The U.S. Insurance Market by Type (Life Insurance, Health Insurance, Property and Casualty Insurance, Travel Insurance, Motor Insurance, and Other Insurance), by End User (Individuals, and Businesses), by Distribution Channel (Direct Sales, Insurance Agents/Brokers, and Bancassurance) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: BFSI | Publish Date: 18-Jun-2025 | No of Pages: 173 | No. of Tables: 135 | No. of Figures: 80 | Format: PDF | Report Code : BF2744

The U.S. Insurance Market Overview

The U.S. Insurance Market size was valued at USD 1.48 trillion in 2023 and is predicted to reach USD 2.39 trillion by 2030, with a CAGR of 6.6% from 2024 to 2030. The market for U.S. insurance is a vast and dynamic industry that offers a comprehensive range of products and services that cater to the needs of individuals, businesses, and organizations.

This market includes various sectors such as life, health, property, casualty, and specialty insurance, each playing a critical role in providing financial security and risk management solutions.

The industry is dominated by both large multinational corporations and smaller, specialized firms that is characterized by intense competition and innovation. The market's adaptability is further demonstrated by its focus on digital platforms and customer engagement strategies, reflecting its commitment to serving a diverse and ever-changing clientele. The regulatory landscape also plays a significant role in shaping the life expectancy industry, ensuring that it remains robust, resilient, and responsive to the needs of consumers.

The Increasing Prevalence of Diseases Fuels the Growth of the Market

The increasing prevalence of diseases such as cancer, diabetes, cardiovascular disorders, and respiratory conditions fuels the growth of the insurance market in the U.S., due to the rising demand for comprehensive health coverage and financial protection. The latest report published by the American Cancer Society stated that there were 1.9 million new cancer cases recorded in 2022 and it is projected to reach to 2 million by the end of 2024. As more individuals face the risk of chronic and acute illnesses, there is a greater need for insurance policies that covers expensive treatments and long-term care.

This surge in demand encourages insurance providers to develop and offer more tailored and extensive coverage options, driving the U.S. insurance market expansion and ensuring that individuals and families are better equipped to manage healthcare costs.

The Growing Economic Stability Propels the Growth of the Market

The increasing economic stability enhances the affordability and appeal of insurance products that leads to greater market penetration as more individuals and families invest in policies for long-term financial security. According to the latest report by the International Monetary Fund (IMF), the U.S. GDP per capita accounted for USD 81.63 thousand in 2023 and it is projected to reach USD 100.58 thousand by 2029 that is a growth of 23.2% in the span of 5 years.

As disposable incomes rise and economic conditions improve, people are more inclined to purchase comprehensive insurance coverage, including life, health, and property insurance to protect themselves and their dependents. This growing demand for insurance portfolios further drives the U.S. insurance market growth, prompting insurers to expand their offerings and innovate to meet the evolving needs of a financially secure population.

The Presence of Key Market Players Propels the Market Growth

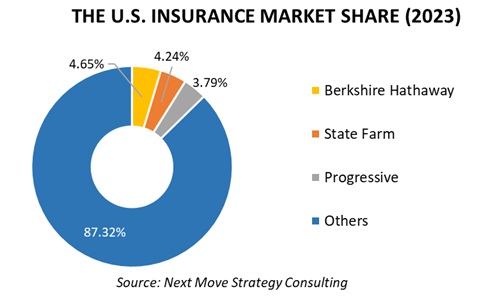

The presence of key market players such as Berkshire Hathaway, State Farm, Progressive, Chubb and others fuels the growth of the U.S. insurance market as they take various initiatives to enhance their service offerings and expand market reach.

For instance, in April 2024, State Farm launched Accident Assistance feature to assist drivers involved in collisions. Moreover, in March 2024, Chubb launched the global transactional risk platform to provide transactional risk liability insurance products across international markets. Their efforts to leverage data analytics, digital platforms, and personalized solutions not only attract new customers but also enhance the overall efficiency and competitiveness of the insurance sector, further propelling the market expansion.

Data Privacy and Security Issues Hinders the Growth of the Market

Insurers handle vast amounts of sensitive customer data, making them prime targets for cyberattacks. The industry's increasing reliance on cloud storage amplified the risk of data breaches.

For Example, in March 2024, Fidelity Investments Life Insurance Co. reported that a breach at Infosys McCamish Systems, a third-party service provider, led to the compromise of personal information for over 28,000 customers.

Additionally, in June 2023, Pan-American Life Insurance Group (PALIG) confirmed that its data was affected by the MOVEit cyberattack, which impacted more than 2,500 businesses. These incidents emphasize the urgent need for the insurance industry to bolster its cybersecurity measures to address evolving threats and protect sensitive data. These incidents highlight the critical need for the insurance industry to strengthen its cybersecurity measures to combat evolving threats and safeguard sensitive data.

The Shift Towards Digital Platforms Creates Future Growth Opportunities in the Market

The shift towards digital platforms and mobile applications presents a significant future growth opportunity for the insurance market trends as it improves customer engagement and streamlines claims processing.

By leveraging these digital tools, insurance companies offer more personalized and accessible services, allowing customers to manage policies, file claims, and receive support directly from their smartphones or computers.

This enhanced convenience and efficiency lead to higher customer satisfaction and loyalty, while also reducing operational costs for insurers. As more consumers embrace digital interactions, the market is poised to expand, with opportunities for innovation in product offerings and service delivery, further driving growth in the insurance sector.

Competitive Landscape

The U.S. insurance industry comprises various market players, such as Berkshire Hathaway Inc., State Farm Insurance, The Progressive Corporation, Nationwide Mutual Insurance Company, New York Life Insurance Company, Travelers Insurance, The Allstate Corporation, USAA, MetLife Services and Solutions, LLC, Chubb, Liberty Mutual Insurance, Zurich Insurance Group, Humana Inc, Erie Indemnity Co., American International Group, and others.

These companies are adopting various strategies including product launch and investment across various regions to maintain their dominance in the U.S. insurance market. By continuously innovating and launching new offerings, they aim to meet the evolving demands of customers and also enables them to capture new opportunities and expand their market share.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

July 2024 |

USAA |

USAA collaborated with Aflac to enhance the insurance options available to its members, primarily focusing on supplemental insurance products. This partnership aims to provide USAA members with greater financial security by offering additional coverage that complements existing health insurance policies. |

|

May 2024 |

Berkshire Hathaway |

Berkshire Hathaway invested in Chubb Limited and acquired a stake valued at approximately USD 6.72 billion to capitalize on the insurer's strong market position and stable revenue streams. |

|

November 2023 |

New York Life Insurance Company |

New York Life introduced a digital portal for employer-sponsored life insurance claims, partnering with Empathy to streamline the process. This new tool consolidates information gathering and document submission into a secure digital platform, simplifying the claims experience for beneficiaries and employers. |

|

May 2023 |

Nationwide insurance |

Nationwide launched CareMatters Together, a long-term care (LTC) insurance product that addresses the growing need for flexible and affordable LTC solutions. This product is designed to meet the challenges posed by rising LTC costs and the limitations of traditional coverage options, which lack flexibility and prohibitively expensive. |

|

December 2022 |

American International Group (AIG) |

AIG invested USD 2.5 billion in 2022 in digital transformation. The company is focusing on leveraging emerging technologies such as artificial intelligence, big data, cloud computing, blockchain and IoT to enhance operational efficiencies, improve product offerings, enhance customer experience, and minimize risks. |

The U.S. Insurance Market Key Segment

By Type

-

Life Insurance

-

Term Life Insurance

-

Whole Life Insurance

-

Universal Life Insurance

-

Variable Life Insurance

-

Burial Life Insurance

-

Other Type of Life Insurance

-

-

Health Insurance

-

Individual Health Insurance

-

Family Health Insurance

-

Group Health Insurance

-

Senior Citizen Health Insurance

-

Maternity Insurance

-

Top-up Health Insurance

-

Personal Accident Insurance

-

Others

-

-

Property and Casualty Insurance

-

Standard Fire and Special Perils Insurance

-

Burglary Insurance Coverage

-

Workmen’s Compensation Insurance

-

Business Interruption Insurance

-

All Risks Insurance Policy

-

-

Travel Insurance

-

International Travel Insurance

-

Family Travel Insurance

-

Senior Citizen Travel Insurance

-

Student Travel Insurance

-

Multi-Trip Travel Insurance

-

Travel Medical Insurance

-

Single Trip Travel Insurance

-

Others

-

-

Motor Insurance

-

Car Insurance

-

Bike Insurance

-

Third Party

-

Comprehensive

-

-

Other Insurance

By End User

-

Individuals

-

Businesses

By Distribution Channel

-

Direct Sales

-

Insurance Agents/Brokers

-

Bancassurance

Key Players

-

Berkshire Hathaway Inc.

-

State Farm Insurance

-

The Progressive Corporation

-

Nationwide Mutual Insurance Company

-

New York Life Insurance Company

-

Travelers Insurance

-

The Allstate Corporation

-

USAA

-

MetLife Services and Solutions, LLC

-

Chubb

-

Liberty Mutual Insurance

-

Zurich Insurance Group

-

Humana Inc

-

Erie Indemnity Co.

-

American International Group

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 1.48 Trillion |

|

Revenue Forecast in 2030 |

USD 2.39 Trillion |

|

Growth Rate |

CAGR of 6.6% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Trillion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst