America In-Vitro Diagnostics Market by Type (Reagents, Instruments, and Software & Services), by Technique (Immunodiagnostics, Hematology, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Others) – Opportunity Analysis and Industry Forecast, 2024–2030

America In-Vitro Diagnostics Market Overview

The America In-Vitro Diagnostics Market size was valued at USD 37.89 billion in 2023 and is predicted to reach USD 49.62 billion by 2030, with a CAGR of 3.6% from 2024 to 2030. The market includes a wide range of medical devices and tests designed to detect numerous diseases or conditions using samples such as blood, urine, or tissue, thus eliminating the need for invasive procedures.

IVD involves a large number of test types such as clinical chemistry, molecular diagnostics, immunoassays, hematology, microbiology, and coagulation, which utilize advanced technologies such as PCR, next-generation sequencing, microarrays, mass spectrometry, and immunoassays. IVDs are essential for diagnosing diseases, monitoring chronic conditions, guiding treatment decisions, and screening for diseases in fields such as oncology, infectious diseases, cardiology, diabetes, and genetic disorders. These diagnostics are used in various healthcare settings, including hospitals, laboratories, and outpatient clinics, playing a crucial role in modern healthcare by facilitating accurate and timely medical decisions.

Increasing Prevalence of Chronic and Infectious Diseases Boosts the Market Growth

The rapidly growing prevalence of chronic and infectious diseases such as cancer, heart diseases, diabetes, and other various infections, is boosting the demand for diagnostic tests in the in-vitro diagnostics market in America.

As the American healthcare systems strive to address these escalating health challenges, there is a growing emphasis on early detection, disease monitoring, and personalized treatment strategies for timely interventions and treatment of patients.

According to the recent report published by the National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP), the prevalence of chronic diseases in the North American countries is growing at a significant rate, with 6 out of 10 adults in the U.S. are living with one or more chronic diseases. Among these, chronic conditions such as cardiovascular diseases, cancer, and diabetes stand out as leading causes of mortality in the country, which in turn drives the America in-vitro diagnostics market demand in this region.

The Rise in Aging Population Creates America In-Vitro Diagnostics Market Expansion

The aging population, driven by its increasing prevalence of age-related diseases and conditions worldwide, serves as a primary factor for the America in-vitro diagnostics market growth. As the population ages, there is a corresponding increase in the prevalence of age-related diseases and conditions, necessitating more frequent diagnostic testing for early detection, monitoring, and management to prevent further progression and complications.

According to the latest report from the Pan American Health Organization, the number of elderly populations is growing at a significant rate in American countries, with Brazil ranking among the top 10 countries in the American region, with the largest population of older adults. With more than 30 million individuals aged 60 years and older, equivalent to about 13% of the country's total population.

Also, the report projects that by 2030, the number of older adults in Brazil is anticipated to reach approximately 50 million individuals, further driving the demand for the America IVD diagnostics market. As a result, healthcare providers are confronted with the increasing task of meeting the changing healthcare requirements of elderly individuals, driving the need for advanced diagnostic solutions.

Moreover, the specific healthcare demands of the aging population emphasize the necessity for precise diagnostic technologies tailored to individual needs. Therefore, the aging demographic plays a pivotal role in shaping the growth and development of the America in-vitro diagnostics market, influencing its future trajectory.

High Costs Associated with R&D and Regulatory Approval Hinders the Market Growth

The high costs of research, development, and regulatory approval for IVD are the major factors restraining the growth of the America IVD market. Operating within this sector necessitates substantial financial investment for companies to navigate the complex landscape of research and development. This investment includes extensive clinical trials, laboratory testing, and product refinement to ensure accuracy and reliability.

Additionally, obtaining regulatory approvals from agencies such as the FDA requires strict adherence to stringent standards, further compounding the financial burden. These financial constraints can discourage potential entrants and limit the expansion of existing companies within the market. Consequently, these high costs act as a significant barrier to growth, hindering the overall development of the IVD industry.

Point-of-Care Testing (POCT) Presents Significant Opportunity for the America IVD Market

Point-of-care testing (POCT) is poised to be a significant opportunity for the America in-vitro diagnostics market in the forthcoming years. POCT serves as a valuable complement to laboratory testing, particularly in situations where immediate results are crucial, such as emergency departments, ambulances, and remote healthcare settings.

POCT technologies offer rapid tests for infectious diseases, cardiac markers, glucose monitoring, pregnancy testing, and more. These rapid tests enable healthcare providers to quickly assess patients' conditions and make timely treatment decisions.

By integrating POCT with traditional IVD, healthcare providers can enhance their diagnostic capabilities, delivering more efficient and patient-centered care. This integration streamlines workflows, allowing for faster diagnosis and treatment initiation, ultimately leading to improved patient outcomes.

By Type, Reagents Dominants the America In-Vitro Diagnostics Market Share

Reagents hold the dominant share of approximately 59% in the type segment of the market. These essential components are used in various diagnostic tests to detect specific biomarkers or substances indicative of diseases or health conditions. Their fundamental role in facilitating accurate and reliable test results makes them indispensable in the diagnostic process.

Additionally, reagents are versatile and can be tailored to accommodate different testing methodologies and platforms, making them widely applicable across a range of diagnostic techniques and technologies. Moreover, the continuous demand for diagnostic testing, driven by factors such as the increasing prevalence of chronic diseases, a growing aging population, and expanding healthcare infrastructure globally, further contributes to the dominance of reagents in the America in-vitro diagnostics market share.

By Technique, Immunodiagnostics Holds the Largest Share of America In-Vitro Diagnostics Market

Immunodiagnostics holds the largest share of the America in-vitro diagnostics market, accounting for approximately 33%. This dominance is attributed to several key factors including their high accuracy and sensitivity in detecting specific antigens or antibodies.

Moreover, the versatility of immunodiagnostic tests contributes significantly to their widespread adoption. The growing prevalence of chronic and infectious diseases such as cancer, diabetes, and cardiovascular diseases, along with various infections, the demand for immunodiagnostic tests has surged.

These tests are essential for early and accurate diagnosis, which is critical for effective disease management and treatment. Additionally, supportive healthcare policies and significant investments in healthcare infrastructure and diagnostic technologies in America promotes the adoption and utilization of immunodiagnostic tests.

The U.S. Dominates the America In-Vitro Diagnostics Market

The prevalence of chronic diseases in the U.S. is the major factor driving the growth of the America in-vitro diagnostics market trends in the region. Chronic diseases such as diabetes, heart diseases, and cancer are increasingly common among the population, leading to the rising demand for IVD tests for early detection and treatment.

According to the National Association of Chronic Disease Directors, cardiovascular diseases account for one out of every three deaths in the U.S., totaling 859,000 individuals annually. Moreover, the presence of prominent companies, including Bio-Rad Laboratories Inc., Becton, Dickinson and Company, Abbott Laboratories, and Quest Diagnostics, fosters the Amercia in-vitro diagnostics market growth through continuous innovation, R&D activities, and collaborations.

For instance, in January 2023, Bio-Rad Laboratories Inc. launched the CFX Opus 96 Dx Real-Time PCR System, approved by the U.S. Food and Drug Administration (FDA) and European Union regulations. Through this launch, Bio-Rad aims to equip healthcare professionals with the means to provide precise and prompt diagnostic outcomes, thereby enhancing patient care and overall outcomes.

Uruguay is Anticipated to Grow at the Fastest Rate in the America In-Vitro Diagnostics Market

The increasing prevalence of diabetes in Uruguay serves as a major factor for the growth of the market. According to the latest report published by the IDF Diabetes Atlas, the prevalence of diabetes in Uruguay is growing at a significant rate, starting at 98.5 thousand individuals in 2000 to 275.6 thousand by 2021, and it is anticipated to reach 325.2 thousand by 2045.

This surge in the number of people with diabetes increases the demand for diagnostic tests to detect, monitor, and manage the disease effectively. Moreover, Uruguay's substantial investment in healthcare, aimed at ensuring quality healthcare provision, further supports this market expansion.

The country invests around nine percent of its GDP for the development of its healthcare sector, with public sector accounting for 71 percent of these funds. With such rise in healthcare investment, the IVD industry in Uruguay is poised to rise, ensuring that Uruguay remains at the forefront of the America IVD market growth.

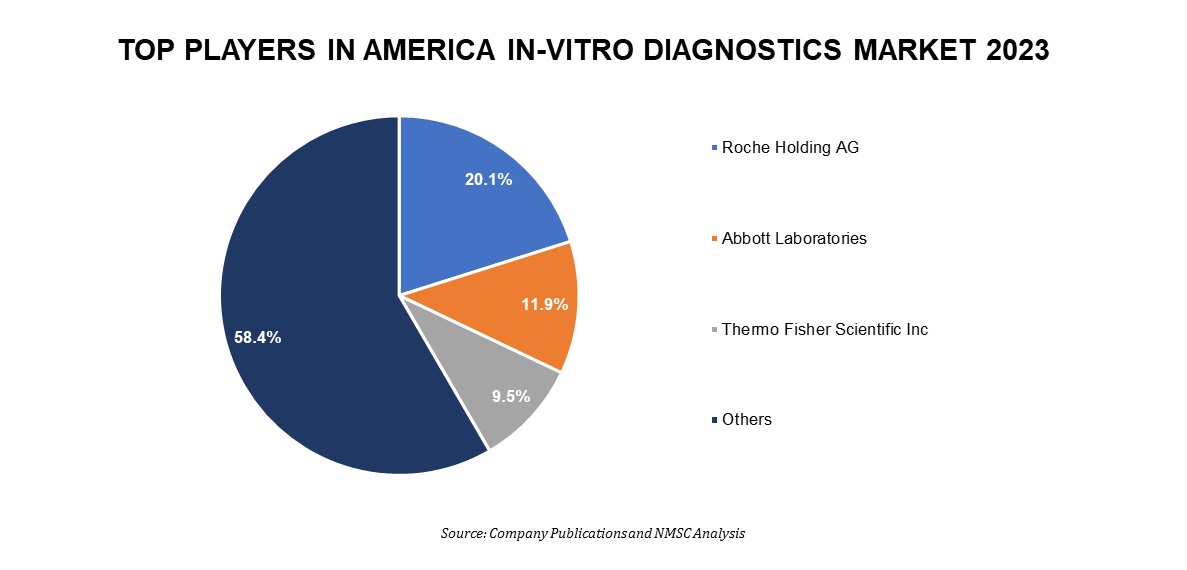

Competitive Landscape

Several market players operating in the America in-vitro diagnostics industry include Roche Holding AG, Abbott Laboratories, Thermo Fisher Scientific Inc, Danaher Corporation, Becton, Dickinson and Company, Siemens Healthineers AG, bioMérieux SA, Sysmex Corporation, QIAGEN N.V., and Bio-Rad Laboratories, Inc., and others.

These market players are adopting various strategies, including partnerships, collaborations, mergers, acquisitions, and innovative product launches across various countries and regions to maintain their dominance in the America in-vitro diagnostics market. These strategies are crucial due to the rapidly evolving technological landscape and the increasing demand for advanced diagnostic solutions.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

Feb- 2024 |

BioMerieux |

BioMerieux and the Food and Drug Administration initiated a strategic research collaboration to enhance microbial detection tools aimed at combating food-borne pathogens. This partnership focuses on developing innovative projects to improve the detection and characterization systems for pathogens such as Shiga-toxin producing E. coli, Cyclospora cayetanensis, Salmonella spp., and Listeria monocytogenes. |

|

|

Feb-2024 |

Roche Holding AG |

Roche partnered with PathAI to create AI-driven companion diagnostic tools that enables comprehensive solution for precision therapeutics. This partnership aims to accelerate the advancement of precision medicine by integrating AI analysis with companion diagnostics, thereby improving patient access to tailored treatments. |

|

|

Feb-2024 |

Sysmex Corporation |

Sysmex and Hitachi High-Tech collaborated to develop new genetic testing systems based on capillary electrophoresis sequencers (CE sequencers). The collaboration combines Hitachi High-Tech's CE sequencer technology with Sysmex's know-how in NGS reagent development and analysis technology. |

|

|

Feb-2024 |

Danaher Corporation |

Danaher Corporation collaborated with Cincinnati Children's Hospital Medical Center to improve patient safety in early drug development. The collaboration aims to address a major cause of failure in clinical trials by improving liver organoid technology as a drug toxicity screening solution. |

|

|

Jan-2024 |

Becton, Dickinson and Company |

BD partnered with Techcyte, an artificial intelligence (AI)-based digital diagnostics company, to develop an AI-based algorithm for a digital cervical cytology system. This system aims to assist cytotechnologists and pathologists in identifying signs of cervical cancer and precancerous lesions effectively through whole-slide imaging. |

|

|

Dec-2023 |

Thermo Fisher Scientific Inc. |

Thermo Fisher Scientific lauched new sample preparation solutions to streamline and automate respiratory diagnostic testing. These solutions aim to improve preanalytical workflows for clinical laboratories and provide IVD and IVD-R approved automated sample preparation solutions to laboratories. |

|

|

Nov- 2023 |

Roche Holding AG |

Roche launched the LightCycler PRO System, a next-generation qPCR technology designed to advance clinical diagnostics and research. This innovative system aims to enhance personalized healthcare, support outbreak readiness, and provide agility and flexibility for translational research and diagnostics. |

|

|

July-2023 |

Siemens Healthineers AG |

Siemens Healthineers launched the Atellica CI Analyzer, a compact testing system designed for immunoassay and clinical chemistry testing. This new addition to the Atellica in vitro diagnostics portfolio received FDA clearance and is available in many major markets. |

|

|

June 2022 |

Bio-Rad Laboratories, Inc. |

Bio-Rad Laboratories, Inc. launched the CFX Opus Deepwell Real-Time PCR Detection System. This system is designed to support researchers in developing nucleic acid detection assays and is the latest addition to the Bio-Rad portfolio of CFX Opus Real-Time PCR instruments. |

America In-Vitro Diagnostics Market Key Segments

By Type

-

Reagents

-

Instruments

-

Software & Services

By Technique

-

Immunodiagnostics

-

Enzyme-Linked Immunosorbent Assay (ELISA)

-

Rapid Tests

-

Chemiluminescence Immunoassay (CLIA)

-

Enzyme-linked Immunosorbent spot (ELISpot)

-

Radioimmunoassay (RIA)

-

Western Blot

-

-

Hematology

-

Molecular Diagnostics

-

PCR

-

INAAT

-

Hybridization

-

DNA diagnostics

-

Microarray

-

Other Molecular Diagnostics

-

-

Tissue Diagnostics

-

Clinical Chemistry

-

Basic Metabolic Panel

-

Liver Panel

-

Renal Profile

-

Lipid Profile

-

Thyroid Function Panel

-

Electrolyte Panel

-

Speciality Chemicals

-

-

Other IVD Techniques

By Application

-

Infectious Diseases

-

Cancer

-

Cardiac Diseases

-

Immune System Disorders

-

Nephrological Diseases

-

Gastrointestinal Diseases

-

Others

By End User

-

Stand Alone Laboratory

-

Hospitals

-

Academics and Medical Schools

-

Point of Care Testing

-

Other End Users

By Country

-

The U.S.

-

Canada

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Uruguay

-

Rest of America

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 37.89 Billion |

|

Revenue Forecast in 2030 |

USD 49.62 Billion |

|

Growth Rate |

CAGR of 3.6% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

9 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Roche Holding AG

-

Abbott Laboratories

-

Thermo Fisher Scientific Inc

-

Danaher Corporation

-

Becton, Dickinson and Company

-

Siemens Healthineers AG

-

bioMérieux SA

-

Sysmex Corporation

-

QIAGEN N.V.

-

Bio-Rad Laboratories, Inc.

Speak to Our Analyst

Speak to Our Analyst