Space Robotics Market by Solution (Remotely Operated Vehicles, Remote Manipulator Systems, Software, and Services), by Application (In-Orbit Maintenance & Life Extension, Deep Space Exploration, Near Space Exploration, Surface Exploration, Space Debris Removal, and Other Applications), and by Organization Size (Government and Commercial) – Global Opportunity Analysis and Industry Forecast 2024-2030

Industry: Aerospace & Defense | Publish Date: 15-May-2025 | No of Pages: 320 | No. of Tables: 250 | No. of Figures: 195 | Format: PDF | Report Code : AD408

Space Robotics Market Overview

The global Space Robotics Market size was valued at USD 4.52 billion in 2024, and is predicted to reach USD 7.11 billion by 2030, with a CAGR of 9.5% from 2025 to 2030.

The market is growing due to expansion of space industry worldwide along with the growing government investment. However, the high cost in developing space robotics systems hinders the market growth as it prohibits the small company to enter in the market. On the contrary, the integration of AI in space robotic is expected to create future growth opportunities.

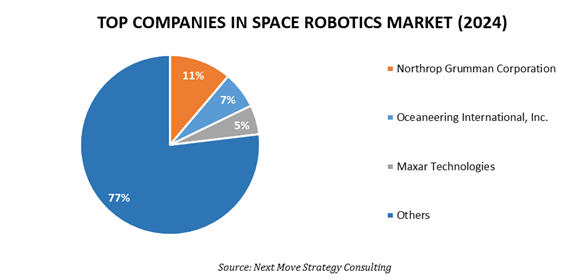

The companies such as Northrop Grumman Corporation, Oceaneering International, Inc., Maxar Technologies are the leading companies in the industries. These companies adopting strategies such as product launches and partnership in order to enhance the market expansion. With the companies investing in AI and ML the market is expected to grow with a CAGR of 9.5% in nearby future.

The Growing Expansion of Space Industry Worldwide Drives the Growth of the Market

The growing demand for advanced robotics which is essential for space exploration and satellite installations in both LEO orbit and distant space is being driven by the rapidly expanding space industry worldwide.

Space robots play a critical role in space missions that include satellite deployment spacecraft maintenance complicated operations support and possible resource mining. They improve human capabilities in space boosting technology advancement scientific study and sustainable use of space resources. The World Economic Forum states that global space economy will reach USD 1.8 trillion by 2035 driving the demand for autonomous space robots in the coming years.

The Rising Investment by Government in Space Exploration Projects Drives the Market Growth

The increasing government policies along with the rising contribution of private sector is further driving the space robotics market growth. Space agencies such as NASA and ISRO are making significant investments in future missions to Mars Moon and other extra-terrestrial objects. These missions require advanced robotics for tasks such as landing exploration and sample collection.

For instance, VIPER also known as Volatiles Investigating Polar Exploration Rover a NASA's Commercial Lunar Payload Services initiative is expected to reach on the lunar surface by end of 2024. During its 100-day mission VIPER is anticipated to travel across various lunar landscapes including crater rims and perpetually shadowed craters to gather samples from different types of lunar soils and environments.

Moreover, companies such as SpaceX and Blue Origin are entering the space exploration sector further driving the demand for robotic solutions to support their missions. This collaboration between public and private sectors significantly enhances the capabilities and reach of satellite servicing robots.

High Cost in the Development of Space Robotics Hinders the Space Robotics Market Expansion

The space robotics sector faces challenges due to the high costs involved in designing engineering and deploying complex systems. These expenses include rigorous testing and research which pose significant barriers for smaller companies and startups with limited resources. Because of these financial demands it's difficult for these entities to bring new innovative solutions to market which limits their ability to compete effectively.

Integration of Artificial Intelligence with Space Robotics Creates Market Opportunity

The space robotics sector stands to gain significant traction due to the powerful potential of artificial intelligence (AI) integration. By enhancing the autonomy and decision-making capabilities of space robots AI allows them to adapt to unexpected situations and perform tasks with greater efficiency and precision.

This advancement is expected to revolutionize space exploration. AI-powered robots independently navigate intricate environments analyze data in real-time and execute missions with minimal human oversight. As AI technology continues its rapid evolution its integration with space robots is poised to unlock new functionalities and drive significant innovation within the sector.

By Solution, Remotely Operated Vehicle Dominates the Space Robotics Market

The Remotely Operated Vehicle holds the major share of the space robotics industry accounting for around 37 percent as they are made for hostile outer space situations. These spacecrafts have specialized tools and instruments for repairing replacing components and inspecting orbiting satellites.

This capacity significantly boosts the operational period of satellites while also improving their performance. They also help in collection of data and samples from celestial bodies such as asteroids comets and the Moon. Their precise maneuverability and ability to navigate challenging terrains make them indispensable for conducting detailed scientific investigations and experiments in space.

By Application, the Near Space Exploration Dominates the Space Robotics Market

The near space exploration segment holds the largest share in the space robotics industry. This is due to the rising focus on space exploration and studying celestial bodies within the solar system.

Highly flexible rovers, landers, and drones, developed with the incorporation of advanced sensors and imaging systems, advance robotics technology in support of near space exploration missions. Such robotic systems are indispensable for conducting detailed scientific research and reconnaissance missions in space as they can tolerate extreme temperatures harsh terrain and low-gravity environments.

North America Dominates the Space Robotics Market Share

North America holds more than 61% of global space robotics industry share driven by the rising investment by the government of countries such as the U.S. and Canada for missions in planetary exploration habitat construction and national security including satellite maintenance and surveillance.

For instance, the government of the U.S. investing heavily in its space agency NASA with investment increasing from 23.3 billion in 2021 to 24.8 billion in 2022 an increase of 7% for space exploration and advancement in space research industry including the development of advanced space robotics.

Additionally, the participation of multiple companies such as Maxar Technologies Inc. Northrop Grumman Corporation and Voyager Space Holdings in the space robotics sector is also driving the space robotics market trends in this region.

For instance, in June 2023 Maxar launched the SAMPLR arm becoming the first robotic arm on the Moon in more than half a century. By initiating this project, the company aims to enhance knowledge and research capabilities on the Moon by aiding in the collection examination and investigation of lunar soil samples.

Asia-Pacific is Expected to Show Steady Growth in the Space Robotics Market Demand

The Asia-Pacific region is anticipated to experience the highest growth rate primarily due the increasing space industry in nations such as China India and Japan. For instance, China announced to launch of the Chang'e-6 lunar mission to the south side of the Moon to collect soil and rock samples aiming to identifying and studying valuable insights into lunar geology and the solar system's history. With such rise in the growth of the solar exploration missions in this region the market for space robotics is poised to rise boosting the growth of the market.

Moreover, rising initiatives by the government of numerous countries from Asia-pacific region including India China and South Korea for advancement in space sector is further boosting the growth of the space robotics industry in this region.

For instance, in April 2023 the Indian government introduced the Indian Space Policy 2023 aiming to formalize private sector involvement in the space industry with ISRO concentrating on advanced space technology research and IN-Space fostering space ecosystems within the country.

Moreover, the number of Indian space startups is growing at a very high rate reaching 189 in 2023. Such growth is expected to drive space technology innovation and establish a strong ecosystem for developing and deploying space robotics positioning Asia-pacific as a pivotal player in the global space sector.

Competitive Landscape

Several key players operating in the space robotics industry include Northrop Grumman Corporation, Oceaneering International, Inc., Maxar Technologies, Airbus SE, Intuitive Machines LLC, Voyager Space Holdings, Blue Origin, GITAI, Astrobotic Technology Inc., Motiv Space Systems, Inc., OneSpace, iSpace Inc, LandSpace Technology Corporation, Surrey Satellite Technology Ltd, and Shark Robotics, among others.

These companies are adopting various strategies such as product launches and partnerships to remain dominant in the market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

|

April 2024 |

Product Launch |

Astrobotic Technology launched two rovers namely the mini rover and NASA VIPER to explore the south pole of Moon for water, making a significant step towards establishing sustainable lunar exploration. |

|

|

January 2024 |

Product Launch |

Northrop Grumman launched the commercial resupply mission to the International Space Station that deliver over 8,200 pounds of supplies. The key items include numerous equipment for semiconductor manufacturing. |

|

|

January 2024 |

Partnership |

Voyager Space partnered with Airbus Defence and Space to develop the Starlab commercial space station, to establish Starlab as a key player in the future of space operations and research. The partnership aims to secure contracts with NASA, the European Space Agency (ESA), and other potential clients as the International Space Station moves towards utilizing commercial platforms. |

|

Source: Next Move Strategy Consulting

Space Robotics Market Key Segments

By Solution

-

Remotely Operated Vehicles

-

Remote Manipulator Systems

-

Software

-

Services

By Application

-

In-Orbit Maintenance & Life Extension

-

Deep Space Exploration

-

Near Space Exploration

-

Surface Exploration

-

Space Debris Removal

-

Other Applications

By Organization Size

-

Government

-

Commercial

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Market Players

-

Northrop Grumman Corporation

-

Oceaneering International, Inc

-

Maxar Technologies

-

Airbus SE

-

Intuitive Machines LLC

-

Voyager Space Holdings

-

Blue Origin

-

GITAI

-

Astrobotic Technology Inc

-

Motiv Space Systems, Inc

-

OneSpace

-

iSpace Inc

-

LandSpace Technology Corporation

-

Surrey Satellite Technology Ltd

-

Shark Robotics

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 4.52 Billion |

|

Revenue Forecast in 2030 |

USD 7.11 Billion |

|

Growth Rate |

CAGR of 9.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst