Anti-Corrosion Coatings Market by Technology (Solvent-Borne, Water-Borne, Powder Coating, UV-Cured), Type (Epoxy, Acrylic, Chlorinated Rubber, Alkyd, Polyurethane, Zinc, Others), End User Industry (Aerospace & Defense, Industrial, Marine, Oil & Gas, Infrastructure, Automotive & Transportation, Power Generation, Others) - Global Opportunity Analysis and Industry Forecast, 2020 – 2030

Industry: Materials and Chemical | Publish Date: 04-Feb-2025 | No of Pages: 375 | No. of Tables: 210 | No. of Figures: 180 | Format: PDF | Report Code : MC3

US Tariff Impact on Anti-Corrosion Coatings Market

Trump Tariffs Are Reshaping Global Business

Market Definition:

The global Anti-Corrosion Coating Market size valued to USD 27.39 billion in 2019 is predicted to reach USD 63.72 billion by 2030, witnessing a CAGR of 7.9% from 2020-2030.

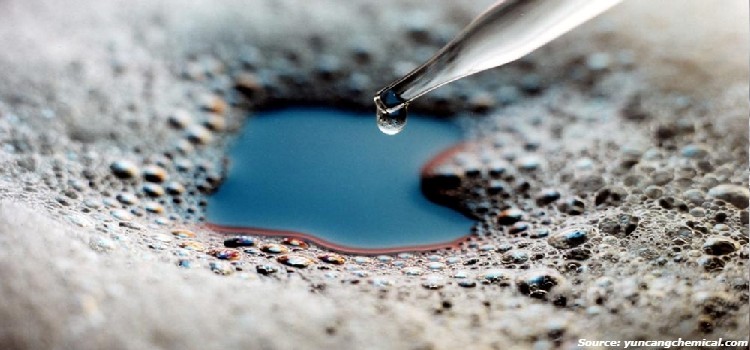

The anti-corrosion coating market observed a volumetric sale of 7,046.9 kilotons in 2019 and it is projected a hike up to 13,940.5 kilotons by 2030, witnessing a CAGR of 6.3% from 2019-2030. The anti-corrosion coatings help protect the metal substrates from getting corroded due to extreme atmospheric conditions like humidity, moisture, saline water, oxidation, as well as exposure to a variety of aggressive chemicals.

Anti-corrosion coatings ensure durability and efficiency of the equipment by providing continuous protecting layers to prevent it from corrosion and abrasion. These coatings hold wide applications in aerospace & defense sector, building & construction sector, maritime industries, oil & gas industries, automotive & transportation sector, power generation industries and other industry verticals; as it offers superior structural strength, high heat resistance, protection against harmful UV radiations, lower coating costs as well as absolute ease-of-application.

Market Dynamics and Trends:

The global anti-corrosion coating market observes lucrative growth due to factors such as increasing government initiatives to improve public infrastructures, favorable regulatory standards for products with low Volatile Organic Compound (VOC), rising awareness about ecofriendly products, as well as augmentation in residential and commercial projects.

Besides, market trends such as modernization of infrastructure, increasing losses due to corrosion, and growing demand for anti-corrosion coatings in the end-use industries are expected to supplement the growth of global anti-corrosion coating market throughout the forecast period.

However, stringent environmental regulations towards use of several aggressive chemicals, limitations of epoxy anti-corrosion coating, fluctuations in the cost of crude-oil and high cost of raw materials may limit the growth of the global anti-corrosion coating market.

Moreover, growing use of anti-corrosion coating in solar and wind energy industry as well as increasing demand for high-efficiency anti-corrosion coatings, are anticipated in creating new opportunities for the market growth in coming years.

Market Segmentations and Scope of the Study:

The anti-corrosion coating market share analysis is based on technology, type, end user industry, and geography. Based on technology, the market is segmented into solvent-borne, water-borne, powder coating, and UV-cured. Based on type, the market covers epoxy, acrylic, chlorinated rubber, alkyd, polyurethane, zinc, and others.

Based on end user industry, the market is classified into aerospace & defense, industrial, marine, oil & gas, infrastructure, automotive & transportation, power generation, and others. Geographic breakdown and analysis of each of the previously mentioned segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis:

Asia-Pacific region is anticipated to grow with the highest CAGR throughout the forecast period, owing to growing demand for anti-corrosion coating from the power generation industries, increasing demand for high-quality infrastructures, higher requirements for maintenance in automotive & transportation industries, as well as stringent government rules & regulations in this region.

Moreover, factors such as easily accessible anti-corrosion solutions, lower labor costs and high shipping traffic in the region are fostering the maritime contribution of Asia-Pacific region, hence supplementing the growth of the anti-corrosion coating market.

North America shows a significant growth accounting for second-largest market share. This is attributable to factors such as increasing government military investments, presence of the largest Naval base, as well as vehemently growing oil & gas sector in this region.

Competitive Landscape:

A comprehensive competitive analysis and profiles of the major industry players such as BASF SE, 3M Co., Wacker Chemie AG, AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, The Dow Chemical Company, Hempel A/S, Kansai Paints Co., Ltd, Nippon Paints Co. Ltd., and others are provided in the anti-corrosion coating market report.

The past endeavors, present developments and futuristic advancements, sum-up to comprehend the overall anti-corrosion coating market growth. For instance, in January 2020, one of the major market players of the anti-corrosion coating market, the Dow Chemical Company, collaborated with PPG Industries, Inc., the American Fortune 500 company, to offer anti-corrosion coatings with reduced GHG emissions, simultaneously lessening high maintenance costs of steel infrastructures. Under Dow’s Official Carbon Partnership with the International Olympic Committee, Dow teams up with PPG to reduce the carbon impact of anti-corrosion coatings for commercial steel infrastructures.

The collaboration aims at offering PPG’s two-coat PSX system, based on Dow polysiloxane technology, that shall not only reduce the emission of GHG, but shall also result in less energy-intensive production and application, for commercial buildings, industrial buildings, other infrastructure such as bridges and marine vessels. While lowering the costs associated with structural metal corrosion, it shall also contribute to a more sustainably built environment for the future.

Key Benefits:

-

The anti-corrosion coating market report provides a quantitative analysis of the current market and estimations throughout 2020-2030 that assists in identifying the prevailing market opportunities to capitalize on.

-

The study comprises a deep dive analysis of the current and future anti-corrosion coating market trends, depicting the prevalent investment pockets in the market

-

The report provides a detailed information related to the key drivers, restraints, and opportunities, alongside their impact on the anti-corrosion coating industry.

-

The report incorporates a competitive analysis of the market players along with their market share and market size in the global anti-corrosion coating market.

-

The study elaborates SWOT analysis and the Porter's Five Forces model for the anti-corrosion coating market.

-

Value chain analysis in the report provides a clear picture of the stakeholders’ roles.

Anti-Corrosion Coating Market Key Segments:

By Technology

-

Solvent-Borne

-

Water-Borne

-

Powder Coating

-

UV-Cured

By Type

-

Epoxy

-

Acrylic

-

Chlorinated Rubber

-

Alkyd

-

Polyurethane

-

Zinc

-

Others

By End User Industry

-

Aerospace & Defense

-

Industrial

-

Marine

-

Oil & Gas

-

Infrastructure

-

Automotive & Transportation

-

Power Generation

-

Others

By Geography

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

Korea

-

Rest of Asia-Pacific

-

-

RoW

-

UAE

-

Argentina

-

Qatar

-

Brazil

-

Key Players:

-

BASF SE

-

3M Co.

-

Wacker Chemie AG

-

AkzoNobel N.V.

-

PPG Industries, Inc.

-

The Sherwin-Williams Company

-

The Dow Chemical Company

-

Hempel A/S

-

Kansai Paints Co., Ltd

-

Nippon Paints Co. Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Analysis Period |

2019–2030 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Market Segmentation |

By Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber, Other Type) By Technology (Solvent-Borne, Water Borne, Powder Coatings, Other Technology) By End Use Industry (Marine, Oil & Gas, Industrial Construction, Energy, Power Plants, Solar Energy, Wind Turbines, Automotive, Other End User Industry) |

|

Geographical Segmentation |

North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, Korea, Rest of APAC), Rest of the World (UAE, Argentina, Qatar, Brazil) |

|

Companies Profiled |

BASF SE, 3M Co., Wacker Chemie AG, AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, The Dow Chemical Company, Hempel A/S, Kansai Paints Co., Ltd, Nippon Paints Co. Ltd. |

Speak to Our Analyst

Speak to Our Analyst