Anti-foaming Agents Market by Market by Type (Silicone-Based, Oil-Based, Water-Based, and Others), and by Application (Pulp & Paper, Water Treatment, Paints & Coatings, Oil & Gas, Chemical Manufacturing, Food & Beverage, and Others) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Materials and Chemical | Publish Date: 07-Apr-2025 | No of Pages: 332 | No. of Tables: 237 | No. of Figures: 162 | Format: PDF | Report Code : MC6

US Tariff Impact on Anti-Foaming Agents Market

Trump Tariffs Are Reshaping Global Business

Anti-foaming Agents Market Overview

The global Anti-foaming Agents Market size was valued at USD 6.09 billion in 2024 and is predicted to reach USD 7.93 billion by 2030, registering a CAGR of 4.1% from 2025 to 2030.

The antifoaming agents market is driven by factors such as expansion in chemical sector rising focus on wastewater treatment, and growing concerns over sustainability and eco-friendly solutions. However, the presence of alternatives, such as mechanical foam control methods or different types of additives limit the growth of the market. Conversely, the growing demand for high performance lubricants in various industries provides ample opportunities for the market in the future.

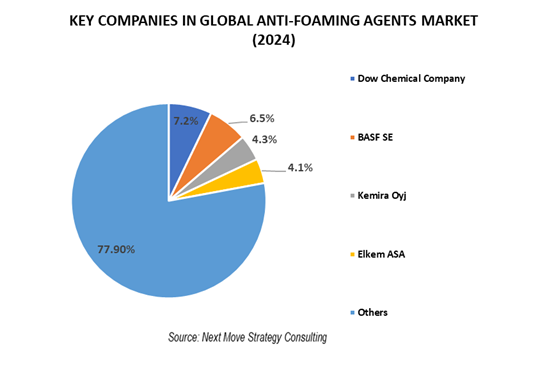

Additionally, the top players of the market such as BASF Corporation, Elkem ASA, Kemira OYJ, Clariant AG, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, and others are adopting various strategies such as business expansion and launches to maintain their dominance in the market.

As industries look to improve operational efficiency and enhance product performance, the need for advanced solutions to control foam formation in lubricants grows, further creating favorable opportunities of the market in coming years.

Growth in the Chemical Sector Worldwide Driving the Demand for Antifoaming Agents

The rising chemical sector across the world accelerates the demand for antifoaming agents to enhance production efficiency and product quality. These agents help in reducing foam-related disruptions, improving process control, and maintaining operational consistency, making them essential in various chemical applications. The European Chemical Industry Council states that, world chemical sales in the year 2022 reached USD 5795.90 billion, increasing from USD 1417.84 billion in 2002. The significant growth in the chemical sector drives the need for effective solutions, such as antifoaming agents, to support enhanced production efficiency and product quality. As the industry expands, the demand for these agents continues to rise, ensuring smoother operations and greater consistency across various chemical applications.

The Increasing Focus on Wastewater Treatment is Accelerating Market Expansion

Increased demand in the efficiency of wastewater treatment drives the anti-foaming agents market expansion. The demand for effective solutions for controlling foam formation increases because municipalities and industries strive to adhere to increasingly stringent environmental regulations. World Health Organisation states that, the percentage of safely treated domestic wastewater increased from 56% in 2020 to 58% in 2022. This shift towards enhanced wastewater management further increases the demand for antifoaming agents for effective and compliant treatment processes.

The Increasing Need for Environmentally Friendly and Sustainable Antifoaming Agents is Driving Market Growth

Growing concerns over sustainability and eco-friendly solutions fuel the demand for more sophisticated antifoaming agents, where industries seek on defoaming solutions that are not only environment-friendly but also cut down resource usage with high performance. For example, in October 2023, Evonik added TEGO Foamex coating additive line with the launch of TEGO Foamex 8880, a defoaming agent intended for water-based inks and coatings. The product contains more than 50% bio-based materials, meets food contact regulations, and possesses excellent foam control properties.

Availability of Alternatives Hinders the Expansion of the Market

The presence of alternatives, such as mechanical foam control methods or different types of additives, limit the growth of the anti-foaming agents market. These alternatives provide simpler or more cost-effective solutions, particularly in industries where foam control is less critical or where budgets are more constrained. As a result, industries choose these options over specialized antifoaming agents, reducing the demand for chemical-based solutions. Increasing demand in high-performance lubricants will drive future opportunities for Antifoaming agents.

The Growing Demand for High Performance Lubricants in Various Industries Provides Ample Opportunities for The Market in The Future

As industries look to improve operational efficiency and enhance product performance, the need for advanced solutions to control foam formation in lubricants grows. For example, in February 2024, DIC launched a PFAS-free antifoaming agent for lubricating oils used in electric vehicles, which provides excellent performance in terms of foam control, thermal stability, and shear stability. With superior antifoaming properties it provides high performance in extreme conditions, making it suitable for lubricants used in metal processing, automotive, and industrial gears.

By Type, Silicone-Based Holds the Dominant Share in the Global Anti-foaming Agents Market

Silicone based antifoaming agents hold around 37% of the global market share, primarily due to their excellent performance and wide range of applications. These agents offer superior foam control and are highly effective in applications such as oil and gas, food processing, and wastewater treatment. Their stability and temperature resistance contribute to their widespread adoption. As industries continue to prioritize efficient foam management, the demand for these defoamers is expected to remain strong, further setting their dominant position in the market.

By Application, Water Treatment, Holds the Highest CAGR of 5.9%

Water treatment is expected to hold the highest CAGR, due to the increasing demand for clean water and effective wastewater management. As urbanization and industrial activities expand, the need for advanced water treatment technologies strengthens, boosting the demand for antifoaming agents to ensure smooth operations and prevent foam related disruptions. Stricter environmental regulations and a growing focus on sustainable water practices are also contributing to the rapid adoption of antifoaming agents in this sector, further accelerating anti-foaming agents market growth.

Asia-Pacific Held the Largest Share in The Global Anti-Foaming Agents Market

The growth in the chemical industry of the region drives the market as these agents reduce foam-related disturbances, improve the process control of chemicals, and maintain consistent operation. According to CEFIC, in 2022, China took the lead position globally in the chemical sales accounting for USD 2549.17 billion. The demand for antifoaming agents is thus projected to be boosted by an increased chemical industry and this should promote manufacturing efficiency and product quality.

Additionally, the paints and coatings industry further drives the demand antifoaming agents in the region, as the agents assist in achieving smooth finishes by controlling foam formation during production. As high-performance coatings demand is growing across industries, there is a rise in the demand for effective foam control solutions. As per the Ministry of Commerce and Industry, paints and coatings industry in India reached USD 9.60 billion in 2024, further increasing to USD 15.04 billion by 2029. Growth in this industry raises the requirement for advanced antifoaming solutions to meet the operational efficiency of the process while removing foam related disruptions.

North America is Expected to Show Steady Growth in the Anti-foaming Agents Market Share

Growing food and beverage processing is driving anti-foaming agents market demand to prevent formation of foam in the process of food, ensuring easy and smooth processing for quality product. The Agriculture and Agri-Food Canada states, in 2022, the F&B processing remained the biggest manufacturing industry in Canada with goods sold worth USD 115.60 billion. As the demand for processed foods rises there is an increasing demand for effective foam control solutions.

In addition, the increasing oil and gas sector boosts the demand for antifoaming agents, as these agents play a very significant role in controlling foam during various extraction and refining processes. The U.S. Energy Information Administration states that, in 2023, the country hit a record of crude oil production at an average of 12.9 million barrels per day. As oil industry is continuously developing, the antifoaming agents become very crucial in ensuring effective operational efficiency and quality of products.

Competitive Landscape

The promising key players operating in the anti-foaming agents industry include The Dow Chemical Company, BASF Corporation, Kemira OYJ, Elkem ASA, Ecolab Inc., Clariant AG, Wacker Chemie AG, Evonik Industries AG, Shin-Etsu Chemical Co., Ltd., Ashland Global Holdings Inc., Croda International Plc Solenis, BYK Additives, Momentive Performance Materials, Univar Solutions LLC, Concentrol Chemical Solutions, Arkema, Schill+Seilacher "Struktol" GmbH, Allnex, DuPont, among others. Other companies include Arkema, Allnex, BRB International B.V. and others. These companies are engaged in various product launches across various regions to maintain their dominance in the anti-foaming agents industry.

For instance, in November 2023, BASF expanded its defoamer production capacity at the Dilovasi plant in Turkey to meet growing demand for anti-foaming agents in South-East Europe, the Middle East, and Africa. The goal was to support customers' growth by improving service levels and reducing lead times.

Moreover, in September 2022, Wacker Chemie AG developed the PRIMIS SAF 9000 series to enhance performance in paints, coatings, and construction materials. It increases water resistance and film durability while ensuring smooth, defect-free surfaces in waterborne systems where antifoaming agents provide optimal performance.

Anti-foaming Agents Market Key Segments

By Type

-

Silicone-Based

-

Oil-Based

-

Water-Based

-

Others

By Application

-

Pulp & Paper

-

Water Treatment

-

Paints & Coatings

-

Oil & Gas

-

Chemical Manufacturing

-

Food & Beverage

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

ANTI-FOAMING AGENTS MARKET KEY PLAYERS

-

The Dow Chemical Company

-

BASF Corporation

-

Kemira OYJ

-

Elkem ASA

-

Ecolab Inc.

-

Clariant AG

-

Wacker Chemie AG

-

Evonik Industries AG

-

Shin-Etsu Chemical Co., Ltd.

-

Ashland Global Holdings Inc.

OTHER NOTABLE PLAYERS

-

Croda International Plc

-

Solenis

-

BYK Additives

-

Momentive Performance Materials

-

Univar Solutions LLC

-

Concentrol Chemical Solutions

-

Arkema

-

Schill+Seilacher "Struktol" GmbH

-

Allnex

-

DuPont

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 6.09 Billion |

|

Revenue Forecast in 2030 |

USD 7.93 Billion |

|

Growth Rate |

CAGR of 4.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst