Intralogistics Market by Component (Hardware, Software, and Services), and by End-User (Logistics, Food and Beverages, Retail and E-Commerce, Automotive, Chemicals, Pharmaceuticals, Airport, and Mining)– Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Construction & Manufacturing | Publish Date: 14-Apr-2025 | No of Pages: 375 | No. of Tables: 272 | No. of Figures: 177 | Format: PDF | Report Code : CM580

US Tariff Impact on Intralogistics Market

Trump Tariffs Are Reshaping Global Business

Intralogistics Market Overview

The global Intralogistics Market size was valued at USD 35.22 billion in 2024 and is predicted to reach USD 79.36 billion by 2030, with a CAGR of 13.8% from 2025 to 2030.

The intralogistics market or internal logistics market is driven by several factors such as rise in online shopping, expansion of automotive sector along with surge in adoption of industrial robots. However, the high operational costs hinder the market growth. On the other hand, the integration of artificial intelligence will enhance opportunity for market development in the future. Key players such as Oriental Motor, Kawasaki Robotics, and others are employing techniques such as product launches and collaboration which is driving the growth of the market.

Surge in Online Shopping Propels the Intralogistics Industry Growth

The rapid growth of the e-commerce market boosts the demand for intralogistics solutions to handle growing numbers of orders, deliver faster and increase customer satisfaction. According to the recent International Trade Administration report, the global B2B e-commerce is expected to grow to USD 36.16 trillion by 2026 from 28.08 trillion in 2024. The increasing online retailing and owing to the presence of omnichannel retailing making efficient warehousing, stock management and order fulfillment process matters, thereby contributing to the intralogistics market expansion.

Expansion of Automotive Sector Drives the Market Growth

The expansion of the automotive industry increases the need to simplify manufacturing operations, control intricate supply chains and deliver components on time that in turn boosts the market growth.

The recent report published by the International Energy Agency states that almost 14 million new electric vehicles are registered at worldwide level in 2023. Thus, the boosting automotive sector requires higher production of vehicles that drives the need for intralogistics solution, thereby boosting the market.

Rise in Adoption of Industrial Robots Accelerates the Market Growth

The growth of the use of industrial robots boosts up the growth of the market by enhancing working efficiency, accuracy, and speed in material handling operations. Industrial robots, such as automated guided vehicles, autonomous mobile robots, and robotic arms, automate processes and diminish reliance on manual workers, eliminate errors, and enhance order fulfillment velocity, solving for the growing need for faster and more efficient material handling processes.

The latest International Federation of Robotics report, states that worldwide average robotics adoption reached 162 units per 10,000 workers in 2023. With industries placing automation as a top priority to manage rising volumes of production and tangled supply chains, the requirements for sophisticated intralogistics solutions with effortless compatibility with such robots are ever on the rise, fueling the intralogistics market growth.

High Initial Investment Restrains the Market Growth

High upfront expenses of sophisticated internal logistics solutions are the prime deterrent to Italy intralogistics sector growth. Automation solutions such as conveyor systems, warehouse management software, mobile robots, and crane systems are expensive to acquire and it is very difficult for small and mid-sized companies to invest in such solutions.

Apart from that, there are recurring costs involved in maintenance, upgrading, and employee training that add the cost factor further. This enormous investment requirement discourages large-scale use, thus limiting the use of advanced intralogistics solutions in numerous industries.

Integration of Artificial Intelligence Offers Promising Opportunities for Market Expansion

The integration of artificial intelligence into intralogistics solutions is anticipated to offer immense opportunities in the upcoming years. Artificial intelligence enabled robots drive independently in warehouse from pickup station to handover station freeing up human workers from repetitive and ergonomically stressful task. For example, in October 2023, Locus Robotics unveiled its artificial intelligence integrated autonomous mobile robots with collaborative adaptability with human partners to help businesses scale affordably and push future automation. Artificial intelligence integration is expected to expand the market growth over the next few years.

By Component, Hardware Dominates the Intralogistics Market Share

In the intralogistics sector, hardware holds the dominant share in the component segment owing to its vital function in guaranteeing efficiency in operation, durability, and reliability in challenging industrial conditions. Key hardware elements, including automated guided vehicles, conveyor systems, robotic arms and storage systems, constitute the core of industrial processes by promoting smooth material movement, effective stock management and expedited order fulfillment.

These systems are designed to be robust against stringent conditions like round the clock operations, heavy loads and varied warehouse environments. The need for high performance and long-lasting hardware solutions is necessitated by the need for higher automation, improved productivity and improved safety in e-commerce automotive and manufacturing sectors. This hardware superiority underscores its role as a driving force of innovation and technological advancement in the internal logistics sector.

By End User, Retail and E-Commerce, Holds the Highest CAGR of 17.2%

E-commerce remains the fastest growing segment behind the highest growth rate in the intralogistics industry, due to high growth of online shopping and the growing need for faster order fulfillment.

As e-commerce companies grow, efficient and automated logistics solutions such as order picking, sorting and last mile delivery become necessary. Inorder to optimize operations and deliver customer expectations for speed and accuracy, sophisticated internal logistics technologies such as robotics and artificial intelligence are being increasingly used.

Europe Region Dominates the Intralogistics Market Share

Europe is the leading region in the market because of the presence of key players that facilitates the intralogistics market demand through the adoption of innovation, automation, and productivity in warehouse and material handling processes. Key players such as Jungheinrich, KION Group, Omron Corporation and others, invest heavily in robotics, artificial intelligence driven warehouse solutions, and autonomous mobile robots to enhance operating productivity and keep costs of labor within control. For example, in August 2023, the OMRON collaborated with ARENA2036 for automation, robotics and artificial intelligence driven material handling solutions. Strategic collaborations by industry leaders help fuel market growth in the region.

In addition, the growth of the chemical industry within the region increases the need for internal logistics by propelling the demand for safe, efficient, and automated management of raw materials, dangerous materials, and products in manufacturing and warehousing facilities. The recent report of Chemical Industries Association, the UK chemical export totals USD 76.42 billion in 2024. This rise in chemical sector growth boosts the need for advanced internal logistics solutions to optimize material flow, improve warehouse management, and meet rigorous safety regulations, thereby propelling the market growth.

Asia-Pacific is Expected to Show a Steady Growth in the Intralogistics Market

Asia Pacific region is expected to witness a steady growth within the intralogistics sector during the forecast period. This is driven by a rise in the growth of the automotive sector propels the market growth by enhancing the demand for efficient material handling, inventory management, and streamlined production procedures.

The latest report of International Trade Administration, China possesses the world's largest vehicle market with domestic output expected to grow to 35 million units by 2025. The surging expansion of the automotive sector fuels the market expansion to enhance operational efficiency, supply chain management, and accommodate the complex logistics of car manufacturing lines.

Also, the increasing demand for online shopping boosts market growth by mandating faster and more efficient picking and inventory. Internal logistics technology delivers higher picking accuracy, reduce processing time and fully utilize the storage capacity of a warehouse that helps businesses keep pace with customers' expectations to receive speedy delivery.

The report of the Ministry of Commerce and Industry states that the Indian e-commerce market will be worth USD 325 billion by 2030. Thus, growth in online shopping improves market creation for warehouse operation optimization and order fulfillment maximization.

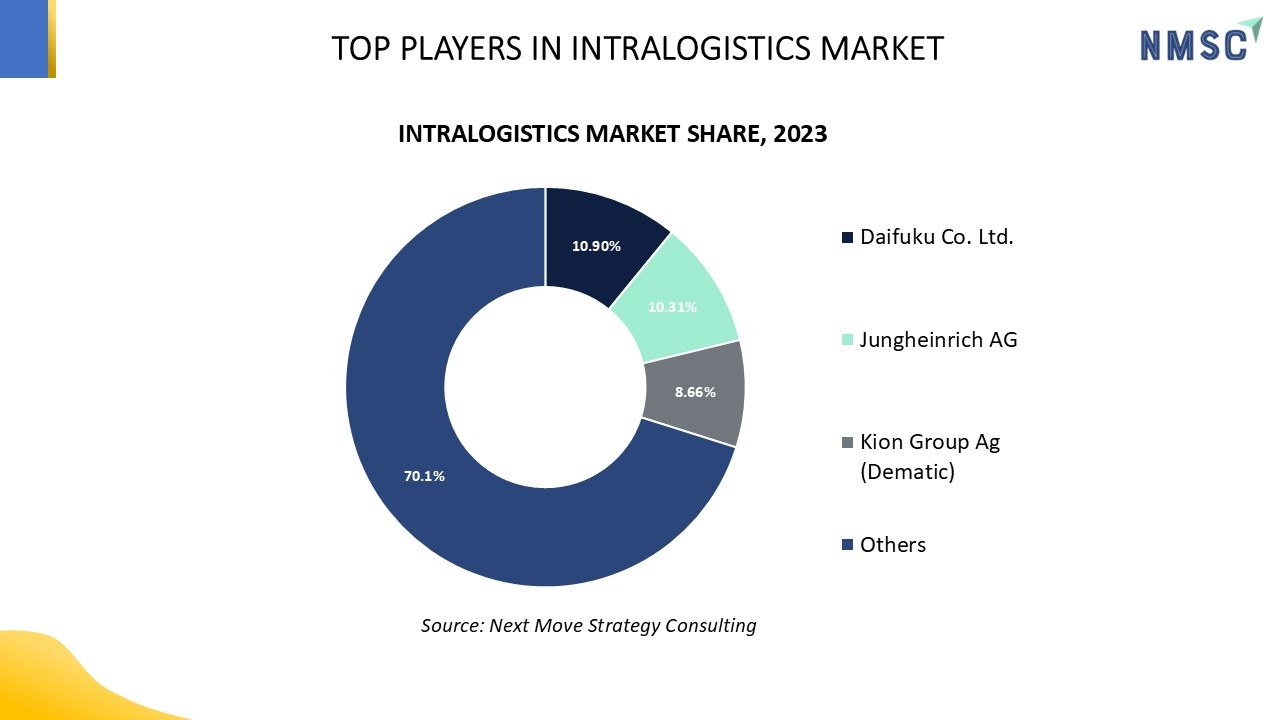

Competitive Landscape

Several key market players operating in the intralogistics industry includes AutoStore Systems, Jungheinrich AG, Honeywell International Inc., Midea Group (KUKA AG + Swisslog), SSI Schafer, KION Group (Dematic), Vanderlande Industries B.V., Daifuku Co., Ltd., Knapp AG, Krones Group, BEUMER Group, KEBA Group AG, TGW Logistics, Siemens AG, GEBHARDT Fördertechnik GmbH, Haclin Group, STILL GmbH, Rhenus Group, Varova Oy, Seacon Logistics, Hanel Corporation, Yusen Logistics, Bowe Intralogistics, DB Group, SVH Corporation and others.

Note: For the latest market share analysis and in-depth intralogistics industry insights, you can reach out to us.

These market players are adopting various strategies, including product launches and partnership across various regions to maintain their dominance in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

November, 2024 |

Oriental Motor |

Oriental Motor released its OVR Series industrial robots that are available in articulated, SCARA, and Cartesian forms. The newly developed MRCU Series Integrated Robot Controller maximizes the system efficiency by integrating various drivers into one. The introduction is meant to improve automation procedures in various industries. |

|

September, 2024 |

Kawasaki Robotics |

Kawasaki Robotics and NEURA Robotics launched the CL Series, a line of high-precision, industrial-grade collaborative robots. The cobots are designed to deliver industrial-scale performance and speed with the safety and flexibility benefits of human-robot collaboration. |

|

July, 2024 |

Rapyuta Robotics Inc. |

Rapyuta Robotics Inc., one of the leading logistics solution providers, announced bringing its Automated Storage and Retrieval System to the American market. The system records up to ten-fold increases in picking productivity and 2.5 times more effective storage compared to manual systems. |

|

July 2024 |

Comau S.p.A. |

Comau collaborated with One Equity Partners to fuel growth in industrial automation business. The partnership will increase Comau's strength in robotics, digital manufacturing, and logistics automation to expand its position in developing intralogistics market. |

|

October 2023 |

AutoStore Systems AS |

AutoStore introduced the R5 Pro robot, upgrading intralogistics market automation with improved high-throughput warehouse performance. Its advanced features enhanced efficiency, maximized storage and simplified order picking, fueling growth in automated storage and retrieval system adoption in warehouses. |

Intralogistics Market Key Segments

By Component

-

Hardware

-

Automated Storage and Retrieval Systems (AS/RS)

-

Unit-Load AS/RS

-

Mini-Load AS/RS

-

Vertical Lift Modules (VLMs)

-

Carousel AS/RS

-

-

Industrial Robots

-

Mobile Robots

-

Automated Guided Vehicle (AGV)

-

Autonomous Mobile Robot (AMR)

-

-

Conveyor Systems

-

Sortation Systems

-

-

Software

-

Warehouse Management System (WMS)

-

Transportation Management System (TMS)

-

Yard Management Software

-

Inventory Management Software

-

Labor Management Software

-

Others

-

-

Services

By End-User

-

Logistics

-

Food And Beverages

-

Retail And E-Commerce

-

Automotive

-

Chemicals

-

Pharmaceuticals

-

Airport

-

Mining

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

AutoStore Systems

-

Jungheinrich AG

-

Honeywell International Inc.

-

Midea Group (KUKA AG + Swisslog)

-

SSI Schafer

-

KION Group (Dematic)

-

Vanderlande Industries B.V.

-

Daifuku Co., Ltd.

-

Knapp AG

-

Krones Group

-

BEUMER Group

-

KEBA Group AG

-

TGW Logistics

-

Siemens AG

-

GEBHARDT Fördertechnik GmbH

-

Haclin Group

-

STILL GmbH

-

Rhenus Group

-

Varova Oy

-

Seacon Logistics

-

Hanel Corporation

-

Yusen Logistics

-

Bowe Intralogistics

-

DB Group

-

SVH Corporation

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 35.22 Billion |

|

Revenue Forecast in 2030 |

USD 79.36 Billion |

|

Growth Rate |

CAGR of 13.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

25 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst