India Elevator Market by Type (Passenger Elevator, and Others), by Technology (Traction and Hydraulic), by Services (New Installation, and others), by Capacity (Less than 1500 KG, and others), by Speed (Less than 1 M/S, and others), by Deck Type (Single Deck and, Double Deck), by Designation Control (Smart, and Conventional), by Door Type (Automatic, and Manual), and by End-User (Residential, Commercial, and Industrial) – Global Opportunity Analysis and Industry Forecast, 2025–2030.

Industry: Construction & Manufacturing | Publish Date: 10-Sep-2025 | No of Pages: 230 | No. of Tables: 186 | No. of Figures: 131 | Format: PDF | Report Code : CM1652

India Elevator Market Overview

India Elevator Market size was valued at USD 2.95 billion in 2024 and is predicted to reach USD 4.84 billion by 2030, registering a CAGR of 7.8% from 2025 to 2030.

The factors such as the rising urbanization, and government initiatives drives the market growth. However, the regulatory challenges, marked by intricate guidelines and stringent compliance standards pose significant challenges to India elevator market expansion. On the contrary, integration of smart technologies, such as IoT and AI, offers promising future opportunities to improve efficiency, safety, and user experience.

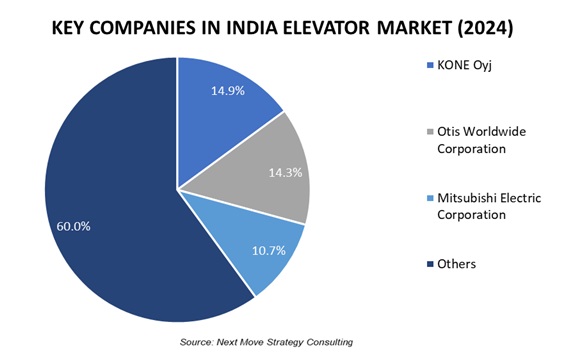

Moreover, the leading companies Kone Oyj, Otis Worldwide Corporation together with others maintain their market expansion through initiatives of business expansion, product launches, and partnership agreements. These initiatives are expected to offer innovation and sustainability in urban development. With AI and IoT integration, the elevator industry in India is rising by creating opportunities for enhanced service delivery and operational efficiency.

Increasing Urbanization Driving Growth in the Elevator Market in India

Rapid urbanization across India continues to be a major catalyst for the expansion of the elevator market. As more individuals migrate to urban areas for employment, education, and better living standards, cities are expanding vertically to accommodate the growing population. This vertical growth has made elevators essential for ensuring efficient, safe, and convenient movement within high-rise residential, commercial, and mixed-use buildings.

The steady rise in India’s urban population is driving the need for enhanced infrastructure, including modern vertical transportation systems. With land becoming scarce in metro and Tier I cities, vertical construction has become a practical solution, making elevators an integral component of urban development. This ongoing trend is expected to maintain strong demand for elevators in both new constructions and retrofit projects across the country.

Growth in Real Estate Development Fuels Elevator Demand in India

The rapid growth of India’s real estate sector is directly influencing the demand for elevators. With a significant increase in residential and commercial construction projects in urban areas, there is a growing need for efficient vertical transportation systems that enhance accessibility and optimize space within buildings. Elevators are now considered standard in most high-rise structures, reflecting their critical role in modern infrastructure.

The rising number of real estate developments—driven by population growth, lifestyle upgrades, and investment in infrastructure—is creating sustained demand for elevators. As the construction of high-density housing, business parks, and retail spaces accelerates, the elevator market in India is expected to continue its upward trajectory, supported by both public and private sector initiatives.

Rising Commodity Prices Hinders Elevator Market Expansion in India

Escalating commodity prices are posing significant challenges for the elevator industry in India. Higher costs for essential raw materials such as metals, electronics, and mechanical components are increasing overall production expenses. In a cost-sensitive market, this makes it more difficult for manufacturers to offer competitively priced solutions, which can discourage developers and contractors from investing in elevator installations.

These rising costs also affect service and maintenance pricing, placing additional pressure on suppliers and maintenance providers to sustain profitability. In turn, this can lead to project delays or cost-cutting on quality and innovation. As the industry navigates these challenges, managing cost volatility will be crucial to maintaining growth momentum in India’s elevator market.

Smart Technology Integration Driving Growth and Innovation in the Elevator Market in India

The integration of smart technologies is transforming the elevator market in India by introducing enhanced efficiency, safety, and functionality. Innovations such as artificial intelligence, IoT-enabled monitoring, and predictive maintenance systems are improving operational performance and minimizing downtime. These technologies align well with the country’s push for smart infrastructure and modern building systems.

With the increasing adoption of intelligent building solutions, the elevator market is evolving toward greater automation and energy efficiency. Touchless controls, real-time data analytics, and seamless integration with building management systems are becoming key differentiators. As urban infrastructure continues to modernize, smart technology is expected to play a central role in shaping the future of India’s elevator industry.

By Type, Passenger Elevator Holds the Dominant Share in India Elevator Market

Passenger elevator holds approximately 45% of India elevator industry. The passenger elevator represents a critical kind of vertical mobility solution designed to raise convenience, security, and the efficiency of transporting passengers across multiple floors in residential buildings, commercial entities, and the public sector. These elevators are equipped with advanced features that include energy-saving motors, control of ride motion, and added safety mechanisms so as to remain reliable and comfort-giving to users.

By Application, Industrial Segment Holds the Highest CAGR of 15%

The industrial elevator application segment in the market is experiencing significant growth due to the increasing need for efficient vertical transportation across various sectors. These elevators are designed to handle heavy loads and facilitate the seamless movement of materials, equipment, and goods across different levels. By improving operational efficiency and reducing manual labor, industrial elevators play a crucial role in supporting industries to meet high production demands and streamline workflows.

Competitive Landscape

The top key players operating in India elevator industry include KONE Oyj, Schindler Group, Otis Worldwide Corporation, Hitachi Ltd. (Hitachi Lift India Pvt. Ltd) , ThyssenKrupp Elevator (India) Private Limited, Johnson Lifts Private Limited, Hyundai Elevators, Mitsubishi Electric Corporation, Fujitec Co., Ltd., Epic Elevators Pvt. Ltd., Omega Elevators, City Lift India Ltd, Escon Elevators Pvt. Ltd, Cibes lift india private limited, Nibav Lifts Private Limited, and others.

These companies are engaged in various business expansion, product launch and partnership across various regions to maintain their dominance in India elevator market.

|

Date |

Company |

Recent Developments |

|

May 2025 |

KONE Oyj |

Secured a major elevator supply contract for the Dubai Residential Clock Tower, one of the world’s tallest residential buildings. |

|

August 2025 |

Schindler Group |

Locked out nearly 300 workers in New South Wales, Australia, due to unresolved pay disputes. The company maintained limited emergency services amid disrupted maintenance |

|

August 2025 |

Otis Worldwide Corporation |

Analysts forecast a rebound in Otis stock, fueled by growing demand in Asia and strength in the service segment. |

|

April 2025 |

Mitsubishi Electric Corporation |

Completed acquisition of Ascension Lifts (Ireland) via subsidiary Motum AB, strengthening its elevator maintenance/renewal business in Europe. |

|

July 2025 |

Fujitec Co., Ltd. |

European investment firm EQT launched a tender offer to acquire an 85% stake, eyeing a takeover valued at approximately $2.6–2.7 billion. |

|

February 2025 |

Omega Elevators |

Completed the installation of a massive 7,000 kg industrial lift at a forging plant in Kolkata. |

|

August 2025

|

City Lift India Ltd.

|

Celebrated its 40th anniversary, marking four decades of vertical mobility solutions in India. During the milestone event, the company reaffirmed its commitment to innovation and launched its “#LiftingTheCities” campaign. Future plans include expanding into Tier II & III cities, doubling revenues, targeting infrastructure projects like metros and airports, and adopting AI/IoT–driven predictive maintenance technologies. |

|

May 2021 |

Mitsubishi Electric Corporation |

Completed construction of a new manufacturing factory to support national demand |

|

July 2024 |

Nibav Lifts Pvt. Ltd |

A consumer publicly reported a serious lift malfunction, where a pneumatic lift dropped unexpectedly; company did not issue a formal recall.

|

Source: Primary Research, Secondary Research, NMSC Analysis

India Elevator Market Key Segments

By Type

-

Passenger Elevator

-

Freight Elevator

-

Other Elevator

By Technology

-

Traction

-

Machine Room (MR) Traction

-

Machine Roomless (MRL) Traction

-

-

Hydraulic

By Service

-

New Installation

-

Maintenance

-

Modernization

By Capacity

-

Less than 1500 KG

-

1500 to 2500 KG

-

2501 to 4000 KG

-

More than 4000 KG

By Speed

-

Less than 1 M/S

-

Between 1 to 4 M/S

-

More than 5 M/S

By Deck Type

-

Single Deck

-

Double Deck

By Designation Control

-

Smart

-

Conventional

By Door Type

-

Automatic

-

Manual

By End-User

-

Residential

-

Low Rise: 10 floors

-

Mid Rise: 11-30 floors

-

High Rise: above 30 floors

-

Affordable Housing

-

Villa/home

-

-

Commercial

-

Airport

-

Hotel & Hospitality

-

Leisure and Education

-

Marine & Port Facilities

-

Medical & Healthcare

-

Multiuse Buildings (Mixed-Use)

-

Retail & Shopping Centers

-

Public Transportation Hubs

-

Office Buildings

-

Low Rise: 10 floors

-

Mid Rise: 11-30 floors

-

High Rise: above 30 floors

-

-

-

Industrial

By State

-

Maharashtra

-

Delhi

-

Tamil Nadu

-

Gujarat

-

Andhra Pradesh

-

Karnataka

-

Kerela

-

Madhya Pradesh

-

Uttar Pradesh

-

West Bengal

-

Remaining States

India Elevator Market Key Players

-

KONE Oyj

-

Schindler Group

-

Otis Worldwide Corporation

-

Hitachi Ltd. (Hitachi Lift India Pvt. Ltd)

-

ThyssenKrupp Elevator (India) Private Limited

-

Johnson Lifts Private Limited

-

Hyundai Elevators

-

Mitsubishi Electric Corporation

-

Fujitec Co., Ltd.

-

Epic Elevators Pvt. Ltd.

-

Omega Elevators

-

City Lift India Ltd

-

Escon Elevators Pvt. Ltd

-

Cibes lift india private limited

-

Nibav Lifts Private Limited

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 2.95 Billion |

|

Revenue Forecast in 2030 |

USD 4.84 Billion |

|

Growth Rate |

CAGR of 7.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst