China Electric Shaver Market by Type (Rotary Shaver, Foil Shaver and Clippers & Trimmers), by Power Source (Battery Powered and Rechargeable/Cordless), by Usage (Dry and Wet & Dry), by Distribution Channel (Online and Offline), and by End User (Men and Women) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Retail and Consumer | Publish Date: 14-Apr-2025 | No of Pages: 110 | No. of Tables: 158 | No. of Figures: 83 | Format: PDF | Report Code : RC2549

US Tariff Impact on China Electric Shaver Market

Trump Tariffs Are Reshaping Global Business

China Electric Shaver Market Overview

China Electric Shaver Market size was valued at USD 1.89 billion in 2024 and is predicted to reach USD 3.07 billion by 2030, registering a CAGR of 8.4% from 2025 to 2030.

The China electric shaver market falls under the category of battery or electricity-powered grooming equipment that is designed for providing efficient and user-friendly solutions for shaving. This use rotating or fast-moving blades sheltered under a protective sheath, so hair could be trimmed without touching the skin, making electric shavers quite suitable for all purposes including facial and body hair.

This market segment addresses the expanding consumer demand for high-quality grooming tools with portability, rechargeability, and minimal maintenance as key points. Compared to manual razors, electric shavers have greatly diminished the instances of skin irritation and eliminated the need for shaving creams; thus, an attractive opportunity exists for the convenience of grooming.

Personal Care and Beauty Sector Is on the Rise in China to Enhance Growth in the Market

The fast growth of personal care and beauty sector owes much to the rising consciousness of consumers about grooming and self-care. With this, people are paying greater attention to their looks and hygiene, and therefore, an effective tool for grooming will always be in demand - electric shavers. Manufacturers have become more aggressive in the development process, including advanced features such as skin-sensitive technology and versatile attachments in order to meet different kinds of grooming needs.

According to a recent report by the Global Wellness Institute, the global personal care and beauty market size was estimated to be about USD 1,088.7 billion in 2022 and grew at USD 1,048.2 billion in 2021 at a growth rate of 3.9%. A change in consumer behavior and a continuous evolution of products has been the key drivers pushing the China electric shaver market demand.

Growing Urbanization Leads to Electric Shaver Market Expansion in China

Urbanization is increasing in its rate of growth, hence creating the major driving force of the market. The urban dweller tends to lead busier lives and hence increase preference for electric shavers. Consumers in the urban scenario will prioritize convenience and effectiveness for everyday activities.

As a result, electric razors appeal as a grooming product, as they provide quick convenience and ease in shaving. The latest report from the UN Population Division shows that urbanization in China was at 897.58 million in 2022, while it was at 882.89 million in 2021, thus recording a growth rate of 1.66%. This trend motivates manufacturers to innovate and develop electric shaver models specific to the needs of urban consumers, which fuels the overall China electric shaver market expansion.

Availability of Alternatives Restraints the Growth of the Market

The electric shaver market faces a challenge in the presence of alternatives, including traditional shavers such as cartridge razors. Traditional razors are cheaper and less maintenance-intensive, thus attractive to budget-conscious consumers. Unlike electric shavers, manual razors do not require electricity or batteries, thus more convenient in areas with unreliable power supply or for those who prefer simpler grooming tools.

Adoption of Sustainable Materials in Electric Shaver Creates Growth Opportunity for the Market

One significant market opportunity that arises is the adoption of sustainable materials in electric shavers are growing environmental awareness and the purchasing behaviors of consumers. Brands including companies offering renewable energy, recyclable materials, and sustainable packaging are helping build brand loyalty and meet the demand for green products. For example, Braun Series 9 Pro shavers are produced exclusively using renewable energy, and Philips has made sure that blade manufacturing is powered with renewable electricity.

Also, Philips uses recycled paper for packaging, and each shaver is accompanied by an Eco Passport, which communicates the brand's commitment to sustainability. All these environmentally responsible practices fit into the shift in consumer priorities and put brands ahead for future growth through innovation.

By Type, Foil Shaver Holds the Dominant Share in China Electric Shaver Market

The foil shaver segment dominates the China electric shaver market share, accounting for nearly 48% of the market share. Foil shavers use thin, perforated metal sheets that overlay oscillating blades to create smooth and consistent results while ensuring that the skin is not subjected to direct contact with the blades. This segment has a preference among users with sensitive skin due to its smooth operation, and it finds applications among those seeking clearly defined grooming, especially along contours such as sideburns and beards.

By Power Source, Rechargeable/Cordless, Holds the Highest CAGR of 9.1%

The China electric shaver market growth is influenced mainly by the power source feature that is rechargeable/cordless. These devices are provided with built-in batteries and recharged for convenience and flexibility for users. Cordless operation enhances portability and, therefore, electric shavers are ideal for travel and on-the-go grooming.

With advancements in battery technology, modern electric shavers ensure longer usage times and rapid charging, which is ideal for consumers who prefer to get the most out of everything. The eco-friendly aspects of rechargeable systems, with the growing preference for more sustainable products, further boost popularity in the market.

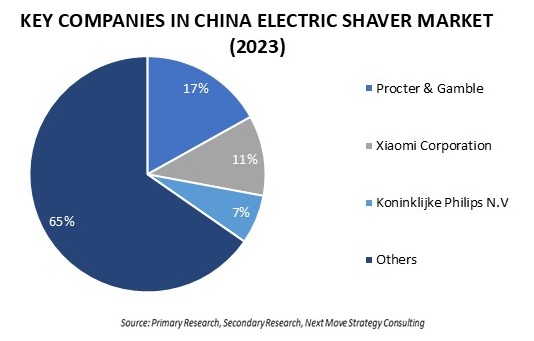

Competitive Landscape

The promising key players operating in China electric shaver industry include Procter & Gamble, Xiaomi Corporation, Koninklijke Philips N.V., Panasonic Holding Corporation, Andis Company, Ningbo Kaili Holding Group Co., Ltd., Shanghai Feike Electric Co., Ltd., Spectrum Brands, Inc., Wenzhou Pritech Industrial Co., Ltd, YooseTech, Yuyao Xiangteng Electrical Appliance Co., ltd., Wenzhou Defu Electric Appliance Co., Ltd., Shenzhen Weidz Technology Co., Ltd., Wenzhou Seenou Electric Appliance Co., Ltd., Wenzhou Mutian Electric Co., Ltd., Zhejiang Haohan Electric Appliance Co., Ltd., Wenzhou Shalon Electric Co., Ltd., JiuJiang Xiyue Electrical Technology Co.,Ltd, Shenzhen Rose & Orchid Technology Co., Ltd., and Shenzhen Achepower Electronic Co., Ltd. among others.

These players are engaged in product launches across the nation to maintain their dominance in the market.

|

Date |

Company |

Recent Developments |

|

May 2024 |

|

Philips launched latest transformers limited edition shavers in China. The product feature designs inspired by Optimus Prime, Bumblebee, and Megatron. |

|

August 2024 |

Panasonic Holding Corporation |

Panasonic launched the Series 900s, a new palm-sized electric shaver with enhanced control and performance. This innovative shaver comes with five Japanese stainless-steel blades and a powerful linear motor that runs at 70,000 cutting actions per minute for a close and efficient shave. |

|

March 2024 |

Xiaomi Corporation |

Xiaomi launched the Mijia Electric Shaver S200 in China, primarily featuring a dual-layered blade system and 360 floating shaving head for a close shave. This model includes IPX7 waterproofing, allowing for easy cleaning and wet or dry use. |

|

March 2024 |

YooseTech |

Yoose launched its innovative mini shaver for the next generation of grooming enthusiasts. This compact and efficient device promises to deliver a convenient shaving experience, combining portability with advanced technology for optimal performance. |

|

November 2023 |

Xiaomi Corporation |

Xiaomi launched Mijia Electric Shaver S302 in China. It has a streamlined design and rotary blades for a smooth shaving experience. This new model focuses on user comfort, offering IPX7 waterproofing, long battery life, and USB-C charging, making it suitable for travel and daily use. |

China Electric Shaver Market Key Segments

By Type

-

Rotary Shaver

-

Foil Shaver

-

Clippers and Trimmers

-

Beard Trimmer

-

Body Trimmer

-

Others

-

By Power Source

-

Battery Powered

-

Rechargeable/Cordless

By Usage

-

Dry

-

Wet and Dry

By Distributional Channel

-

Online

-

Offline

By End-User

-

Men

-

Women

Key Players

-

Procter & Gamble

-

Xiaomi Corporation

-

Koninklijke Philips N.V.

-

Panasonic Holding Corporation

-

Andis Company

-

Ningbo Kaili Holding Group Co., Ltd.

-

Shanghai Feike Electric Co., Ltd.

-

Spectrum Brands, Inc.

-

Wenzhou Pritech Industrial Co., Ltd.

-

YooseTech

-

Yuyao Xiangteng Electrical Appliance Co., Ltd.

-

Wenzhou Defu Electric Appliance Co., Ltd.

-

Shenzhen Weidz Technology Co., Ltd.

-

Wenzhou Seenou Electric Appliance Co., Ltd.

-

Wenzhou Mutian Electric Co., Ltd.

-

Zhejiang Haohan Electric Appliance Co., Ltd.

-

Wenzhou Shalon Electric Co., Ltd.

-

JiuJiang Xiyue Electrical Technology Co., Ltd.

-

Shenzhen Rose & Orchid Technology Co., Ltd.

-

Shenzhen Achepower Electronic Co., Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 1.89 Billion |

|

Revenue Forecast in 2030 |

USD 3.07 Billion |

|

Growth Rate |

CAGR of 8.4% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst