Metalworking Fluids Market by Type (Mineral, Synthetic, and Bio-based), by Function (Neat Cutting Oils, Water Cutting Oils, Corrosion Preventive Oils, and Others), by Application (Construction, Electrical & Power, Agriculture, Automotive & Transportation, Telecommunication, and Healthcare), and by End-User (Metal Fabrication, Transportation Equipment, Machinery, and Others)- Global Opportunity Analysis and Industry Forecast 2024-2030

US Tariff Impact on Metalworking Fluids Market

Trump Tariffs Are Reshaping Global Business

Market Definition

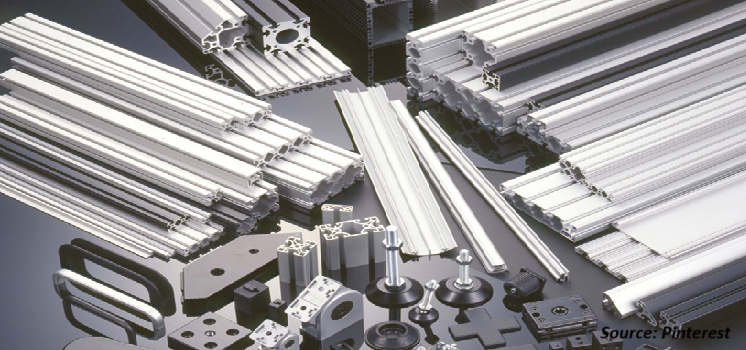

The Metalworking Fluids Market size was valued at USD 11.1 billion in 2023 and is predicted to reach USD 15.1 billion by 2030 with a CAGR of 4.5% from 2024-2030. Metalworking fluids, also known as coolants or lubricants, are used in industrial metalworking operations to cool and lubricate the metals during the cutting and grinding process. These fluids can be made from a variety of substances, including water, oil, and synthetic compounds. Metalworking fluids are used in a wide range of manufacturing operations including drilling, turning, milling, and grinding.

These fluids are applied to the workpiece and cutting tool to reduce friction and heat that is generated during the cutting and grinding process. This helps to extend the life of the cutting tool, increase the efficiency and precision of the grinding operations, and improve the surface finish of the finished product. Metalworking fluids are also used to complete other important functions such as rust inhibition, corrosion inhibition, and bacteria control.

Market Dynamics and Trends

The demand for metalworking fluids is significantly boosted due to the growing automotive and aerospace industries across the globe. As per the latest report published by the International Organization of Motor Vehicle Manufacturers, about 85 million vehicles were sold in 2022 as compared to about 80 million in 2021. These industries serve as major consumers of metalworking fluids in various manufacturing processes, including cutting, grinding, and stamping of metals. The increasing production and operations in these sectors contribute to the heightened demand for metalworking fluids to facilitate efficient and effective manufacturing processes.

Moreover, the growth of the metalworking fluids market is further propelled by stringent government regulations promoting workplace safety. These regulations promote the use of safe metalworking fluids to ensure the well-being of both workers and the environment. The emphasis on compliance with safety standards and environmentally friendly practices is contributing to an increased adoption of metalworking fluids to minimize the impact of industrial processes.

Furthermore, the development of bio-based fluids such as plant oils and animal fats is further driving the growth of the metalworking fluids market. These bio-based alternatives are gaining popularity due to their environmentally friendly nature and lower toxicity levels compared to other fluids. The shift toward bio-based metalworking fluids, as industries seek alternatives that minimize environmental impact while maintaining effective performance, is boosting the demand for bio-based metalworking fluids.

However, the risk of skin cancer caused by metal working fluids along with its harmful impacts on the environment are the major factors restraining the growth of the market. On the contrary, the introduction of biodegradable synthetic fluids and smart fluids that can monitor and adjust according to the changes in temperature are expected to create ample opportunities in the coming years in the metalworking fluids market.

Market Segmentations and Scope of the Study

The metalworking fluids market share is segmented based on type, function, application, end users, and region. Based on type, the market is divided into mineral, synthetic, and bio-based. Based on function, the market is classified into neat-cutting oils, water-cutting oils, corrosion preventive oils, and others.

Based on application, the market is segmented into construction, electrical & power, agriculture, automotive & transportation, telecommunication, and healthcare. Based on end-users, the market is segmented into metal fabrication, transportation equipment, machinery, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

Asia Pacific holds the dominant share of the metalworking fluids market and is expected to continue its dominance during the forecast period. This is attributed to factors such as the increasing demand for metalworking fluids from automotive industries to cool and lubricate cutting and grinding tools during the manufacturing of vehicle components.

According to the Ministry of Industry and Information Technology, China is the largest automotive manufacturing country in the world with a sale of 25 million vehicles in 2020 and it is expected to reach 35 million vehicles by 2025. This robust presence of the automotive industry in the Asia Pacific contributes significantly to the growing demand for the metalworking fluids market in the region.

Moreover, the rapidly growing demand for electricity and power in the Asia Pacific region is further propelling the growth of the metalworking fluid market. According to World Energy & Climate Statistics, China is the largest electricity consumer with 31% of global electricity consumption in 2021. As the economies in the region continue to grow and industrialize, the demand for industrial equipment and fluids is poised to rise, creating a lucrative opportunity for the growth of the market.

On the other hand, North America is expected to show steady growth in the metalworking fluids market due to the presence of a well-established healthcare industry and the ongoing increase in research and development (R&D) activities focused on advanced medical equipment. According to the latest report from the U.S. Department of Commerce, healthcare spending in the United States reached USD 4.5 trillion in 2022, reflecting a growth rate of 4.1% compared to the previous year. This robust healthcare sector in North America contributes to the demand for metalworking fluids, which play a crucial role in the manufacturing processes of medical equipment and devices.

Moreover, the rising development construction industry due to the strong housing market along with the increasing government investment in public infrastructures is further driving the growth of the metalworking fluids market. For instance, in May 2023, the government of the U.S. announced to invest USD 220 billion in 32,000 infrastructure projects across 4,500 communities across the country. These infrastructure projects range from transportation networks and utility upgrades to community development.

Competitive Landscape

Various market players operating in the metalworking fluids industry include Houghton International Inc., Blaser Swisslube AG, BP plc, Exxon Mobil Corp., Total S.A., Fuchs Petrolub SE, Chevron Corp., China Petroleum & Chemical Corp., Kuwait Petroleum Corp., Castrol, Chevron Phillips Chemical, Clariant, Quaker Chemical Corporation, Master Fluid Solution, Biosynthetic Technologies, and others. These market players are adopting product launches to remain dominant in the metalworking fluids market.

For instance, in September 2022, Clariant launched several additives to develop lubricity fully synthetic metalworking fluids. Through this launch, the company aims to extend its support to manufacturers of synthetic metalworking solutions in the development of highly efficient metalworking fluids.

Moreover, in October 2020, Biosynthetic Technologies launched a new line of Oleo-derived high-performance bio-based additives for metalworking fluid application. This new Biocea additive was produced with naturally derived oils that improve the quality of formulated metalworking fluids and are also biobased and biodegradable.

Key Benefits

-

The report provides quantitative analysis and estimations of the metalworking fluids market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep dive analysis of the metalworking fluids market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the metalworking fluids market is provided in the report.

-

A competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porter's Five Forces model are elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of the roles of stakeholders.

Metalworking Fluids Market Key Segments

By Type

-

Mineral

-

Synthetic

-

Bio-based

By Function

-

Neat Cutting Oils

-

Water Cutting Oils

-

Corrosion Preventive Oils

-

Others

By Application

-

Construction

-

Electrical & Power

-

Agriculture

-

Automotive & Transportation

-

Telecommunication

-

Healthcare

By End-user

-

Metal Fabrication

-

Transportation Equipment

-

Machinery

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players:

-

Houghton International Inc

-

Blaser Swisslube AG

-

BP plc

-

Exxon Mobil Corp

-

Total S.A

-

Fuchs Petrolub SE

-

Chevron Corp

-

China Petroleum & Chemical Corp

-

Kuwait Petroleum Corp

-

Castrol

-

Chevron Phillips Chemical

-

Clariant

-

Quaker Chemical Corporation

-

Master Fluid Solution

-

Biosynthetic Technologies

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 11.1 Billion |

|

Revenue Forecast in 2030 |

USD 15.1 Billion |

|

Growth Rate |

CAGR of 4.5% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst