Top Fintech Firms Shaping the Mobile Payment Market

Published: 2025-09-11

The global mobile payment market is expected to grow annually at a rate of 13.5% from 2024 to 2030, reaching a value of USD 201.39 billion in 2030, as per the analysis conducted by Next Move Strategy Consulting. This growth is primarily driven by the rising adoption of smartphones and other mobile devices, that enable people to access the internet and conduct financial transactions.

Mobile Payment Market Overview

Mobile payment market refers to the sector that includes various payment processing services conducted through mobile devices, such as smartphones and tablets. This market allows consumers to make financial transactions via mobile applications instead of traditional methods such as cash and credit cards. This market includes various payment methods, including mobile wallets, mobile banking apps, and online payment services. It leverages technologies such as NFC, QR codes, and SMS to facilitate both proximity and remote transactions. The market has seen significant growth due to increased smartphone penetration, advancements in fintech and digital banking, and changing consumer preferences towards contactless payments.

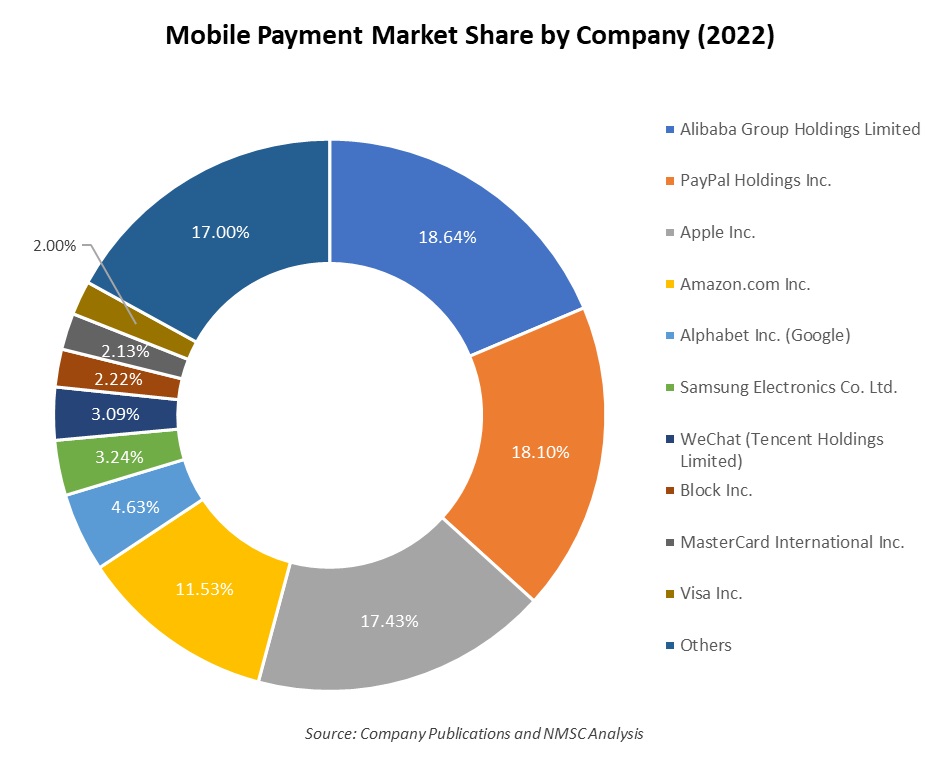

Top players in the mobile payment industry includes Alibaba Group Holdings Limited, PayPal Holdings Inc., Apple Inc., Amazon.com Inc., Alphabet Inc. (Google), Samsung Electronics Co. Ltd., WeChat (Tencent Holdings Limited), Block Inc., MasterCard International Inc., Visa Inc., and others.

For the latest market share analysis and in-depth report on global mobile payment market, you can reach out to us at: https://www.nextmsc.com/mobile-payment-market/request-sample

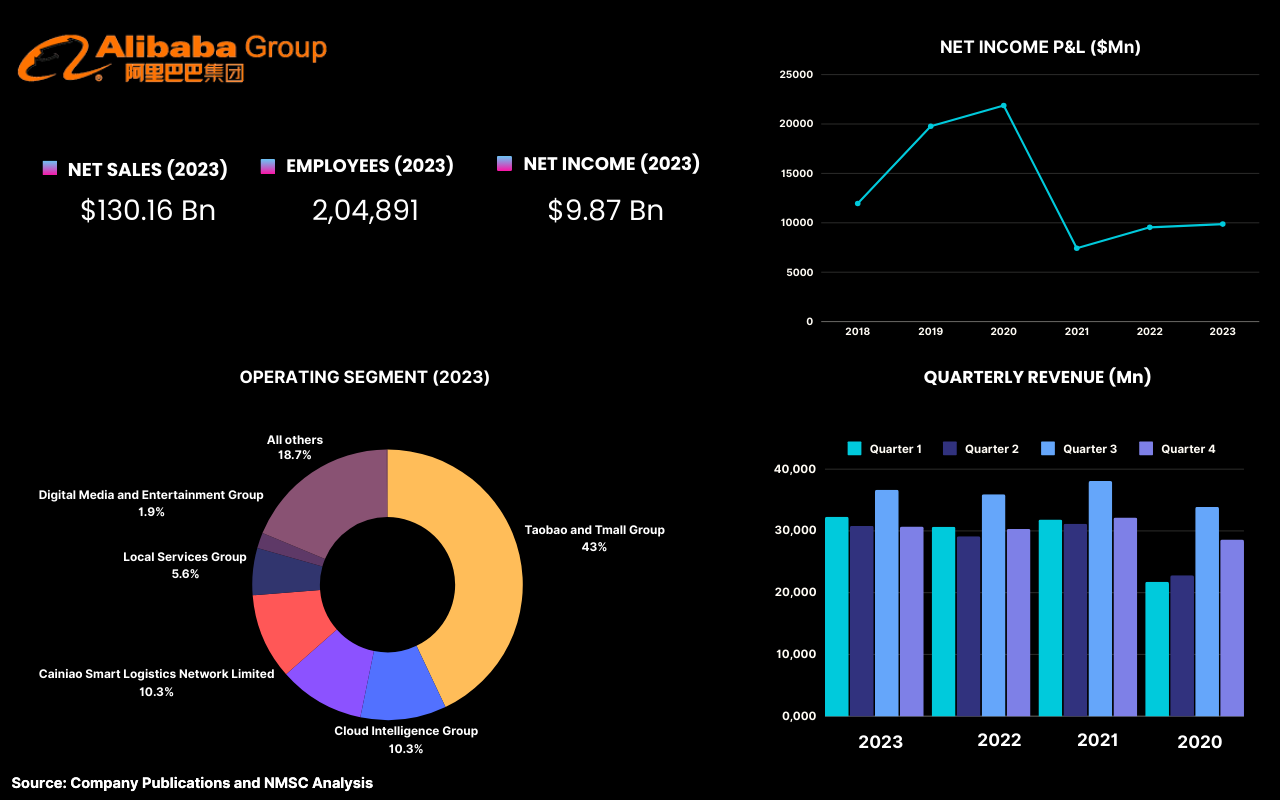

Highlights of Alibaba Group Holdings Limited

Alibaba Group Holding Limited is a multinational technology company specializing in e-commerce, retail, internet, and technology services. The company operates through six major business groups: Taobao and Tmall Group, Alibaba International Digital Commerce Group, Cloud Intelligence Group, Local Services Group, Cainiao Smart Logistics Network Limited, and Digital Media and Entertainment Group. Through its fintech affiliate, Ant Group, Alibaba established a significant presence in the mobile payment sector. Ant Group owns the world's largest mobile payment platform and is expanding its global presence with its digital offering, Alipay+. This strategy aims to connect mobile payment apps worldwide, positioning Alibaba as a major player in the international mobile payment market.

In March 2023, Alibaba and its fintech affiliate, Ant Group, launched RISC-V chips designed specifically for payment processing. These chips are intended to enhance the performance and security of payment systems, aligning with the growing demand for advanced technology in financial transactions.

This strategic move to innovate and improve their technological infrastructure contributed to the company's financial growth, as evidenced during the fiscal year 2024, when Alibaba's total revenue increased by 3%, rising from USD 126.05 billion in fiscal year 2023 to USD 130.16 billion. The company's net income also saw substantial growth, increasing by 28% from USD 7.42 billion in fiscal year 2022 to USD 9.54 billion in fiscal year 2023, and by 3% to USD 9.87 billion in fiscal year 2024.

Income from operations increased by 13% in fiscal year 2024, reaching USD 15.70 billion, driven primarily by an increase in adjusted EBITA and a decrease in share-based compensation expenses. General and administrative expenses decreased from USD 6.14 billion in fiscal year 2023 to USD 5.82 billion in fiscal year 2024. However, sales and marketing expenses rose by 11%, from USD 15.05 billion in fiscal year 2023 to USD 15.95 billion in fiscal year 2024. Alibaba built its core technologies for online and mobile commerce, as well as its cloud businesses, in-house. To achieve this, it employs research and development personnel dedicated to building the technology platform and developing new online and mobile products.

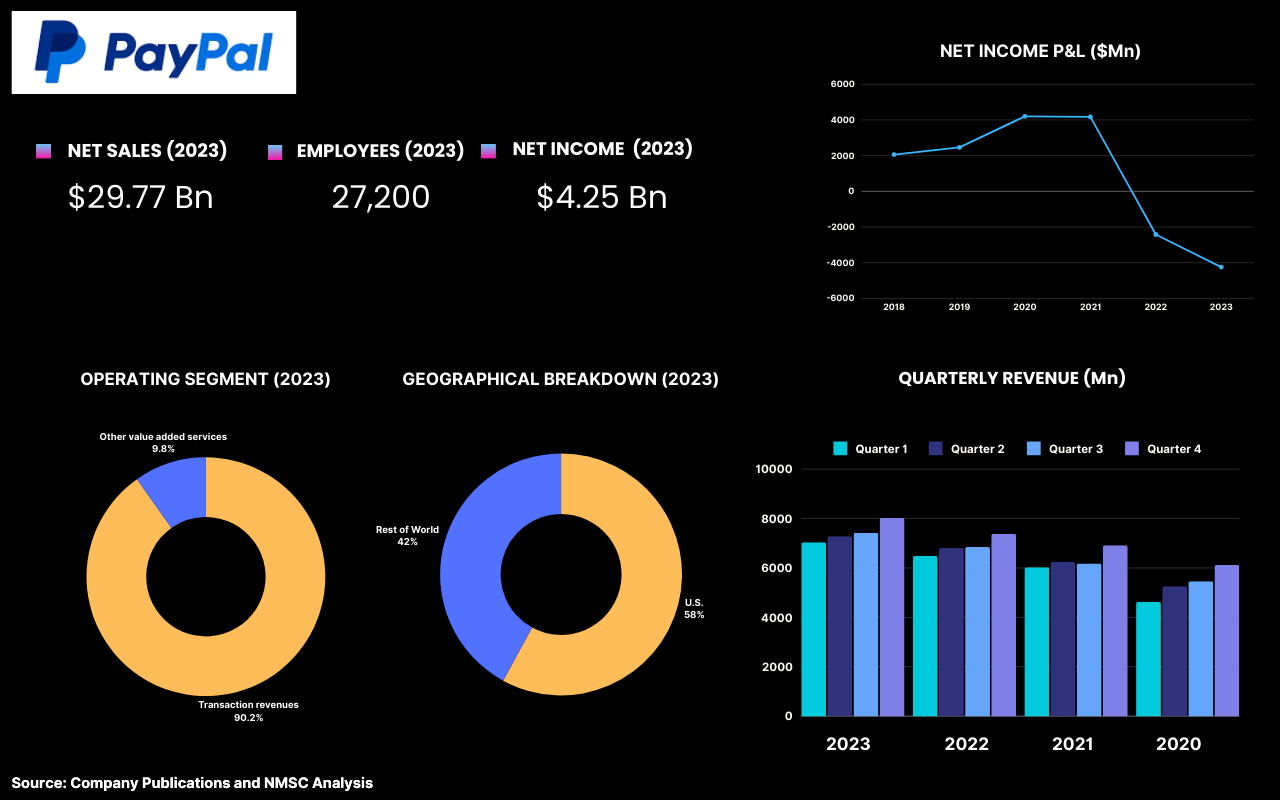

Highlights of Paypal Holdings Inc.

PayPal is a global company that operates in approximately 200 markets around the world. As of December 31, 2023, the company employed around 27,200 people globally, with approximately 38% based in the U.S. and 62% based outside the U.S. PayPal operates a comprehensive platform that facilitates online and mobile transactions for both consumers and businesses. Its services include person-to-person payments, payment processing, and mobile commerce solutions, enabling users to send and receive money globally. The company is known for its brands such as Venmo, Braintree, and Xoom, and established a robust two-sided network that connects millions of merchants and consumers across various industries. With a focus on innovation, PayPal continues to expand its offerings, including mobile payment capabilities and cryptocurrency transactions, positioning itself at the forefront of the evolving digital payment landscape.

Net sales generated by the company stood at USD 29.77 billion, USD 27.52 billion, and USD 25.37 billion in 2021, 2022, and 2023, respectively. This represents an increase of USD 2.30 billion, or 8%, in 2023 compared to 2022, driven primarily by a 13% growth in total payment volume. Total operating expenses of the company increased by USD 1.10 billion, or 4%, in 2023 compared to 2022, mainly due to higher transaction expenses. The company witnessed an operating income of USD 5.02 billion, an increase of USD 1.20 billion, or 31%, in 2023 compared to 2022. Additionally, net income increased by USD 1.80 billion, or 76%, in 2023 compared to 2022. This substantial growth was primarily due to profits from strategic investments, contrasting with the losses and impairments experienced in the previous year. Furthermore, the company benefited from higher interest earnings driven by increased interest rates. This brief overview of PayPal highlights the important role played by it in the mobile payment industry.

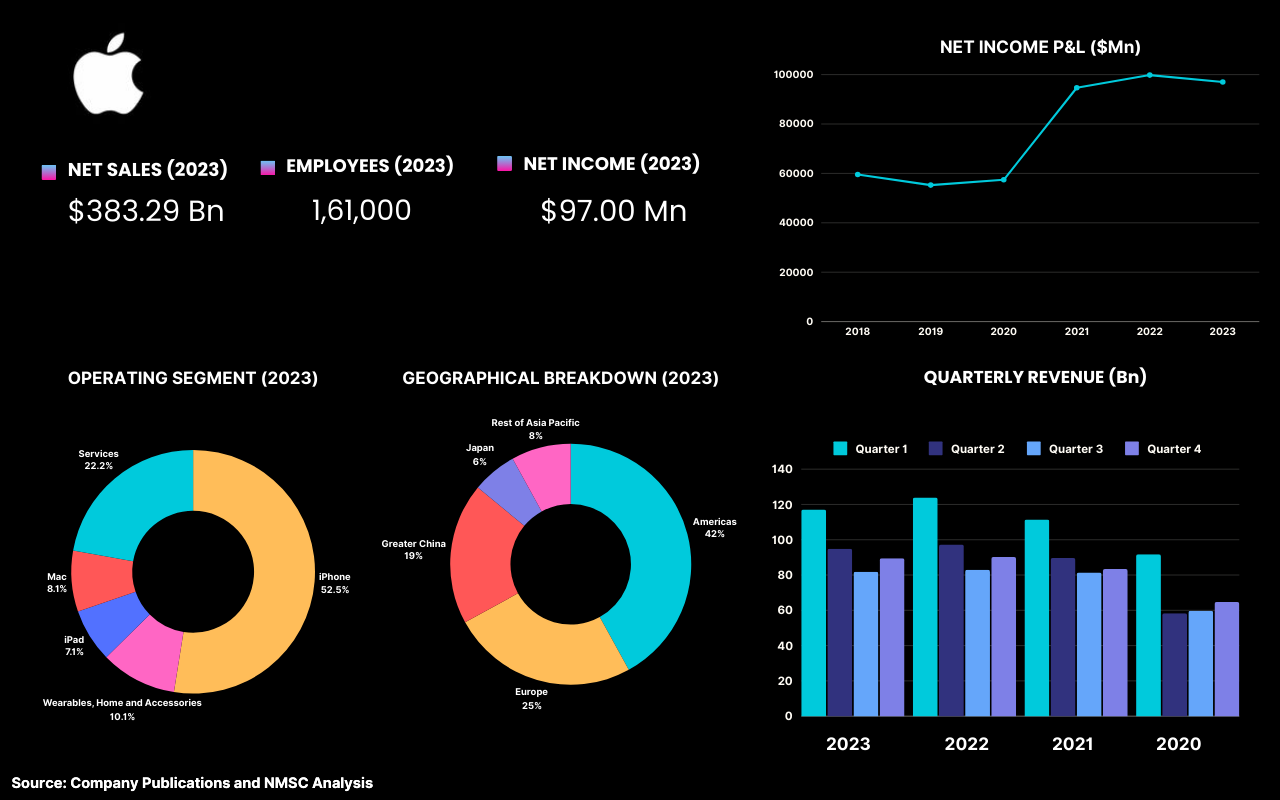

Highlights of Apple Inc.

Apple Inc., headquartered in Cupertino, California, is an American multinational technology company. It offers wide range of services, including Apple Music, iCloud, and Apple Pay, that enhances its ecosystem and user experience. Apple Inc. established a significant presence in the mobile payment sector through its Apple Pay service, launched in 2014. Apple Pay is a digital wallet and mobile payment platform that allows users to make secure, contactless transactions using their Apple devices, including iPhones, iPads, Apple Watches, and Macs. The service supports credit, debit, and prepaid cards from major financial institutions and is used for in-store purchases, in-app transactions, and web-based payments. Apple Pay utilizes advanced security features such as tokenization and biometric authentication (Touch ID, Face ID) to protect user data and prevent fraud. The company expanded Apple Pay globally, making it available in numerous countries and partnering with millions of merchants worldwide.

During 2023, the company’s total net sales were USD 383.29 billion and net income was USD 97.00 billion during 2023. The company’s net sales through its direct and indirect distribution channels accounted for 37% and 63%, respectively, of total net sales. The company’s international operations with sales outside the U.S. represents a majority of the company’s total net sales.

To stay competitive, Apple continuously develops new technologies and enhances its existing products and services through research and development (R&D), intellectual property licensing, and the acquisition of third-party businesses and technology. The company's R&D expenses increased from USD 21.91 billion in 2021 to USD 29.92 billion in 2023, reflecting its commitment to innovation amid rapid technological advancements. The company’s ability to compete successfully depends heavily upon its ability to ensure a continual and timely flow of competitive products, services and technologies to the marketplace.

In June 2024, Apple launched a new peer-to-peer payment feature called "Tap to Cash" for iPhone users, allowing them to transfer money simply by holding their phones together. This new feature is part of Apple's broader strategy to integrate more payment functionalities into its ecosystem, alongside other updates that will enhance user rewards and payment options for debit and credit cards. In addition to expanding its payment functionalities, Apple also demonstrated strong financial performance in recent years. Apple’s net income for the past three years was USD 94.68 billion in 2021, USD 99.80 billion in 2022, and USD 97.00 billion in 2023. This reflects the company’s robust financial performance despite facing various economic challenges.

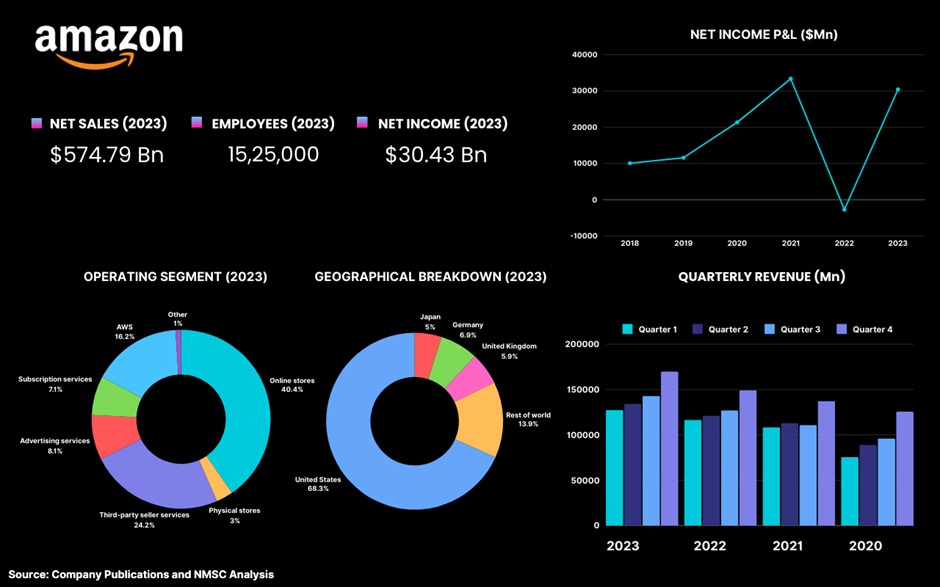

Highlights of Amazon.com Inc.

Amazon.com Inc., headquartered in Seattle, Washington, is one of the American multinational technology companies. It grew into the world's largest e-commerce platform, offering a vast array of products including electronics, apparel, and groceries, alongside services such as Amazon Prime and Amazon Web Services (AWS).

The company made significant pace in the mobile payment sector through its Amazon Pay service. It is designed to provide a seamless and secure payment experience, Amazon Pay allows customers to use their existing Amazon account information to make purchases on third-party websites and mobile apps without the need for additional sign-ups or sign-ins. The service supports various payment methods, including major credit and debit cards, and integrates with digital wallets such as Apple Pay and Visa Checkout.

Amazon's total revenue grew by 12% year-over-year, increasing from USD 513.98 billion in 2022 to USD 574.79 billion in 2023. By segment, revenue in North America rose by 12%, from USD 316.00 billion in 2022 to USD 353.00 billion in 2023. International revenue grew by 11%, from USD 118.00 billion in 2022 to USD 131.00 billion in 2023. Additionally, AWS revenue increased by 13%, rising from USD 80.00 billion in 2022 to USD 91.00 billion in 2023.

During 2023, net sales from the international segment accounted for 23% of the company's consolidated revenues. Furthermore, the company's operating income stood at USD 24.88 billion in 2021, USD 12.25 billion in 2022, and USD 36.85 billion in 2023.

Amazon's operating income and free cash flow (FCF) improved in 2023. Operating income increased by 201% year-over-year, from USD 12.2 billion in 2022 to USD 36.90 billion in 2023. Free cash flow improved primarily due to rising operating income and efficient management of accounts receivable, inventory, accounts payable, and capital expenditures. The increases in operating income were a result of higher sales of products and services and effective management of operating costs. This demonstrates the company’s strong financial performance and its crucial role in mobile payment service.

Highlights of Alphabet Inc.

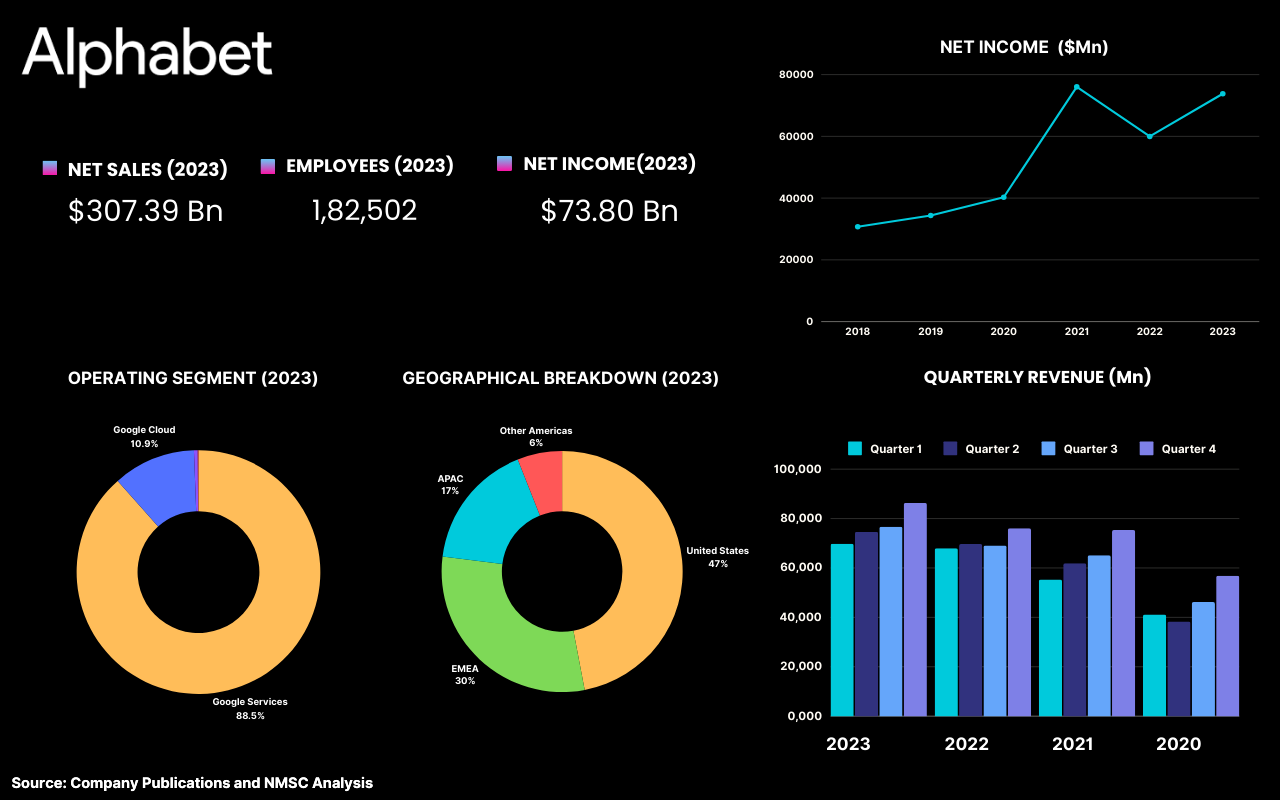

Alphabet Inc. is an American multinational technology conglomerate headquartered in Mountain View, California. Established in 2015 as part of a corporate restructuring of Google, Alphabet serves as the parent company to Google and several other subsidiaries, including Waymo, Verily, and YouTube. The company through its main subsidiary, offers Google Pay as a mobile payment platform. Google Pay allows users to make payments using their Android devices and is integrated into various Google services. Alphabet's primary revenue streams come from digital advertising, cloud computing, and other technology-related services. The company's involvement in mobile payments is more of a complementary offering to support its broader ecosystem of products and services, rather than a central part of its business strategy.

The company generated revenue of USD 307.39 billion in 2023, an increase of 9% year-over-year, primarily driven by an increase in Google Services revenues by 8%, and an increase in Google Cloud revenues by 26%. More than 75% of total revenues were generated from online advertising in 2023.

During the years ended December 31, 2022 and 2023, the company spent USD 31.50 billion and USD 32.30 billion on capital expenditures, respectively. The company expects to increase investment in technical infrastructure, including servers, network equipment, and data centers, to support the growth of its business and long-term initiatives.

Research and development expenses of the company stood at USD 31.56 billion in 2021, USD 39.50 billion in 2022, and USD 45.43 billion in 2023. Additionally, the long-term debt of the company stood at USD 13.25 billion in 2023 as compared to USD 14.70 billion in 2022. This strategic investment in R&D enabled Google to expand its product offerings and market presence. In May 2024, Google launched the Google Wallet app in India for Android users, allowing them to save their travel tickets, gift cards, and event passes. These advancements underscore Google's commitment to enhancing user experience and maintaining its competitive edge in the mobile payment market.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/mobile-payment-market/inquire-before-buying

Summary of Mobile Payment Industry

The mobile payment market is experiencing robust growth, fueled by technological advancements and increasing consumer adoption. Leading companies in the sector are enhancing their digital payment solutions to offer secure and seamless transaction experiences across various platforms. Innovations such as advanced payment processing chips, integrated digital wallets, and peer-to-peer payment features are improving the efficiency and security of mobile transactions. As these companies invest heavily in technology and infrastructure, the mobile payment industry is becoming more competitive, with significant financial impacts that underscore its expansion and strategic importance in the global digital economy.

About the Author

Sreeparna Das is a researcher with over two years of experience specializing in market trend analysis, trend forecasting, and competitive analysis across various industries. She has worked on many comprehensive reports while offering actionable recommendations that help businesses make informed decisions, ensuring clients stay ahead in their respective markets. With a keen interest in writing, she shares her insights through blogs and articles. She spends her time in reading, cooking and photography when not keeping up with industry news.

Sreeparna Das is a researcher with over two years of experience specializing in market trend analysis, trend forecasting, and competitive analysis across various industries. She has worked on many comprehensive reports while offering actionable recommendations that help businesses make informed decisions, ensuring clients stay ahead in their respective markets. With a keen interest in writing, she shares her insights through blogs and articles. She spends her time in reading, cooking and photography when not keeping up with industry news.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment