Digital Marketplace Market by Application (Desktop, Mobile, and Tablets), by Model Type (Business to Business (B2B), Business to Consumer (B2C), and Consumer-to-Consumer (C2C)), and by End User (Commercial and Personal) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 16-Jan-2025 | No of Pages: 292 | No. of Tables: 227 | No. of Figures: 172 | Format: PDF | Report Code : IC1554

US Tariff Impact on Digital Marketplace Market

Trump Tariffs Are Reshaping Global Business

Digital Marketplace Market Overview

The global Digital Marketplace Market size was valued at USD 580.31 billion in 2024 and is predicted to reach USD 1064.90 billion by 2030, with a CAGR of 10.6% from 2025 to 2030.

Digital marketplaces also known as online marketplace or digital electronic commerce platforms where buyers and sellers meet to trade goods, services or information. It includes platforms serve as intermediaries, facilitating transactions among various parties such as buyers and sellers, within a centralized space tailored for product discovery, purchase, and delivery.

These marketplaces capitalize on technology to enhance transaction efficiency. They ensure smooth and secure payment processing by safeguarding the financial details of both buyers and sellers.

Moreover, they extend their services by providing features such as customer reviews, ratings and mechanisms for resolving disputes that arises during transactions. They play an important role in the contemporary economy, bridging businesses and consumers across geographical barriers, and facilitating seamless and convenient commerce on a global scale.

Global Expansion of E-Commerce Sector Boost the Market Growth

The global expansion of the e-commerce sector drives this online marketplace market at an international level through several interacting mechanisms. As e-commerce continues to expand in more regions and industries, these online marketplaces emerge as crucial portals that aggregate various products and services offered by multiple sellers, providing consumer access to a wide range of offerings conveniently.

As per data from International Trade Administration, the overall global retail e-commerce segment is expected to grow by 11.16% CAGR during 2023-2027. These growths are influenced by variables such as growing internet penetration, increasing penetration of smartphones, and enhancements in digital payment mechanisms, resulting in a gradually swelling pool of online buyers.

In addition, geographical distance and globalization of trade enable business operations globally through digital marketplaces by creating opportunities for cross-border transactions and further expanding into markets.

Thus, the globalization of e-commerce catalyzes growth in the online marketplace in a dynamic way through establishing an ecosystem between the seller and buyer of every origin, driving innovation and healthy competition and economic growth.

The Rising Adoption of Smartphones Fuels the Market Growth

The increasing usage of smartphones worldwide fuels the market growth as mobile phones enable consumers to access the web and check out products from different online sources. According to International Telecommunication Union, there were over 8.58 billion mobile subscriptions globally in 2022. This surpasses the population of the world that stands at 7.95 billion. Smartphones are a fundamental tool that allows users to access online sources from virtually anywhere.

This accessibility broadens the reach of electronic commerce marketplaces and enable a larger segment of the population to participate in online shopping. Features such as mobile applications and easy interfaces enhance the browsing, purchasing and selling experience on digital marketplaces. Consequently, the rise in dependence on smartphones leads to the growth of the market that subsequently increased transactions, revenue and penetration into the international market.

Cybersecurity Threats and Consumer Trust Issues Hinders the Growth of the Market

Cybersecurity threats through data breaches and fraud are some of the major risks that online marketplaces face since such situations destroy the confidence consumers have in online transactions.

If consumers feel a digital platform is vulnerable to any form of cyberattack, they are reluctant to give out personal information or conduct online transactions due to a fear of privacy violation or loss. This erosion of trust translates to reduced usage of hesitation to shop online, hindering digital marketplace market expansion.

More precisely, frauds or other forms of data breaches impact the overall reputation of digital marketplaces and further discourage both buyers and sellers from participating in the online ecosystem.

Integration of Augmented Reality and Virtual Reality Technologies Creates Future Opportunity

The integration of Augmented Reality (AR) abbreviated as AR and virtual reality as VR technologies into online marketplaces is anticipated to create ample opportunities in the market growth. AR and VR enable digital marketplaces to offer customers an immersive and interactive experience. Using these technologies, consumers will be able to see the product in realistic settings, virtually try before they buy, and take a look at virtual interactive worlds.

Therefore, it encourages improved consumer engagement with the brand through such channels for consumption that leave a positive impression on building future sales. The extent to which AR and VR can show the products in great detail largely by their specific use and designed recommendation is therefore another advantage that online shopping benefits from.

So, accordingly, integration of AR and VR based technologies holds bright possibilities for transforming the future perspective of the industry in ways incredible yet unimaginable; hence new, engaging online shopping dimensions evolve.

By Application, Mobile Holds the Dominant Share in the Digital Marketplace Market

Mobile applications play an important role towards driving the digital marketplace industry due to their convenience, accessibility, and interactive interfaces. These apps offer continuous purchasing experiences, personalized recommendations, and secure payment options that enhances customer satisfaction.

With their growing penetration among smartphones and advancements in mobile internet technologies, mobile applications are assumed as a most preferred platform for e-commerce, enabling businesses to reach wide audiences. Furthermore, push notifications and real-time updates deepen user engagement and cement the stature being assumed by mobile applications in the digital marketplace.

By Model Type, Business to Consumer is Expected to Achieve Highest CAGR Growth Through 2030

The business-to-consumer (B2C) model is the fastest-growing segment, expected to achieve the highest CAGR due to increasing internet penetration and the rising adoption of online shopping platforms. This model simplifies transactions between businesses and end-users, offering convenience, competitive pricing, and personalized shopping experiences. The growing preference for digital payment methods and advancements in mobile commerce further drive the segment's expansion.

Asia-Pacific Region Leads in Digital Marketplace Market

The Asia-Pacific region dominates the digital marketplace market share due to increasing disposable income within the region. The Government of China reports that per capita disposable income in China rose to USD 5,511 in 2023; this is a nominal rise of 6.3% year over year. With increased consumers' purchasing power, it is more likely to spend on discretionary products, one of which are those present on digital marketplaces.

With more free money at hand, consumers are increasingly turning toward online platforms in order to achieve their shopping goals and satisfactions. More demand for goods and services leads to this traffic on digital marketplaces, which thus increases sale volumes and ultimately revenue volume.

In addition, the mounting government activities in the region itself serves as a strong push factor for the digital marketplaces market in the region. In 2022, the Government of India initiated a network called "Open Network for Digital Commerce (ONDC)" with the objective to give equal opportunity to MSMEs to win at digital commerce and democratize e-commerce.

ONDC will enhance innovation and entrepreneurship because it enables MSMEs to demonstrate their products to a greater population. It will ensure more effective participation of MSMEs in the digital marketplace ecosystem, thereby bringing out more competition and diversity into the market.

Moreover, growth in the purchase of mobile phones across the region propels the growth of the market. The International Trade Administration report recorded that purchases of mobile phones in South Korea went from USD 134 billion in 2021 to USD 134.3 billion in 2022.

In addition, as shown by a 2023 Ministry of Science and ICT report 99.96 percent of Korean households were connected to the internet in the year 2022. The increased mobile phone penetration and internet connectivity seamlessly integrate with numerous electronic commerce apps and platforms for consumers to have smooth, easy shopping experiences that enhance the digital marketplace market demand in the region.

North America is anticipated to experience steady growth in The Digital Marketplace Industry

North America is anticipated to witness an increased demand for the market share due to the growth of the e-commerce industry in the region. As per the International Trade Administration, the U.S. e-commerce industry is forecasted to grow at a CAGR of 11.22 percent by 2027.

As more and more customers are opting for online shopping, there is a developing need for easy interfaces that offer an assortment of products and services from numerous sellers. Digital marketplaces are central points where business organizations can interact with the customers, facilitate transactions, and increase their outreach. With the development of electronic commerce, digital marketplaces are expected to grow.

Moreover, the presence of major key players such as Amazon and eBay influences growth of the market. The leaders from this industry have made evidence of their willingness to constantly innovate and change by remaining agile and adaptable within digital commerce.

With their extensive reach, high-tech infrastructure, and good understanding of consumer behavior, Amazon and eBay have captured the top position in the North American market, further fueling the growth of the market.

For example, in January 2024, Amazon collaborated with Meta to integrate ecommerce capabilities into Meta's platforms including Facebook and Instagram. This collaboration is targeting the enhancement of users' shopping experience through product discovery and purchasing directly in the Meta ecosystem.

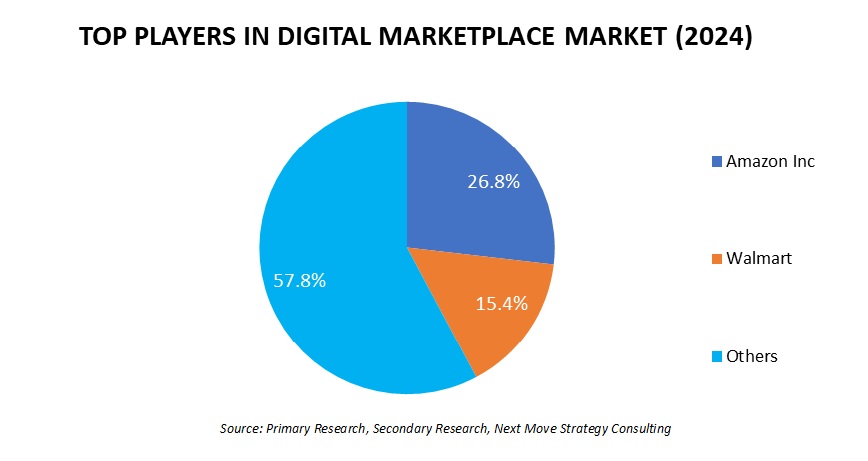

Competitive Landscape

Several key players operating in the global digital e-commerce platforms industry include Amazon Inc., Walmart Inc., eBay Inc., Alibaba Group Holding Limited, Rakuten Group, Inc., Sea Limited, MercadoLibre, Inc., JD.com, Inc., Etsy, Inc., Kogan.com, Seek, Carsales, REA Group Ltd., Airtasker Ltd., Freelancer Ltd., and others. These market players are adopting strategies, such as product launches and partnership to maintain their dominance in this market.

Note: In others we have also analysed the companies such as Kogan.com, Seek, Carsales, REA Group Ltd., Airtasker Ltd., Freelancer Ltd., Hipages Group, and others.

These market players are adopting various strategies including product launches across various regions to maintain their dominance in the digital e-commerce platforms market. By continuously innovating and launching new offerings, they aim to meet the evolving demands of customers and also enables them to capture new opportunities and expand their market share.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

April-24 |

Walmart |

Walmart collaborated with the Jessica Simpson Collection, introducing a new line of boho-chic fashion to its growing assortment. This partnership aimed to expand Walmart's fashion offerings and cater to diverse consumer preferences by providing affordable yet stylish clothing options. |

|

|

April-24 |

Rakuten Group Inc. |

Rakuten Mobile partnered with Radcom to further enhance Rakuten Mobile's network performance and customer experience by leveraging Radcom's advanced network intelligence technology. The collaboration aims to delivering innovative and high-quality telecom services. |

|

|

Mar-24 |

Sea Ltd. |

Shopee an e-commerce platform operated by Sea Ltd., expanded its presence into Mexico with the launch of its mobile app. This marks Shopee's entry into the Mexican online market, offering consumers access to a wide range of products by its easy to use platform. |

|

|

Feb-24 |

Amazon.com |

Amazon.com launched an ecommerce platform in India to capitalize on the country's thriving online shopping landscape. The platform provides an extensive array of products, expanding Amazon's reach in the Indian market. |

|

|

Feb-24 |

JD.com,Inc |

JD.com launched ChatJD, a product similar to ChatGPT that focuses on retail and finance sectors with features including content generation and dialogue capabilities. This aims to enhance user experiences in areas such as product summaries on shopping websites and financial analysis assistance in e-commerce, logistics, and payments. |

|

|

Jan-24 |

Airstaker. |

Airtasker partnered Trustpilot to facilitate its growth in new markets. This partnership underscored Airtasker's commitment to leveraging digital tools and platforms to expand its presence and solidify its position in the competitive landscape of online service marketplaces. |

|

|

Jan-24 |

Etsy |

Etsy launched a new AI-powered "Gift Mode" feature to help shoppers find personalized gifts for any occasion. The interactive tool allows users to enter details about the recipient, such as their interests and relationship to the giver, and then uses Etsy's machine learning technology to suggest relevant gift options from the platforms over 100 million items. |

|

|

Sept-23 |

ebay |

eBay partnered with Noverstock to empower sellers on eBay's platform by providing them with tools and resources to optimize their inventory management and drive growth. |

|

|

June-23 |

REA Group. |

REA Group launched real Estimate automated valuation model, AI-powered features designed to enhance the real estate experience for agents and consumers alike. |

Digital Marketplace Market Key Segments

By Platform

-

Desktop

-

Mobile

-

Tablets

By Model Type

-

Business to Business (B2B)

-

Business to Consumer (B2C)

-

Consumer-to-Consumer (C2C)

By End User

-

Commercial

-

Personal

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Vietnam

-

New Zealand

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Amazon Inc.

-

Walmart Inc.

-

eBay Inc.

-

Alibaba Group Holding Limited

-

Rakuten Group, Inc.

-

Sea Limited

-

MercadoLibre, Inc.

-

JD.com, Inc.

-

Etsy, Inc.

-

Kogan.com

-

Seek

-

Carsales

-

REA Group Ltd.

-

Airtasker Ltd.

-

Freelancer Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 577.16 Billion |

|

Revenue Forecast in 2030 |

USD 1064.90 Billion |

|

Growth Rate |

CAGR of 10.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

30 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst