Uncovering The Strategies of LG Energy and Others in the Battery Industry

28-Apr-2025

According to NMSC analysis the battery industry valued at $151.48 billion in 2024 and is expected to reach $378.53 billion by 2030. The expansion is driven by the application of consumer electronics and the expanding electric vehicle industry.

As the need for sustainable energy solutions accelerates the battery technology innovations are enhancing energy density, charging efficiency and lifecycle performance. Governments and industries are investing in battery development to support renewable energy integration and emission reduction goals.

Curious about the Battery Market? Download FREE Sample Now!

Additionally, the pursuit of localized battery production that is driven by supply chain resilience and sustainability concerns is also propelling market expansion. Increasing demand for battery-based solutions across various industries is transforming energy storage with rapid development and mass adoption.

BATTERY MARKET OVERVIEW

The battery industry is witnessing robust growth on account of growing demand for energy storage systems from a range of industries such as automotive along with consumer electronics and renewable energy. Advances in battery technologies including lithium and other chemistries are improving energy density and charging time.

The growth in electric vehicles and the worldwide momentum for renewable energy alternatives are strong drivers that is propelling market growth. Governments and private companies are investing in battery manufacturing and recycling to meet the demand. Further the cost reduction along with safety improvement and supply chain resilience are being prioritized by companies to improve their market position. As energy needs continue to evolve the battery sector is poised for revolutionary transformation shaping the future of mobility and portable power systems.

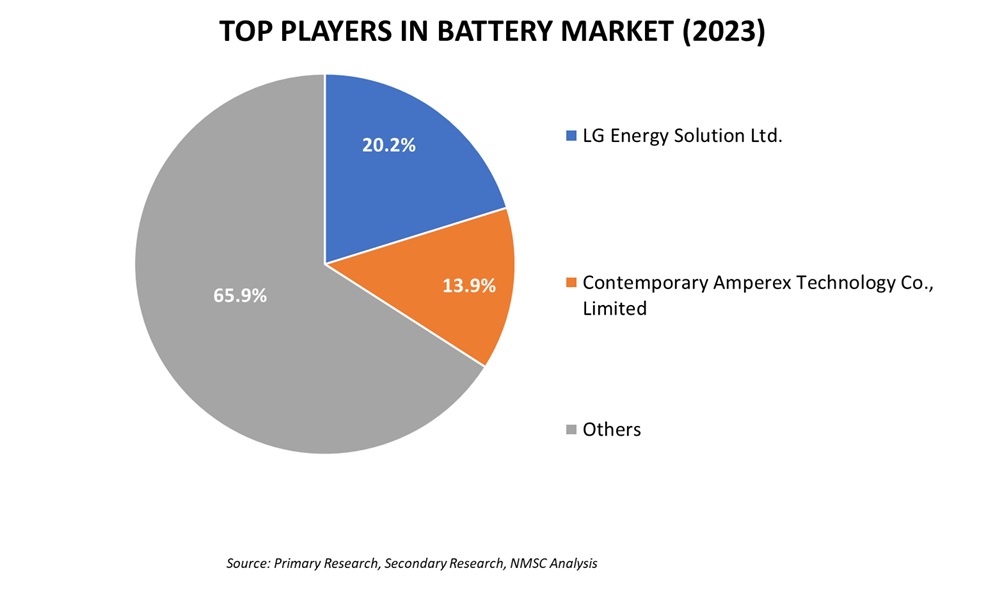

The major players operating in battery market are LG Energy Solution Ltd., Contemporary Amperex Technology Co., Limited, SK Innovation Co. Ltd., EVE Energy Co., Ltd., Panasonic Holdings Corporation, Sunwoda Electronic Co., Ltd., Samsung SDI Co., Ltd., Tesla Inc., EVE Energy Co., Ltd., BYD Company Ltd., Gs Yuasa Corporation, Gotion High tech Co Ltd, Toshiba Corporation, Exide Industries Ltd., EnerSys, Inc., and others.

HIGHLIGHTS OF LG ENERGY SOLUTION LTD.

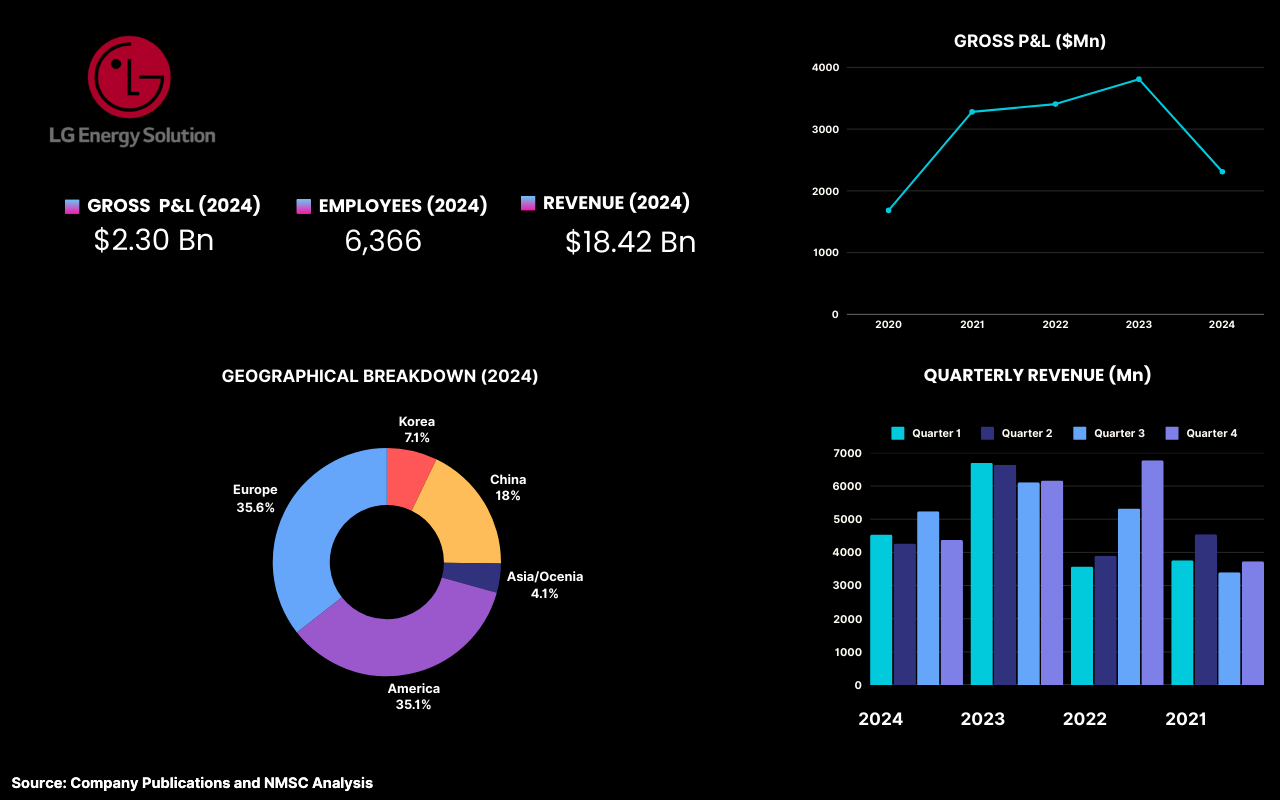

LG Energy Solution Ltd. one of the leading company in the global battery market witnessed a decline of approximately 28% in its revenue for the year 2024 standing at $18.42 billion from $25.61 billion in 2023. Its gross profit also fell from approximately $3.80 billion in 2023 to approximately $2.30 billion in 2024.

LG Energy Solution Ltd. one of the leading company in the global battery market witnessed a decline of approximately 28% in its revenue for the year 2024 standing at $18.42 billion from $25.61 billion in 2023. Its gross profit also fell from approximately $3.80 billion in 2023 to approximately $2.30 billion in 2024.

As a single segment firm LG Energy Solution earns all its revenue from its battery business for application across industries that range from electric vehicles along with energy storage systems to consumer electronics. Hiring a total of about 6,366 individuals the corporation has businesses across numerous regions with 2023 revenue by region of $1.85 billion from Korea, $4.78 billion from China, $1.07 billion from Asia/Oceania, $9.13 billion from America and $9.24 billion from Europe.

To maintain its competitive edge the company increased its research and development spending to $764 million in 2023 from $592 million in 2022 focusing on battery technology and efficiency enhancement. In December 2024 it introduced a system-on-chip based battery management system for enhancing performance and safety.

Further strengthening its market position LG Energy Solution announced in October 2024 that it will optimize battery utilization and initiate U.S.-based battery production for ESS in 2025. In September 2024, it also launched 'B.around,' a new brand for battery management total solution (BMTS) service, with the goal of providing end-to-end battery lifecycle management. With ongoing innovations and strategic investments, LG Energy Solution remains a large contributor to the evolving battery industry, transforming in accordance with market demands and building its technological competitiveness.

HIGHLIGHTS OF SK INNOVATION CO. LTD.

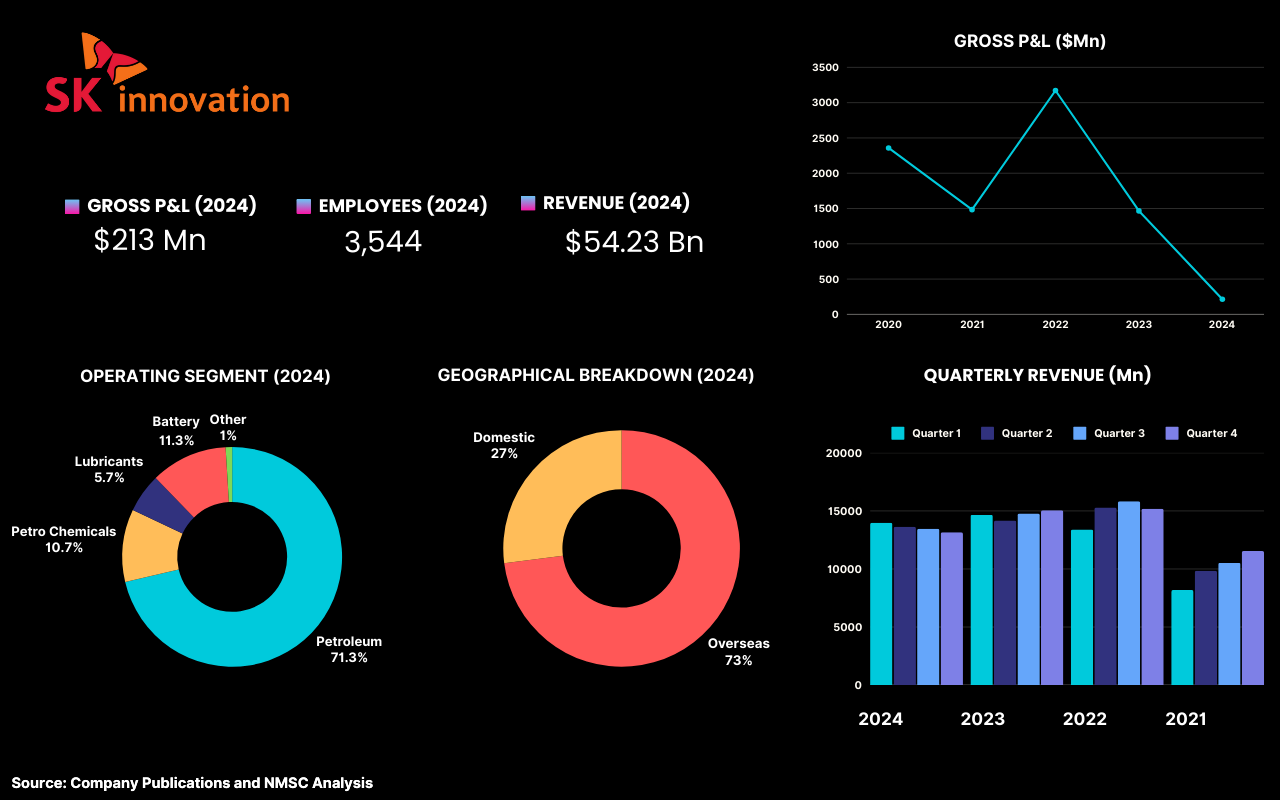

SK Innovation Co. Ltd. a South Korean battery and energy manufacturer recorded revenue of $54.23 billion in 2024 a 7% decline from $57.66 billion in 2023. The company gross profit drastically decreased from approximately $1.46 billion in 2023 to approximately $213 million in 2024 owing to adversity in its business environment. SK Innovation operates in several business segments of which petroleum claims the most significant portion around 71.3% followed by petrochemicals with 10.7%, lubricants with 5.7%, batteries with 11.3% and other business activities summed up at 1%.

SK Innovation Co. Ltd. a South Korean battery and energy manufacturer recorded revenue of $54.23 billion in 2024 a 7% decline from $57.66 billion in 2023. The company gross profit drastically decreased from approximately $1.46 billion in 2023 to approximately $213 million in 2024 owing to adversity in its business environment. SK Innovation operates in several business segments of which petroleum claims the most significant portion around 71.3% followed by petrochemicals with 10.7%, lubricants with 5.7%, batteries with 11.3% and other business activities summed up at 1%.

It has approximately 3,544 staff and a very strong degree of global presence with 73% of its revenues derived from overseas and 27% from domestic operations. In January 2025 company announced it would be partnering with Nissan to supply electric vehicles batteries from 2028 reiterating its long-term commitment to environmentally friendly mobility solutions. The company has been investing heavily in next generation battery technologies including high nickel cathodes and solid-state batteries to enhance energy density and safety.

HIGHLIGHTS OF PANASONIC HOLDINGS CORPORATION

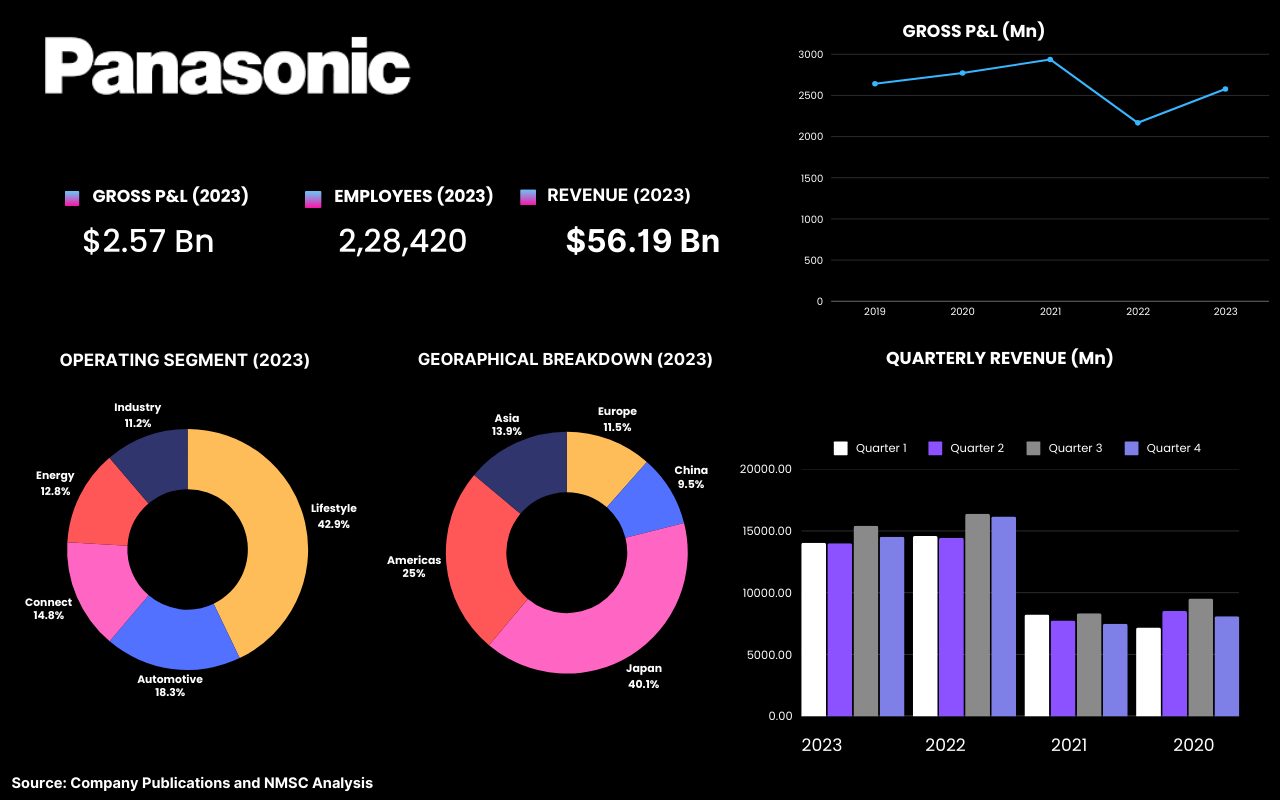

Panasonic Holdings Corporation a Japanese company generated revenue of $56.19 billion in 2024 a decrease of 10% from $62.90 billion in 2023. While revenue fell the company gross profit increased from approximately $2.16 billion in 2023 to approximately $2.57 billion in 2024. Panasonic which is active in a number of segments generated revenue primarily from its Lifestyle segment 42% followed by Automotive with 18.3%, Connect with around 14.8%, Energy with around 12.8% and Industry with 11.2%. The company has approximately 2,28,420 workers and a strong global footprint with 40.1% of its sales derived from Japan followed by the Americas with 25%, Asia with 13.9%, Europe with 11.5% and China with 9.5%. Panasonic has been investing in innovation with research and development of $3.24 billion in 2023 compared to $3.52 billion in 2022.

Panasonic Holdings Corporation a Japanese company generated revenue of $56.19 billion in 2024 a decrease of 10% from $62.90 billion in 2023. While revenue fell the company gross profit increased from approximately $2.16 billion in 2023 to approximately $2.57 billion in 2024. Panasonic which is active in a number of segments generated revenue primarily from its Lifestyle segment 42% followed by Automotive with 18.3%, Connect with around 14.8%, Energy with around 12.8% and Industry with 11.2%. The company has approximately 2,28,420 workers and a strong global footprint with 40.1% of its sales derived from Japan followed by the Americas with 25%, Asia with 13.9%, Europe with 11.5% and China with 9.5%. Panasonic has been investing in innovation with research and development of $3.24 billion in 2023 compared to $3.52 billion in 2022.

Panasonic remains one of the big players in the battery sector focusing on battery technology for various sectors. In April 2024 Panasonic Energy established a new research and development facility in Japan for the advancement of battery manufacturing reaffirming its determination to innovate the boundaries of battery technology.

In September 2024 Panasonic Energy Co. Ltd. started the production of 4680 automotive lithium-ion batteries a next generation large capacity cell aimed at improving electric vehicle performance and efficiency.

The company continues to expand its business in the electric vehicle battery business working closely with automakers to develop high energy density batteries to drive the transition to ecofriendly mobility.

Panasonic is also expanding its production capacity to respond to the growing demand for battery products particularly in North America where it has been accelerating production to serve key customers.

HIGHLIGHTS OF CLARIOS INTERNATIONAL INC.

Clarios International Inc established in 1885 and having it’s headquarters in Wisconsin is an advanced battery technologies with a focus in low voltage energy storage solutions for the automotive and industrial sectors. The company significantly contributes to powering conventional, hybrid and electric vehicles by way of its extensive range of lead and lithium batteries. In February 2025 Clarios marked a milestone by delivering its one millionth lithium battery reflecting its focus on innovation in sophisticated energy storage.

Continuing to grow its global presence Clarios introduced its Delkor batteries in Australia and New Zealand in August 2024 to address increasing demand for electrified vehicle solutions. With a high focus on sustainability the firm has a closed loop recycling system that recycles millions of batteries every year lowering environmental footprints and improving resource efficiency.

Clarios serves top automobile manufacturers and aftermarkets worldwide leveraging its extensive production and distribution capabilities to deliver secure energy solutions. The company continues to invest in research and development to further increase battery performance and life solidifying its position as a leading provider of global energy storage solutions. By strategic innovation and green practices Clarios is powering the shift toward a cleaner and more efficient mobility environment.

HIGHLIGHTS OF CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

CATL established in 2011 and based in China is one of the world leading producers of lithium batteries for electric vehicles and industrial uses. The company posted $16.95 billion revenue in 2023 an increase of 22% over the prior year demonstrating solid demand for its advanced battery technologies.

CATL has cemented its position as a prime vendor to the world top automakers including Tesla and Volkswagen and further broadened its dominance in the commercial vehicle and energy storage business. In January 2025 CATL unveiled sodium-ion batteries indicating a strategic push toward green and economical substitutes for conventional lithium-based solutions.

In October 2024 the company introduced Freevoy a new hybrid vehicle battery that aims to enhance energy efficiency and overall performance of the vehicle. Continuing to expand its product portfolio CATL introduced CATL TIANXING in July 2024 its first electric vehicle battery brand specifically designed for commercial use as well as two special battery solutions for light commercial vehicles further demonstrating its leadership in transportation electrification.

The firm has a keen emphasis on research and development investing continually in next generation battery technologies to become sustainable. Leveraging extensive global manufacturing capabilities, collaborations and continuous improvements in battery chemistry CATL is leading the development of clean energy storage solutions to contribute significantly to the electrification and carbon neutralization push on a global scale.

ABOUT THE AUTHOR

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Travel, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at [email protected]

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Travel, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at [email protected]

Add Comment

Related Blogs

Beyond The Lithium Era: Exploring the Batteries of Tomorrow

The global battery market has traditionally been led by lithium-ion technol...

What Makes Tesla, ChargePoint & Siemens EV Charging Leaders?

According to NMSC analysis, the global electric vehicle (EV) charging market is...

What’s Powering the Induction Charger Revolution?

In the ever-evolving landscape of technology, the focus on sustainability has be...