Finland Battery Market by Type (Lead Acid, Lithium Ion, Nickel Metal Hydride, Nickel Cadmium, and Others), by Application (Residential, Industrial, and Commercial), and by Power System (Fuel Cell Batteries, Nuclear Batteries, and Other Power Systems) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Energy & Power | Publish Date: 12-Sep-2024 | No of Pages: 78 | No. of Tables: 79 | No. of Figures: 44 | Format: PDF | Report Code : EP703

Finland Battery Market Overview

The Finland Battery Market size was valued at USD 107.7 million in 2023 and is predicted to reach USD 582.8 million by 2030, registering a CAGR of 25.1% from 2024 to 2030. The battery market refers to the industry for research, development, manufacturing, and distribution of batteries, that plays an important role in converting chemical energy into electrical energy.

This industry covers various battery types, including lithium-ion, lead-acid, and nickel-metal hydride, serving diverse applications such as consumer electronics, electric vehicles, large-scale energy storage systems, industrial machinery, and medical devices.

The battery supply chain in Finland is growing rapidly due to the shift towards electric mobility, increasing adoption of renewable energy, and technological advancements that improve battery efficiency and energy density. Furthermore, environmental regulations, government support for green energy, and innovations in battery recycling are key factors driving market growth.

Growth of Renewable Energy Projects Drives Market Expansion

The expansion of renewable energy projects is driving the growth of the battery market in Finland by increasing the demand for efficient energy storage solutions to support intermittent renewable sources such as wind and solar power.

Major players such as Fortum and VSB are actively enhancing battery technologies and infrastructure to meet this rising demand. For example, in June 2023, Fortum launched Finland’s first solar power project in Virolahti, supporting the green transition and sustainable development while addressing the increasing need for renewable energy storage.

Additionally, in June 2024, VSB Finland introduced a 450 MW hybrid project to boost renewable energy production in the country, reflecting Finland’s commitment to sustainable energy solutions. Furthermore, the focus on sustainable energy practices is further driving this demand.

In May 2024, the European Climate, Infrastructure and Environment Executive Agency signed agreements for seven solar projects across Finland, totaling 213 MW. As Finland invests heavily in expanding its renewable energy infrastructure, the need for advanced battery technologies to store and manage the produced energy becomes even more critical.

Consequently, the Finland battery market is experiencing significant growth, with companies concentrating on developing innovative, high-capacity, and long-life battery solutions to meet the evolving needs of the renewable energy sector.

Rapid Growth in Electric Vehicle Sector Fuels Expansion of Finland's Battery Market

The expanding electric vehicle (EV) sector is driving the growing demand for advanced battery technologies that provide higher energy density, faster charging times, and extended driving ranges.

A recent report from the Finnish Information Centre of the Automobile Sector projects that the EV market in Finland will reach 42% by 2025 and 70% by 2030. This increase in demand is prompting battery manufacturers to innovate and scale up production, contributing to significant growth in the Finland battery market.

Additionally, the focus on reducing carbon emissions and moving towards a cleaner transportation system further amplifies the need for advanced battery solutions, thereby supporting the Finland battery market expansion.

Government Initiatives Accelerate Market Growth

Government initiatives in the energy sector are fueling the Finland battery market growth by driving investments and development in renewable energy, smart grid technologies, and energy efficiency. These initiatives include subsidies, tax incentives, and regulatory support, promote the adoption of innovative energy solutions and increase demand for related technologies and services.

According to a recent report by the European Commission, the Finnish government aims to raise the share of renewable energy to at least 62% of total final energy consumption, with a cap of 239.6 TWh by 2030.

Additionally, in August 2022, Finland's Minister of Transport and Communications announced extended subsidies for electric vehicles (EVs) to boost consumer adoption. This grant provides approximately USD 2,006 to buyers of new fully electric passenger cars priced below USD 50,170.

As governments prioritize sustainable energy practices and the transition to a low-carbon economy, the Finland battery market is experiencing substantial growth. Companies are responding by developing new products and expanding their capabilities to meet evolving regulatory standards and consumer expectations.

High Costs of Advanced Battery Technologies Limit the Market Growth

The high cost of advanced battery technologies poses a significant barrier to market growth, particularly for price-sensitive consumers, smaller businesses, and emerging markets. These elevated costs stem from the use of costly raw materials, complex manufacturing processes, and ongoing investment in research and development.

As a result, many potential users are discouraged from adopting advanced battery solutions, choosing instead more affordable, though less efficient, alternatives. This financial challenge hampers the market's expansion, as companies and consumers delay their transition to advanced battery systems until technological improvements or economies of scale reduce prices to a more manageable level.

Innovations in Battery Technology Expected to Create Future Growth Opportunity

Innovations in battery technology, such as the development of graphene-based batteries, present significant opportunities for future market growth. Graphene's exceptional electrical conductivity and mechanical strength offer enhanced energy storage, faster charging, and longer battery life compared to traditional lithium-ion batteries.

For instance, Skeleton Technology’s SuperBattery uses their proprietary Curved Graphene material, providing a long lifespan, high power, energy density similar to high-power batteries, and excellent safety.

As graphene technology progresses, it is expected to transform various industries, including electric vehicles, portable electronics, and renewable energy storage. The superior performance and efficiency of graphene batteries are likely to attract substantial investment and drive further research and development, paving the way for considerable market growth in the coming years.

By Type, Lead Acid Dominates the Finland Battery Industry

Lead acid batteries dominate the Finland battery market trends, holding a valuation of USD 41.6 million. This leadership is largely due to their cost-effectiveness, reliability, and extensive use in various applications. Lead acid batteries are widely employed in automotive starting, lighting, and ignition systems, as well as backup power and industrial applications, thanks to their robust performance and high current delivery capabilities.

The well-established recycling infrastructure for lead acid batteries also enhances their environmental sustainability and reduces disposal costs. Additionally, the mature manufacturing processes and economies of scale contribute to lower production costs, making lead acid batteries an attractive option in price-sensitive markets. Despite the rise of newer battery technologies, these advantages ensure that lead acid batteries continue to hold a significant market share.

By Application, Industrial Sector Expected to Achieve Highest CAGR Growth Through 2030

The industrial sector is anticipated to achieve the highest compound annual growth rate (CAGR) of 26.6% through 2030. This strong growth is driven by the rising adoption of automation and industrial robotics, that require reliable and high-performance batteries.

Additionally, as industries focus more on sustainable and energy-efficient practices, there is an increasing demand for advanced energy storage solutions that can optimize energy use and lower operational costs.

The expansion of industrial applications across sectors such as manufacturing, telecommunications, and mining further fuels this growth, as these sectors require batteries with longer life cycles, faster charging capabilities, and improved safety standards.

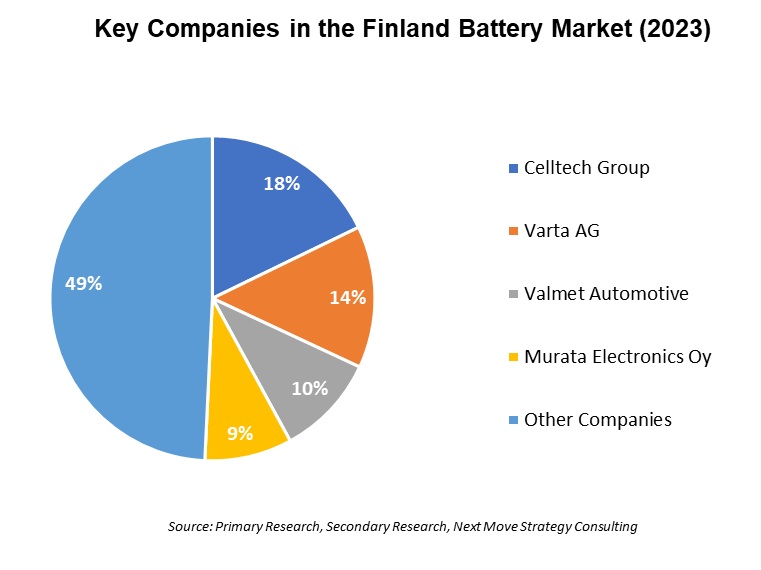

Competitive Landscape

The Finland battery industry include various market players such as Celltech Group, Valmet Automotive, BroadBit Batteries Oy, Geyser Batteries Oy, SAFT, Northvolt AB, Varta AG, Freyr AS, Murata Electronics Oy, Skeleton Technologies GmbH, and others.

These companies are engaged in various business expansion and partnership across various regions to maintain their dominance in the Finland battery market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Dec 2023 |

Business Expansion |

Skeleton Technologies expanded its operations to Finland through the acquisition of European Batteries Oy's assets. This expansion involves launching pilot production at a 9,400 square meter facility in Varkaus. The new facility aims to boost manufacturing capacity and accelerate product development. |

|

|

Oct 2022 |

Partnership |

Celltech Solutions Oy partnered with Fortum to establish a new factory in Pirkkala, Finland, focused on producing industrial battery systems. This new facility is designed to address the increasing demand for sustainable energy solutions in Europe and support the transition to electric mobility. |

|

|

Jul 2022 |

Collaboration |

Northvolt partnered with Stora Enso to develop wood-based batteries using lignin-based hard carbon sourced from Nordic forests, with production based in Finland |

|

|

Jan 2022 |

Business Expansion |

FREYR Battery expanded its operations with a new battery cell production plant in Vaasa, Finland. This facility is designed to establish a large-scale manufacturing base to meet the increasing demand for localized and decarbonized battery solutions in Europe |

Finland Battery Market Key Segments

By Type

-

Lead Acid

-

Stationary

-

Motive

-

-

Lithium Ion

-

Lithium Nickel Manganese Cobalt (LI-NMC)

-

Lithium Iron Phosphate (LFP)

-

Lithium Cobalt Oxide (LCO)

-

Lithium Titanate Oxide (LTO)

-

Lithium Manganese Oxide (LMO)

-

Lithium Nickel Cobalt Aluminum Oxide (NCA)

-

-

Nickel Metal Hydride

-

Nickel Cadmium

-

Others

By Application

-

Residential

-

Industrial

-

Manufacturing & Construction

-

Automotive

-

Medical

-

Telecom & IT

-

Consumer Electronics

-

Power & Utility

-

Aerospace

-

Marine

-

Others

-

-

Commercial

By Power Systems

-

Fuel cell batteries

-

Proton exchange membrane fuel cells

-

Alkaline fuel cells

-

Phosphoric acid fuel cells

-

Solid oxide fuel cells

-

Molten carbonate fuel cells

-

-

Nuclear batteries

-

Other Power Systems

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2023 |

USD 107.7 Million |

|

Revenue Forecast in 2030 |

USD 582.8 Million |

|

Value Growth Rate |

CAGR of 25.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Key Players

-

Celltech Group

-

Valmet Automotive

-

BroadBit Batteries Oy

-

Geyser Batteries Oy

-

SAFT

-

Northvolt AB

-

Varta AG

-

Freyr AS

-

Murata Electronics Oy

-

Skeleton Technologies GmbH

Speak to Our Analyst

Speak to Our Analyst