The U.K. Aluminium Market by Type (Primary and Secondary), by Product Type (Flat-Rolled, Casting, Extrusions, Forgings, Powder & Paste, Billets, Wire Rods, Other Types), by Alloy Series (1xxx Series, 2xxx Series, 3xxx Series, 4xxx Series, 5xxx Series, 6xxx Series, 7xxx Series) and by End-User (Transportation, Machinery & Equipment, Construction, Packaging, Electrical Engineering, and Others) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Materials and Chemical | Publish Date: 17-Mar-2025 | No of Pages: 160 | No. of Tables: 123 | No. of Figures: 68 | Format: PDF | Report Code : MC1345

US Tariff Impact on UK Aluminium Market

Trump Tariffs Are Reshaping Global Business

The U.K. Aluminium Market Overview

The U.K. Aluminium Market size was valued at USD 2.03 billion in 2023, and is predicted to reach USD 2.53 billion by 2030, at a CAGR of 3.2% from 2024 to 2030. The aluminum industry covers the sector focused on creating, distributing, and applying aluminum, a light and silvery metal.

Aluminum is a major element in the Earth's crust, representing about 8% by weight. Valued for its low density, strength, and resistance to corrosion from a protective oxide layer, aluminum is essential in industries like aerospace, automotive, construction, packaging, and electronics. Its lightweight quality improves performance and efficiency, especially in transportation. The metal is produced from bauxite ore via the bayer process and electrolysis. Technological advancements and recycling improvements have enhanced production sustainability, contributing to the industry expansion.

Growing Recycling Initiatives Drive Market Expansion in the U.K.

The U.K.'s strong focus on recycling, particularly aluminum recycling, is a major factor driving growth in the aluminum market. The country has invested heavily in developing advanced recycling systems and infrastructure, making the process of recycling aluminum more efficient and widespread.

Aluminum, known for its high recyclability, fits well into the UK's sustainability goals. Recycling aluminum requires significantly less energy compared to producing new aluminum from raw materials, which helps to lower carbon emissions and conserve natural resources.

This commitment to recycling not only supports environmental protection but also strengthens the aluminum supply chain by increasing the availability of recycled material. Consequently, the enhanced recycling practices contribute to a more sustainable aluminum sectot in the U.K., aligning with broader environmental and economic objectives.

The Growing Automotive Industry Fuels the Growth of Aluminium Market.

The automotive industry in the region significantly contributes to the growing U.K. aluminium market demand. As automakers focus on producing lighter, more fuel-efficient vehicles to meet stringent emissions standards, aluminum's lightweight yet durable properties make it an ideal material. This shift towards aluminum-intensive designs helps manufacturers reduce vehicle weight, improving fuel efficiency and lowering carbon emissions.

The market demand is further driven by the strong automotive sector of the region, which includes both local manufacturers and international companies investing in advanced production facilities. This ongoing trend is expected to continue bolstering the U.K. aluminium market growth, as the industry prioritizes sustainability and innovation.

Environmental and Regulatory Constraints Hinders the Growth of Aluminium Market

The U.K. aluminium market expansion is challenged by environmental regulations and sustainability requirements, including emissions control, waste management, and energy efficiency targets, that increases operational costs for some producers. Meeting strict emissions standards, adhering to waste management rules, and achieving energy consumption goals often require significant investments and efforts to reduce the environmental impact of aluminum production. These sustainability measures, while crucial for creating a greener and more sustainable industry, also add to the overall costs and complexities of aluminum production.

Sustainable Packaging Creates Ample Future Opportunities

The increasing emphasis on sustainable packaging is anticipated to create substantial growth opportunities for the U.K. aluminium market trends. Aluminum's recyclability and effectiveness in preserving product quality and freshness make it a preferred choice for packaging applications such as cans, bottles, and foils.

As consumers and brands become more environmentally conscious, they are opting for aluminum to minimize waste and support sustainability efforts. This shift towards eco-friendly packaging solutions drives demand for aluminum, contributing significantly to the market's expansion.

Competitive Landscape

Several key players operating in the U.K. aluminium market include Sapa Profiles Ltd, W. Howard Metals (One51), Alcoa Europe European Mill Products, Bremco Aluminium, Bridgnorth Aluminium Ltd. (Viohalco), Brookside Metal, Norton Aluminium, The Brock Metal Co, Ryobi Aluminium Casting, Coleshill Aluminium, Tandom Metallurgical Group, Novelis, Evtev Automotive, Mil-Ver Metal, Sarginsons Industries and others.

The U.K. Aluminium Market Key Segments

By Type

-

Primary

-

Secondary

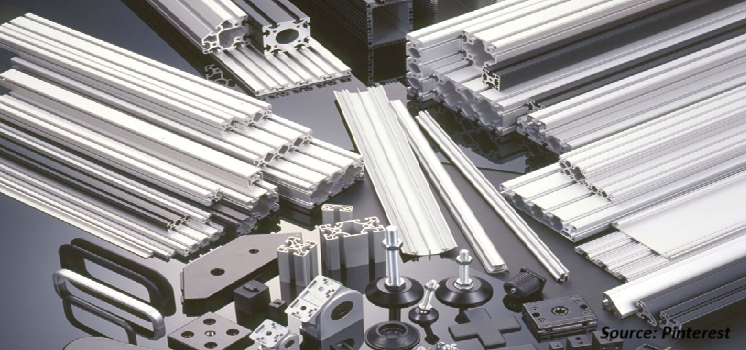

By Product Type

-

Flat-Rolled

-

Casting

-

Extrusions

-

Forgings

-

Powder & Paste

-

Billets

-

Wire Rods

-

Other Types

By Alloy Series

-

1xxx Series

-

2xxx Series

-

3xxx Series

-

4xxx Series

-

5xxx Series

-

6xxx Series

-

7xxx Series

By End User

-

Transportation

-

Aerospace

-

Automotive

-

Marine

-

-

Machinery & Equipment

-

Construction

-

Packaging

-

Food & Beverage

-

Cosmetics

-

Others

-

-

Electrical Engineering

-

Other End Users

Key Players

-

Sapa Profiles Ltd

-

W. Howard Metals (One51)

-

Alcoa Europe European Mill Products

-

Bremco Aluminium

-

Bridgnorth Aluminium Ltd. (Viohalco)

-

Brookside Metal

-

Norton Aluminium

-

The Brock Metal Co

-

Ryobi Aluminium Casting

-

Coleshill Aluminium

-

Tandom Metallurgical Group

-

Novelis

-

Evtev Automotive

-

Mil-Ver Metal

-

Sarginsons Industries

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 2.03 Billion |

|

Revenue Forecast in 2030 |

USD 2.53 Billion |

|

Growth Rate |

CAGR of 3.2% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst