Military Computer Market by Component (Hardware, Software, and Service), by Product Type (Rugged Computers, Embedded Computers, and Wearable Computers), by Application (Command and Control Systems, Communication Systems, Combat and Tactical Operations, Intelligence, Surveillance, and Reconnaissance (ISR) Systems, and Others), and by End User (Army, Navy, and Air Force)– Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Aerospace & Defense | Publish Date: 10-Oct-2025 | No of Pages: 416 | No. of Tables: 323 | No. of Figures: 248 | Format: PDF | Report Code : AD2918

Military Computer Market Overview

The global Military Computer Market size was valued at USD 10.25 billion in 2024 and is predicted to reach USD 15.33 billion by 2030, with a CAGR of 6.3% from 2025 to 2030.

The military computer market involves advanced computing systems specifically designed for defense and military applications to cover command and control, communications, intelligence gathering, and mission-critical operations.

Defense computers are distinguished by rugged design, high-performance capabilities, and rugged environment capacity for functionality in hostile environments, including extreme temperatures, vibrations, and electromagnetic interference. The benefit of defense computing is the sharpening of good decision-making procedures by proper information analysis, productivity enhancement, upgraded situational awareness, and much support for any complex and fluid military operation.

Increasing Investments In Defense Modernization Fuel Market Growth

Rising global investments in defense modernization are a key factor driving the growth of the military computer market. Governments and defense agencies around the world are significantly expanding their military budgets to strengthen national security, address evolving threats, and maintain strategic superiority. A considerable portion of these investments is being directed toward advanced digital infrastructure, including high-performance military computers.

These systems play a crucial role in modern warfare, supporting a wide range of applications such as command and control, cybersecurity, surveillance, and autonomous weapon systems. As armed forces adopt technologies like artificial intelligence, machine learning, and network-centric operations, the demand for powerful, reliable, and interoperable computing platforms continues to rise. This ongoing trend toward digital transformation in defense operations is expected to sustain long-term market growth.

Technological Advancements In Military Computing Enhance Operational Efficiency

Continuous advancements in military computer technologies are significantly boosting the market by enhancing system performance, durability, and mission adaptability. Military-grade computers are now being designed to operate in extreme environments while offering modular and scalable configurations to meet a wide range of tactical requirements.

Recent innovations include the development of rugged systems with detachable computing modules, which enable faster upgrades, field-level maintenance, and cross-platform compatibility. These advancements improve operational flexibility and allow for seamless integration with various military platforms, including ground vehicles, naval vessels, and aircraft.

Moreover, the integration of edge computing, embedded AI, and secure communication protocols further enhances the capabilities of military computers in terms of real-time analytics, situational awareness, and decision-making. As a result, these innovations are contributing to more agile, informed, and resilient military operations.

Risk Of Cybersecurity Threats As A Major Restraint On The Growth Of The Military Computer MarketCybersecurity Risk Restrains The Military Computer Market Growth

The growing risk of cybersecurity threats poses a significant challenge to the expansion of the military computer market. As defense operations increasingly depend on digital systems, cloud-based platforms, and real-time data exchange, military computers become highly susceptible to cyber intrusions. The convergence of technologies such as artificial intelligence, Internet of Things (IoT), and cloud computing in modern military systems introduces a wide range of potential vulnerabilities.

Military computers often serve as the backbone of command, control, communication, intelligence, surveillance, and reconnaissance (C4ISR) operations. The integration of networked sensors, unmanned systems, and battlefield communication technologies creates multiple attack surfaces that can be targeted by malicious actors, including cybercriminals, terrorist organizations, and state-sponsored entities. A successful breach could lead to the manipulation or destruction of mission-critical systems, unauthorized access to classified data, or even the sabotage of operational capabilities.

Furthermore, the complex and global nature of supply chains in military computing introduces additional cybersecurity risks. Components sourced from various vendors may be exposed to tampering or may contain embedded vulnerabilities that could be exploited after deployment.

Integration Of Artificial Intelligence And Machine Learning Technologies Unlocks Future Market Potential

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to revolutionize the military computer market by unlocking a new era of advanced defense capabilities. These technologies are transforming military computing systems from traditional data processors into intelligent platforms capable of autonomous decision-making, real-time threat analysis, and mission-critical automation.

AI and ML are being increasingly embedded into military computing systems to enhance operational efficiency, speed, and precision in battlefield scenarios. For instance, AI algorithms can rapidly process and interpret vast datasets—including satellite imagery, surveillance feeds, radar signals, and intelligence reports—providing defense personnel with actionable insights and significantly reducing decision-making latency. This real-time analytical capability supports superior situational awareness, threat identification, and mission planning.

Furthermore, ML models continuously learn from operational data and evolving threat patterns, enabling military computers to adapt to dynamic combat environments and improve performance over time. This self-improving capability is especially critical in areas such as cyber defense, electronic warfare, and intelligence analysis, where new threats emerge rapidly.

By Component, Hardware Holds the Dominant Share in the Military Computer Market

In the military computer sector, hardware dominates with 53.07% share. This dominance is drive by essential role hardware plays in ensuring performance, reliability and durability of defense computer in demanding environments.

Defense computer require robust, high-performance hardware to withstand extreme conditions such as high temperatures, vibration, and dust. The increasing need for high performance computing systems in military defense forces globally reflects about the dominance of hardware in defense computer market, making a central element of innovation and technological advancement in the sector.

By Product Type, Wearable Computers, holds the highest CAGR of 19.5%

The wearable computer segment within the product type is expected to grow at a CAGR of 19.5% driven by transformative application in defense operations. These wearable devices empower military personnels with hands free access to mission critical information, real time data processing, and enhanced situational awareness on the battlefield.

Their compact, lightweight design ensures mobility and comfort while advanced features such as augmented reality integration, GPS, and secure communication channels streamline decision making in high pressure scenarios.

North American Region Dominates the Military Computer Market

North America dominates the military computer market share due to the presence of large defense sector that drives the market growth by fostering substantial investment in advanced technologies and modernization programs. The report by the Aerospace Industries Association has reported that the U.S. aerospace and defense sector reached USD 955 billion in 2023, an increase of 7.1% from 2022. The growth of defense sector in the region boosts the adoption of defense computer for meeting up the technological requirement of the modern warfare and defense operations.

Additionally, the growing demand for advanced autonomous drones and other tactical weapon in the region drives the market growth as these systems rely on high performance computing to enable real time data processing navigation and mission execution. For instance, in December 2023, the Government of Canada announced to invest around USD 2.49 billion investment in Remotely Piloted Aircraft Systems for Canadian Armed Force. Such initiative aims to enhance surveillance and operational support capabilities, modernize defense equipment and improve interoperability with the U.S. and NATO forces, further accelerating the demand for military computers to support defense technologies.

Asia-Pacific is Expected to Show a Steady Growth in the Military Computer Market

Asia Pacific region is expected to witness a steady rise in the military computers market during the forecast period. This is due to rise in military capability in the region that drives the demand for modern defense technology to facilitate communication, intelligence, surveillance, and operational efficiency.

As per the report of Lowy Institute Asia Power Index, China score around 69.7 in 2024, that is an increase of 4.3% growth compared to 2021. This rise in military capability increase the adoption of defense computer to improve defense operation and maintain strategic advantage.

Furthermore, the growth of defense manufacturing sector in the region propels the market growth as modern defense equipment and systems requires advanced computing capabilities for effective operation.

According to reports published by Ministry of Commerce and Industry in 2024, India's defense manufacturing sector is growing rapidly, with production reaching USD 12.82 billion and exports rising to USD 1.36 billion in 2023. As defense manufacturers in the region expand production to meet the rising security demands, the requirement for advanced defense computing solutions accelerates, thereby boosting the market growth.

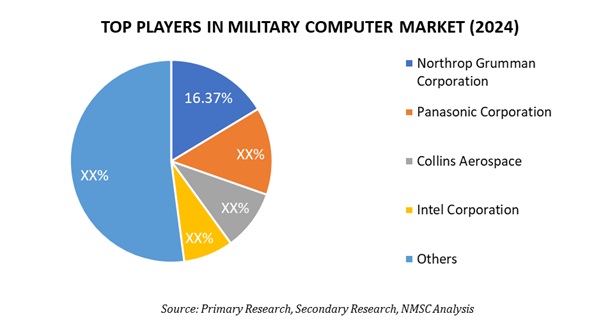

Competitive Landscape

Several key market players operating in the military computer industry includes Intel Corporation, Bae Systems, Microchip Technology Inc., Elbit Systems Ltd., Northrop Grumman Corporation, Getac Technology Corporation, General Dynamics Corporation, Rtx (Collins Aerospace), Curtiss-Wright Corporation, Panasonic Corporation, and others.

These market players are adopting various strategies, including product launches across various regions to maintain their dominance in the market.

|

DATE |

COMPANY |

|

|

August 2025 |

BAE Systems |

BAE Systems announced a modernization investment in its Nashua, New Hampshire Microelectronics Center (MEC), which will upgrade tools, expand capacity, speed delivery and reduce costs for U.S. Defense-related semiconductor production. The upgraded MEC is one of the few U.S. defense-centric foundries capable of handling GaAs / GaN / HEMT devices for military applications. |

|

September 2025 |

Northrop Grumman Corporation |

Northrop unveiled its Prism software / AI testbed aircraft (modified Model 437 Vanguard) which is slated to fly and demonstrate plug-and-play mission software modules—i.e. modular computing, mission adaptability.The Prism architecture is intended to allow partners to attach different computing or sensor modules, thereby advancing modular, software-centric defense systems.

|

Military Computer Market Key Segments

By Component

-

Hardware

-

Processors

-

Input/Output Devices

-

Others

-

-

Software

-

Operating Systems

-

Application Software

-

-

Service

By Product Type

-

Rugged Computers

-

Rugged Laptops

-

Rugged Tablets

-

Rugged Displays

-

Rugged Handhelds

-

-

Embedded Computers

-

Wearable Computers

By Application

-

Command and Control Systems

-

Communication Systems

-

Combat and Tactical Operations

-

Intelligence, Surveillance, and Reconnaissance (ISR) Systems

-

Others

By End User

-

Army

-

Navy

-

Air Force

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Intel Corporation

-

Bae Systems

-

Microchip Technology Inc.

-

Elbit Systems Ltd.

-

Northrop Grumman Corporation

-

Getac Technology Corporation

-

General Dynamics Corporation

-

Rtx (Collins Aerospace)

-

Curtiss-Wright Corporation

-

Panasonic Corporation

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 10.25 Billion |

|

Revenue Forecast in 2030 |

USD 15.33 Billion |

|

Growth Rate |

CAGR of 6.3% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst