Automotive Artificial Intelligence (AI) Market by Component (Hardware, Software, and Services), by Technology (Machine Learning & Deep Learning, Computer Vision, and Natural Language Processing), and by Application (Semi-Autonomous and Fully Autonomous) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Automotive & Transportation | Publish Date: 01-Mar-2025 | No of Pages: 356 | No. of Tables: 230 | No. of Figures: 175 | Format: PDF | Report Code : AT357

US Tariff Impact on Automotive Artificial Intelligence (AI) Market

Trump Tariffs Are Reshaping Global Business

Automotive Artificial Intelligence (AI) Market Overview

The global Automotive Artificial Intelligence (AI) Market size was valued at USD 4.29 billion in 2023, and is predicted to reach USD 25.78 billion by 2030, with a CAGR of 29.2% from 2024 to 2030. Automotive Artificial Intelligence, or Automotive AI, refers to the application of machine learning and artificial intelligence technologies in the design, development, and operation of vehicles and related systems within the automotive industry.

Automotive AI encompasses a wide range of applications, including autonomous driving, advanced driver assistance systems (ADAS), predictive maintenance, natural language processing for in-car voice recognition, and improving the overall efficiency and safety of vehicles. This technology enables vehicles to perceive their surroundings, make decisions, and interact with drivers and passengers. This will ultimately enhance the driving experience, safety, and efficiency of automotive systems.

Rising Government Regulations and Safety Concerns Boost the Automotive AI Market

Government regulations and safety standards are key drivers of the automotive AI market growth. Around the world, regulatory bodies are placing a strong emphasis on vehicle safety and reducing emissions. As a result, automakers are increasingly turning to AI-driven solutions to ensure compliance with these standards. This push for compliance ensures that vehicles are safer and more environmentally friendly than before.

Technological Advancements in Automotive AI Fuel the Market Growth

Significant AI advancements are acting as prominent catalysts within the automotive sector. Developments in domains such as machine learning, computer vision, and natural language processing are paving the way for groundbreaking applications in vehicles. These breakthroughs empower automobiles to comprehend and engage with their environments more effectively than before.

They lead to practical features, such as autonomous driving, voice-controlled functionalities, and advanced safety mechanisms. The evolving AI landscape is reshaping the automotive industry, enriching vehicle safety, convenience, and functionality while delivering enhanced and smarter driving experiences to consumers. For instance, in June 2022, AI chipmaker Hailo collaborated with Renesas to enable automotive customers to scale from ADAS to automated driving seamlessly. This collaboration aims to provide advanced AI solutions for the automotive industry.

Data Privacy and High Cost Associated with Automotive AI Restrain the Market Growth

Data privacy concerns and high costs are collectively restraining the growth of the automotive AI market. Consumers worry about how their personal data is collected, used, and protected by AI systems in vehicles. This led to demands for stringent data privacy measures. Additionally, the high development and integration costs of AI in vehicles can result in higher vehicle prices. This, in turn, potentially limits market adoption, especially among cost-conscious consumers. Balancing data privacy and cost considerations is crucial for the widespread acceptance and growth of automotive AI technologies.

The Rising Prevalence of Predictive Maintenance and ADAS Creates Opportunities for the Market

The increasing use of AI, particularly in predictive maintenance and advanced driver assistance systems (ADAS), is poised to open up substantial growth prospects in the automotive industry. AI's ability to predict maintenance needs and enhance safety through ADAS systems is creating a promising avenue for market expansion in the future. This technology improves vehicle reliability and contributes to safer and more efficient driving than before, thus driving market opportunities for growth.

North America Dominates the Automotive AI market

The automotive AI market share in North America is experiencing significant growth, due to the growing interest in self-driving cars combined with a push for safer and more efficient transportation. These factors spurred automakers to invest heavily in AI-driven technologies in the region. According to the Insurance Institute for Highway Safety, there will be 3.5 million autonomous vehicles on American roads by 2025, with the number increasing to 4.5 million by 2030.

These technologies, essential for autonomous navigation, enhance vehicle safety and performance. As a result, the pursuit of autonomous vehicles is fuelling the development and adoption of automotive AI in the U.S. This also makes it a pivotal factor in the market's growth as it meets the evolving needs of American consumers.

Also, the presence of major market players such as NVIDIA and Tesla, Inc. in the region is boosting the growth of the market. They are adopting various strategies, including partnerships. For instance, in May 2023, NVIDIA partnered with MediaTek to introduce MediaTek Intelligent Cabin Solutions, aiming to enhance in-car experiences for consumers.

This collaboration integrates MediaTek's solutions with NVIDIA's automotive AI platform, leading to more interactive and personalized vehicle cabins. This partnership is significant in developing AI-driven automotive technology and creating more intelligent and interactive capabilities for future vehicles.

Asia-Pacific to Show Steady Growth in the Automotive AI Market

Asia-Pacific is expected to witness an increased demand for automotive AI in the coming years, driven by factors such as the rising technological progress in the automotive industry. For instance, in July 2023, Geely introduced the world's first all-scenario AI large model for the automotive industry. This innovation signifies a major technological advancement that enhances various aspects of the automotive experience, such as safety, convenience, and entertainment.

By implementing AI across multiple in-vehicle scenarios, Geely aims to provide a more intelligent and adaptive driving and passenger experience. This step underlines the increasing significance of AI in the automotive sector and its continuous expansion into smart and connected vehicles. This technological advancement is reshaping the future of driving and transportation.

In addition, the automotive AI market in the region is driven by China's prominent role as the largest producer of AI research globally. This leadership position compels companies to invest in AI technologies to align with stringent regional regulations. As a result, the Asia-Pacific automotive AI sector is witnessing a surge in research and innovation, fostering technology advancements and promoting the adoption of AI in the automotive industry to meet regulatory compliance and enhance competitiveness.

For instance, in July 2021, China introduced its inaugural national standards for classifying autonomous driving, establishing official terminology and definitions for self-driving vehicles. Several Chinese cities also authorized the operation of autonomous taxis in specific zones, subject to approval from local authorities. These developments foster a favorable environment for the growth and integration of AI-driven solutions in the automotive sector, positioning Asia-Pacific as a hub for innovation in this field.

Competitive Landscape

Several market players operating in the automotive AI industry include NVIDIA Corporation, Alphabet, Inc., Intel Corporation, Microsoft Corporation, IBM Corporation, Qualcomm, Inc., Tesla, Inc., BMW AG, Micron Technology, Xilinx, Inc., Waymo LLC, Baidu Inc., General Motors Company, Ford Motor Company, Pony.ai, and others. These market players are adopting product launches, business expansion, and innovation strategies across various regions to maintain dominance in the global market.

For instance, in September 2023, BMW extended its collaboration with Amazon Web Services (AWS) to enhance the intelligence and connectivity of its next-generation vehicles, which are set to launch in 2025. This partnership focuses on integrating the Internet of Things (IoT) and AI technologies to deliver advanced features and services in BMW's upcoming vehicles. It exemplifies the growing integration of cloud computing, IoT, and AI in the automotive industry to create smarter and more connected vehicles than before.

Moreover, in August 2023, Qualcomm collaborated with Hyundai Motor Group to develop purpose-built vehicle systems using Qualcomm's cutting-edge technologies. This partnership aims to create advanced in-car experiences, including rich infotainment, cockpit, and driver assistance systems.

Furthermore, in June 2021, Xilinx launched a new Versal AI Edge series to bring advanced AI capabilities to automotive applications. This development highlights the increasing significance of AI in the automotive industry, enabling vehicles to utilize AI for various functions, such as autonomous driving and advanced driver-assistance systems (ADAS).

Key Benefits

-

The report provides quantitative analysis and estimations of the automotive AI market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the automotive AI market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the global market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Automotive Artificial Intelligence (AI) Market Key Segments

By Component

-

Hardware

-

Software

-

Services

By Technology

-

Machine Learning & Deep Learning

-

Computer Vision

-

Natural Language Processing

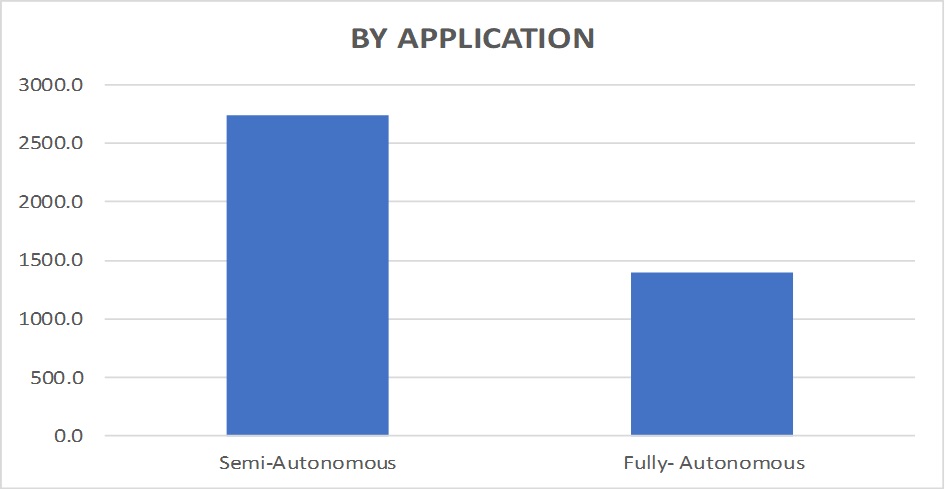

By Application

-

Semi-Autonomous

-

Fully Autonomous

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

Rest of the World (RoW)

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

NVIDIA Corporation

-

Alphabet, Inc.

-

Intel Corporation

-

Microsoft Corporation

-

IBM Corporation

-

Qualcomm, Inc.

-

Tesla, Inc.

-

BMW AG

-

Micron Technology

-

Xilinx, Inc.

-

Waymo LLC

-

Baidu Inc.

-

General Motors Company

-

Ford Motor Company

-

Pony.ai

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 4.29 Billion |

|

Revenue Forecast in 2030 |

USD 25.78 Billion |

|

Growth Rate |

CAGR of 29.2% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

The rising government regulations and safety concerns Technological advancements in the automotive industry |

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst