Smart Manufacturing Market by Information Technology (Human Machine Interface, Plant Asset Management, Warehouse Management System, and Manufacturing Execution System), by Enabling Technology (Industrial Sensors, AI in Manufacturing Machine, Condition Monitoring, Industrial Machine Vision, Industrial Cybersecurity, Digital Twin, AGV, AR & VR in Manufacturing, and 5G Industrial IoT) and Others– Global Opportunity Analysis and Industry Forecast, 2024– 2030

US Tariff Impact on Smart Manufacturing Market

Trump Tariffs Are Reshaping Global Business

Market Definition

The Smart Manufacturing Market size was valued at USD 238.78 billion in 2023 and is predicted to reach USD 622.73 billion by 2030 with a CAGR of 14.7% from 2024-2030.

Smart manufacturing refers to the integration of advanced technologies and data analytics into the manufacturing process to optimize efficiency, productivity, and flexibility. It involves the use of interconnected devices, sensors, automation, artificial intelligence (AI), and machine learning to enable real-time monitoring, analysis, and decision-making in production operations. By leveraging these technologies, smart manufacturing enhances efficiency and productivity through predictive maintenance and data-driven decision-making. This leads to reduced downtime, improved quality, and increased competitiveness in the market.

Market Dynamics and Trends

The integration of artificial intelligence (AI) in the manufacturing sector serves as a significant driver for the growth of smart manufacturing market globally. By incorporating AI, manufacturing facilities can implement predictive maintenance strategies, optimize production processes, and enhance quality control standards through real-time data analysis.

This technological advancement accelerates manufacturing operations by automating repetitive tasks, streamlining workflows, minimizing downtime, and enhancing decision-making capabilities. For instance, in November 2023, Next Generation Manufacturing Canada (NGen) allocated USD 19 million in Global Innovation Cluster funding for 12 pioneering AI manufacturing projects, valued at USD 55 million.

NGen’s AI for manufacturing challenge aimed to build advanced manufacturing capabilities and accelerate the commercialization of AI and machine learning innovations across various manufacturing sectors in Canada. This integration of AI in the manufacturing sector helps revolutionize production processes thus propelling the growth of smart manufacturing on a global scale.

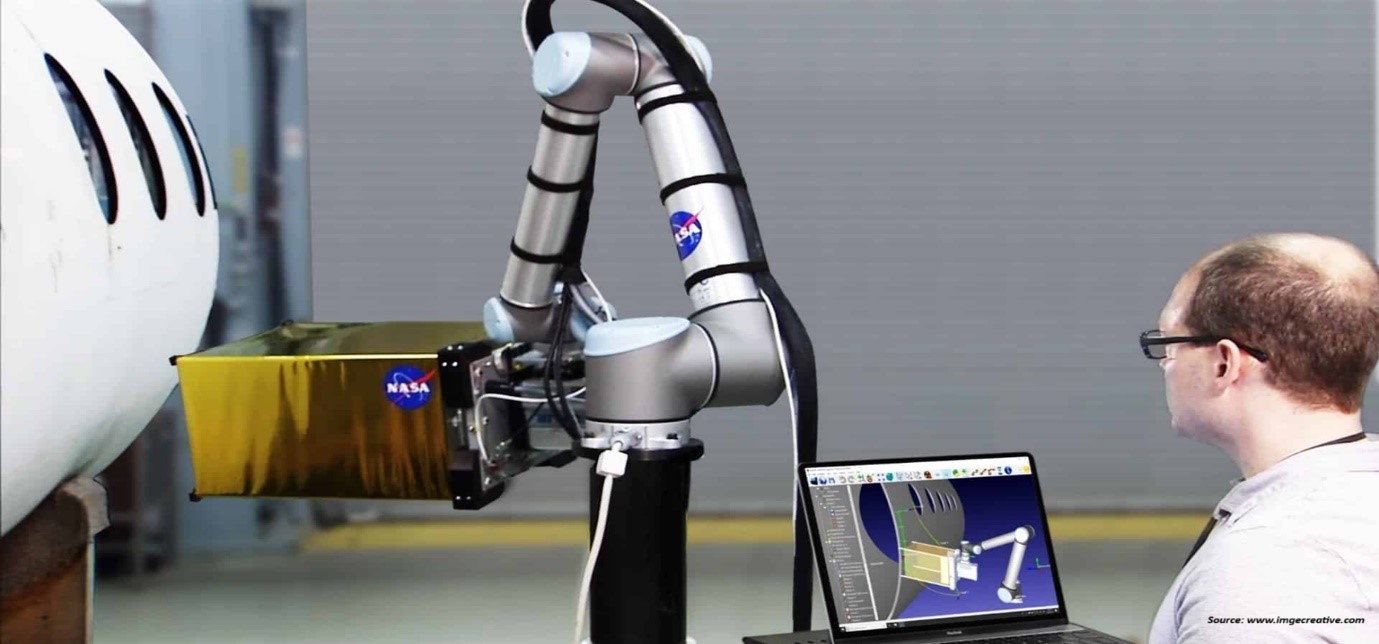

Also, the global surge in smart manufacturing demand is being driven by the growing adoption of industrial robots in the manufacturing sector. These robots help in enhancing workplace safety, productivity and reducing labor costs.

Their integration into various facets of manufacturing, from assembly to welding and material handling, has reshaped traditional workflows. By predicting tasks that are hazardous or involve substantial risks, they mitigate human exposure to potential dangers.

For instance, Mitsubishi Electric's forthcoming industrial robotics system launched in 2023, exemplifies this trend. This advanced system, leveraging Maisart AI technologies, including cutting-edge speech recognition capabilities, empowers robots to navigate challenging environments including food-processing plants more effectively. By enabling precise control through voice commands, it promises to dramatically reduce task completion times from 60 hours to a mere 5 hours for a sample task.

However, the initial high costs associated with implementing advanced technologies such as AI and industrial robots present a significant barrier to their adoption among manufacturers with limited finance. On the contrary, the development of autonomous robotic systems for collaborative and adaptable manufacturing processes within the sector is expected to drive the smart manufacturing market in the coming years. This advancement is expected to enhance optimization of production workflows and flexibility in manufacturing operations, contributing to increased efficiency and competitiveness.

Market Segmentations and Scope of the Study

The smart manufacturing market is segmented on the basis of information technology, enabling technology, enterprise size, end-user industry, and region. On the basis of information technology, the market is segmented into human machine interface, plant asset management, warehouse management system, and manufacturing execution system. On the basis of enabling technology, the market is classified into industrial sensors, AI in manufacturing machine, condition monitoring, industrial machine vision, industrial cybersecurity, digital twin, AGV, AR & VR in Manufacturing, and 5G industrial IoT. On the basis of enterprise size, the market is divided into large enterprise and small & medium enterpise. On the basis of end-user industry, the market is distributed into process industry and discrete industry. The process industry segment is further distributed into oil & gas, food & beverages, pharmaceuticals, chemicals, energy & power, metal & mining, pulp & paper, and others. The discrete industry segment is further categorized into automotive, aerospace & defense, semiconductor & electronics, medical devices, machine manufacturing, and others. The regional breakdown includes regions such as North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

Geographical Analysis

North America holds the dominant share of the smart manufacturing market and is expected to continue its dominance during the forecast period. This is attributed to the region's robust technological infrastructure, particularly in the field of artificial intelligence (AI) and robotics. These advancements have prompted significant improvements in labor productivity across industries in North America.

By embracing smart manufacturing principles, businesses in the region empower their workforce to achieve heightened levels of productivity and output. According to insights provided by the U.S. Bureau of Labor Statistics, there has been a steady annual average increase of 1.2 percent in labor productivity from 2022 to 2023. This growth in labor productivity illustrates the tangible benefits derived from the integration of advanced technologies in manufacturing processes.

Moreover, in North America, the expansion of smart manufacturing industry finds significant momentum due to the widespread adoption of advanced manufacturing (AM) techniques, particularly in the U.S. and Mexico. These techniques seamlessly blend digital technologies, automation, and data analytics, leading to a new era of efficiency and productivity across industries.

As companies in Mexico embrace advanced manufacturing practices, they increasingly recognize the value of investing in smart manufacturing solutions to stay competitive in the global market. According to insights provided by the International Trade Administration in 2023, Mexico stands among the top five largest importers of 3D printing technology worldwide.

Moreover, the data highlights a noteworthy annual growth rate of 6.28 percent in Mexican imports of 3D printing products. These statistics underscore Mexico's growing adoption of 3D printing techniques, playing a pivotal role in driving the growth of smart manufacturing in North America.

On the other hand, Asia Pacific is expected to show a steady rise in the smart manufacturing market owing to the incorporation of robotic technology to streamline manufacturing processes. According to the International Federation of Robotics (IFR), this region showcases a robust adoption of industrial robots, with China leading the trend, having installed 268,200 units in 2022, followed by Japan.

This integration of industrial robots across manufacturing facilities plays a pivotal role in propelling the smart manufacturing market. By automating tasks, these robots enhance efficiency, optimize workflows, and facilitate seamless integration with other smart technologies such as artificial intelligence (AI) and the Internet of Things (IoT). This interconnected ecosystem not only boosts production capabilities but also elevates the overall competitiveness of the manufacturing sector in the region.

Also, the growth of smart manufacturing in Asia Pacific is strongly driven by the rising demand for innovative technologies and solutions aimed at enhancing efficiency, productivity, and competitiveness within the manufacturing sector.

As manufacturers strive to modernize their operations and maintain a leading edge in an ever-evolving market, the adoption of smart manufacturing practices becomes increasingly imperative. The expanding manufacturing sector in the region further heightens the demand for smart manufacturing solutions. As evidenced by data from Trading Economics, manufacturing production in India saw a notable increase of 1.20% in 2023 compared to 2022, reflecting the region's upward trend in industrial output.

Competitive Landscape

Various market players operating in the smart manufacturing market include 3D System, Inc., ABB Ltd, Cisco System, Inc., Emerson Electric Co., General Electric, Honeywell International Inc., Siemens AG, Nano Dimension, Mitsubishi Electric Corporation, and Rockwell Automation, Inc. These market players continue to adopt various market development strategies including product launches to maintain their dominance in the smart manufacturing market.

For instance, in April 2023, Siemens, a German multinational technology conglomerate, launched Industrial Operations X, for automating and operating industrial production. This new portfolio, part of Siemens Xcelerator, focuses on production engineering, execution, and optimization by integrating cutting-edge IT capabilities such as low code, edge, cloud computing, and artificial intelligence with automation technology. The goal is to make industrial production processes more adaptable, autonomous, and resilient, allowing plants and production lines to become more flexible and modular for quick adaptation to changes.

Additionally, in April 2023, Nano Dimension, an American-Israeli manufacturer of 3D printers, launched GrabCAD Print Pro, an advanced version of GrabCAD Print software that offers enhanced features for additive manufacturing. The software is currently available for FDM and SAF 3D printers, and it provides features such as an accuracy center, manufacturing templates, 3rd party plugins, and per-part estimation.

Key Benefits

-

The report provides quantitative analysis and estimations of the smart manufacturing market from 2024 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the smart manufacturing market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the smart manufacturing market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Key Market Segments

By Information Technology

-

Human Machine Interface

-

Plant Asset Management

-

Warehouse Management System

-

Manufacturing Execution System

By Enabling Technology

-

Industrial Sensors

-

AI in Manufacturing Machine

-

Condition Monitoring

-

Industrial Machine Vision

-

Industrial Cybersecurity

-

Digital Twin

-

AGV

-

AR & VR in Manufacturing

-

5G Industrial IoT

By Enterprise Size

-

Large Enterprises

-

Small & Medium Enterprises

By End-User Industry

-

Process Industry

-

Oil & Gas

-

Food & Beverages

-

Pharmaceuticals

-

Chemicals

-

Energy & Power

-

Metal & Mining

-

Pulp & paper

-

Others

-

-

Discrete Industry

-

Automotive

-

Aerospace & Defense

-

Semiconductor & Electronics

-

Medical Devices

-

Machine Manufacturing

-

Others

-

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 238.78 Billion |

|

Revenue Forecast in 2030 |

USD 622.73 Billion |

|

Growth Rate |

CAGR of 14.7% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

3D System, Inc.

-

ABB Ltd

-

Cisco System, Inc.

-

Emerson Electric Co.

-

General Electric

-

Honeywell International Inc.

-

Siemens AG

-

Nano Dimension

-

Mitsubishi Electric Corporation

-

Rockwell Automation, Inc.

Speak to Our Analyst

Speak to Our Analyst