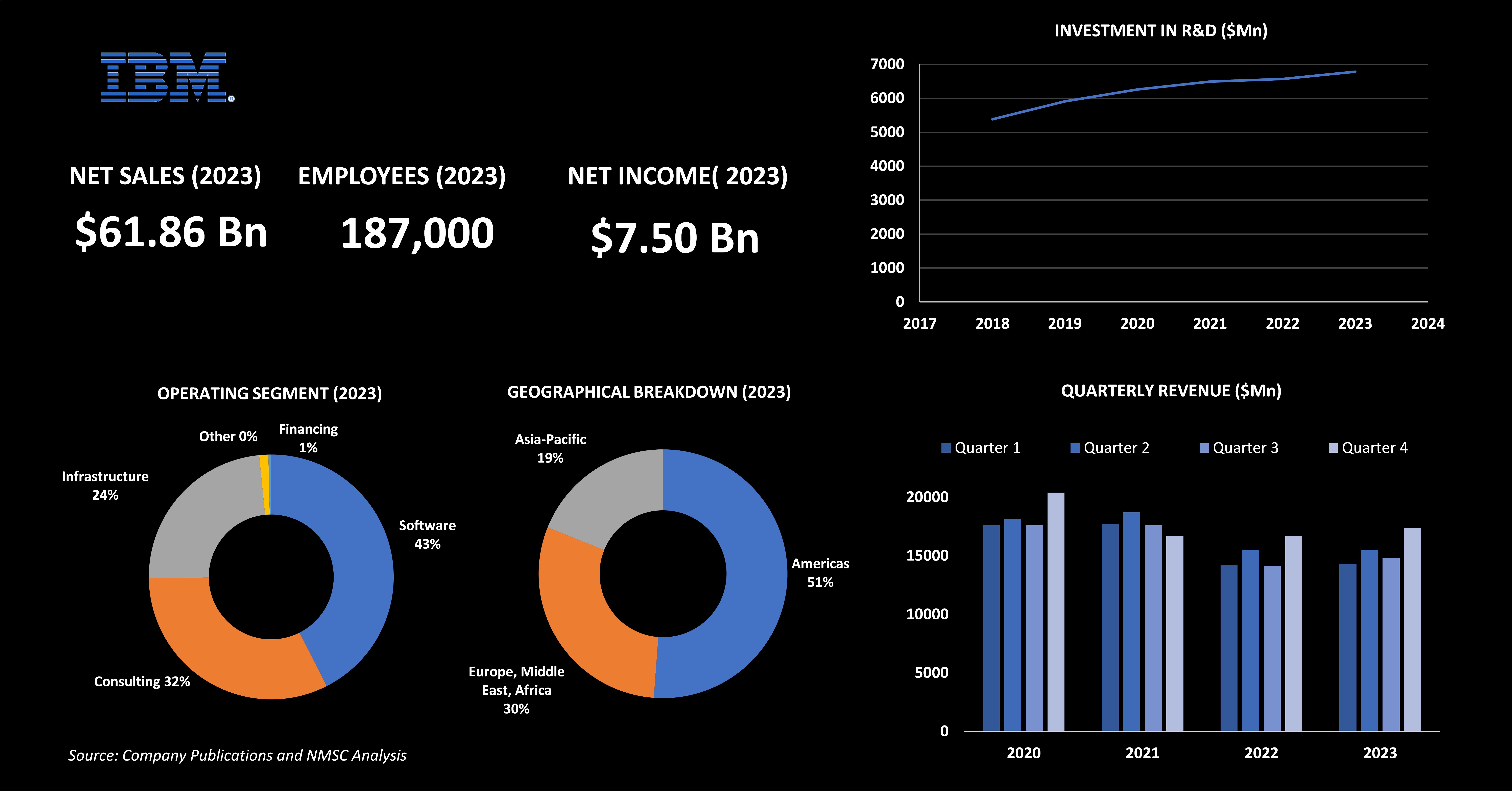

HIGHLIGTS OF IBM CORPORATION

IBM Corporation a major player in the technology sector reporting a revenue of USD 61.86 billion in 2023, supported by a net income of USD 7.50 billion. The company, with a global workforce of 187,000, operates in over 175 countries. Its market presence is particularly strong in the Americas, which contributed 51% of its revenue. IBM's business is organized into four key segments: Software, Consulting, Infrastructure, and Financing, with Software being the largest, accounting for 43% of the market in 2023.

IBM's commitment to innovation is evident through its significant investment in research and development, which rose from USD 5.38 billion in 2018 to USD 6.78 billion in 2023. This investment supports advancements across critical technologies such as AI, quantum computing, and semiconductors. In 2023, IBM made nine acquisitions to strengthen its hybrid cloud and AI capabilities and also launched Watsonx, an AI platform built on Red Hat OpenShift, enhancing its AI offerings for business.

The company’s strategic partnerships with leading technology companies, including AWS, Microsoft, SAP, Salesforce, and Adobe, have strengthened its position in the market. The redesigned Partner Plus program offers extensive resources and support to its partners, facilitating innovation delivery to clients. Looking ahead to 2024, IBM plans to continue its hybrid cloud and AI strategy, focusing on co-creating with clients to drive digital transformation and deliver business value.

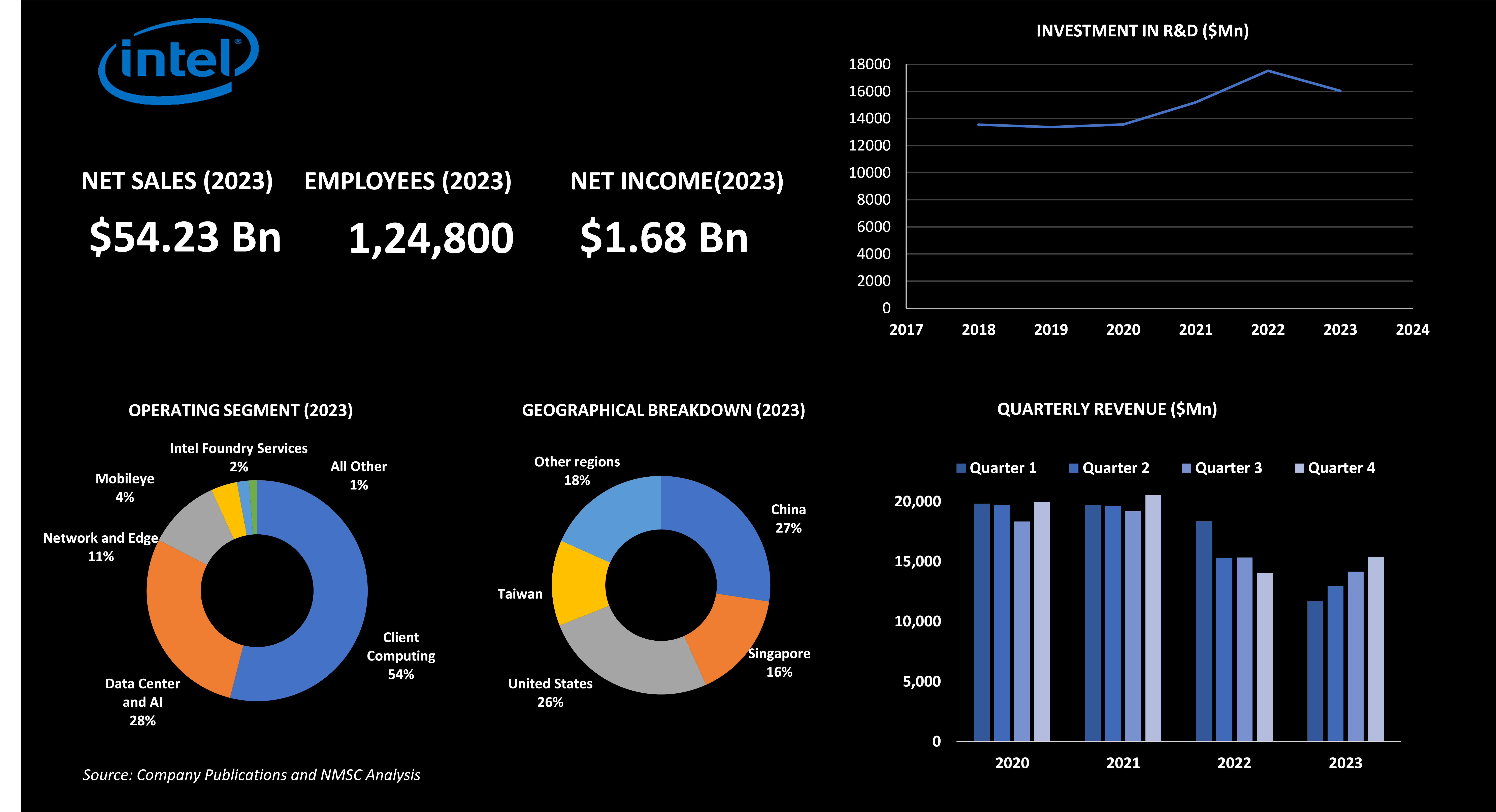

HIGHLIGHTS OF INTEL CORPORATION

Intel Corporation, a leading name in semiconductor manufacturing and innovation, reported a revenue of USD 54.23 billion and a net income of USD 1.68 billion, supported by a workforce exceeding 120,000 employees. The company's business is organized into five primary segments including Client Computing, Data Center and AI, Network and Edge, Mobileye, and Intel Foundry Services. Among these, Client Computing was the largest segment, accounting for 54% of the market share in 2023. Intel manages extensive global operations across manufacturing, assembly, testing, R&D, and sales. In 2023, 74% of its revenue came from international markets, with China alone contributing 27% of the total revenue.

Intel’s investment in research and development is substantial, totaling USD 16.05 billion in 2023, despite an 8% decrease from 2022, due to cost-cutting measures offset by higher incentive-based cash compensation. The company’s product portfolio includes solutions for data centers, network infrastructure, PCs, edge computing, and emerging fields such as AI and autonomous driving. In 2023, Intel introduced several new products, including the 13th Gen Intel Core mobile processor family, the 4th Gen Intel Xeon Scalable processors with Intel vRAN Boost, and the Intel Core Ultra processors featuring integrated neural processing units for efficient AI acceleration.

To support its IDM 2.0 strategy, Intel employs a Smart Capital approach. This strategy encompasses smart capacity investments, government incentives, strategic capital investments, customer commitments, and the use of external foundries. This strategy allows the company to rapidly respond to market opportunities while managing its margin structure and capital spending, positioning the company for sustained growth and innovation in the semiconductor industry.

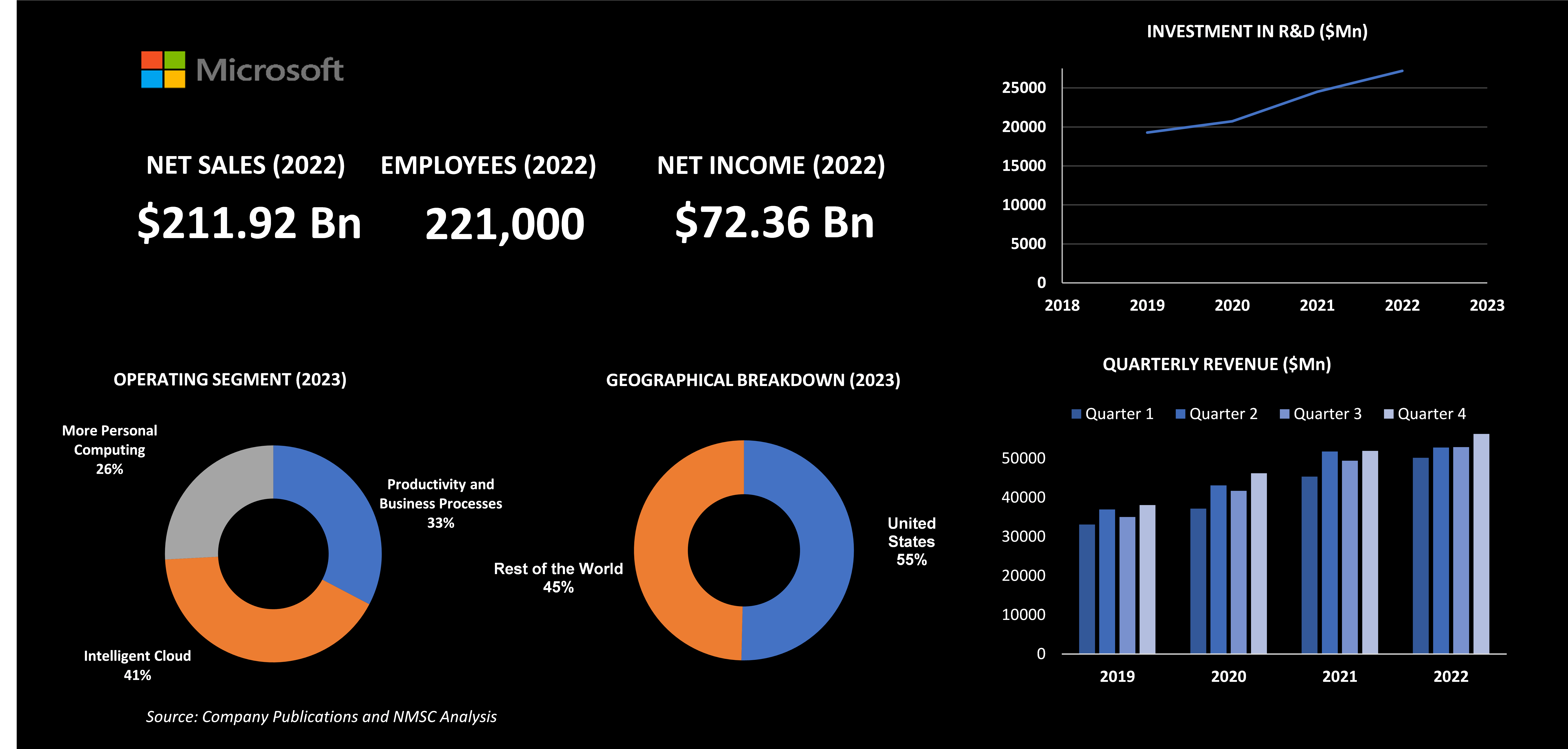

HIGHLIGHTS OF MICROSOFT CORPORATION

As a leading technology company, Microsoft recorded a revenue of USD 211.92 billion in 2022, with a workforce of over 220,000 employees. The company experienced substantial growth over the past four years, with revenue increasing by 47% from USD 143.02 billion in 2019 to USD 211.92 billion in 2022.

Operating through four main business segments—Client Productivity and Business Processes, Intelligent Cloud, More Personal Computing, and others, the company has a global presence. In 2022, the intelligent cloud segment held the largest market share at 41%, while domestic sales in the U.S. accounted for the highest share at 50.4% of total revenue. The company invests heavily in research and development, with spending rising from USD 16.88 billion in 2018 to USD 27.20 billion in 2022. Microsoft’s R&D efforts focus on three key ambitions: reinventing productivity and business processes, building intelligent cloud and edge platforms, and enhancing personal computing.

Microsoft continues to lead in technology innovation, driving advancements in AI, cloud computing, and personal productivity. In February 2023, Microsoft launched an AI-powered version of its Edge browser and Bing search engine, featuring Bing Chat for improved search capabilities and content generation. The new Microsoft Edge offers enhanced security and quick access to AI-powered tools. Additionally, Microsoft introduced the first online Professional Certificate on Generative AI in partnership with LinkedIn Learning, created AI tools for educators, and hosted its first AI Community Learning event in the U.S.

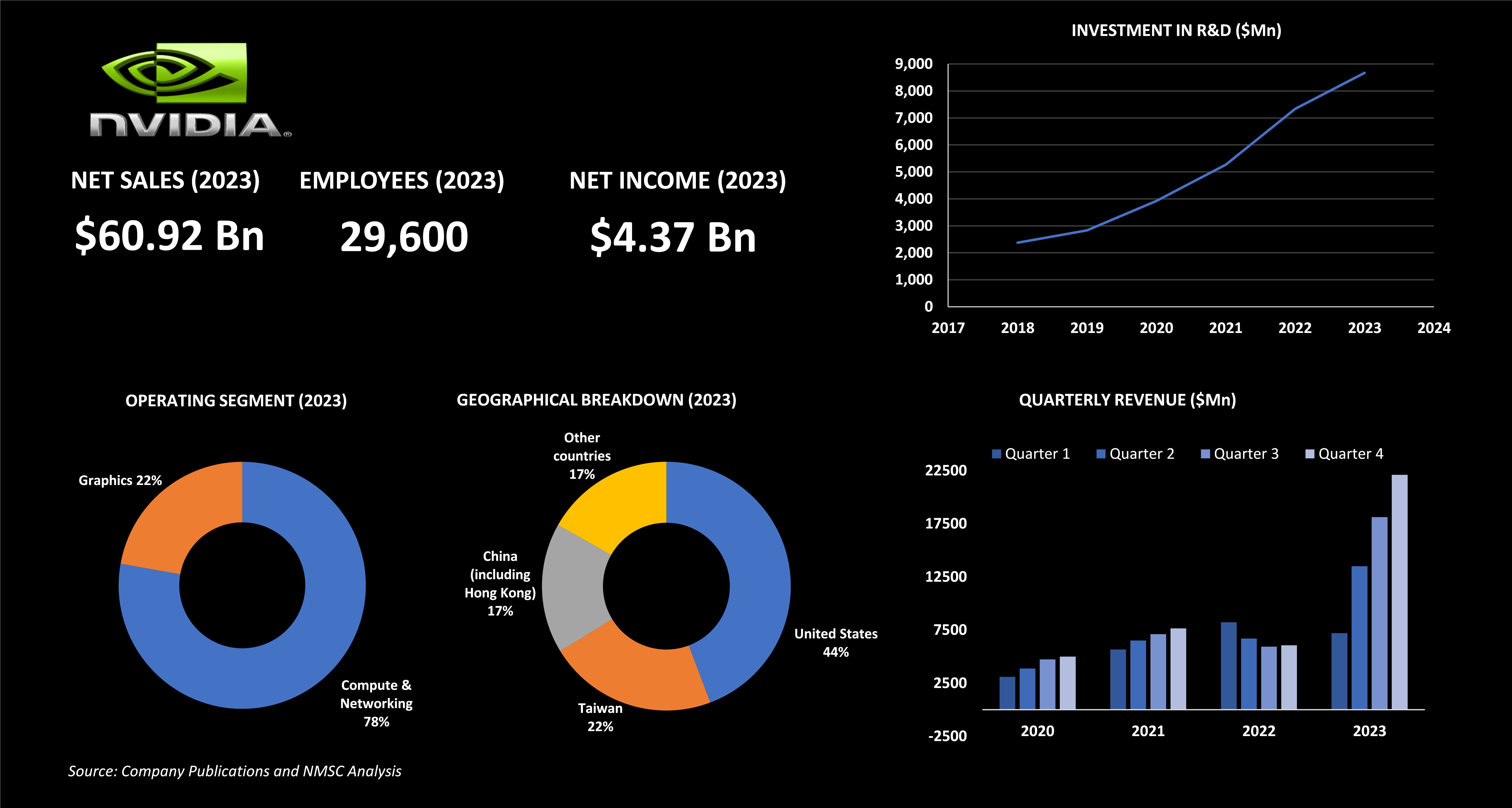

HIGHLIGHTS OF NVIDIA CORPORATION

Nvidia Corporation, a prominent leader in the technology sector, achieved remarkable financial milestones in 2023, with revenue surpassing USD 60 billion and a net income reaching USD 4.37 billion. The company’s Compute & Networking segment stands out as the primary revenue driver, contributing over 70% to the total earnings. Nvidia employs more than 29,000 individuals globally, maintaining a significant presence in the U.S., which accounts for 44% of the total share in the revenue.

Nvidia's significant R&D investment, reaching USD 8,675 million in 2023—up from USD 7,339 million in 2022—reflects its strong commitment to innovation, particularly in AI. The company has averaged USD 5,000 million annually on R&D over the past six years. The launch of the NVIDIA DGX Cloud, an AI-training-as-a-service platform, emphasizes its focus on AI, offering cloud-based infrastructure, customizable pretrained models, and expert support. Additionally, over 1.2 million developers and 10,000 customers use NVIDIA Isaac and Jetson platforms for AI-driven robots. Project GR00T aims to enhance humanoid robots' understanding of natural language and human-like movements.

Nvidia is driving a major transformation in AI computing for PCs, positioning generative AI as the emerging "killer app" for high-performance systems. With over 100 million Nvidia RTX GPUs in use, the company sets the standard for AI PCs and workstations, making them the top choice for AI application developers. Nvidia's relentless innovation and expansion in AI and computing technologies solidify its role as a key player in the global AI market.

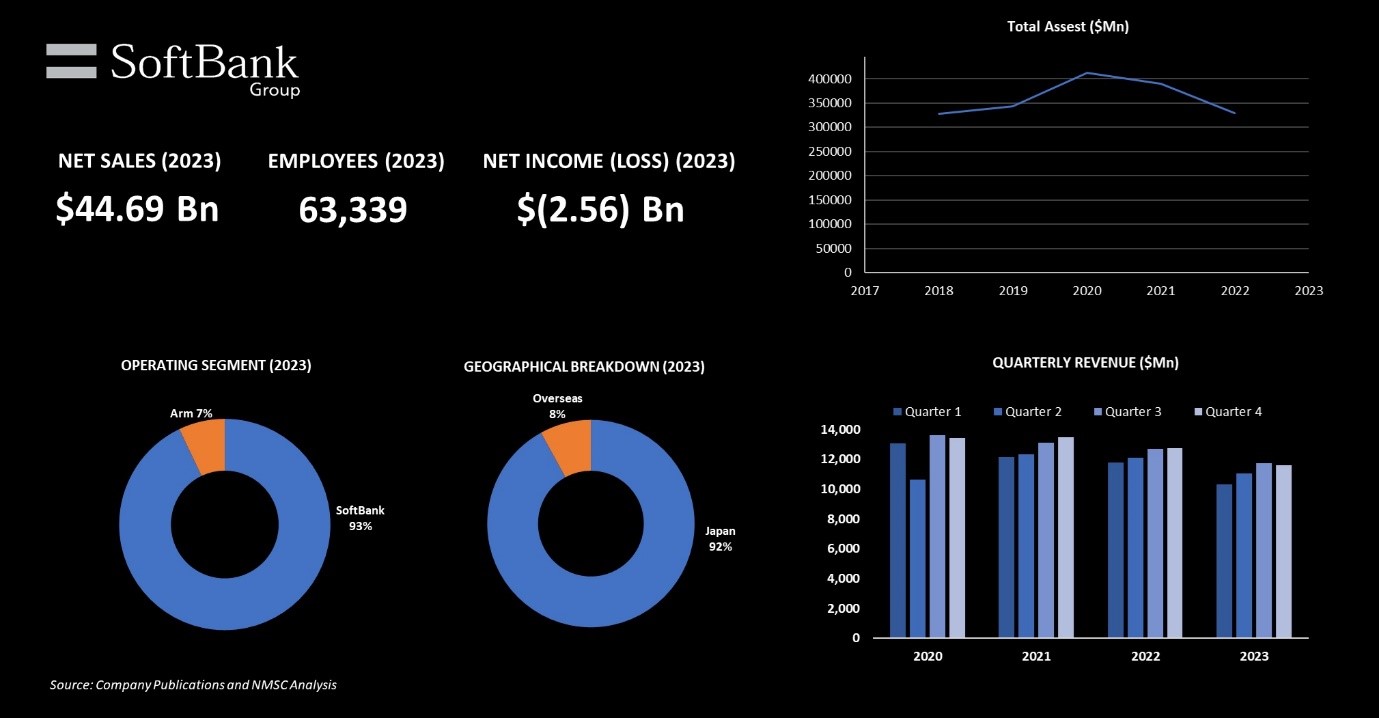

HIGHLIGHTS OF SOFTBANK GROUP CORPORATION

SoftBank Group Corporation, a global powerhouse in technology investment, reported a revenue of USD 44.69 billion in 2023. Japan remains the primary revenue source, accounting for more than 90% of the company's income. The company operates through four segments: investment business of holding companies, SoftBank Vision Funds, SoftBank, and ARM.

Losses were incurred in both the investment business of holding companies and the SoftBank Vision Funds segment in 2023, primarily due to USD 33.1 billion markdown in the value of its wide range of private investments. Despite this, SoftBank saw a partial recovery in losses due to increased fair values from its investments in both private and public assets.

SoftBank's Latin America Funds have invested in 105 companies with a cumulative acquisition cost of USD 7.4 billion, yielding a total cumulative return of USD 6.3 billion. The company’s investments span across various industries, including significant holdings in companies like DoorDash, Coupang, ByteDance, and WeWork.

A significant player in the evolution of artificial intelligence (AI), SoftBank's subsidiary Arm is at the forefront of this revolution. By December 31, 2022, an impressive 258 billion chips based on Arm technology had been shipped, underscoring the pervasive presence of Arm-based chips in various devices. This growth highlights Arm's crucial role in advancing AI technology.

SoftBank’s investment strategy focuses on AI businesses with transformative potential to drive significant technological advancements. The SoftBank Vision Funds (SVF) are central to this approach, having invested in over 470 companies worldwide by March 31, 2023. SVF2 features a more diversified portfolio than SVF1, offering valuable insights for future investment strategies. The company's diversified investment approach allows it to capitalize on the full spectrum of AI technology enables SoftBank to support and nurture innovation across the AI landscape, reinforcing its position as a leader in the global technology market.

SUMMARY OF AI ROBOTS MARKET

The AI robots market is growing rapidly, driven by advancements in AI and robotics, enhancing efficiency and safety across various industries. Despite challenges such as high costs and integration issues, opportunities in collaborative robots and edge computing are expected to propel market growth. Major players such as IBM, Intel, Microsoft, Nvidia, and SoftBank dominate the tech sector with their significant advancements in AI, cloud computing, and semiconductor technologies. As we delve into the rapidly evolving landscape of technology, the role of AI robots in shaping our future becomes increasingly evident. These intelligent machines, once considered the realm of science fiction, are now poised to revolutionize various industries and transform the way we live and work.

About the Author:

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics. The author can be reached at arjun.chetry@nextmsc.com

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics. The author can be reached at arjun.chetry@nextmsc.com

Add Comment

Related Blogs

UGVS and the Power Players: Genetal Dynamics, Qinetiq, and Boston Dynamics

According to Next Move Strategy Consulting, the UGV Market i...

The Era of Smart Living: Navigating the Home Automation Landscape

Introduction In today's rapidly advancing technologic...

Future-Forward Forklifts: Innovations Reshaping Logistics

Introduction Embarking on a transformative journey, the forklift truck indust...