Asia-Pacific Tactile Sensor Market by Type (Resistive Tactile Sensors, Capacitive Tactile Sensors, Piezoelectric Tactile Sensors, Optical Tactile Sensors, and Others), by Application (Robotics, Computer Hardware, Security System, Touch Screens, Medical Devices, Handheld Devices, and Others), and by Industry Vertical (Automotive, Robotics and Automation, Aerospace and Defense, Consumer Electronics, Healthcare, and Other Industry) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Semiconductor & Electronics | Publish Date: 17-Dec-2024 | No of Pages: 313 | No. of Tables: 206 | No. of Figures: 151 | Format: PDF | Report Code : SE2518

US Tariff Impact on Asia-Pacific Tactile Sensor Market

Trump Tariffs Are Reshaping Global Business

Market Overview

The Asia-Pacific Tactile Sensor Market size was valued at USD 2.72 billion in 2023 and is predicted to reach USD 6.13 billion by 2030, with a CAGR of 11.4% from 2024 to 2030. In terms of volume, the market size was 1 billion units in 2023 and is projected to reach 4 billion units in 2030, with a CAGR of 14.9% from 2024 to 2030.

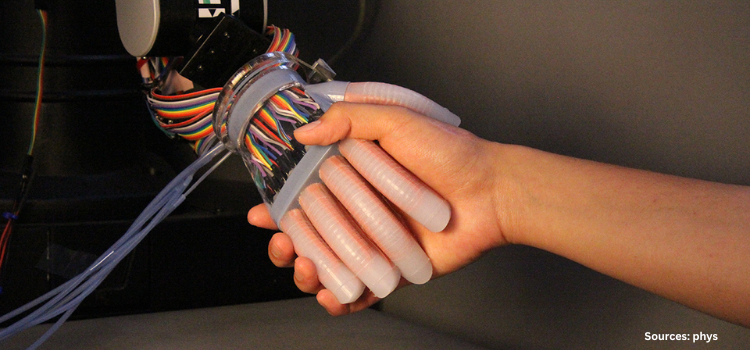

Tactile sensor is a specialized device designed to detect and measure physical interactions, such as touch, pressure, and force, with precision and responsiveness. These sensors are crucial in various applications across multiple industry verticals, including robotics and automation, healthcare, consumer electronics, automotive, and aerospace. They employ advanced technologies such as capacitive, resistive, piezoelectric, and optical sensing to provide detailed feedback on physical contact, thereby enabling improved control, safety, and functionality within complex systems.

The Rising Adoption of Industrial Robotics is Driving the Demand for Tactile Sensors

In the Asia-Pacific region, the demand for the tactile sensor market is fueled by several overarching factors spanning various industries. A significant driver is the widespread adoption of industrial robotics across the region, which drives the need for tactile sensors to ensure seamless operation and optimization of robotic systems. As industries strive to improve efficiency and productivity, tactile sensors play a crucial role in enabling precise and responsive automation processes.

These sensors enable robots to perceive and interact with their environment accurately, facilitating tasks such as assembly, pick-and-place operations, and quality control in manufacturing facilities. The integration of tactile sensors in industrial robots enhances their capabilities, driving the demand for such sensors in the Asia-Pacific region's burgeoning robotics market.

The Increasing Technological Advancements in Smart Wearable Devices is Driving the Asia-Pacific Tactile Sensor Market Growth

Tactile sensors play a crucial role in the operation and user satisfaction of smart wearables, including fitness trackers, smartwatches, and augmented reality devices. The growing demand for these sensors is driven by continuous technological advancements in smart wearable devices from various manufacturers. These sensors are essential for enhancing the functionality and user experience of wearable gadgets by enabling precise and responsive touch interactions.

For instance, in October 2023, Maxic introduced the MT3102, which incorporates a miniature, ultra-low power digital optical sensor paired with a 940nm VCSEL and its advanced skin recognition algorithm. primarily designed for wireless bluetooth earphones such as TWS/OWS, portable hardware devices, smartwatches, and smartphones, the MT3102 offers exceptional accuracy and versatility across diverse applications.

High Maintenance Costs Restrain the Market Growth

The Asia-Pacific Tactile sensor market necessitates regular calibration and maintenance to maintain their reliability and accuracy, which elevates the overall cost of ownership for businesses. Additionally, their sensitivity to environmental factors such as temperature and humidity presents challenges in maintaining consistent responsiveness and precision, particularly in harsh or variable conditions.

These issues add complexity to the operation of sensor and discourage potential users who require low-maintenance solutions or consistent performance in diverse environments. Consequently, addressing these limitations is essential for the broader adoption and sustained growth of the market.

Integration Of Quantum Sensing Creates Market Opportunities

The incorporation of quantum sensing methods into sensors technology utilizes the distinct characteristics of quantum mechanics, such as superposition and entanglement, to achieve remarkably sensitive and precise measurements.

The integration of quantum phenomena, allows these sensors to detect even the slightest changes in pressure, force, or other physical attributes with unparalleled accuracy. This heightened sensitivity creates opportunities across various domains. In scientific exploration, it enables researchers to investigate phenomena at incredibly small scales. Within precision engineering, it enhances the accuracy and efficiency of manufacturing processes and quality control.

In the realm of quantum computing, it facilitates the advancement and operation of sophisticated computational systems. As these applications continue to develop and broaden, the incorporation of quantum sensing methods into these sensors are anticipated to propel the Asia-Pacific tactile sensor market growth substantially, in the forthcoming years.

China Dominates the Asia-Pacific Tactile Sensor Market Share

China, the global leader in manufacturing and automation, has witnessed widespread deployment of industrial robots, necessitating the adoption of tactile sensors to ensure the seamless operation and optimization of robotic systems. According to the International Federation of Robotics 2023 report, significant investment in industrial robotics propelled China to attain the 5th rank in robot density globally, surpassing the United States in 2022.

The Chinese manufacturing industry now boasts 322 operational industrial robots per 10,000 employees, indicating a growing reliance on automation to enhance productivity and competitiveness. This trend drives substantial demand for tactile sensors, establishing them as essential components in China’s rapidly evolving industrial landscape.

Moreover, the escalating adoption of electric vehicles (EVs) in the country is driving the need for tactile sensors to ensure optimal performance and safety standards. Tactile sensors are integral components within EV systems, facilitating critical functions such as battery management, thermal regulation, and safety systems.

According to the International Energy Agency report 2024, new electric car registrations reached 8.1 million in 2023, marking a 35% increase relative to 2022 in China alone. This surge in EV adoption underscores the importance of tactile sensors in maintaining optimal performance and safety standards across the rapidly expanding automotive market in the country.

South Korea to Witness Substantial Growth in the Market, with a Projected CAGR of 13.8%

With its strong emphasis on robotics as a catalyst for economic growth and competitiveness, South Korea is poised to witness a further escalation in the demand for tactile sensors as it embraces automation across various industries, including automotive manufacturing, electronics assembly, and logistics. Tactile sensors empower robots to execute tasks with enhanced precision, flexibility, and safety.

According to the International Federation of Robotics 2024 report, South Korea leads globally in the adoption of industrial robots, with 1,012 robots installed per 10,000 employees in the country in 2022. This increasing integration of industrial robots in South Korea is driving significant demand for tactile sensors, given their critical role in augmenting the capabilities and efficiency of robotic systems.

Moreover, as South Korea solidifies its position as a global gaming powerhouse with a vibrant esports culture and a tech-savvy population, the demand for tactile sensors in gaming peripherals is experiencing rapid growth. Tactile sensors play a pivotal role in gaming peripherals such as controllers, keyboards, and virtual reality (VR) devices, enhancing user interaction through responsive touch feedback and precise motion tracking.

According to the International Trade Administration report 2023, South Korea ranks among the top four largest gaming markets worldwide, with over 74% of Koreans between the ages of 10 and 65 regularly engaging in gaming activities. The Korean gaming industry was valued at USD 17.6 billion in 2022. The exponential growth of the gaming industry in South Korea is driving the Asia-Pacific tactile sensor market demand, fueled by the imperative to deliver immersive gaming experiences and innovative peripherals.

Competitive Landscape

Several market players operating in the Asia-Pacific tactile sensor industry include Broadcom, Shenzhen Goodix Technology Co., Ltd., Synaptics Incorporated, Alps Electric (Cirque Corporation), Stmicroelectronics N.V., Focaltech Systems Co., Ltd., Elan Microelectronics, Pressure Profile Systems, Ais Global Group (Touch International Inc.), Tekscan Inc., Forcen, Contactile, Sensobright, X-Sensors, Barrett Technology and others. These market players are adopting strategies, such as product launches and partnership to maintain their dominance in the market.

Asia-Pacific Tactile Sensor Market Key Segments

By Type

-

Resistive Tactile Sensors

-

Capacitive Tactile Sensors

-

Piezoelectric Tactile Sensor

-

Optical Tactile Sensors

-

Others

By Application

-

Robotics

-

Computer Hardware

-

Security System

-

Touch Screens

-

Medical Devices

-

Handheld Devices

-

Others

By End User

-

Automotive

-

Robotics and Automation

-

Aerospace and Defense

-

Consumer Electronics

-

Healthcare

-

Other Industry

By Country

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Malaysia

-

Taiwan

-

Thailand

-

Vietnam

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size In 2023 |

USD 2.72 Billion |

|

Revenue Forecast In 2030 |

USD 6.13 Billion |

|

Growth Rate (Value) |

CAGR Of 11.4% From 2024 To 2030 |

|

Market Volume In 2023 |

1 Billion Units |

|

Market Volume In 2030 |

4 Billion Units |

|

Growth Rate (Volume) |

14.9% |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

11 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing And Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Broadcom

-

Shenzhen Goodix Technology Co., Ltd.

-

Synaptics Incorporated

-

ALPS Electric (Cirque Corporation)

-

STMicroelectronics N.V.

-

FocalTech Systems Co., Ltd.

-

Elan Microelectronics

-

Pressure Profile Systems

-

AIS Global group (Touch International Inc.)

-

Tekscan Inc.

-

ForceN

-

Contactile

-

Sensobright

-

X-Sensors

-

Barrett Technology

Speak to Our Analyst

Speak to Our Analyst