Denmark Waste Management Market by Waste Type (Municipal Solid Waste (MSW) or Household, Industrial and Commercial), and by Waste Treatment (Recycling, Incineration, and Landfill) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Energy & Power | Publish Date: 14-Apr-2025 | No of Pages: 103 | No. of Tables: 145 | No. of Figures: 70 | Format: PDF | Report Code : EP2734

US Tariff Impact on Denmark Waste Management Market

Trump Tariffs Are Reshaping Global Business

Denmark Waste Management Market Overview

Denmark waste management market size was valued at USD 17.17 billion in 2024 and is predicted to reach USD 23.69 billion by 2030, registering a CAGR of 4.36% from 2025 to 2030.

The Denmark waste management market is driven by factors such as increasing urbanization, growing industrial sector, and rising government initiatives promoting circular economy practices. However, challenges such as high operational costs and complex waste sorting requirements hinder market growth.

On the other hand, advancements in recycling technologies, including waste to energy and chemical recycling, present promising opportunities by enhancing efficiency and sustainability.

Moreover, key players have been investing through innovative waste solutions and upgrading capacity in recycling such as Vestforbrænding, RenoNord, ARC. In future, as companies are progressing towards a healthier environment, thus the waste sector will remain among the pillars behind the fulfillment of national environmental agenda.

Growing Urban Population Necessitates the Need for Effective Waste Management Solutions

The increased urbanization rate in Denmark boosts the waste management industry as people are relocating to cities, and consequently, more waste is generated from residential, commercial, and industrial areas. In an urban setting, there is always a mix of household, packaging, and construction debris. This makes it important to ensure that such a collection recycling and disposal system is efficient.

According to the report of World Bank, the total population living in cities of Denmark is computed at 5.22 million for the year of 2022. The rate has escalated at 0.97% in the last year, according to the report. This urban rising stream creates wastes and must be supported by heavily advanced infrastructure in the form of centralised sorting facilities and programs for urban recycling. Secondly, urbanization creates the opportunities of adopting latest technology to improve processes of waste management and decrease environmental degradation in urban areas.

Increasing Rate of Recycling in Denmark Increases Demand for Waste Management Solutions

The increasing focus on recycling in Denmark, supported by ambitious sustainability objectives, established the country as a leader in waste management. Denmark’s robust recycling mandates and waste separation practices at both residential and industrial levels aim to minimize landfill dependency while maximizing resource recovery.

According to a report published by the European Environment Agency, the rate of collected municipal waste is projected to be recycled at 55% for the year 2025 as compared with the preceding years.

Investment in advanced technologies and infrastructure concerning recycling is critical in attaining these objectives such as automated systems for sorting municipal waste and specialist facilities for dealing with plastics, metals, or organic waste. These initiatives fall under Denmark's broad agenda of enhancing a circular economy and environmental sustainability.

Rapidly Growing Industrial and Commercial Sector Fuels the Demand for Waste Management Solutions

Over the years, Denmark has seen large portions of growth in industrial and commercial sectors, which meant more waste was produced there. The industry contributes much waste either hazardous or non-hazardous.

According to United Nations Environment Programme, for the year 2023, almost 1.1 million tons of hazardous waste is produced per capita in Denmark. The figure would also continue to rise since more and more enterprises are looking to have sound waste management systems in place, which would include factors like recycling, resource recovery, and waste-to-energy. This demand for sector-specific waste management services is a key driver of the Denmark waste management market growth, fostering innovation and the expansion of specialized waste handling and disposal infrastructure.

Stringent Government Regulations Towards Waste Management Hinders the Denmark Waste Management Market Expansion

Denmark waste management industry operates within a framework of stringent environmental regulations set forth by both national and European Union authorities. Denmark's EPA, the Danish Waste Management Act, and directives from the EU such as the Waste Framework Directive, and the Circular Economy Action Plan are major sources of regulation.

It is quite challenging and resource-intensive to adhere to the mentioned regulations about segregated waste, recycling targets, and landfill reductions. All this regulatory complexity leads to increased operational costs and a risk of delays in the implementation of the system.

Adoption Of Waste-To-Energy Technologies Creates Future Growth Opportunities in the Market

The adoption of waste-to-energy technologies such as incineration, anaerobic digestion, and gasification presents a significant growth opportunity for the waste management market as these technologies would reduce landfill dependency and contribute toward sustainable energy generation. Waste management solutions that convert waste into a valuable resource have a positive effect on environmental sustainability and drive expansion in the Denmark waste management market trends.

This new approach adheres to a global trend to embrace circular economy practices and promotes economic benefits with the generation of energy from wastes that present promising growth avenues in the waste management sector. It also added new sets of challenging goals through a Green Transition Plan and Climate Action Act by Denmark, which targeted reducing landfill wastes and increasing their renewable energy resource usage.

These policies boost investment in WTE infrastructure, which further converts non-recyclable waste into valuable energy and contributes to waste reduction and renewable energy targets for Denmark. The government also proposed a reduction of 480 kilo tons/year of waste generation and a decrease of incineration capacity from 4 million Tons/Year to 2.7 million Tons/Year.

By Waste Type, Municipal Solid Waste (MSW) or Household Dominates the Denmark Waste Management Market Share

MSW constitutes 54% of Denmark Waste Management. This sector mainly comprises household waste, packaging waste, organic waste as well as recyclables coming from households. Functioning MSW management depends highly on sorting systems, waste-to-energy plants, recycling plants, and smart collection systems that improve the processing efficiency of waste while minimizing landfills and supporting Danish sustainability objectives. The integration of advanced sorting technologies and automated waste processing solutions has been instrumental in improving recycling rates and minimizing environmental impact.

By Waste Treatment, Recycling, holds the highest CAGR of 4.75%

The recycling segment in the waste management industry in Denmark is growing because of increasing regulatory emphasis on sustainability and circular economy initiatives. Technologies included in this segment are automated sorting systems, material recovery facilities, chemical recycling, and AI-powered waste classification. These solutions help in efficient separation, processing, and repurposing of recyclable materials to reduce landfill waste and help businesses and municipalities meet environmental targets.

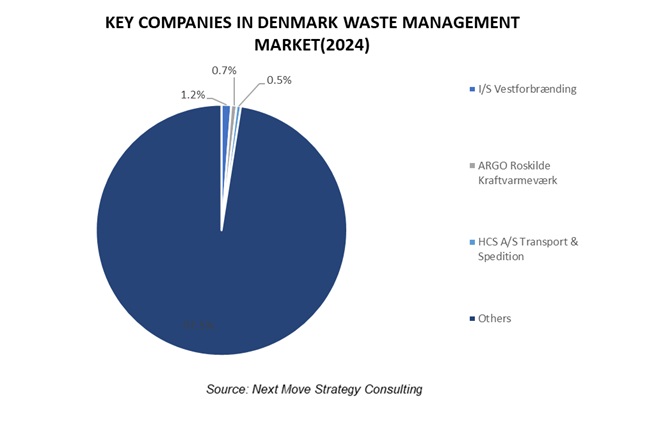

Competitive Landscape

The key players operating in Denmark waste management industry include I/S Vestforbrænding, ARGO Roskilde Kraftvarmeværk, HCS A/S Transport & Spedition, Veolia Environnement S.A., Marius Pedersen A/S Company, Remondis, Amager Resource Center (ARC), Kredsløb Holding A/S, DP CleanTech, Nordværk (RenoNord), Energnist I/S, I/S REFA, I/S Norfors, Eldan Recycling A/S, Verdis A/S, Fortum Recycling & Waste, M&J Recycling, Resource Denmark ApS, Aerbin ApS, TOMRA Systems ASA among others.

These players are engaged in various partnership, and business expansion across various regions to maintain their dominance in the market.

|

Date |

Company |

Recent Developments |

|

November 2024 |

ARGO Roskilde Kraftvarmeværk |

Argo expanded its direct reuse initiative by opening a new facility in Bjæverskov that aims to promote sustainability and reduce waste through community engagement. This expansion is part of a broader effort to encourage recycling and the reuse of items across various municipalities. |

|

October 2024 |

ARGO Roskilde Kraftvarmeværk |

Argo collaborated with Stevns Municipality and launched a new initiative for direct reuse at their recycling centers in Harlev and Store Heddinge. This program allows individuals to donate or pick up various reusable items, including building materials, furniture, electronics, and toys, all at no cost. |

|

July 2024 |

Remondis |

Remondis SE & Co. KG partnered with KeyKeg to launch a collection network for used KeyKegs in Denmark, focusing on enhancing sustainability and recycling within the beverage industry. |

|

June 2024 |

Kredsløb Holding A/S |

Kredsløb Holding A/S expanded its business by opening a new local recycling station in Denmark. This initiative is part of their broader efforts to enhance recycling and promote a circular economy in the region. |

|

October 2023 |

I/S Vestforbrænding |

Vestforbrænding expanded the district heating network in the Greater Copenhagen area. This initiative, is part of the company’s Heat Plan for 2030 to provide 39,000 additional residents with district heating by utilizing waste heat and surplus energy from businesses |

|

August 2023 |

Amager Resource Center (ARC) |

Amager Resource Center in Copenhagen launched a new carbon capture facility that captures CO2 emissions from its waste-to-energy plant. With a capacity of up to 4 tons of CO2 per day, the facility will supply the captured carbon to local vegetable growers, integrating waste management with sustainable agricultural practices. |

|

March 2023 |

Nordværk (RenoNord) |

Nordværk partnered with Gemidan A/S to lease a significant area for the construction of a pre-treatment plant for food waste in Aalborg East. This collaboration aims to enhance regional waste management efforts and complements Nordværk's existing operations in the area. |

Denmark Waste Management Market Key Segments

By Waste Type

-

Municipal Solid Waste (MSW) or Household

-

Mixed Municipal Waste

-

Biodegradable Waste

-

Incineration Waste

-

Paper and Cardboard

-

Wood

-

Glass

-

Metals

-

Plastics and Tires

-

Electronic Batteries

-

Other Waste Types

-

-

Industrial

-

Manufacturing Waste

-

Construction & Demolition Waste

-

Agriculture Waste

-

Other Industrial waste

-

-

Commercial

By Waste Treatment

-

Recycling

-

Incineration

-

Landfill

Key Players

-

I/S Vestforbrænding

-

ARGO Roskilde Kraftvarmeværk

-

HCS A/S Transport & Spedition

-

Veolia Environnement S.A.

-

Marius Pedersen A/S Company

-

Remondis

-

Amager Resource Center (ARC)

-

Kredsløb Holding A/S

-

DP CleanTech

-

Nordværk (RenoNord)

-

Energnist I/S

-

I/S REFA

-

I/S Norfors

-

Eldan Recycling A/S

-

Verdis A/S

-

Fortum Recycling & Waste

-

M&J Recycling

-

Resource Denmark ApS

-

Aerbin ApS

-

TOMRA Systems ASA

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 17.17 Billion |

|

Revenue Forecast in 2030 |

USD 23.69 Billion |

|

Growth Rate |

CAGR of 4.36% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst