Top UGV Players: Genetal Dynamics, Qinetiq, & Boston Dynamics

Published: 2025-09-11

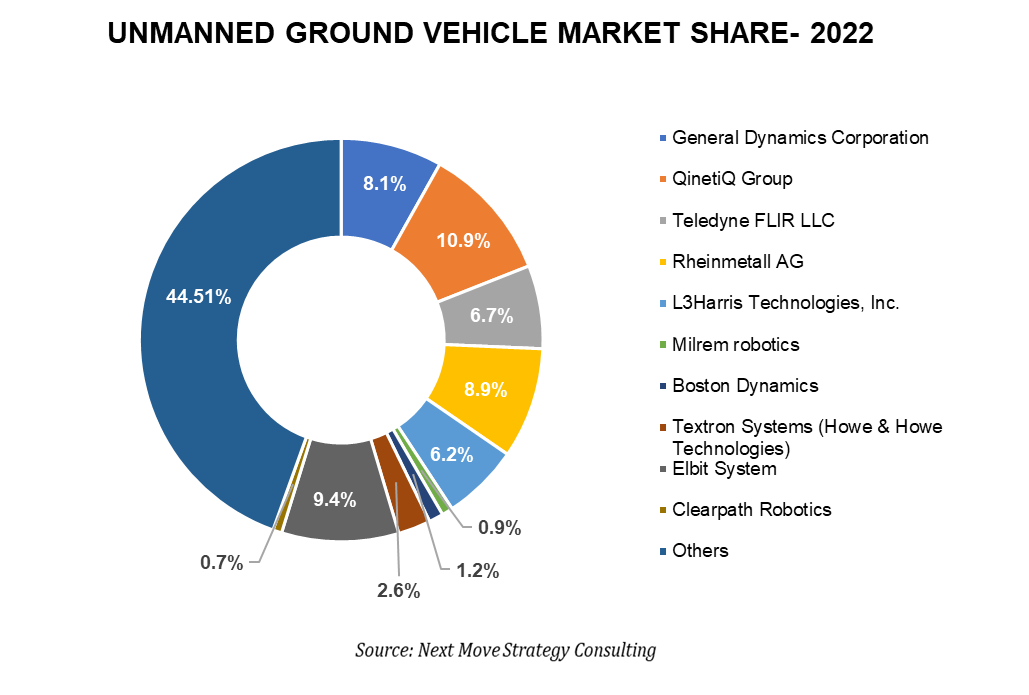

According to Next Move Strategy Consulting, the UGV Market is expected to grow from USD 2.56 Bn in 2023 to USD 4.08 Bn in 2030, with a CAGR of 6.1% during the forecast period, due to advancements in self-navigation technology.

UGV Market Overview

The Unmanned Ground Vehicle (UGV) market refers to the industry segment focused on the development, production, and deployment of autonomous or remotely operated vehicles designed to operate on the ground without direct human intervention. These vehicles, often used for military, industrial, and commercial applications, include various types such as robotic platforms, autonomous drones, and utility vehicles. The market encompasses technologies related to navigation, control systems, sensors, and artificial intelligence, aiming to enhance operational efficiency, safety, and versatility across diverse environments.

UGVs excel in hazardous environments, reducing risks to human operators and performing dangerous tasks with high precision. Their ability to handle repetitive or complex operations leads to increased productivity and cost savings. Versatile in application, UGVs are used across various industries for tasks such as surveillance, logistics, and exploration. The growth of the UGV market is driven by technological advancements, increasing automation demand, rising security and surveillance needs, cost efficiency, significant military and defense investments, and expanding industrial applications. Cost reduction is another key driver, as UGVs help lower operational expenses. Investments in military and defense, along with expanding industrial applications, also contribute to market growth.

However, the market faces challenges such as high initial costs, regulatory issues, and technical difficulties. Despite these challenges, opportunities for growth remain strong with advancements in AI, the development of collaborative robots, the use of edge computing, and sustainability initiatives. These factors are expected to drive the UGV market forward in the coming years.

For the latest market share analysis and in-depth report on unmanned ground vehicle industry insights, you can reach out to us at: https://www.nextmsc.com/unmanned-ground-vehicle-market/request-sample

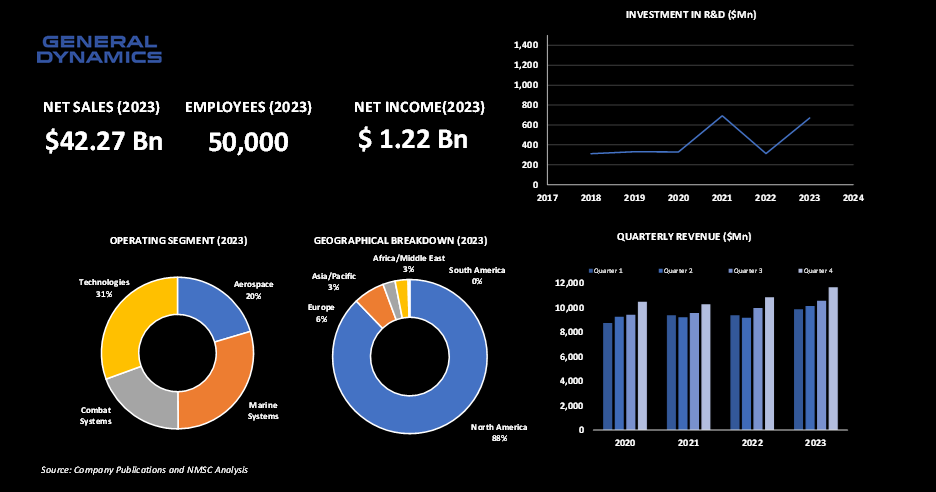

Highlights of General Dynamics

General Dynamics, a leading name in aerospace and defense, reported impressive financial results in 2023 with net sales of USD 42.27 billion and a net income of USD 1.22 billion. The company, which employs around 50,000 people globally, operates across four main segments, with its Technologies segment being the largest contributor, accounting for 31% of its total business. North America remains a key market, representing 88% of the company’s operations.

A significant player in the unmanned ground vehicle (UGV) market, General Dynamics’ Land Systems division is at the forefront of developing advanced UGV technologies. The division’s recent innovation, the M10 Booker combat vehicle, exemplifies its commitment to enhancing military capabilities. This vehicle, is set to provide increased precision firepower, better survivability, and enhanced maneuverability, is currently in low-rate initial production with 60 units planned for delivery through 2025. The U.S. Army’s goal is to acquire over 500 of these vehicles, highlighting the growing importance of UGVs in modern defense strategies.

General Dynamics continues to invest heavily in research and development (R&D), with a substantial USD 670 million allocated in 2023 for R&D activities. This investment supports advancements in UGV technologies and other cutting-edge solutions. The company’s new Emerge Innovation Center is central to expanding its R&D efforts, focusing on developing digital accelerators, expanding research, and upskilling its workforce.

Through its robust R&D investments and strategic focus on UGVs, General Dynamics is well-positioned to drive innovation and maintain leadership in the unmanned ground vehicle market, supporting the development of sophisticated autonomous and unmanned systems for defense applications.

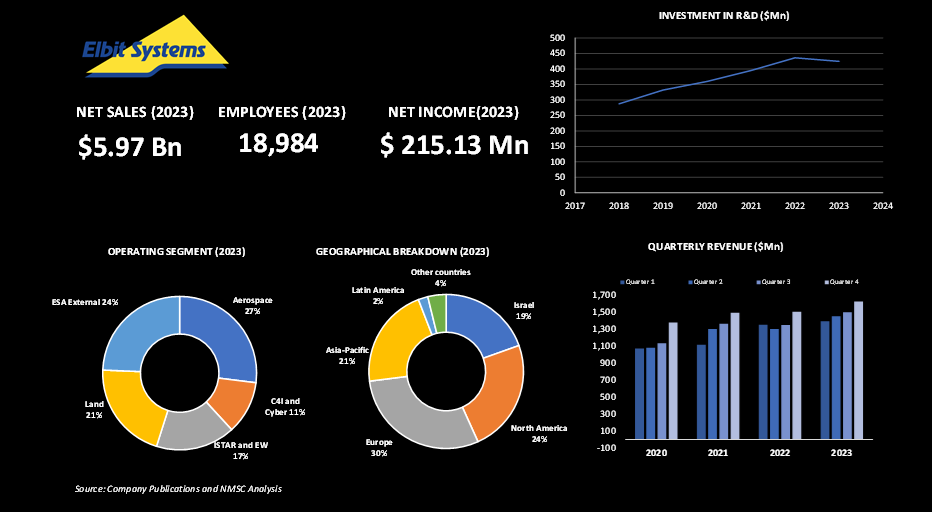

Highlights of Elbit System

Elbit Systems, a global leader in high-tech defense and homeland security solutions, demonstrated strong performance in 2023 with revenues reaching USD 5.97 billion, reflecting a notable increase from the previous year. The company operates through five key segments: Aerospace, C4I and Cyber, Intelligence, Surveillance, Target Acquisition and Reconnaissance (ISTAR) and Electronic Warfare (EW), Land, and Elbit Systems of America (ESA). Each segment recorded significant growth, with Aerospace up by 8% due to increased training and simulation projects in Europe, and ISTAR and EW witnessing a 13% rise, driven by European projects and a surge in Countermeasure Systems deliveries, particularly in Asia.

Elbit's commitment to innovation is evident in its consistent investment in research and development (R&D), which amounted to USD 502.6 million in 2023. This investment aligns with the evolving needs of defense and homeland security, influenced by global geopolitical instability and the growing demand for advanced capabilities, including unmanned systems and electronic warfare. The company's strategic focus on these areas positions it strongly in the rapidly expanding Unmanned Ground Vehicle (UGV) market, where the demand for robust, autonomous systems is increasing.

The ongoing "Swords of Iron" war has further amplified the demand for Elbit's products and solutions, particularly from the Israeli Ministry of Defense (IMOD). Since the conflict began, Elbit has secured over USD 2 billion in contracts, underscoring its critical role in providing advanced defense technologies. Additionally, the acquisition of Pacific Electronics Enterprises Inc. (PEE) in 2023 has bolstered Elbit's capabilities in avionics and electronic systems, complementing its existing portfolio and enhancing its position in the UGV market, where integration of advanced electronics and communication systems is crucial.

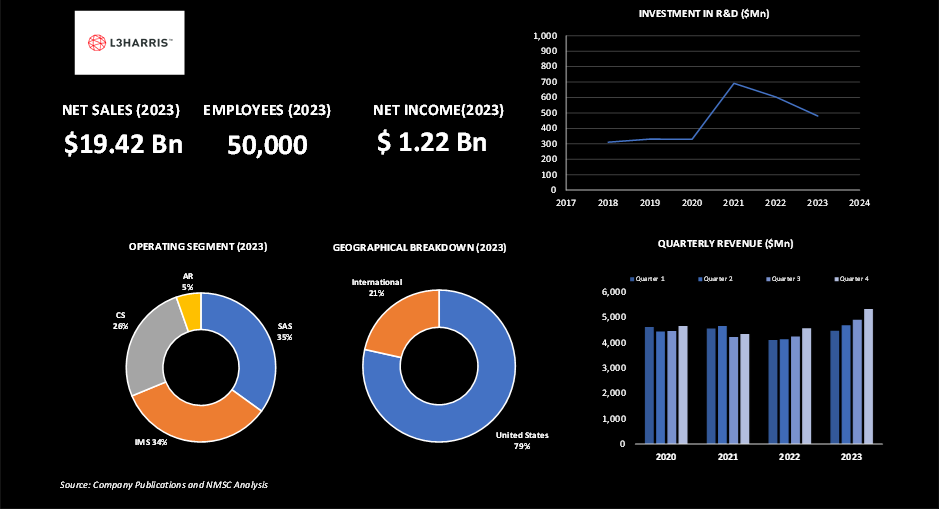

Highlights of L3harris Technologies, Inc.

L3Harris Technologies, recognized as a trusted disruptor in the defense industry, focuses on delivering mission-critical solutions across space, air, land, sea, and cyber domains. The company's operations are segmented into Space & Airborne Systems (SAS), Integrated Mission Systems (IMS), Communication Systems (CS), and the newly formed Aerojet Rocketdyne (AR) segment, following the acquisition of Aerojet Rocketdyne Holdings, Inc. (AJRD) in July 2023. This acquisition contributed to a 14% revenue increase in fiscal 2023, with notable gains in the CS and SAS segments, amounting to USD 853 million and USD 472 million, respectively. With approximately 50,000 employees, including 20,000 engineers and scientists, L3Harris remains deeply integrated into U.S. national security efforts, supported by the 2024 DoD budget. The company’s strategic contracts and a revenue of USD 19.42 billion underscore its capability to address growing global defense needs, particularly through advancements in ISR aircraft, tactical communications, and networked systems.

The integration of AJRD enhances L3Harris' position in strategic defense and missile systems, aligning with the broader defense landscape, which increasingly incorporates Unmanned Ground Vehicles (UGVs) for ground-based operations. L3Harris' extensive R&D investments, totaling USD 480 million in fiscal 2023, along with its expertise in communication systems and ISR, contribute to the evolving UGV market, where advanced communication and networked systems are crucial. The company's international reach, with USD 4.2 billion in export revenue primarily from the EMEA and APAC regions, further supports its influence in the global UGV landscape.

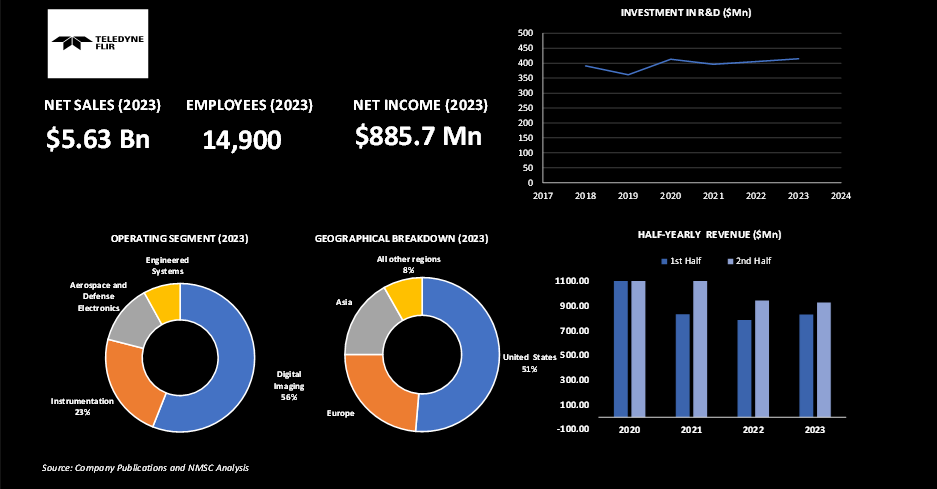

Highlights of Teledyne Technologies Incorporated

Teledyne Technologies Incorporated delivers advanced technology solutions across various high-growth and high-reliability sectors, including aerospace and defense, oceanographic research, and deepwater oil and gas. The company recorded net sales of USD 5.63 billion in 2023, with net income reaching USD 885.7 million. The company operates through four main segments: Digital Imaging, Instrumentation, Aerospace and Defense Electronics, and Engineered Systems. The digital imagining segment contributed the highest share in its revenue with 56%, followed by Instrumentation at 23%, Aerospace and Defense Electronics at 13%, and Engineered Systems at 8%.

In 2023, Teledyne Technologies Incorporated experienced significant growth in its international sales, reaching USD 2,740.1 million, up from USD 2,586.0 million in 2022. Of these sales, the U.S. accounted for USD 900.5 million, a notable increase from USD 837.9 million in the previous year. The company’s global reach is evident, with its products being sold in over 100 foreign countries. Notably, approximately 90% of these international sales were concentrated in just 30 countries. The top five international markets—United Kingdom, China, Japan, Germany, and Norway—represented about 21% of Teledyne’s total net sales, underscoring its global market penetration.

In the Unmanned Ground Vehicle (UGV) market, Teledyne strengthened its position through strategic acquisitions. In the fourth quarter of 2023, Teledyne acquired Xena Networks ApS for USD 24.2 million, enhancing its Instrumentation segment with high-speed Ethernet validation and testing solutions, crucial for advanced UGV systems. Moreover, Teledyne FLIR, a subsidiary of Teledyne, introduced the Black Recon in 2023—a cutting-edge technology concept enabling users to autonomously deploy and recover small drones from within a military vehicle. This innovation significantly boosts reconnaissance and surveillance capabilities, directly contributing to the UGV market by integrating advanced unmanned systems into military operations.

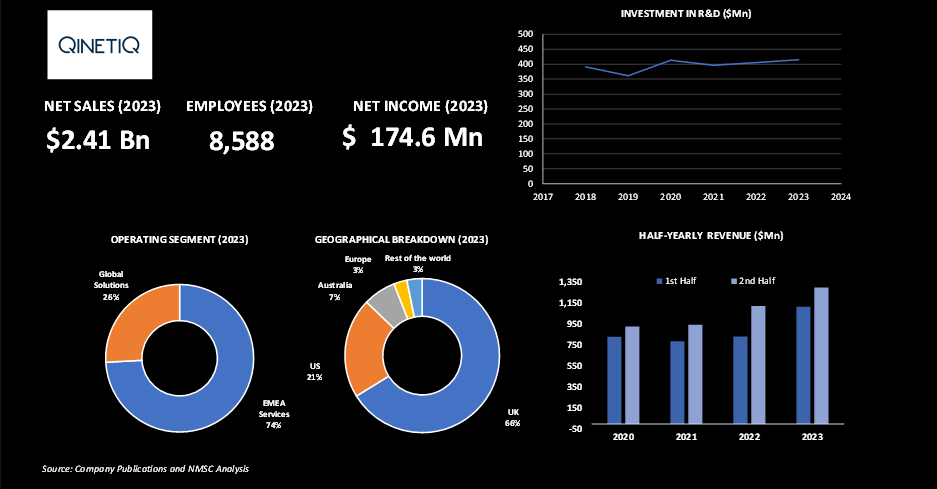

Highlights of Qinetiq Group

QinetiQ, established in July 2001 from the split of the Ministry of Defence’s Defence Evaluation and Research Agency (DERA), has emerged as a significant force in defense technology. Initially privatized with Carlyle Group investment, QinetiQ reported a revenue of USD 2.41 billion in 2023 and employs over 8,000 people worldwide. The UK represents 66% of its market share, reflecting its strong domestic presence. The company invested USD 415 million in R&D in 2023, underscoring its commitment to innovation. The company operates through two primary segments: EMEA Services and Global Solutions. EMEA Services generated USD 1,791.5 million in 2023, focusing on capability integration, threat representation, and operational readiness, supported by long-term contracts that ensure stable revenue and cash flow. Global Solutions, contributing USD 625.8 million, aims to expand its portfolio for larger, longer-term programs.ecent advancements highlight QinetiQ’s impact on the Unmanned Ground Vehicle (UGV) market.

The company, in collaboration with Dstl, MBDA, and Leonardo, achieved the UK’s first high-power laser directed energy weapon firing against aerial targets, enhancing UGV defense capabilities. In March 2024, QinetiQ demonstrated the UK’s first jet-to-jet crewed-uncrewed teaming, integrating crewed aircraft with autonomous drones to advance UGV operations. Additionally, QinetiQ supported the Royal Navy in the NATO Robotic Experimentation Prototyping Augmented by Maritime Unmanned Systems (REPMUS) Exercise, showcasing its expertise in managing multiple uncrewed vehicles.

Hosting Formidable Shield 2023, QinetiQ demonstrated its capabilities in complex defense system testing, involving over 20 ships, 35 aircraft, and nearly 4,000 personnel from 13 NATO nations. This exercise reinforced QinetiQ’s role as a key player in the UGV market. The company’s focus on high-power laser technology, autonomous systems, and advanced multi-vehicle command and control systems positions it as a leader in shaping the future of unmanned ground vehicles.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/unmanned-ground-vehicle-market/inquire-before-buying

Summary of UGV Market

The Unmanned Ground Vehicle (UGV) market is set for robust growth, driven by advancements in automation, artificial intelligence, and robotics. As UGVs continue to evolve, their applications are expected to expand across various sectors, including defense, agriculture, and logistics. These vehicles will play a crucial role in enhancing operational efficiency, reducing human intervention in hazardous environments, and enabling data-driven decision-making. Additionally, the integration of UGVs with other emerging technologies, such as the Internet of Things (IoT) and 5G, will further enhance their capabilities, paving the way for more sophisticated and autonomous systems. As the industry progresses, we can anticipate a growing demand for UGVs, fueled by the need for innovative solutions in both commercial and military domains.

About the Author

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics.

Arjun Chetry is an accomplished researcher and writer with a history of more than three years of conducting thorough research. With a professional background as a research analyst, he has a keen eye for analyzing industry trends and understanding consumer behavior. His dedication to exploring diverse subjects and conducting in-depth analyses has equipped him with a deep understanding of research intricacies. He remains committed to staying up-to-date with the latest market trends and recognizing their impact on business and society. His well-rounded interests and experiences contribute to his ability to offer insights and perspectives on various topics.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment