Tactile Sensor Market by Type (Resistive Tactile Sensor, Capacitive Tactile Sensor, Piezoelectric Tactile Sensor, Optical Tactile Sensor and Others), by Application (Robotics, Computer Hardware, Security System, Touch Screens, Medical Devices, Handheld Devices and Others) and by Industry Vertical (Automotive, Robotics and Automation, Aerospace and Defense, Consumer Electronics, Healthcare and Other Industry)– Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 18-Jan-2025 | No of Pages: 727 | No. of Tables: 524 | No. of Figures: 449 | Format: PDF | Report Code : SE2109

US Tariff Impact on Tactile Sensor Market

Trump Tariffs Are Reshaping Global Business

Tactile Sensor Market Overview

The global Tactile Sensor Market size was valued at USD 5.44 billion in 2024 and is predicted to reach USD 9.81 billion by 2030, with a CAGR of 9.6% from 2025 to 2030. In terms of volume the market size was 2473 million units in 2024 and is projected to reach 5408 units in 2030, with a CAGR of 13.1% from 2025 to 2030.

The tactile sensor market refers to the sector focused on the development and application of sensors that detect and measure physical touch or pressure. These sensors convert pressure, vibration, and texture, into electrical signals, allowing machines, robots, or devices to perceive and respond to their environment in a manner similar to human touch. These sensors are crucial in various applications across multiple industry verticals.

They employ advanced technologies such as capacitive, resistive, piezoelectric, and optical sensing to provide detailed feedback on physical contact, thereby enabling improved functionality within complex systems. The market for sensory feedback encompasses their entire lifecycle, including manufacturing, distribution, and application.

Growing Demand for Automation Across Industries is Boosting the Market

Rising automation and robotics across the world is driving the tactile sensor industry by increasing the demand for sensors that enable robots to relate with their environment more precisely and safely. As industries adopt robotic systems for tasks requiring high accuracy, tactile sensors provide the necessary response for robots to handle delicate and complex operations. The report from International Federation of Robotics shows a significant rise in industrial robots, with a total of 3.9 million robots operating globally in 2022.

The countries with the highest robot density are South Korea, with 1,012 robots per 10,000 workers, followed by Singapore and Germany with 730 robots and 415 robots respectively. As businesses seek to enhance operations and stay competitive, the adoption of these sensors are increasing, thereby fostering innovation and expanding the market.

The Surge in Adoption of Smart Wearable Devices is Driving the Tactile Sensor Market Growth

The increasing adoption of smart wearable devices globally is driving the growth of the tactile sensor market as these devices require advanced sensing technologies to enhance user interaction, improve functionality, and provide real-time feedback. For instance, in January 2024, Double Point introduced a new gesture and touch technology for wearable devices that enables users to control devices through finger gestures and touch interactions, eliminating the need for physical buttons or touchscreens.

The system utilizes advanced sensors to detect touch and gestures, offering a more intuitive user experience. The widespread adoption of such devices, coupled with ongoing advancements in sensor technologies, drives market expansion, presenting new opportunities for innovation and growth within the industry.

Technological Advancements Driving the Growth of the Tactile Sensor Market

Advancements in sensor technology are driving the growth of the tactile sensor market as improvements in precision, sensitivity, and adaptability expand their applications. The continuous development of tactile sensors enhances their functionality, enabling more effective interaction in industries such as robotics, healthcare, and consumer electronics.

For instance, in October 2024, GelSight partnered with Meta AI to introduce the Digit 360 tactile sensor, a new innovation that combines GelSight's advanced tactile sensing technology with Meta AI's artificial intelligence expertise. This collaboration aims to enhance the precision and functionality of tactile sensors, enabling more accurate and real-time interactions for various applications, including robotics, healthcare, and consumer electronics.

High Maintenance Costs Restrain Market Growth

Tactile sensor industry necessitates regular calibration and maintenance to maintain their reliability and accuracy, which can elevate the overall cost of ownership for businesses. Additionally, their sensitivity to environmental factors such as temperature and humidity presents challenges in maintaining consistent responsiveness and precision, particularly in harsh or variable conditions.

These issues add complexity to the operation of touch sensor and may discourage potential users who require low-maintenance solutions or consistent performance in diverse environments. Consequently, addressing these limitations is essential for the broader adoption and sustained growth of the market.

Integration of Quantum Sensing Creates Market Opportunity

The incorporation of quantum sensing methods into sensory feedback technology utilizes the distinct characteristics of quantum mechanics, such as superposition and entanglement, to achieve remarkably sensitive and precise measurements. The integration of quantum phenomena, allows these sensors to detect even the slightest changes in pressure, force, or other physical attributes with unparalleled accuracy.

This heightened sensitivity creates opportunities across various domains. As these applications continue to develop and broaden, the incorporation of quantum sensing methods into these sensors are anticipated to propel substantial market growth in the forthcoming years.

By Type, Resistive Tactile Sensors Holds the Dominant Share in the Tactile Sensor Market

Resistive Tactile Sensors Holds 40.3% share of the tactile sensor industry, these sensors work by detecting changes in resistance when pressure is applied, offering high precision for a variety of applications, including robotics, automotive systems, and consumer electronics. Their ease of integration into existing devices and simple operational mechanisms make them an attractive option for industries that prioritize functionality and affordability.

By Application, Robotics Holds the Highest CAGR of 12.5%

Robotics is expected for significant growth, with a projected CAGR of 12.5%. This expansion is driven by the increasing adoption of automation across various industries, such as manufacturing, healthcare, and logistics. As robots become more integrated into everyday operations, the demand for advanced sensory technologies, like tactile sensors, is rising.

Tactile sensors play a critical role in improving robots' ability to interact with their environment, enhancing precision, feedback mechanisms, and overall functionality. With advancements in sensor technologies, tactile sensors are expected to become more sensitive, adaptive, and reliable, further driving the growth of the robotics sector.

Asia Pacific Region Dominates the Tactile Sensor Market, with the Highest Projected CAGR of 10.7% till 2030

Asia-Pacific region holds the dominant in the tactile sensor market share, contributing 58.9% to the global market in 2024 due to the increasing emphasis on automation for enhancing productivity and competitiveness in the industrial sector. According to the 2023 report from the International Federation of Robotics, China's substantial investment in industrial robotics propelled it to the 5th position in global robot density rankings, surpassing the United States in 2022, with 322 operational industrial robots per 10,000 employees in the manufacturing industry.

In addition, the increasing adoption of these sensors in electronic products in Japan is significantly driving the tactile sensor market growth in the region. As companies incorporate touch sensors into devices such as smartphones and automotive electronics, they aim to enhance user interaction and ensure product reliability. This trend is supported by the growth of the electronic industry, as highlighted by the notable production figures reported by the Japan Electronic and Information Technology Industries Association.

For instance, in February 2024 alone, Japan's electronics production reached an impressive USD 5,839.08 million, with expectations of reaching USD 11,484.87 million by the end of the year. With the electronic sector expected to continue expanding and evolving due to ongoing technological advancements, the demand for these sensors in Japan is set to rise further. This growth trajectory positions Japan as a significant contributor of the Asia-Pacific touch sensor market, reflecting its commitment to advancing technology and delivering high-quality products.

Moreover, the gaming industry in South Korea, characterized by its vibrant esports culture and tech-savvy population, serves as a key driver for the escalating tactile sensor market demand in gaming peripherals. These sensors are integral to devices such as controllers, keyboards, and virtual reality (VR) equipment, enriching user interaction with responsive touch feedback and precise motion tracking.

According to the International Trade Administration's 2023 report, South Korea ranks among the top-four largest gaming markets globally, with over 74% of Koreans aged 10-65 regularly engaging in gaming activities. The country's gaming industry was valued at USD 17.6 billion in 2022. With such rapid growth in the gaming sector, there is a growing need for touch sensors as companies aim to deliver immersive gaming experiences and innovative peripheral devices.

Competitive Landscape

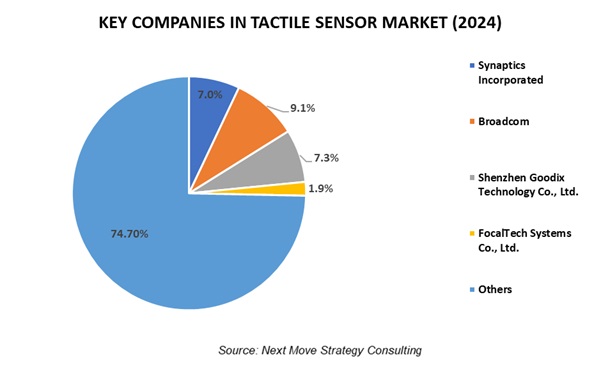

Several key players operating in the global tactile sensor industry include Broadcom, Shenzhen Goodix Technology Co., Ltd., Synaptics Incorporated, ALPS Electric (Cirque Corporation), STMicroelectronics N.V., FocalTech Systems Co., Ltd., Elan Microelectronics, Pressure Profile Systems, AIS Global group (Touch International Inc.), Touchence Inc., XELA Robotics, Contactile, Omron Corporation, Bosch Sensortec GmbH, TE Connectivity, Autonics Corporation, Infineon Technologies AG, Future Electronics, and Mouser Electronics, Tekscan Inc., and others.

Other companies include ForceN, Contactile, Sensobright X-Sensors, and others.

These companies are adopting various strategies including product launches across various regions to maintain their dominance in the touch sensors market. By continuously innovating and launching new offerings, they aim to meet the evolving demands of customers and also enables them to capture new opportunities and expand their market share.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

March, 2024 |

Senso bright |

Sensobright unveiled its latest offerings, the Tactile Sensor and Smart Surface Development Kits. These kits are designed to provide developers and engineers with accessible tools to integrate cutting-edge touch sensor technology across various applications. |

|

February 2024 |

ALPS Electric (Cirque Corporation) |

Alps Alpine launched the HSLCMB series ICs, previously designed for internal use, to external markets. These ICs, incorporating a capacitance measurement circuit and a 32-bit CPU, offer higher sensitivity and noise robustness for capacitive sensing. This advancement is particularly beneficial for tactile sensors, as the improved performance supports more precise and reliable touch interactions. |

|

February 2024 |

Tekscan Inc. |

Tekscan introduced a new pressure mapping sensor tailored for battery applications, known as the 7800-battery sensor. This innovative sensor is designed to meet the specific needs of battery applications, offering advanced pressure mapping capabilities. |

|

September 2023 |

STMicroelectronics N.V. |

STMicroelectronics launched a new FlightSense multi-zone ranging sensor with a viewing angle of 90°. This optical sensor has a 33% wider viewing angle than the previous generation product, providing realistic scene perception capabilities for home automation, home appliances, computers, robots, and smart devices used in stores, factories, and other areas. |

|

May 2023 |

Synaptics Incorporated |

Synaptics launched the Triton FS7800 family of high-resolution single-chip sensors as part of its expanded Match-in-Sensor (MiS) Fingerprint Authentication Portfolio, marking a major advancement in biometric security and reinforcing its leadership in frictionless fingerprint authentication. |

|

May 2022 |

Contactile |

Contactile invested USD 2.5 million in funding to expedite the advancement of tactile sensor technology for robotic dexterity. This investment will propel the company's efforts in developing innovative touch sensors aimed at enhancing robotic capabilities, driving progress in the field of robotics. |

Tactile Sensor Market Key Segments

By Type

-

Resistive Tactile Sensor

-

Capacitive Tactile Sensor

-

Piezoelectric Tactile Sensor

-

Optical Tactile Sensor

-

Others

By Application

-

Robotics

-

Computer Hardware

-

Security System

-

Touch Screens

-

Medical Devices

-

Handheld Devices

-

Others

By End User

-

Automotive

-

Robotics and Automation

-

Aerospace and Defense

-

Consumer Electronics

-

Healthcare

-

Other Industry

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Austria

-

Sweden

-

Czech Republic

-

Hungary

-

Belgium

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Malaysia

-

Taiwan

-

Thailand

-

Vietnam

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Broadcom

-

Shenzhen Goodix Technology Co., Ltd.

-

Synaptics Incorporated

-

ALPS Electric (Cirque Corporation)

-

STMicroelectronics N.V.

-

FocalTech Systems Co., Ltd.

-

Elan Microelectronics

-

Pressure Profile Systems

-

AIS Global group (Touch International Inc.)

-

Tekscan Inc.

-

Touchence Inc.

-

XELA Robotics

-

Contactile

-

Omron Corporation

-

Bosch Sensortec GmbH

-

TE Connectivity

-

Autonics Corporation

-

Infineon Technologies AG

-

Future Electronics

-

Mouser Electronics

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 5.44 Billion |

|

Revenue Forecast in 2030 |

USD 9.81 Billion |

|

Growth Rate |

CAGR of 9.6% from 2025 to 2030 |

|

Market Volume in 2024 |

2473 Million Units |

|

Volume Forecast in 2030 |

5408 Million Units |

|

Growth Rate (Volume) |

CAGR of 13.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Market Volume Estimation |

Million Units |

|

Growth Factors |

|

|

Countries Covered |

30 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst