Italy Intralogistics Software Market by Component (Software (Warehouse Management System, Transportation Management System, and Others), and Services), by Technology (Internet of Things, Artificial Intelligence, Big Data Analytics, Cloud Security, Digital Twins, and Others), by Deployment Mode (On-Premises and Cloud-Based), and by End-User (Retail and E-commerce, Automotive, Food and Beverage, Pharmaceuticals, Aviation, Logistic, and Others)–Opportunity Analysis and Industry Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 17-Mar-2025 | No of Pages: 186 | No. of Tables: 147 | No. of Figures: 72 | Format: PDF | Report Code : IC3083

US Tariff Impact on Italy Intralogistics Software Market

Trump Tariffs Are Reshaping Global Business

Italy Intralogistics Software Market Overview

Italy Intralogistics Software Market size was valued at USD 704.0 million in 2024 and is predicted to reach USD 1251.0 million by 2030, registering a CAGR of 9.3% from 2025 to 2030.

The market is fueled by drivers such as expansion of e-commerce business, rapid growth of the automobile industry, and innovative strategies pursued by the prominent players. However, the regulatory framework relating to data protection, privacy, and compliance impedes the development of the market.

On the other hand, the implementation of new technologies such as artificial intelligence (AI) offers opportunity in the future growth of the market as companies want to improve automation, streamline supply chain processes, and make better decisions. Additionally, the market leaders such as Generix Group S.A., System Logistics S.p.A., Zucchetti S.p.A., etc. implement several development strategies in order to hold their position in the market.

Rising E-Commerce Drives Demand for Intralogistics Software Solutions

The growth of e-commerce in Italy is fueling the rise of sophisticated intralogistics software solutions to ensure effective warehouse management, real time tracking or stock management and order fulfillment automation. A recent B2B eCommerce Association report states that the Italian eCommerce activity is forecasted to grow 57% annually in the years 2023 to 2028. Such rapid expansion accelerates Italian businesses to adopt smart logistics solutions in order to be capable of maintaining competitiveness within the emerging digital marketplace.

Rapidly Expanding Automotive Sector Fuels the Market Growth

The thriving automotive sector is fueling the growth of the industry as automotive manufacturing companies are increasingly embracing intralogistics software to automate the handling of inventories and ensure in-time supply of components. The European Automobile Manufacturers Association indicates that, Italy manufactured around 1.5 million vehicles in 2023 from 1.3 million in 2022 that is a growth of around 19% within one year. This increase in car manufacturing reflects the importance of intralogistics software in promoting smooth material handling and thereby driving the Italy intralogistics software market expansion.

Innovative Initiatives Taken by Key Players Further Boost the Market Growth

The innovative initiatives taken by key players further boost the Italy intralogistics software market growth due to their focus on enhancing automation and real-time data analytics in warehouse management. The increasing demand for seamless supply chain operations led companies to invest in advanced technologies to improve efficiency and reduce operational costs. For example, in March 2023, CLS iMation launched GEMINI, a software suite designed to create added-value solutions in intralogistics and factory logistics. The continuous development of logistics solutions by market players is transforming the industry, enabling businesses to meet evolving demands and maintain a competitive edge in the rapidly growing market

Complex Regulatory Environment Hinders the Growth of The Market

The intricate regulatory structure related to data security, privacy, and compliance slows down the development of the market as enterprises struggle to maintain compliance with strict legal protocols. Laws such as the General Data Protection Regulation (GDPR) place strict directives on data handling, requiring firm security protocols that increase complexity and expenses in putting new software systems in place. It takes substantial investments in cybersecurity, system upgrades, and legal counsel to comply with these changing regulations, and hence, it becomes challenging for businesses, particularly small and medium-sized businesses (SMEs), to implement sophisticated intralogistics solutions smoothly.

Adoption Of Advanced Technologies Creates Significant Growth Opportunities for The Market

The incorporation of cutting-edge technologies, such as artificial intelligence (AI), is a massive future growth opportunity for the market as companies pursue increasing automation, supply chain optimization, and smarter decision-making processes. AI solutions facilitate predictive analysis, real-time inventory monitoring, and smart route optimization, thus enabling companies to automate logistics processes and minimize inefficiencies in their operations. As businesses increasingly focus on digitalization, the adoption of AI-based intralogistics software is likely to propel efficiency, cost reduction, and overall market growth in the future.

By Component, Software Holds the Dominant Share in the Italy Intralogistics Software Market

Software maintains a dominant in Italy intralogistics software market share owing to the increased demand for automation, real-time analytics, and efficiency in operations. Companies are using warehouse management systems, artificial intelligence, and IoT-based solutions in increasing numbers to automate tracking of inventory, enhance workflows, and make informed decisions, thereby resulting in cost reduction and greater productivity.

By Technology, Artificial Intelligence, Holds the Highest CAGR of 10.9%

Artificial intelligence makes a contribution toward attaining the fastest growth rate in Italy's intralogistics software market due to its power to improve automation of warehouses, streamline resource usage, and maximize decision-making via real-time analysis of data. As companies emphasize digital transformation in order to adapt to increasing Italy intralogistics software market demands in logistics, AI adoption within intralogistics software keeps gaining momentum, placing it as Italy's fastest-growing sector.

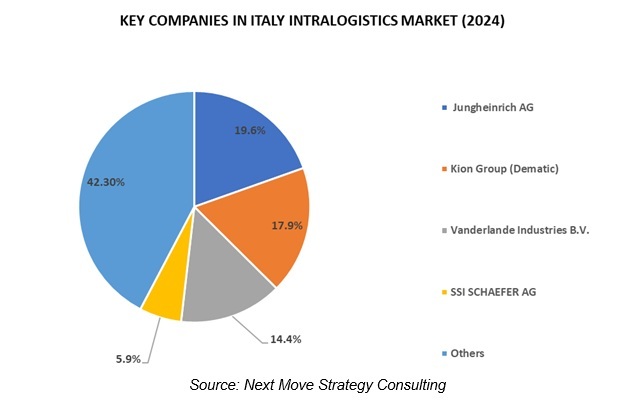

Competitive Landscape

The promising key players operating in the Italy Intralogistics software industry include Generix Group S.A., System Logistics S.p.A., Zucchetti S.p.A., Dematic GmbH, SSI Schaefer Group, Vanderlande Industries B.V., TGW Logistics Group GmbH, AutoStore AS, Jungheinrich AG, Knapp AG, Bastian Solutions LLC, Muratec (Murata Machinery, Ltd.), Honeywell Intelligrated, Errevi Automation S.r.l., Leuze Electronic Pvt. Ltd., Conductix-Wampfler Group, LCS Group S.p.A., Ferretto Group S.p.A., CMC Intralogistics S.r.l., Mecalux S.A., among others.

Other companies include Fives Group, Swisslog, and others. These companies are engaged in various product launch and partnership across to maintain their dominance in the Italy intralogistics software industry.

For instance, in February 2023, TGW Group launched Plancise, a software solution designed to enhance the planning and optimization processes within logistics and supply chain management.

Italy Intralogistics Software Market Key Segments

By Component

-

Software

-

Warehouse Management System (WMS)

-

Transportation Management System (TMS)

-

Yard Management Software

-

Inventory Management Software

-

Labor Management Software

-

Others

-

-

Services

By Technology

-

Internet Of Things (IoT)

-

Artificial Intelligence (AI)

-

Big Data Analytics

-

Cloud Security

-

Digital Twins

-

Others

By Deployment Mode

-

On-Premises

-

Cloud-Based

By End-User

-

Retail and E-commerce

-

Automotive

-

Food and Beverage

-

Pharmaceuticals

-

Aviation

-

Logistics

-

Others

Italy Intralogistics Software Market Key Players

-

Generix Group S.A.

-

System Logistics S.p.A.

-

Zucchetti S.p.A.

-

Dematic GmbH

-

SSI Schaefer Group

-

Vanderlande Industries B.V.

-

TGW Logistics Group GmbH

-

AutoStore AS

-

Jungheinrich AG

-

Knapp AG

-

Bastian Solutions LLC

-

Muratec (Murata Machinery, Ltd.)

-

Honeywell Intelligrated

-

Errevi Automation S.r.l.

-

Leuze Electronic Pvt. Ltd.

-

Conductix-Wampfler Group

-

LCS Group S.p.A.

-

Ferretto Group S.p.A.

-

CMC Intralogistics S.r.l.

-

Mecalux S.A.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 704.0 Million |

|

Revenue Forecast in 2030 |

USD 1251.0 Million |

|

Growth Rate |

CAGR of 9.3% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst