Lithium-Air Batteries Market by Type (Aqueous Lithium-Air Battery, Non-Aqueous Lithium-Air Battery, Solid State Lithium-Air Battery, and Others), and by Application (Automotive & Transportation, Energy Storage, Consumer Electronics, Medical Devices, and Others) – Global Opportunity Analysis and Industry Forecast 2023-2030

Market Definition

The global Lithium-Air Batteries Market size was valued at USD 10.15 billion in 2022 and is predicted to reach USD 20.81 billion by 2030 with a CAGR of 9.4% from 2023-2030. Lithium-air batteries, also known as lithium-oxygen batteries an electrochemical battery that produces electricity by the lithium oxidation process. These are metal-air batteries that operate in a redox process which produces an electric current by oxidizing lithium metal and then reducing oxygen.

The cells are used in many areas from low-powered applications to batteries and electric vehicle batteries for PV systems such as solar panel systems, intelligent buildings, and home PV installation. These batteries tend to have higher energy density, voltage capacity, and lower self-discharge rates than other secondary batteries. Lithium-air batteries are used in a wide range of applications including medical equipment, mobile devices, defense, ships, and backup power systems among others.

Market Dynamics and Trends

The surge in demand for lithium-air batteries in consumer goods and smart appliances, including smart home appliances, wearables, and smartphones, is a key factor propelling the growth of the lithium-air batteries market. For instance, in 2022, the number of smartphones sold worldwide reached 1510.3 million units, as compared to 1397.4 million units sold in 2020. This increase in the demand for smartphones and other electronic devices is driving the demand for lithium-air batteries market.

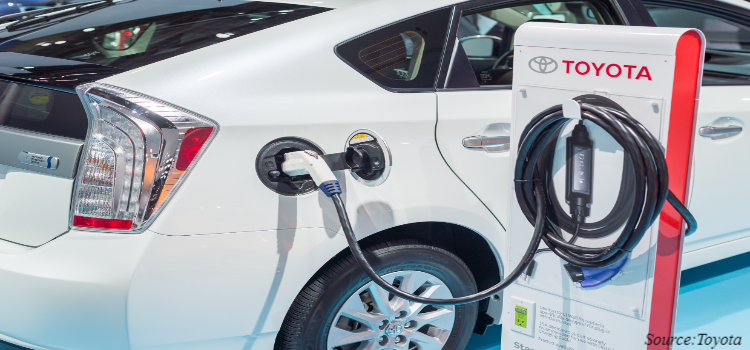

Moreover, increasing demand for electric vehicles and portable electronics to improve the range and performance of electric vehicles and to extend the battery life of portable electronic devices is driving the growth of the lithium-air batteries market. According to the International Energy Agency, in 2021, sales of electric cars rose to 6.6 million from two years earlier which is further expected to drive the growth of the lithium-air batteries market during the forecast period.

However, slow charging rates and safety concerns such as overheating, thermal runaway, and potential fire hazards due to the use of pure lithium-ion batteries are the factors restraining the growth of the market during the forecast period. On the contrary, the growing use of lithium-air batteries in advanced industrial applications such as drones, mobile robots, and underwater robots could better power the applications are expected to create ample growth opportunities for the market in the coming years.

Market Segmentations and Scope of the Study

The lithium-air batteries market share is segmented on the basis of type, application, and region. On the basis of type, the market is divided into aqueous lithium-air battery, non-aqueous lithium-air battery, solid state lithium-air battery, and others. On the basis of application, the market is categorized into automotive & transportation, energy storage, consumer electronics, medical devices, and others. Regional breakdown and analysis of each of the aforesaid segments includes North America, Europe, Asia-Pacific, and Rest of World (RoW).

Geographical Analysis

North America holds the dominant share of the lithium-air batteries market. This is attributed to factors such as increasing demand for consumer goods and electronics such as smartphones, tablets, and smart home appliances in countries such as the U.S., Canada, and Mexico. For instance, the average house in the U.S. has 20.2 connected devices including smartphones, computers, tablets, and connected appliances. The surging adoption of technology-intensive electronic products is boosting the demand for lithium-air batteries in the region.

Also, the rising government initiatives and investments in the field of lithium-air batteries are driving the market growth in this region. For instance, in March 2022, the U.S. Department of Energy (DOE) coordinated with the U.S. Department of Labor and the AFL-CIO and launched a national workforce development strategy for lithium-battery manufacturing. They also invested USD 5 million investment to support training programs in the energy and automotive industries to advance workforce partnerships between industry & labor for the domestic lithium battery supply chain.

On the other hand, Asia-Pacific is expected to show a steady rise in the lithium-air batteries market. The increasing adoption of lithium-air batteries in electric vehicles due to their high energy density and long lifespan is boosting the growth of the market in this region. According to the International Trade Administration, China is the largest vehicle manufacturing country in the world, selling over 25 million vehicles in 2020. The domestic production of vehicles is expected to reach 35 million by 2025, further driving the demand for lithium-air batteries in this region.

Moreover, the growing investments by major companies for the development of high-energy-density lithium-air batteries for various sectors, including automotive, power, and consumer electronics, are playing a significant role in propelling the expansion of the lithium-air batteries market. For instance, in July 2021, leading battery manufacturers such as LG Energy Solution, Samsung SDI, and SK Innovation, invested USD 35.4 billion in the development of next-generation lithium-air battery technology for electric vehicles.

Competitive Landscape

The lithium-air batteries market trends comprises of various industry players such as Poly Plus Battery Co., Mullen Technologies Inc., Lithium Air Industries, Inc., MTI Corporation, SoftBank Group, Tesla Inc., Metair, IATA, Amperex Technology Ltd (ATL), and BYD among others. These market players are adopting various new product launches and collaborations across various regions to maintain their dominance in the lithium-air batteries market.

For instance, in July 2022, PolyPlus, a leading battery technology company, launched a product line for protected lithium electrodes and lithium seawater batteries. The newly launched batteries reached a record-setting energy density of 2000 Wh/kg, promising advancements in energy storage capabilities.

Moreover, in December 2021, SoftBank collaborated with Japan's National Institute for Materials Science on the development of a groundbreaking battery technology with double the capacity of traditional lithium-ion batteries, potentially revolutionizing energy storage. The innovation could have far-reaching implications for various industries, from electric vehicles to renewable energy systems.

KEY BENEFITS

-

The report provides quantitative analysis and estimations of the lithium-air batteries market from 2023 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the lithium-air batteries industry, including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the lithium-air batteries market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

LITHIUM-AIR BATTERIES MARKET KEY SEGMENTS

By Type

-

Aqueous Lithium-Air Battery

-

Non-Aqueous Lithium-Air Battery

-

Solid State Lithium-Air Battery

-

Others

By Application

-

Automotive & Transportation

-

Energy Storage

-

Consumer Electronics

-

Medical Devices

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

KEY PLAYERS

-

Poly Plus Battery Co.

-

Mullen Technologies Inc.

-

Lithium Air Industries Inc.

-

MTI Corporation

-

SoftBank Group

-

Tesla Inc.

-

Metair

-

IATA

-

Amperex Technology Ltd (ATL)

-

BYD

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2022 |

USD 10.15 Billion |

|

Revenue Forecast in 2030 |

USD 20.81 Billion |

|

Growth Rate |

CAGR of 9.4% from 2023 to 2030 |

|

Analysis Period |

2022–2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Surge in demand for lithium-air batteries in smart home appliances, wearables, and smartphones Increasing demand for electric vehicles and portable electronics |

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst