Aluminium Market by Type (Primary and Secondary), by Product Type (Flat-Rolled, Casting, Extrusions, Forgings, Powder & Paste, and Other Types), by Alloy Series (1xxx, 2xxx, 3xxx, 4xxx, 5xxx, 6xxx, and 7xxx Series), and by End User (Transportation (Aerospace, Automotive, and Marine), Machinery & Equipment, Construction, Packaging (Food & Beverage, Cosmetics, and Other End Users), Electrical Engineering and Others)– Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Materials and Chemical | Publish Date: 12-Mar-2025 | No of Pages: 246 | No. of Tables: 358 | No. of Figures: 283 | Format: PDF | Report Code : MC18

US Tariff Impact on Aluminium Market

Trump Tariffs Are Reshaping Global Business

Aluminium Market Overview

The global Aluminium Market size was valued at USD 222.59 billion in 2024 and is predicted to reach USD 302.04 billion by 2030, with a CAGR of 4.6% from 2025 to 2030.

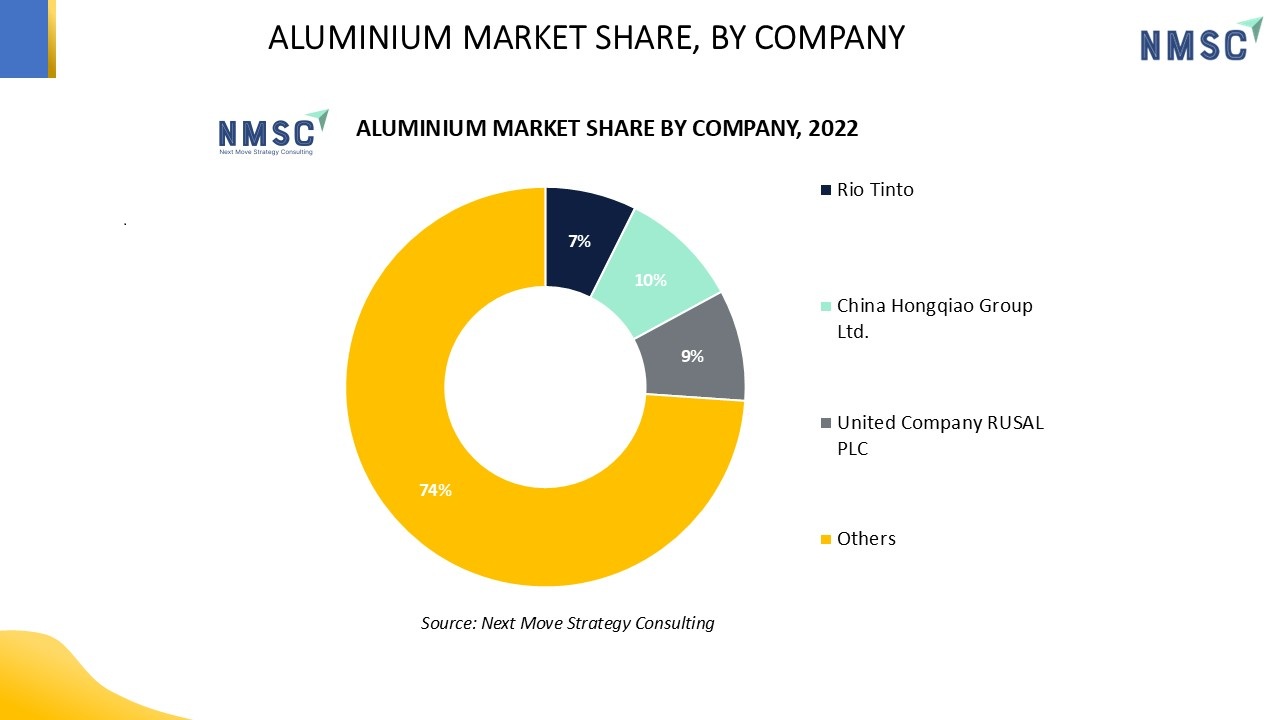

The aluminium market is driven by several factors such as rising demand for electric vehicles along with growth of processed good and construction industry. However, environment regulations and policies restrain the market growth due to pollution caused by its smelting. On the other hand, the demand for sustainable packaging presents prospective growth opportunities. Key players such as Rio Tinto, United Company RUSAL PLC., and others adopted various business strategies such as product launches, partnership and business acquisition propel the market growth.

Surge in Demand for Electric Car Propels the Aluminium Market Growth

The increasing demand for electric vehicles drives the demand for light weight, corrosion and durability resistant materials for vehicle efficiency improvement that subsequently drives the growth of the market.

The recent International Energy Agency report reveals that nearly 14 million new electric vehicles were registered across the world in 2023. The increase in electric vehicle demand is speeding up the utilization of aluminium in the production of electric vehicle component to save weight and improve the acceleration of vehicles.

Rising Growth of the Construction Sector Drives the Market Growth

The expansion of the construction industry drives the demand for aluminium due of its versatility, strength, lightweight nature that makes it perfect for various building uses. This light weighted product is applied to the windows, doors, roofing and other framework parts to provide corrosion resistance and power efficiency.

According to the published report by the McKinsey, about USD 13 trillion gross yearly production is directed towards building projects in 2023. Consequently, the rise in infrastructure development accelerates the need for sustainable and long-lasting construction material, thereby boosting the aluminum market expansion.

Growth of the Processed Food Industry Accelerates the Market Growth

Processed food industry growth further boosts the demand for food packaging, which further drives the growth of the market. Aluminium contains superior barrier qualities against light, moisture and contamination that ensure greater shelf life and improve food quality.

The U.S. Department of Agriculture reports states that the processed food exports in U.S. amounted to USD 38.84 billion whereas in Japan it is expected to amount to USD 1.85 billion by the end of 2024. The change in consumer preference towards ready to eat meals raises the demand for dependable packaging, thus propelling the aluminum market growth.

Environmental and Regulatory Constraints Restrains the Aluminium Market Growth

Environmental and regulatory constraints limit the aluminum market growth by virtue of tight emission controls and recycling requirements. For instance, the EU Emissions Trading System limits greenhouse gas emissions, that incurs higher costs of production for aluminum manufacturers. Similarly, Clean Air Act puts limitation on the pollution caused by aluminum smelting. The imposition of such policies by governments at different regions limits the growth of the market.

Rising Demand for Sustainable Packaging Offers Promising Opportunities for Market Expansion

The demand for sustainable packaging is a potential growth opportunity in the future because companies require green packages that are alternatives to conventional products. The recyclability of aluminium can be reused numerous times without changing its quality and, hence, it is best to use it for sustainable packing solutions in food, drinks, and consumer package goods. With growing regulatory weights looming over sustainability and consumers leaning more and more towards greener choices, now emerges the profitable prospect for aluminium market demand.

By Type, Primary Aluminium Holds the Dominant Share in the Aluminium Market

Primary type dominates the type segment in the aluminum industry with a significant market share of 22.73% due to its vital role in various industries such as automotive, construction, and packaging. Primary type is used in manufacturing light, durable, and corrosion resistant parts that play an important role in enhancing the efficiency and sustainability of products in these industries.

The rise in demand for fuel efficient vehicles, environment friendly building and packaging products is propelling the demand for the primary type. Its ability to be recycled and low-cost position it as a prime aluminium type to meet the worldwide environmental standards, making it a significant type for the aluminum industry.

By Product Type, Flat Rolled Aluminium, Holds the Highest CAGR of 7.2%

Within the aluminum industry, the flat-rolled product category is expected to witness huge growth due to its widespread use in automotive, aerospace, and construction sectors. Flat rolled type is used for its light weight, strength, and resistance to corrosion, and is best suited to manufacture energy efficient vehicle components, long lasting building materials and high-performance aerospace components.

The growing demand for electric vehicles, as well as the expanding demand for green infrastructure, is propelling the demand for flat rolled product type. Moreover, their usage in the production of precision components and efficiency in the development of energy efficient solutions fuel their swift adoption, guaranteeing growth in the segment in the long term.

Asia-Pacific Region Dominates the Aluminium Market Share

Asia-Pacific region holds the largest market share due to presence of large cosmetic industry in the region. The surge in growth of the cosmetic industry in the region increases the demand for aluminium due to its extensive use in packaging solutions such as tubes, bottles, jars and aerosol cans.

The recent report of the Ministry of Commerce and Industry states that India's cosmetic industry is expected to hit USD 20 billion by 2025. The rise in the cosmetic industry drives the demand for functional packaging, thus driving the market growth.

Additionally, the increased demand for car fuels the market growth as producers use aluminium to produce lighter, fuel saving and environment friendly cars. The latest report of the International Trade Administration, China is the largest vehicle market in the world, with 35 million vehicles by 2025.

With growing car demand, the demand for aluminum further accelerates as it lightens weight of vehicles, increases fuel efficiency, and lowers carbon emissions, that is essential to meet stricter global emission regulations.

Europe is Expected to Show a Steady Growth in the Aluminium Market

Europe region is anticipated to experience a consistent growth in the market over the forecast period. This is due to the expansion of the manufacturing sector in the region that accelerates utilization of aluminum due to its vital role in the production of light, strong and high-performance components in diverse industrial sectors.

The UK Government Report states that the UK manufacturing industry witnessed dramatic growth in 2023 as total sales increased by 3.9% to USD 473.84 billion. This manufacturing growth fuels the market growth due to its ability to enhance performance of products, achieve weight savings and enhance energy efficiency.

Furthermore, the growth of the processed food industry boosts the consumption of aluminum because of its central role in packaging, freshness preservation, durability and long shelf life of products. The U.S. Department of Agriculture report, the French food processing industry generated around USD 230 billion annually in revenue in 2024.

As people demand convenient and ready to consume foods more and more, especially in the urban areas, the need for efficient, green packaging solutions boosts, thereby encouraging the use of aluminum in food products.

Competitive Landscape

Several key market players operating in the aluminium industry includes Rio Tinto, China Hongqiao Group Limited, Aluminum Corporation of China Limited (CHALCO), United Company RUSAL PLC., Norsk Hydro ASA, Emirates Global Aluminium PJSC, Alcoa Corporation, East Hope Group Company Limited, Vedanta Aluminium & Power, Xinfa Group Co., Ltd., Hindalco Industries Ltd., South32, Century Aluminum Company, Saudi Arabian Mining Company, Arconic Inc., Vivalda Group, Jack Aluminium, Thai Metal Aluminium Co., Ltd., Metalcom Ltd., United Aluminium Industry, and others.

Note: For the latest market share analysis and in-depth aluminium industry insights, you can reach out to us.

These market players are adopting various strategies, including product launch, acquisition, partnership and business expansion across various regions to maintain their dominance in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

February 2025 |

Rio Tinto |

Rio Tinto partnered with Hydro to design carbon capture technologies for smelting aluminium. The alliance aimed to develop and test carbon capture solutions to reduce CO2 emissions from the electrolysis process, that generates a high percentage of smelter emissions. |

|

June, 2024 |

Rio Tinto |

Rio Tinto acquired ELYSISTM technology, a groundbreaking carbon-free aluminum smelting technology. The deal is the first license of the ELYSISTM technology and forms part of Rio Tinto's initiative towards reducing carbon emissions and striving to achieve net-zero emissions by 2050. |

|

January, 2024 |

Vivalda Group |

Vivalda Group launched MetSkin, a new solid aluminium cladding system for the UK's high-rise housing and local authority development markets. As a series of configurations, the system offers stylish design solutions safely and with straightforward installation. |

|

July, 2023 |

Jack Aluminium |

Jack Aluminium expanded its aluminium factory by 17,000 sq. ft., making the new area 28,000 sq. ft. The bigger site improve stockholding, cope with growing demand particularly for the ID30 Internal Glazing suite and improve delivery performance. |

Aluminium Market Key Segments

By Type

-

Primary

-

Secondary

By Product Type

-

Flat-Rolled

-

Casting

-

Extrusions

-

Forgings

-

Powder & Paste

-

Other Types

By Alloy Series

-

1xxx Series

-

2xxx Series

-

3xxx Series

-

4xxx Series

-

5xxx Series

-

6xxx Series

-

7xxx Series

By End User

-

Transportation

-

Aerospace

-

Automotive

-

Marine

-

-

Machinery & Equipment

-

Construction

-

Packaging

-

Food & Beverage

-

Cosmetics

-

Others

-

-

Electrical Engineering

-

Other End Users

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Rio Tinto

-

China Hongqiao Group Limited

-

Aluminum Corporation of China Limited (CHALCO)

-

United Company RUSAL PLC.

-

Norsk Hydro ASA

-

Emirates Global Aluminium PJSC

-

Alcoa Corporation

-

East Hope Group Company Limited

-

Vedanta Aluminium & Power

-

Xinfa Group Co., Ltd.

-

Hindalco Industries Ltd.

-

South32

-

Century Aluminum Company

-

Saudi Arabian Mining Company

-

Arconic Inc.

-

Vivalda Group

- Jack Aluminium

-

Thai Metal Aluminium Co., Ltd.

-

Metalcom Ltd.

-

United Aluminium Industry

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 222.59 Billion |

|

Revenue Forecast in 2030 |

USD 302.04 Billion |

|

Growth Rate |

CAGR of 4.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst