How Avolta, DUFRY & Lagardère Lead the Travel Retail Sector

Published: 2025-09-11

The travel retail and duty-free market, is expected to witness more than 2X growth from USD 76.59 billion in 2023, to around USD 156.28 billion by 2030. This remarkable expansion is fueled by advancements in technology, the rise of digital innovation in shopping experiences, and a growing consumer appetite for travel-related luxury goods.

Travel Retail and Duty-Free Market Overview

The travel and duty-free market is undergoing a significant transformation, influenced by technological innovations and shifting consumer behaviours. A major trend driving market innovation is the integration of Artificial Intelligence (AI). AI technologies are revolutionizing customer engagement, inventory management, and personalized shopping experiences. AI-powered analytics enable retailers to better understand consumer preferences, predict demand trends, and optimize product offerings. Additionally, AI enhances the efficiency of supply chains, ensuring timely stock replenishment and reducing operational costs.

The COVID-19 pandemic had a profound impact on the travel and duty-free sector, drastically reducing passenger volumes and leading to a sharp decline in sales. Lockdowns, travel restrictions, and decreased consumer spending severely affected revenue streams, leaving many companies struggling with financial instability and operational disruptions. As the industry navigates the recovery phase, companies are focusing on rebuilding their operations, adapting to new consumer behaviours, and leveraging technological advancements to drive growth. Efforts to revive the sector include enhancing digital platforms, improving safety protocols, and exploring new revenue streams to adapt to the post-pandemic landscape.

Digital platforms and e-commerce solutions are reshaping how consumers interact with duty-free environments. Mobile apps and online stores are gaining popularity, allowing travelers to browse and purchase products before reaching the airport. This digital shift enhances customer convenience and helps retailers reach a broader audience, driving sales and customer loyalty.

Another significant trend is the use of augmented reality (AR) and virtual reality (VR) to create immersive shopping experiences. These technologies enable customers to virtually try on products or explore duty-free stores, making the shopping experience more engaging and personalized. AR and VR also provide retailers with opportunities to showcase exclusive products and promotions in innovative ways, enhancing brand visibility and customer interaction.

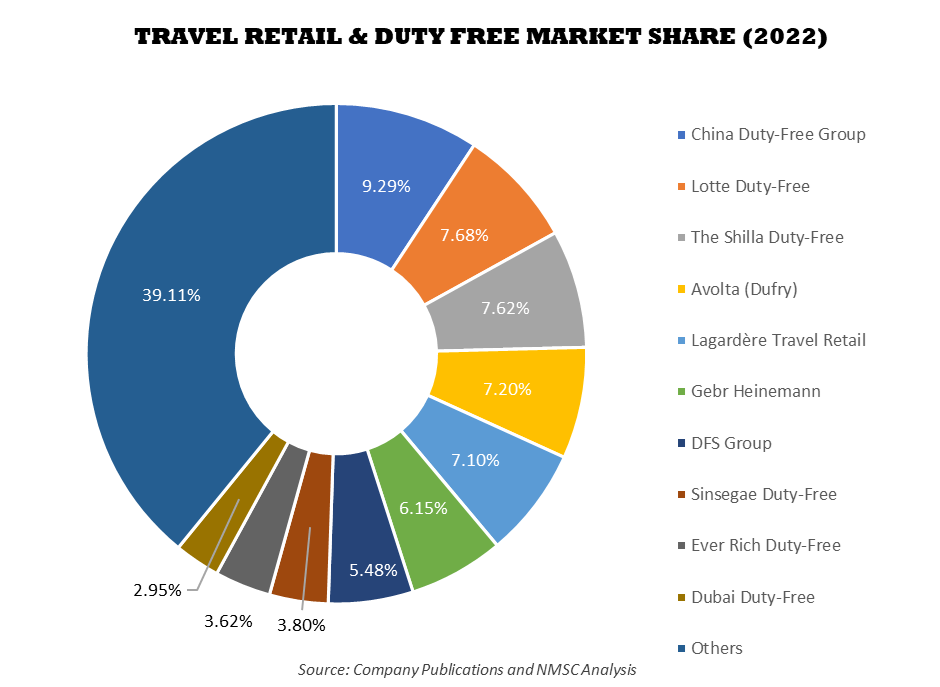

In the rapidly expanding travel and duty-free market, several key players are making a significant impact through innovation and strategic investments. Companies such as China Duty-Free Group, Lotte Duty-Free, TheShilla Duty-Free, Avolta (Dufry), and Lagardere Travel Retail are at the forefront, driving advancements with their cutting-edge technologies and extensive market reach. The ongoing contributions by these key players are shaping the industry's trajectory, setting new standards for customer experience, digital integration, and operational efficiency in the global travel retail sector.

For the latest market share analysis and in-depth travel retail and duty-free industry insights, you can reach out to us at: Sample Report PDF

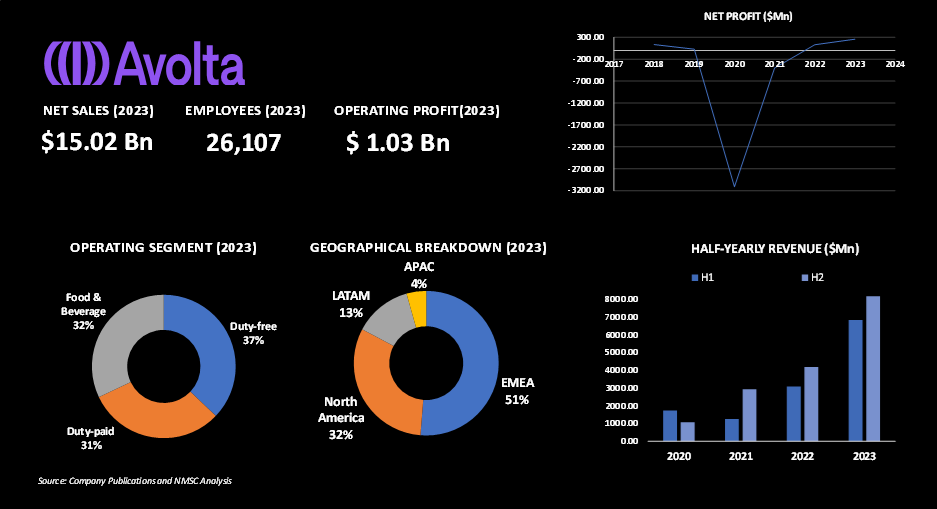

Highlights of Avolta (Dufry)

Avolta, formerly known as Dufry, recently underwent a major transformation through its merger with Autogrill. On November 3, 2023, Dufry’s shareholders approved a name change to Avolta, marking the successful completion of the business combination under the new brand. Despite this change, the company's former consumer-facing brands, including Dufry, Autogrill, Hudson, and World Duty Free, continue to operate as usual.

In 2023, Avolta reported net sales of approximately USD 15.02 billion, a substantial increase from USD 8.02 billion in 2022. The company achieved an operating profit of USD 1.03 billion, up from USD 0.59 billion the previous year. This growth reflects the company's resilience and strategic positioning in the global travel retail sector. Avolta’s revenue distribution by product categories demonstrates its diverse offerings including perfumes and cosmetics generated about USD 2.87 billion; food, confectionery, and catering amounted to USD 6.41 billion; wine and spirits brought in USD 1.55 billion; luxury goods contributed USD 0.91 billion; tobacco goods totalled USD 1.64 billion; electronics for USD 0.25 billion; and fuel accounted for USD 0.30 billion. Other categories added up to USD 0.91 billion.

The company operates across 73 countries in over 1,000 airports, motorways, and other locations worldwide, employing around 26,107 people. In 2023, Avolta achieved a CORE turnover of approximately USD 12.53 billion, with a CORE organic growth rate of 21.6% year-over-year and a CORE EBITDA margin of 9.0%. This performance is attributed to resilient travel demand and increased spending per passenger, which surpassed pre-pandemic levels. Avolta has also made notable contributions to the travel retail and duty-free sector. The company received the title of Best Retailer from the Middle East & Africa Duty Free Association (MEADFA) and won six prestigious awards at the FAB Awards (Airport Food & Beverage Conference & Awards). Additionally, Avolta has been involved in the development of the Duty-Free World Council’s Self-Regulatory Code of Conduct for the Sale of Alcohol Products in Duty-Free and Travel Retail. Overall, Avolta continues to play a pivotal role in shaping the travel retail and duty-free landscape through strategic expansions, innovative practices, and significant industry contributions.

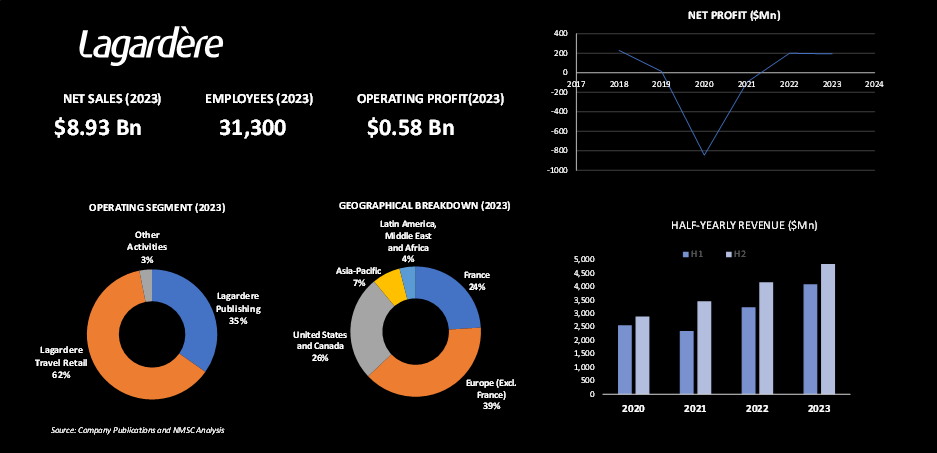

Highlights of Legardere Travel Retail

Lagardere Travel Retail is one of the prominent players in the global travel retail and duty-free market, known for its extensive operations and significant industry presence. In 2023, the company reported a revenue of USD 8.93 billion, marking a notable increase from USD 6.93 billion in 2022. The recurring operating profit of fully consolidated companies for the same period was USD 0.58 billion, up from USD 0.49 billion in the previous year. The company's revenue distribution by region highlights its extensive global footprint: 24% of revenue comes from France, 39% from Europe (excluding France), 26% from the U.S. and Canada, 7% from Asia-Pacific, and 4% from the Latin America, Middle East and Africa. Lagardere Travel Retail operates in over 290 airports and 700 rail and urban transport stations, with more than 5,120 stores and restaurants.

In recent years, Lagardere Travel Retail has made significant investments to strengthen its market position. In 2022, the company invested USD 177 million in property, plant, equipment, and intangible assets, reflecting a USD 41 million increase from the previous year. This investment was driven by business recovery and the rollout of deferred projects. In 2023, investments rose to USD 269 million, including USD 72 million allocated to Lagardere Travel Retail. This increase was primarily due to new tender wins and ongoing investment projects.

Additionally, noteworthy acquisitions have also strengthened Lagardere Travel Retail's market presence. As an example, in February 2023, the company acquired 100% of Marché International AG, enhancing its portfolio with a renowned international foodservice brand and expanding its restaurant network across Europe. Furthermore, in April 2022, Lagardere Travel Retail acquired a majority stake in Creative Table Holdings Ltd, a Dubai-based company with a successful track record in airport catering and food and beverage brands. This acquisition provided Lagardere Travel Retail with a significant foothold in a major airline hub and new growth opportunities at Dubai airport.

In terms of innovation, Lagardere Travel Retail has been at the forefront of integrating advanced retail technologies to enhance customer experience and operational efficiency. The company continues to explore new technological solutions and digital transformations to maintain its competitive edge in the travel retail and duty-free sector.

Highlights of China Duty Free Group

China Tourism Group Duty Free Corporation Limited (CTG Duty Free), established in 1928 and headquartered at Beijing, China, is a key player in the travel retail and duty-free business. As the principal company within China Travel Group’s tourism retail business group, CTG Duty Free operates as a large-scale joint-stock tourism retailer and is a key state-owned enterprise authorized by the State Council to manage nationwide duty-free operations. In 2023, China Duty Free Group reported revenue of USD 9.31 billion, marking an increase from USD 7.61 billion in 2022. This represents a growth of USD 1.70 billion. The company’s gross profit for 2023 was approximately USD 2.87 billion, compared to USD 2.06 billion in 2022, reflecting an increase of approximately USD 816 million. CTG Duty Free's market share stands at 9.29%, with product revenue reaching USD 5.47 billion in 2022.

The company was listed on the Shanghai Stock Exchange in 2009 under the stock code 601888, marking a significant milestone in its development. The company is recognized for its substantial achievements, including being selected for the SSE 50 and FTSE China A50 Indexes and receiving numerous accolades such as the Golden Bull Top 100 Listed Companies Award and the Top 100 High-Growth Enterprises in China. These honours highlight the company’s influence and success in the market.

CTG Duty Free established itself as a leading operator in the travel retail sector, with over 200 retail stores spread across key domestic and international locations. The company’s primary sales channels include major hub airports in Beijing, Shanghai, Guangzhou, Chengdu, and Hangzhou, as well as Asia-Pacific international airports in Hong Kong and Macao. Additionally, CTG Duty Free operates at major border ports and the Sanya International Duty-Free Shopping Complex in Hainan. It caters to nearly 200 million domestic and international tourists annually, making it the largest duty-free retailer in terms of store count and retail outlets within a single country.

For example on May 1, 2024, China Duty Free Group (CDFG) launched a global shopping festival to celebrate May Day, showcasing its strategic focus on enhancing customer engagement and driving sales within the travel retail and duty-free markets. The month-long festival featured exclusive promotions across a wide array of product categories, including luxury goods, cosmetics, and fashion items. This initiative reflects about CDFG's efforts to leverage its extensive network of duty-free stores and online platforms to attract a global audience, thereby reinforcing its position as a leading player in the travel retail industry and expanding its influence in both domestic and international markets.

Additionally, on September 2, 2024, China Duty Free Group (CDFG) announced its entry into Singapore's travel retail market with the opening of a Qeelin boutique at Changi Airport. This new boutique, dedicated to the luxury jewellery brand Qeelin, represents CDFG's strategic expansion into high-end retail segments within key global airports. The move highlights CDFG's commitment to enhancing its international footprint and offering premium shopping experiences to travellers. The launch aligns with the company's ongoing efforts to strengthen its position in the global travel retail and duty-free market.

The company’s portfolio extends beyond duty-free shops to include tax-bearing retail and tourism retail complexes. Its wholly-owned subsidiary, CTG Duty Free Investment Development Co., Ltd., established in May 2010, focuses on overseas investments and operations management for tourism retail complexes. This subsidiary aims to enhance resource integration, industrial investment, asset management, and capital operation, further positioning CTG Duty Free as a leading player in the global tourism retail market.

Looking ahead, CTG Duty Free is committed to maintaining steady and healthy growth by focusing on customer-centered and market-oriented development. Moreover, the company plans to upgrade its value chain around duty-free business, extend its industrial chain in tourism retail, and strive towards becoming a world-class global tourist retailer. This aligns with the broader goal of China Tourism Group to become a leading international tourism service group with global competitiveness.

Highlights of Lotte Duty Free

Lotte Duty Free, founded in February 1980 and headquartered at Seoul, South Korea, is one of the leading global players in the travel retail and duty-free market. Founded in February 1980 and headquartered in Seoul, South Korea, it began as a modest operation but quickly grew to become one of the world’s leading players in the travel retail and duty free sector. Guided by the leadership of CEO Kim Ju Nam, Lotte Duty Free has not only navigated the complexities of the global market but has also thrived, securing its position as the second-largest travel retailer worldwide.

From its humble beginnings, Lotte Duty Free expanded its footprint, establishing a substantial presence across 11 international airports in seven countries, including Australia, Guam, Japan, Korea, New Zealand, and Vietnam. These strategic locations have allowed the company to cater to a diverse and global clientele, offering a wide range of products from luxury goods to everyday essentials. By 2023, the company had reported an operating revenue of approximately USD 2.08 billion. Though this was a decrease from USD 2.50 billion in 2022, Lotte Duty Free’s resilience from its remarkable market share of 7.68% in the global travel retail and duty-free sector, according to NMSC analysis.

Despite the financial fluctuations, Lotte Duty Free's commitment to innovation and customer service remains unwavering. The company continues to lead with a product revenue of USD 4.53 billion, operating 20 duty-free stores across its international locations. A key component of their strategy is the pre-order service available at all locations, enhancing the convenience and experience for travelers.

Lotte Duty Free made significant strides in expanding its operations and enhancing its service offerings. One notable example of this includes in April, 2024 the company launched operations at Gimpo International Airport in Seoul, a move that further solidified its presence in South Korea and provided travelers with more duty-free shopping options. This new outlet showcases a diverse range of luxury goods, from cosmetics to fashion and accessories, catering to a broad audience of international travelers.

Recognizing the shifting demographics and preferences of the modern traveler, Lotte Duty Free also launched the "Summer Vacation" promotion in July 2024, specifically targeting young travelers through the Young Travel Club membership program. This initiative offers exclusive discounts and benefits on luxury goods and cosmetics, aiming to attract and engage a younger consumer base, which is increasingly influential in the travel retail market.

Furthermore, Lotte Duty Free embraced the growing trend of online shopping by introducing a new online duty-free shopping service in collaboration with Korea Airports Corporation. This service, launched in July 2024, allows travelers to pre-order and purchase duty-free items online before arriving at the airport, making the shopping experience more seamless and convenient.

Moreover, Lotte Duty Free strengthened its global presence with the opening of a new Dior pop-up store at Da Nang International Airport in Vietnam. This seasonal pop-up, featuring a curated selection of Dior's luxury products, aims to attract both local and international customers, reinforcing Lotte Duty Free’s position as a key player in the global travel retail sector.

As Lotte Duty Free continues to expand its reach and innovate in the industry, it remains a significant contributor to the global duty-free and travel retail market. The company’s ongoing commitment to delivering exceptional retail experiences and adapting to the ever-changing needs of travelers ensures its status as a major industry player.

Highlights of the Shila Duty Free

The Shilla Duty Free, founded in 1986, is headquartered in Seoul, South Korea, and is recognized as Asia’s influential airport duty-free cosmetics and perfumes retailer. Under the leadership of CEO Boojin Lee, The Shilla Duty Free has established itself as one of the leading companies in the travel retail and duty-free sector, offering an exceptional shopping experience tailored to global travellers.

With over 30 years of expertise in the beauty sector, The Shilla Duty Free provides an extensive range of luxury and high-quality brands. The retailer features more than 1,300 brands, including world-renowned names such as Louis Vuitton, Chanel, Hermes, and Gucci. Its selection encompasses over 500 beauty brands, ensuring a diverse and premium shopping experience.

The company operates major duty-free cosmetics and perfumes stores at key Asian hub airports, including Incheon International Airport, Changi Airport, and Hong Kong Airport. The company also runs branches in Macau Airport and Jeju Island, as well as an online store, catering to a broad international audience. As per our analysis, the company holds a significant market share of 7.62%, ranking third after China Duty Free Group and Lotte Duty Free, with product revenue of USD 4.49 billion in 2022.

As the duty-free market continues to evolve, The Shilla Duty Free is making significant strides in enhancing the travel retail experience. Recently, The Shilla Duty Free unveiled a new flagship store at Incheon International Airport, highlighting its commitment to enhancing the duty-free shopping experience. This new development highlights The Shilla Duty Free's dedication to offering a premium duty-free shopping experience, featuring an extensive range of top-tier beauty products. The flagship location is part of the company's strategy to strengthen its global presence in the travel retail market, providing travelers with exclusive beauty brands and a sophisticated store design. This development highlights The Shilla Duty Free's commitment to delivering high-quality products and exceptional service.

Additionally, the company is focusing towards coming up with innovative launches in the market for instance, Shilla introduced "Glow Up" summer campaign at Singapore Changi Airport that highlights a curated selection of beauty products and exclusive offers. It aims to enhance the shopping experience for travellers by showcasing popular and trendy beauty brands, offering special discounts and benefits. This initiative is part of The Shilla Duty Free’s strategy to attract and engage customers during the peak travel season, reinforcing its position in the travel retail market.

Notably, The Shilla Duty Free continues to contribute significantly to advancements in the travel retail and duty-free business. By continually innovating its store designs, expanding its product offerings, and launching strategic marketing campaigns, The Shilla Duty Free enhances the shopping experience and also sets new standards in the industry. The company's efforts in integrating cutting-edge technology and customer-centric strategies further solidify its role as a trailblazer in the global travel retail sector.

Have questions? Inquire Before Buying

Summary of Travel Retail and Duty-Free Market

The travel retail and duty-free market, significantly impacted by the COVID-19 pandemic, is on a path to recovery. The pandemic drastically affected global travel, leading to a sharp decline in sales and operational disruptions across the sector. However, with the gradual easing of travel restrictions and the resumption of international travel, the market is rebounding. The key players are focusing on personalized shopping experiences, leveraging data to offer targeted promotions and optimize inventory management.

Additionally, there is a growing emphasis on sustainability, with companies adopting eco-friendly practices and products to appeal to environmentally conscious consumers. By 2025, the market is expected to recover to pre-COVID-19 levels, driven by a resurgence in global travel and the implementation of advanced technologies. This recovery is supported by the growing demand for travel and increased consumer confidence, alongside strategic investments in digital transformation and customer engagement. As the sector continues to evolve, companies are expected to further innovate and adapt to changing consumer preferences, ensuring sustained growth and resilience in the post-pandemic era.

About the Author

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Travel & Tourism and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavours.

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Travel & Tourism and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavours.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment