Pet Food Ingredients Market by Type (Non-Vegan, Vegan, and Novel Proteins), by Nature (Organic and Inorganic), by Form (Dry and Wet), by Pet Type (Dog, Cat and Others), and by Distribution Channel (Online and Offline) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Retail and Consumer | Publish Date: 10-Sep-2025 | No of Pages: 622 | No. of Tables: 524 | No. of Figures: 492 | Format: PDF | Report Code : RC2616

Pet Food Ingredients Market Overview

The global Pet Food Ingredients Market size was valued at USD 37.16 billion in 2023 and is predicted to reach USD 67.23 billion by 2030, registering a CAGR of 8.4% from 2024 to 2030. In terms of volume the market size was 7,549 kilotons in 2023 and is projected to reach 11,104 kilotons in 2030, with a CAGR of 5.29% from 2024 to 2030.

The pet food ingredients market refers to the raw materials used to formulate pet foods that meet the nutritional requirements of various pet species. These ingredients include proteins, carbohydrates, fats, vitamins, and minerals, sourced from both plant and animal origins, and are processed to improve their nutritional content and flavor.

Using high-quality ingredients is important for promoting pet health and growth, as they provide the necessary nutrients for specific dietary needs and health conditions. The emphasis on pet health drives advancements in ingredient sourcing and processing methods, leading to improved nutritional quality and better formulations in pet food products.

Rising Pet Ownership Fuels Growth of the Market

The increasing rate of pet ownership worldwide is driving the growth of the pet food ingredients market, as more people seek high-quality, nutritious food options for their pets. This includes specialized ingredients that cater to various dietary needs.

For example, a 2020 report by the American Veterinary Medical Association revealed that 45% of the U.S. households owned dogs, while the People's Dispensary for Sick Animals reported that 28% of the UK adults had pet dogs, totaling an estimated 10.6 million. This surge in pet ownership is pushing manufacturers to meet the evolving demands and nutritional preferences of pet owners, reflecting a broader focus on improved pet care and wellbeing.

Increasing Pet Food Expenditure Boosts Growth of the Market

The rising expenditure on pet food is fueling the growth of the pet food ingredients market, as pet owners increasingly invest in premium, nutritious options for their pets. This has led to a higher demand for quality ingredients that provide essential nutrients and meet specific dietary requirements.

In 2023, the American Pet Products Association reported that approximately USD 64.4 billion was spent on pet food in the U.S., compared to USD 31.14 billion in 2022. The growing focus on high-quality ingredients reflects the evolving preferences of pet owners that prioritize nutrition and health in their purchasing decisions. This trend highlights a broader awareness of pet wellness, encouraging manufacturers to source superior ingredients to meet consumer expectations.

Resource Scarcity Impedes Growth of the Market

The shortage of essential resources, including high-quality meats, specialized grains, and plant-based proteins, significantly hinders the growth of the market. This scarcity often arises from supply chain challenges, agricultural limitations, and fluctuating availability of organic and inorganic materials, making it difficult for companies to meet the increasing demand for nutritious and diverse pet food options.

As pet owners look for premium and sustainable ingredients, this shortage restricts the market's capacity to expand and innovate, slowing overall growth in the sector.

Adoption of Sustainable Protein Sources Creates Future Opportunity for the Market Growth

The adoption of sustainable protein sources, such as egg-based protein, tofu dregs, black soldier flies, and silkworms, is expected to create future opportunities in the market. These alternatives gain popularity due to their high nutritional value and lower environmental impact compared to traditional proteins including beef and pork.

Egg-based proteins and tofu dregs not only provide essential nutrients but also help reduce food waste. Similarly, insects such as black soldier flies and silkworms offer an efficient way to produce protein using fewer resources, making them sustainable alternatives in the pet food ingredients market.

By Type, Non-Vegan Ingredients Holds the Dominant Share in the Pet Food Ingredients Market

Non-vegan pet food ingredients, including chicken, beef, and fish, plays an important role in the pet food market, holding a value of approximately USD 26.04 billion. These ingredients are favored for their high protein content and essential nutrients, that are crucial for the health and wellbeing of pets.

Beef is the most widely used protein due to its rich nutrient profile and high digestibility, while chicken and fish also provide valuable omega-3 fatty acids and other essential nutrients that contribute to overall pet health. The increasing demand for these ingredients highlights pet owners' commitment to offering high-quality, nutritious diets for their pets.

By Form, Dry Pet Food Ingredient is Expected to Achieve Highest CAGR Growth Through 2030

The dry form of pet food ingredient is expected to achieve the highest CAGR of 9.0%. This significant growth is attributed to several factors, including convenience, longer shelf life, and cost-effectiveness compared to wet or canned food options. Pet owners increasingly prefer dry food because it is easier to store and serve, and it often leads to better dental health for pets.

Additionally, the rising trend of premiumization in pet food drives manufacturers to enhance the quality of dry ingredients, incorporating higher protein levels and specialized nutrients that cater to specific dietary needs. As a result, the dry pet food segment is poised for continued expansion, reflecting the evolving preferences of pet owners who prioritize both convenience and nutrition in their pets' diets.

North America Holds the Dominating Share of Pet Food Ingredients Industry

The increasing rate of pet ownership in this region, along with the growing tendency to treat pets as members of the family, is boosting the demand for premium pet food ingredients. Pet owners are becoming more conscious of the health and wellbeing of their pets, leading them to seek high-quality, natural, and nutritious food options.

This shift in consumer behavior encourages manufacturers to focus on developing superior ingredients that provide essential nutrients and support overall pet health.

Moreover, rising disposable income drives the growth of the pet food ingredients sector as consumers have more financial resources, they are increasingly willing to invest in premium pet food that offers higher nutritional value and supports their pets' health. This shift toward purchasing higher-quality ingredients, including natural and organic options, reflects the growing emphasis on pet wellness. As pet owners prioritize better diets for their pets, the demand for superior pet food ingredients continues to rise.

Asia-Pacific to witness the fastest Growth in the Pet Food Ingredients Industry

The growing rate of pet ownership is driving demand for pet food ingredients, as more pet owners are seeking high-quality options for their pets' diets. This shift in consumer preferences is not only increasing sales for manufacturers but also pushes them to innovate and diversify their product offerings, strengthening the pet food ingredients market.

According to an August 2024 report by the World Animal Foundation, 32% of households in Asia-Pacific (APAC) countries have a dog, while 26% own a cat. This rising trend emphasizes the need for diverse and nutritious pet food ingredients to meet the evolving needs of pet owners.

Additionally, increasing demand for sustainable ingredients, such as fish and organic options further drives manufacturers to produce premium-quality pet food focused on pet well-being. This shift toward environmentally friendly and nutritious products is expanding product offerings and driving market growth as pet owners seek healthier, more sustainable choices for their pets.

Competitive Landscape

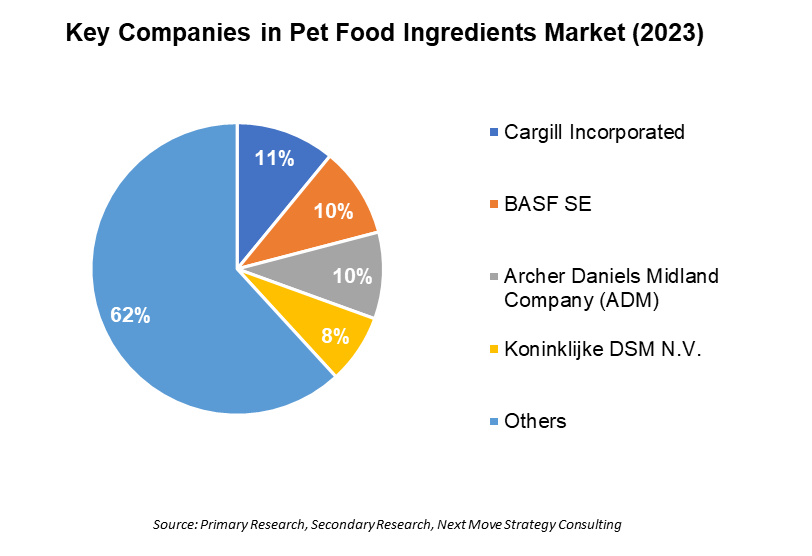

The pet food ingredients industry includes various players such as Cargill Incorporated, BASF SE, Archer Daniels Midland Company (ADM), Koninklijke DSM N.V., Mowi ASA, Symrise AG, Darling Ingredients Inc., The Scoular Company, Sinova GmbH (Saria SE & Co. KG), Roquette Freres and others. Other companies include Cookee Inc. (Omega Protiens), Novozymes A/S, AFB International, and others.

These players are engaged in various product launches, partnerships, business expansion and acquisition across various regions to maintain their dominance in the global pet food ingredients market.

|

Date |

Company |

Recent Developments |

|

May 2024 |

Product Launch |

ADM launched B2B pet wellness solutions in the EMEA region, featuring seven product formulas in the form of soft chews and supplement powders. These offerings aim to improve pet health and address the growing demand for wellness solutions among pet owners in Europe. |

|

April 2024 |

Partnership |

Cargill Incorporated partnered with Nestle’s Purina to promote regenerative agriculture practices in the pet food industry, with the goal of reducing carbon footprints over time. |

|

September 2023 |

Business Expansion |

BASF expanded its business by providing Product Carbon Footprints (PCFs) for its ingredients in both the human and animal nutrition markets, thereby enhancing transparency and sustainability. |

|

May 2023 |

Acquisition |

Scoular acquired a fish-processing facility in Burlington, Washington, to increase its pet food production. This acquisition complements Scoular's joint venture in Oregon, improving its ability to supply high-quality, sustainable fish ingredients throughout the year. |

|

January 2023 |

Partnership |

BASF SE partnered with Cargill to deliver high-performance enzyme solutions for animal protein producers in the U.S. This collaboration seeks to enhance feed efficiency, minimize nutrient waste, and support sustainability initiatives within the industry. |

|

October 2022 |

Business Expansion |

Scoular opened a fishmeal processing facility in Oregon, marking the first such operation in North America in over 25 years. This joint venture with Da Yang Seafood and Bornstein Seafoods aims to upcycle local fish trimmings into sustainable protein sources for the pet food and aquaculture markets. |

|

February 2022 |

Acquisition |

Symrise AG acquired Wing Pet Food to enhance its presence in the rapidly expanding APAC pet food market. This acquisition intends to speed up the diversification of its pet food application areas. |

Basic Points (BPS) Change, 2023-2030

BPS (Basis Points) changes in the Pet Food Ingredients market refer to slight percentage shifts in key market indicators, which impact pricing, demand, or growth rates of specific ingredients. For instance, a 50 BPS (0.5%) increase indicate a slight uptick in demand for premium or organic ingredients due to changing consumer preferences, while a decrease might reflect adjustments in ingredient costs or shifts in production efficiency.

|

Years |

BPS Change |

|

2024-2025 |

143 |

|

2025-2026 |

110 |

|

2026-2027 |

77 |

|

2027-2028 |

52 |

|

2028-2029 |

16 |

|

2029-2030 |

-11 |

Pet Food Ingredients Market Key Segments

By Type

-

Non-Vegan

-

Beef

-

Chicken

-

Fish

-

Others

-

Vegan

-

Soyabeans

-

Peas

-

Lentils

-

Others

-

Novel Proteins

By Nature

-

Organic

-

Inorganic

By Form

-

Dry

-

Wet

By Pet Type

-

Dog

-

Cat

-

Others

By Distribution Channel

-

Online

-

Offline

Key Players

-

Cargill Incorporated

-

BASF SE

-

Archer Daniels Midland Company (ADM)

-

Koninklijke DSM N.V.

-

Mowi ASA

-

Symrise AG

-

Darling Ingredients Inc.

-

The Scoular Company

-

Sinova GmbH (Saria SE & Co. KG)

-

Roquette Freres

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 37.16 Billion |

|

Revenue Forecast in 2030 |

USD 67.23 Billion |

|

Growth Rate |

CAGR of 8.4% from 2024 to 2030 |

|

Market Volume in 2023 |

7,549 Kilotons |

|

Volume Forecast in 2030 |

11,104 Kilotons |

|

Growth Rate (Volume) |

CAGR of 5.3% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst