Spain Intralogistics Software Market by Component (Software (Warehouse Management System, Transportation Management System, and Others), and Services), by Technology (Internet of Things, Artificial Intelligence, Big Data Analytics, Cloud Security, Digital Twins, and Others), by Deployment Mode (On-Premises and Cloud-Based), and by End-User (Retail and E-commerce, Automotive, Food and Beverage, Pharmaceuticals, and Others) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 04-Mar-2025 | No of Pages: 186 | No. of Tables: 147 | No. of Figures: 72 | Format: PDF | Report Code : IC3022

US Tariff Impact on Spain Intralogistics Software Market

Trump Tariffs Are Reshaping Global Business

Spain Intralogistics Software Market Overview

The Spain Intralogistics Software Market size was valued at USD 396.5 million in 2024 and is predicted to reach USD 870.3 million by 2030, registering a CAGR of 13.3% from 2025 to 2030.

The Spain intralogistics software market is growing due to the growing use of automation in warehouses and the demand for effective supply chain management. Demand for real time tracking, optimization of inventory and smooth integration of warehouse operations is driving market growth. However, the high initial cost of investment and complexity of integration with existing systems can hinder adoption.

In contrast, advancements in technology for artificial intelligence and cloud-based logistics solutions will tend to lead to new business opportunities. Companies such as market leaders Daifuku Co., Ltd, Jungheinrich AG, Vanderlande Industries B.V. and others are focusing on strategic partnerships and innovation to gain higher market share. With growing use of AI-powered automation and data-driven decision-making, the market will see robust growth that improves efficiency and reduces costs of operations for companies.

Growth in E-Commerce Sectors Drives the Spain Intralogistics Software Market Growth

The swift expansion of e-commerce in Spain enhances the expansion of intralogistics software market owing to increased demand for effective warehousing, order processing, and distribution solutions. With online shopping expanding further, fueled by consumer need for convenience and quicker delivery alternatives, companies are more dependent on effective logistics systems to support their operations. This dependency creates increased need for intralogistics software to increase operational efficiency by streamlining activities like inventory management, order fulfillment and real time monitoring of goods.

According to the report published by the International Trade Administration, the e-commerce users in Spain accounted to 32 million in 2023 and this figure is estimated to reach to 40 million by 2025 reflecting a growth of 25%. With e-commerce expanding, the need for sophisticated intralogistics software will increase making it a key element to enhance efficiency, accuracy and supply chain agility.

Rising Demand of Industrial Robots Across Various Sector Boosts the Spain Intralogistics Software Market Trends

Increasing deployment of industrial robots is one of the major growth drivers in the market for intralogistics software with companies aiming at increasing warehouse automation, efficiency, and precision. Industrial robots like automated guided vehicles, robotic picking systems and autonomous mobile robots are dependent on intelligent intralogistics software that organizes movement, streamlines process flows, and provides for uninterrupted integration with in-place warehouse management systems.

These software solutions provide real time monitoring, predictive maintenance and data driven decision-making, improving the speed of order fulfilment and cutting down operational costs. Total annual industrial robot installations in Spain equated to 3800 units in the year 2023, representing a 10% increase from earlier years, as indicated by 2023 world Robotics report. As businesses continue to adopt robotics for supply chain and warehouse operations the intralogistics software market will see sustained growth being an important part of logistics modernization in infrastructure and enhancing overall efficiency.

Rising Initiatives by Key Spain Intralogistics Software Market Players Boost the Market Demand

Top industry players are driving the logistics software solutions industry expansion with innovative efforts promoting material flow adaptability. Their implementation of flexible intralogistics solutions supports real-time tracking, streamlines warehouse operations, and enhances supply chain efficiency overall. As businesses increasingly focus on material handling agility the market for sophisticated intralogistics software keeps growing.

For example, in March 2024, Siemens launched the Siemens Xcelerator solution aimed at assisting sustainable and flexible material flow systems in intralogistics. The program brings together advanced hardware and software to make important warehouse functions like transportation, storage and shipping more efficient.

Rise Of Cybersecurity Risks Hinders the Growth of The Market

Cybersecurity threats constitute a major barrier to intralogistics software implementation since growing interconnectivity using IoT, cloud computing and AI-based automation puts supply chain activities at risk of cyberattacks. Cyberattacks via data breaches, ransomware and system hacking can jeopardize essential inventory and warehouse management information resulting in monetary losses and system downtime.

Security risks also come with cloud-based intralogistics solutions with the requirement for robust encryption, multi-factor authentication and real time intrusion detection to prevent unauthorized intrusions. Moreover, organizations must ensure regulatory compliance standards such as GDPR and CCPA, increasing the risk complexity of security deployment. Denial of services due to ignored risks can mean system downtime, inefficiency of supply chains and regulatory fines hence implying cybersecurity as a necessary obstacle in adopting intralogistics software.

Integration of Artificial Intelligence in Intralogistics Software Market Creates Future Opportunities for the Market

Integration of artificial intelligence in intralogistics software is anticipated to create ample growth opportunity for the market in the future by enhancing automation, efficiency and decision-making. AI-driven solutions enable real time data analysis, predictive maintenance and intelligent route optimization allowing warehouses and distribution centers to streamline operations and reduce downtime. As an example, Mecalux integrated Siemens Simatic Robot Pick AI vision software into its robotic picking system which utilizes deep learning algorithms to enhance warehouse order fulfillment.

This collaboration aims to automate and optimize the picking process addressing challenges in the logistics industry. The system is designed to operate autonomously adapting its functions based on the items being handled thus improving efficiency in intralogistics operations. Consequently, AI-driven intralogistics software will become essential for businesses seeking greater agility, efficiency and scalability in their supply chain operations.

By Component, Software Holds the Dominant Share in the Spain Intralogistics Software Market

Software maintains a dominant the Spain intralogistics software market share, owing to the increased demand for automation, real time analytics and efficiency in operations. Companies are using warehouse management systems, artificial intelligence and IoT-based solutions in increasing numbers to automate tracking of inventory, enhance workflows and make informed decisions thereby resulting in cost reduction and greater productivity.

By Technology, Artificial Intelligence, Holds the Highest CAGR of 14.5%

Artificial intelligence makes a contribution toward attaining the fastest growth rate in Spain intralogistics software report due to its power to improve automation of warehouses, streamline resource usage, and maximize decision-making via real-time analysis of data. As companies emphasize digital transformation in order to adapt to increasing Spain Intralogistics Software Market demands in logistics, AI adoption within intralogistics software keeps gaining momentum, placing it as Spain's fastest-growing sector.

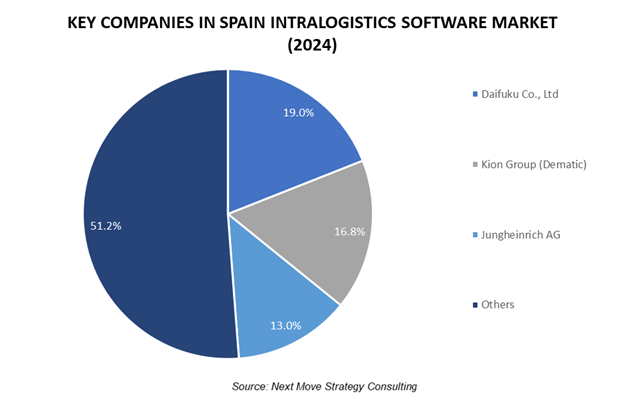

Competitive Landscape

The promising key players operating in the Spain Intralogistics software industry include Daifuku Co., Ltd., Kion Group, Jungheinrich AG, Vanderlande Industries B.V., SSI Schaefer AG, Generix Group, Autostore Systems, KNAPP AG, Viastore SYSTEMS S. A., Beumer Group GmbH and Co. KG, AutoStore AS, Mecalux S.A., Grupo Moldtrans, Esnova ES, E2e Logistics Solutions S.L., Balluff Automation, Alstef Group, Smartlog Group, Bowe Intralogistics, Keba Automation among others.

These players are engaged in various product launch and partnership across various regions to maintain their dominance in the global market.

|

Date |

Company |

Recent Developments |

|

March 2024

|

SSI Schafer Group |

SSI SCHAEFER Group launched LOGIONE, a new stand-alone software for its vertical lift module (VLM) that is designed to enhance warehouse efficiency. |

|

July 2023 |

Generix Group |

Generix Group collaborated with Resol to implement its warehouse management system in software as a service mode for Resol's operations in Spain. This partnership aims to enhance Resol's logistics efficiency and support its growth plans. |

|

July 2023 |

BEUMER Group |

BEUMER Group partnered with Elara Digital GmbH to offer innovative standard maintenance software that optimizes maintenance processes, maximizes machine availability, and reduces the maintenance team's workload. |

Spain Intralogistics Software Market Key Segments

By Component

-

Software

-

Warehouse Management System (WMS)

-

Transportation Management System (TMS)

-

Yard Management Software

-

Inventory Management Software

-

Labor Management Software

-

Others

-

-

Services

By Technology

-

Internet Of Things (IoT)

-

Artificial Intelligence (AI)

-

Big Data Analytics

-

Cloud Security

-

Digital Twins

-

Others

By Deployment Mode

-

On-Premises

-

Cloud-Based

By End-User

-

Retail and E-commerce

-

Automotive

-

Food and Beverage

-

Pharmaceuticals

-

Aviation

-

Logistics

-

Others

Key Players

-

Daifuku Co., Ltd.

-

Kion Group

-

Jungheinrich AG

-

Vanderlande Industries B.V.

-

SSI Schaefer AG

-

Generix Group

-

Autostore Systems

-

KNAPP AG

-

Viastore SYSTEMS S. A.

-

Beumer Group GmbH and Co. KG

-

AutoStore AS

-

Mecalux S.A.

-

Grupo Moldtrans

-

Esnova ES

-

E2e Logistics Solutions S.L.

-

Balluff Automation

-

Alstef Group

-

Smartlog Group

-

Bowe Intralogistics

-

Keba Automation

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 396.5 Million |

|

Revenue Forecast in 2030 |

USD 870.3 Million |

|

Growth Rate |

CAGR of 13.3% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst