Europe VPX SBC Market by Forms (Standard and Custom), by Rack Unit (3U and 6U), by Processor (Intel-Based Architecture, NXP Power Architecture, and ARM Architecture), by Processing Power (Low, Medium, and High), by Memory Storage (0-16 GB, 16-32 GB, 32-48 GB, and 48-64 GB), by Switch Fabric (Ethernet, InfiniBand, PCI Express (PCIE), Serial RapidlO (SRIO), and Other Switch Fabrics) and Others– Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 27-Mar-2025 | No of Pages: 309 | No. of Tables: 246 | No. of Figures: 191 | Format: PDF | Report Code : SE3117

US Tariff Impact on Europe VPX SBC Market

Trump Tariffs Are Reshaping Global Business

Europe VPX SBC Market Overview

The Europe VPX SBC Market size was valued at USD 69.9 million in 2024, and is predicted to reach USD 159.5 million by 2030, at a CAGR of 13.6% from 2025 to 2030.

Drivers such as rising defense spending coupled with industry 4.0 adoption propel the market growth. Nevertheless, reliance on imported parts raises product costs that act as a major hindrance to market growth. On the contrary, 5G and AI adoption in VPX SBCs presents lucrative growth prospects for the market in future years.

SBCs offer improved ruggedness, enhanced performance in stressful environments and flexibility to adapt to changing demands, making it ideal for companies looking for dependable, high-performance systems in harsh environments.

Moreover, few notable players such as Curtiss-Wright Corporation, Kontron Ag, and others are pursuing various initiatives as product launches to expand their presence in the market and diversify their offerings. These efforts spur innovation and propels its adoption in different industries, guaranteeing strong growth in the Europe VPX SBC market.

Growing Investment in Defense Modernization Fuels the Growth of the Market

The growing investment in defense modernization as per NATO programs and initiate the Future Combat Air Systems (FCAS), is generating demand for high-performance computing solutions.

These solutions focus on mission-critical applications such as radar systems, surveillance missions, and avionics where rugged, high-performance VPX SBCs are a must to improve efficiency, reliability, and operational performance, thereby driving the Europe VPX SBC market growth.

Rising adoption of Industry 4.0 Drives the VPX SBC Market

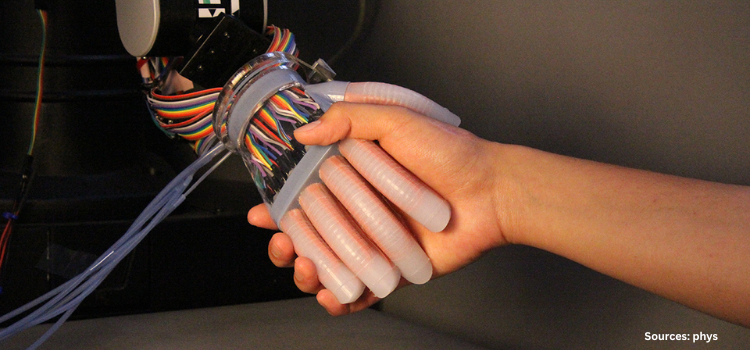

An acceleration of the adoption of VPX SBCs is occurring due to European leadership in Industry 4.0 and smart manufacturing, especially industrial robotics. These systems facilitate real-time data processing and advanced automation to back the region's intention of innovative and efficient manufacturing processes culminating in Europe VPX SBC market expansion.

Import Dependency and Supply Chain Vulnerabilities Holds Back the Market Growth

Small and medium-sized firms reduce access to low-cost solutions and empty the growth of markets. The entire region relies on imported VPX SBC parts, therefore ratcheting up the costs of production and resulting in risks to the supply delays and restricted availability.

Introduction of 5G and AI-enabled SBCs Creates Future Opportunity for the VPX SBCs

The integration of 5G and AI-enabled SBCs is expected to create significant opportunity for the VPX SBC industry. As 5G require high speed, low latency processing, the incorporation of AI enhances SBCs capabilities for complex tasks such as real time data analysis and decision making. VPX SBCs, with their robust architecture, are well equipped to support these advanced applications, driving demand for reliable and scalable solutions in sectors such as telecommunications, defense, and aerospace.

The incorporation of 5G and AI technologies creates a promising growth path for VPX SBCs in future as industries seek powerful, efficient platforms for next generation technologies. For instance, Particle launched Tachyon, the first 5G AI-enabled SBC that features a Qualcomm Snapdragon chipset, addressing the growing need for AI-driven solutions. This innovation is expected to drive interest in VPX SBCs as industries seek powerful, rugged computing solutions, fostering growth and innovation in the market.

Germany Holds the Dominant Market Share in Europe Region

The growth in demand for modernized military platforms and advanced rugged computer solutions required for mission-critical applications stimulates VPX SBC growth. Such solutions allow for real-time data processing, effective communication, and precision for radar and electronic warfare systems that support current military operations.

The defense arena calls for significant investment toward the bolstering of infrastructures for VPX innovation, support, and operation, and thus, have dictated the growth of this market. Yet Germany's extra focus on smart manufacturing and high-end automation drives applications for VPX as they further allow real-time data processing and accurate control of operations; this all allows Germany to also maintain a prominent position as the leader in manufacturing innovations.

Sweden to Witness Substantial Growth in the Europe VPX SBC Market

The developed defense and aerospace industry of Sweden creates a major contribution towards the advancement of a wide range of advanced military technologies and aerospace applications, such as VPX SBCs.

While Sweden invests in developing its defense capabilities, rich demand for rugged, highly reliable embedded systems, such as VPX SBCs, is expected to grow, enabling high-performance applications such as avionics, radar systems, and defense communications. Accordingly, the Swedish government prediction has defense spending to surpass USD 176.72 billion for military defense in 2030.

Additionally, the growing emphasis on industrial automation, particularly in manufacturing and smart grids drives the demand for advanced computing solutions capable of real-time data processing. VPX SBCs with their ability to handle complex automation tasks, predictive maintenance and remote monitoring, are increasingly adopted within Sweden’s industrial sector thereby driving market growth.

Competitive Landscape

The promising players operating in the Europe VPX SBC industry include Curtiss-Wright Defence Solutions, Kontron, Abaco Systems, Mercury Systems, Inc., ADLINK Technology Inc., General Electric Company, Logic Fruit Technologies, Elma Electronic, North Atlantic Industries, Aitech, Extreme Engineering Solutions Inc., General Micro Systems, Inc., Interface Concept, Acromag, EIZO Rugged Solutions and others.

Europe VPX SBC Market Key Segments

By Form

-

Standard

-

Custom

By Rack Unit

-

3U

-

6U

By Processor

-

Intel-Based Architecture

-

NXP Power Architecture

-

ARM Architecture

By Processing Power

-

Low

-

Medium

-

High

By Memory Storage

-

0-16 GB

-

16-32 GB

-

32-48 GB

-

48-64 GB

By Switch Fabric

-

Ethernet

-

InfiniBand

-

PCI Express (PCIE)

-

Serial RapidlO (SRIO)

-

Other Switch Fabrics

By Cooling Mode

-

Air-Cooled

-

Conduction-Cooled

-

Other Cooling Modes

By Application

-

Radar Processing

-

Electronic Warfare

-

Signal Processing

-

Mission Computing

-

Intelligence, Surveillance and Reconnaissance (ISR)

By End-User

-

Military

-

Land Military

-

Naval Military

-

Airforce Military

-

-

Aerospace

-

Industrial

-

Transportation Industrial

-

Telecommunications Industrial

-

Healthcare Industrial

-

Energy Industrial

-

-

Other End User

By Country

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

United Kingdom

-

Russia

-

Sweden

-

Norway

-

Denmark

-

Netherlands

-

Finland

-

Rest of Europe

-

Key Players

-

Curtiss-Wright Defence Solutions

-

Kontron

-

Abaco Systems

-

Mercury Systems, Inc.

-

ADLINK Technology Inc.

-

General Electric Company

-

Logic Fruit Technologies

-

Elma Electronic

-

North Atlantic Industries

-

Aitech

-

Extreme Engineering Solutions, Inc

-

General Micro Systems, Inc.

-

Interface Concept

-

Acromag

-

EIZO Rugged Solutions

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size Value in 2024 |

USD 69.9 million |

|

Revenue Forecast in 2030 |

USD 159.5 million |

|

Value Growth Rate |

CAGR of 13.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

3 |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst