Video Game Market by Device Type (Smartphones, PC and Laptops, Consoles), By Platform Type (Online Games, Offline Games), By Game Genre (Action, Adventure, Role-Playing and Others), By Monetization Model (Premium Games, Free-to-Play Games with In-Game Purchases and Others), By Age Group (Children, Teenagers, Adults, Older Adults), By End User (Individual Consumers, Competitive Players and Esports Participants, Institutional Users) — Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Video Game Market size was valued at USD 298.98 billion in 2024, and is expected to be valued at USD 337.85 billion by the end of 2025. The industry is projected to grow, hitting USD 612.26 billion by 2030, with a CAGR of 12.98% between 2025 and 2030.

Rising household disposable income is a key driver of the video game market, as greater financial flexibility allows consumers to spend more on gaming and related entertainment. Players are increasingly investing in premium game titles, downloadable content, consoles, accessories, and subscription services, encouraging developers and publishers to focus on high-quality games, live-service content, and diverse pricing strategies. This trend expands the potential revenue base, strengthens player engagement, and broadens the gaming audience, positioning video games as a mainstream and widely accessible form of entertainment for multiple demographics.

The rapid adoption of advanced network technologies, such as 5G, is transforming the market by enabling fast, low-latency connections that enhance mobile, cloud, and real-time multiplayer gaming. Developers now deliver console-quality experiences on smartphones and low-spec devices, while supporting augmented and virtual reality gameplay previously limited by network constraints. This technological shift opens new opportunities for cloud gaming, subscription models, and socially interactive experiences, allowing studios to reach wider audiences and create more immersive, engaging, and accessible games.

What are the Key Trends in Video Game Industry?

How is Cloud Gaming and Streaming Accelerating Platform Convergence in the Video Game Market?

Cloud streaming is fundamentally redefining the video game market, shifting it from a hardware-dependent model to a service-driven ecosystem. By enabling instant access to high-quality games across smartphones, TVs, tablets, and low-end PCs, cloud technology is expanding the market’s reach and accessibility. This democratization of gaming is opening doors for millions of new players who previously lacked access to expensive consoles or gaming rigs. Industry-wide investments in cloud infrastructure, data centers, and game streaming platforms are accelerating this transition, signaling that cloud-based gaming is becoming one of the fastest-growing segments in the global market.

From a market perspective, this evolution is prompting developers and publishers to design cloud-optimized titles that maintain performance across variable internet speeds and devices. At the same time, companies are pursuing strategic collaborations with telecommunication providers and smart-device brands to ensure seamless delivery and improved latency. The move toward subscription-based cloud gaming models is also reshaping monetization patterns, turning one-time purchases into continuous revenue streams. For the broader market, cloud streaming is not just a technological advancement, it’s a structural transformation driving inclusivity, cross-platform engagement, and long-term market expansion by decoupling gaming from physical hardware constraints.

How is Expanding Internet and Mobile Broadband Access Driving the Video Game Market Growth?

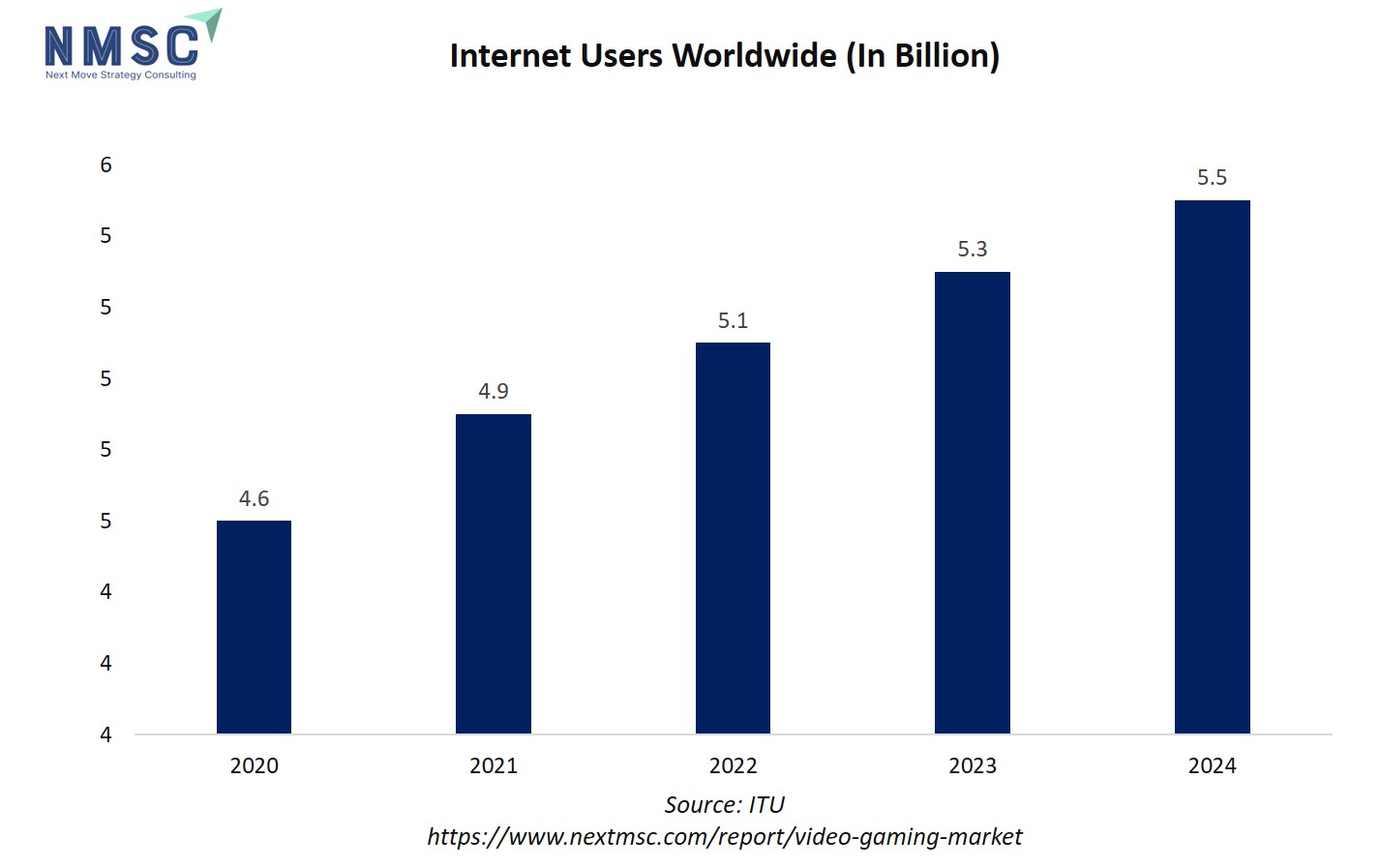

The expansion of global internet access is shaping the market, transforming how and where people play. According to the International Telecommunication Union (ITU), around 5.5 billion people, about 68% of the world’s population were online in 2024, highlighting the steady growth of connectivity worldwide. This trend is allowing more players, including those in regions with limited gaming infrastructure, to engage with online, mobile, and cloud-based games, expanding the market’s reach. In response, developers are creating lightweight, cross-platform titles that run on PCs, consoles, smartphones, and even low-spec devices, while publishers are leveraging digital distribution channels to connect with these newly connected audiences. Overall, growing internet access is broadening the player base and reshaping the market toward more inclusive, accessible, and globally connected gaming experiences.

How is Stronger Government Regulation on In-Game Purchases Influencing the Video Game Market Trends?

Increasing government oversight on in-game billing is emerging as a significant trend in the market, reshaping how publishers design monetization systems. Regulatory bodies, such as the U.S. Federal Trade Commission, have taken major enforcement actions, including issuing over USD 126 million in refunds for deceptive in-game charges, and governments are publishing guidelines to improve protections around randomized purchases like loot boxes. This is prompting game companies to simplify purchase flows, implement clear parental controls, enforce spending limits, and transparently disclose odds and prices. For the market, studios that proactively audit checkout processes, remove dark patterns, and ensure compliance not only reduce legal risks but also strengthen player trust and engagement, which translate into sustained revenue growth. Overall, regulatory pressure is pushing the market toward safer, more transparent, and player-friendly monetization practices.

The steady rise in global internet users, from 4.6 billion in 2020 to a projected 5.5 billion in 2024, directly fuels market growth by massively expanding the potential player base for online, mobile, and cloud-based games; this connectivity is the essential infrastructure that allows the industry to thrive by making games more accessible, supporting live-service models, enabling digital distribution, and fostering the ecosystems of esports and game streaming, thereby ensuring the market's continued expansion.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Video Game Industry in Next Decade?

The video game market demand is being driven by rising household disposable income, which enables consumers to allocate a greater share of their budgets toward gaming and entertainment. This increased financial flexibility fuels spending on premium titles, downloadable content, consoles, accessories, and subscription-based services. Developers and publishers are responding by creating high-quality, immersive, and live-service games supported by diverse pricing models to attract a broader audience. As a result, the market continues to expand, with gaming becoming a mainstream and inclusive entertainment choice across different age groups and regions.

Simultaneously, the rapid deployment of 5G networks is reshaping the industry by offering faster, more reliable connections that enhance mobile, cloud, and multiplayer gaming experiences. Players now enjoy high-performance games on a wider range of devices, including smartphones and tablets, while developers gain the ability to integrate augmented and virtual reality features seamlessly. By leveraging 5G, companies are expanding cloud gaming ecosystems, subscription models, and social interaction within gameplay, unlocking new growth opportunities and deeper engagement in global markets.

Growth Drivers:

How is Rising Household Disposable Income Impacting the Video Game Market Expansion?

Rising household disposable income is influencing the market by enabling consumers to allocate more of their budget toward gaming and related entertainment. With more financial flexibility beyond essential expenses, players are increasingly investing in premium game titles, downloadable content, consoles, accessories, and subscription services. This shift is motivating developers and publishers to focus on high-quality games, live-service content, and varied pricing strategies to appeal to a wider audience. For the market, higher disposable income means larger potential revenue, stronger player engagement, and a growing customer base, positioning gaming as a mainstream, accessible, and attractive entertainment option for a broad range of demographics.

How is the Global Rollout of 5G Driving Growth in the Video Game Market?

The video game market is being driven by rising household disposable income, which allows consumers to allocate more of their budgets toward gaming and related entertainment. Increased financial flexibility encourages spending on premium game titles, downloadable content, consoles, accessories, and subscription services, motivating developers and publishers to focus on high-quality games, live-service content, and flexible pricing strategies. This trend supports stronger player engagement, larger potential revenue, and a growing customer base, positioning gaming as a mainstream and accessible form of entertainment for diverse demographics worldwide.

At the same time, the rapid adoption of 5G networks is transforming the market by enabling fast, low-latency connections that enhance mobile, cloud, and multiplayer gaming experiences. Developers now deliver console-level games on smartphones, tablets, and low-spec devices, while supporting AR and VR experiences previously limited by network constraints. Leveraging 5G, studios expand cloud gaming, subscription models, and socially interactive gameplay, creating richer, more accessible experiences that drive both engagement and revenue across global markets.

Growth Inhibitors:

How is Elevated Household Saving and Cautious Consumer Spending Constraining the Market?

Rising household savings in key markets are creating a notable restraint on the video game industry. Recent data from Eurostat highlight elevated saving rates across the euro area, while the US Bureau of Economic Analysis reports that personal savings in the United States remain well above pre-pandemic levels. This trend limits discretionary spending, directly impacting demand for premium games, hardware upgrades, downloadable content, and in-game purchases. As a result, the market is experiencing slower console replacement cycles, more cautious spending on high-priced titles, and increased price sensitivity for subscriptions and microtransactions. Consequently, revenue growth for publishers and studios constrained unless strategies such as free-to-play models, trial offers, flexible pricing, and smaller-ticket monetization are aggressively employed.

How does High E-Commerce Adoption Create New Opportunities for Video Game Monetization?

With 77% of EU internet users buying goods or services online in 2024, players are increasingly comfortable with digital payments and online transactions. This creates a significant opportunity for the video game industry to expand digital storefronts, microtransactions, subscriptions, and in-game purchases. Game publishers and developers leverage this trend by offering low-cost digital content, trial versions, and regionally tailored pricing, encouraging player engagement and spending without depending on high-priced physical games or hardware upgrades. By aligning offerings with these established online purchasing behaviors, the industry enhance revenue resilience even as households prioritize saving and limit discretionary spending.

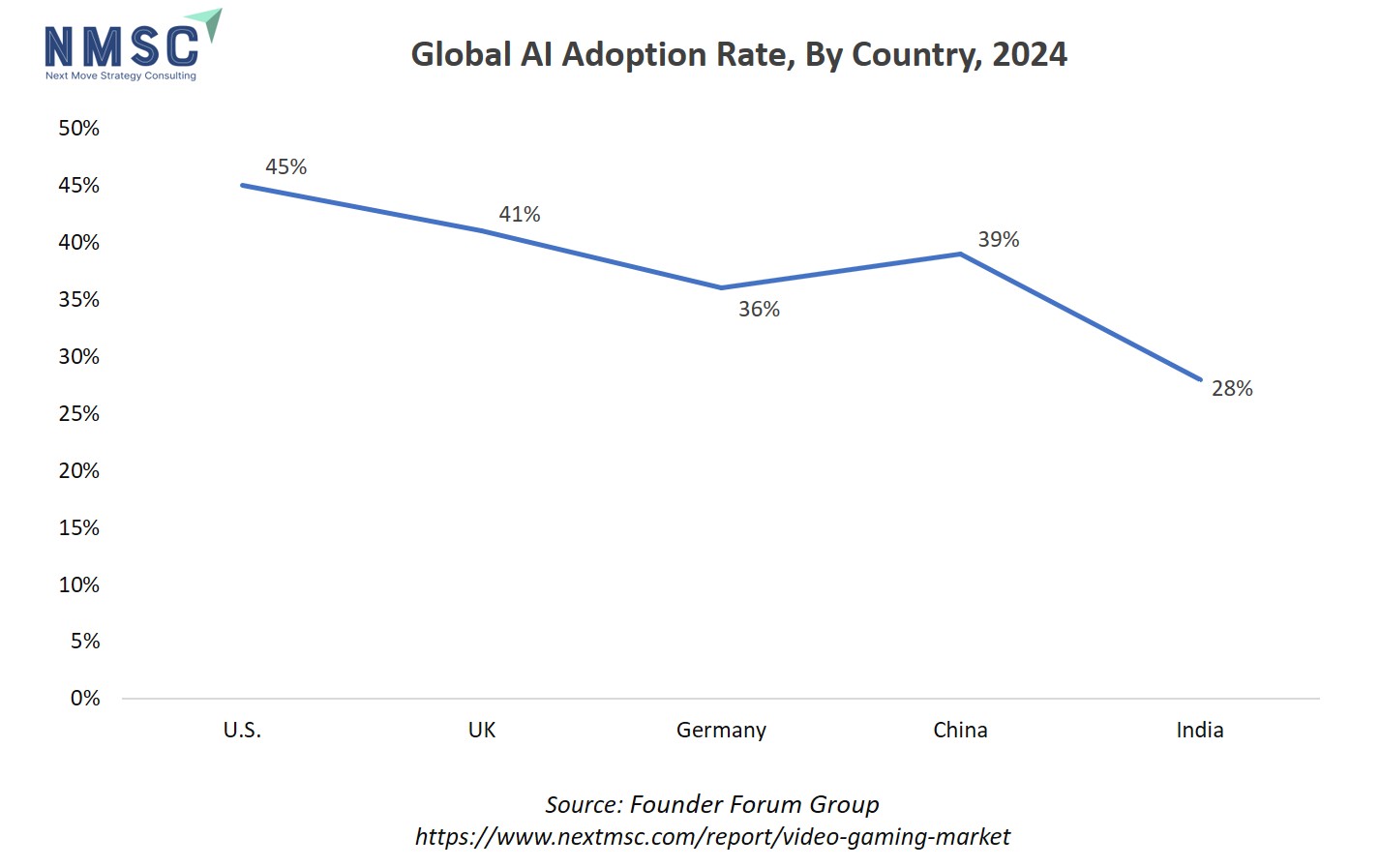

The chart illustrates the AI adoption rates across different countries in 2024, showing significant variation with nations like the U.S., UK, and China leading the way, and this technological integration is profoundly accelerating market growth by enabling sophisticated advancements in game development through procedural content generation, highly responsive and intelligent NPC behavior powered by AI, and hyper-personalized player experiences, while also streamlining production pipelines and pioneering new genres of interactive entertainment, thereby enhancing game quality, innovation, and overall player engagement on a global scale.

How is the Video Game Market is Segmented in this Report, and What are the Key Insights from Segmentation Analysis?

By Device Type Insights

How is the Video Game Market Shaped by Device Type?

Based on device type, the market is segmented into smartphones, PC and laptops and consoles.

The smartphone segment represents a key category in the video game market, driven by the widespread adoption of mobile devices and the convenience of gaming on the go. Mobile games are typically designed for short, accessible play sessions and feature free-to-play models with in-app purchases, making them highly monetizable. This segment allows developers to reach a broad and diverse audience, including casual gamers who do not invest in dedicated gaming hardware like consoles or high-end PCs. With increasing internet penetration and mobile connectivity, smartphones continue to be a strategic platform for engagement, digital monetization, and expanding the overall gaming ecosystem.

By Platform Type Insights

Which Platform Type Dominates the Video Game Market?

Based on platform type, the market is segmented into online and offline platform.

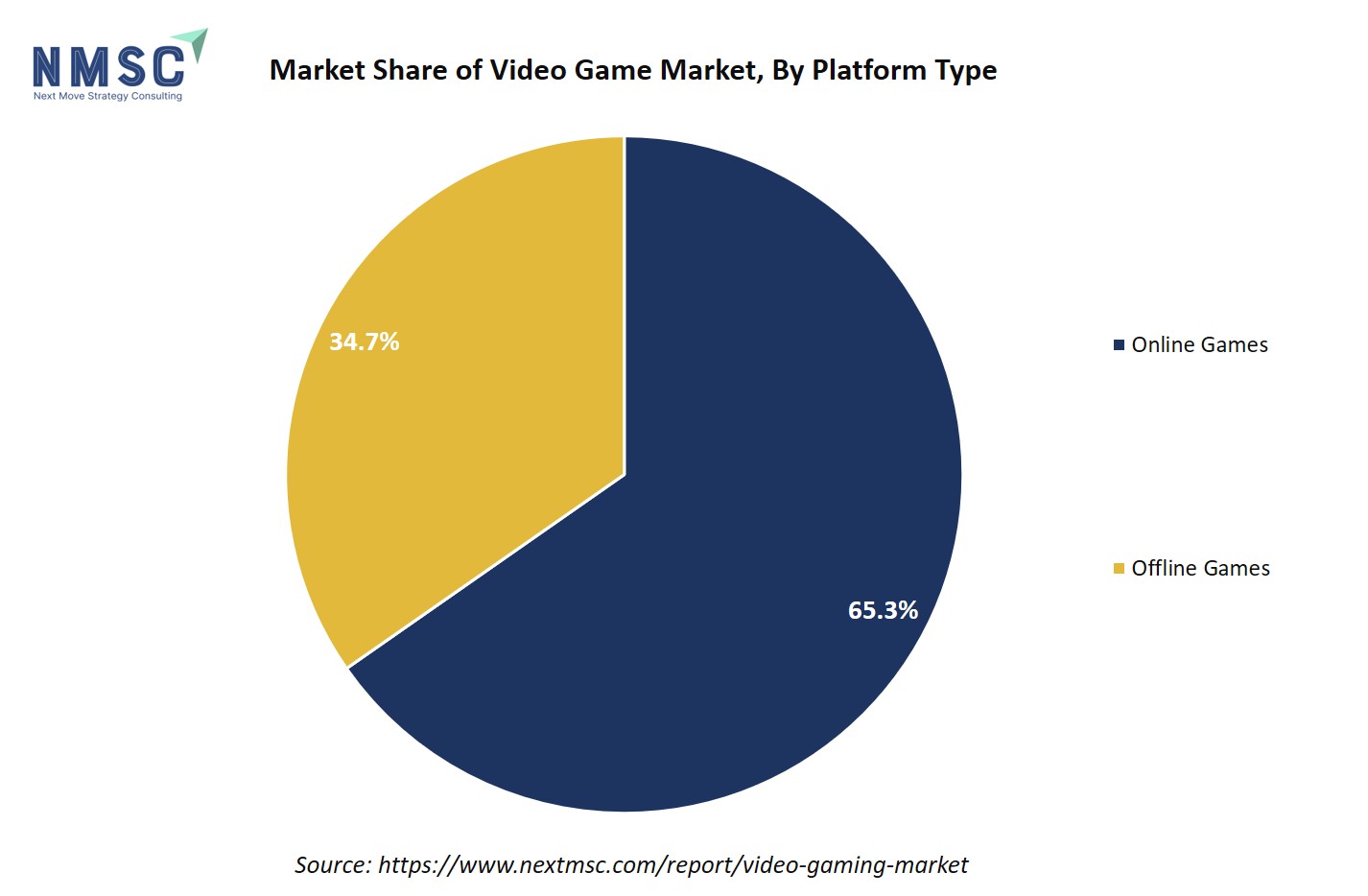

The online games segment encompasses games that require an internet connection, offering interactive and connected experiences. This includes cloud-based games, which allow players to stream games without high-end hardware, and multiplayer online games, which enable real-time interaction with other players globally. Online games are increasingly popular due to their continuous content updates, social engagement, and monetization opportunities through subscriptions, in-game purchases, and microtransactions. This platform type allows developers to maintain long-term player engagement, expand their audience reach, and create recurring revenue streams, making it a critical segment in the evolving market.

This chart illustrates the division of the global video game market share by platform type, revealing a dominant distribution where online platform category holds a commanding 65.3% majority share, while the offline platform type accounts for the remaining 34.7% of the market.

By Age Group Insights

How Is the Market Influenced by Age Group?

Based on age group, the market is segmented into children, teenagers and others.

The children segment represents a key demographic in the video game market, focused on games that are age-appropriate, educational, and entertaining. Games for this group emphasize simple mechanics, colorful visuals, and interactive learning elements, catering to shorter attention spans and developmental needs. This segment also drives opportunities for parent-approved purchases, mobile and tablet-based gaming, and branded or licensed content. By designing safe, engaging, and accessible games, developers capture early brand loyalty and foster long-term engagement as these young players grow into broader gaming audiences.

By End User Insights

Which End User Dominates the Video Game Market?

Based on end user, the market is segmented into individual consumers and others.

The individual consumers segment includes casual and dedicated gamers who purchase or access video games for personal entertainment. This group drives demand for a wide range of gaming experiences, from mobile and console games to PC and cloud-based titles. Individual consumers engage with games through one-time purchases, subscriptions, and in-game microtransactions, making them a crucial revenue source for publishers and developers. Their preferences influence game design, content updates, and monetization strategies, as studios aim to provide engaging, personalized, and easily accessible gaming experiences that cater to diverse interests and play styles.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa and each region is further studied across countries.

Video Game Market in North America

North America remains a leading region in the video game market, driven by strong adoption of next-gen consoles, cloud gaming, and subscription-based services. The region benefits from a robust esports ecosystem and widespread streaming platforms that enhance engagement and monetization opportunities. Mobile gaming is also growing rapidly due to high smartphone penetration and digital payment adoption. Additionally, the rise of VR/AR and immersive gaming experiences attracts both casual and hardcore gamers. Independent studios and established publishers are investing in innovative content and cross-platform games, making North America a hub for technological innovation, premium gaming experiences, and diversified revenue streams.

Video Game Market in the United States

The U.S. market is experiencing robust growth, driven by increasing adoption of console and PC gaming, the expansion of esports and competitive gaming, and rising mobile game downloads. Subscription-based and cloud gaming platforms are enhancing accessibility, while innovative content and immersive gameplay are attracting a broader audience. Significant investments in VR/AR technologies and AI-driven gaming further support market expansion. Additionally, growing monetization through in-game purchases and downloadable content (DLC) strengthens revenue streams. According to the American Gaming Association, online gaming accounted for 30.0% of nationwide commercial gaming revenue in 2024, generating a record USD 21.54 billion, underscoring the country’s leading position in the global video game ecosystem.

Video Game Market in Canada

Canada’s growth is supported by a strong gaming community and high smartphone penetration. The market benefits from government support for game development studios and incentives for technological innovation. Increasing adoption of mobile and indie games, along with investments in AR/VR experiences, drives engagement. Additionally, the country’s strong broadband infrastructure supports cloud gaming and live-streaming platforms. With esports tournaments and influencer-led promotions gaining popularity, Canada presents substantial growth potential for both domestic and international game publisher.

Video Game Market in Europe

Europe’s video game market is expanding due to high console and PC adoption, growing mobile gaming, and a strong esports ecosystem. Urban populations in the UK, Germany, France, and Spain drive demand for VR/AR and immersive gaming experiences, while broadband penetration and digital literacy support online and cloud-based platforms. Government incentives and funding programs for local game development foster innovation and international collaboration. Increasing interest in cross-platform, multiplayer, and live-service titles, combined with influencer marketing and streaming engagement, boosts player acquisition. Together, these factors position Europe as a mature yet rapidly evolving market with opportunities for both domestic and international game publishers.

Video Game Market in the United Kingdom

The UK video game market is experiencing robust growth, driven by increasing adoption of console and mobile gaming, the expansion of esports events, and strong engagement with online gaming communities. The rise of cloud gaming and subscription-based models enhances accessibility for casual gamers, while UK-based game development studios focus on innovative VR/AR titles and interactive experiences. High broadband penetration and growing digital literacy support online multiplayer games and streaming platforms. Government initiatives to promote digital entertainment and competitive gaming further strengthen market expansion, positioning the UK as a key European hub for gaming innovation. According to Data City Innovations Ltd, the UK gaming sector is projected to reach approximately USD 49.3 billion USD by 2027, based on a growth rate of 9.1%. This growth underscores the country's leading role in the global video game ecosystem

Video Game Market in Germany

Germany’s market growth is driven by console and PC gaming, competitive esports, and expanding mobile gaming adoption. Developers are investing in AR/VR applications, simulation games, and strategy titles that cater to tech-savvy users. Strong broadband infrastructure and high disposable incomes encourage premium gaming purchases, including hardware, software, and in-game content. Government initiatives promoting digital culture and game development, combined with high engagement in multiplayer and online platforms, position Germany as one of the leading markets in Europe.

Video Game Market in France

France’s gaming industry is fueled by a growing base of mobile gamers and the popularity of PC and console esports. Developers are focusing on VR/AR content, multiplayer online games, and live-service titles. Government support through funding programs and tax incentives for game development encourages local innovation. Increasing internet penetration and smartphone usage boost access to mobile and cloud-based gaming platforms. Additionally, rising engagement with gaming content on social media and streaming platforms drives user acquisition, making France a vibrant and steadily expanding video game market in Europe.

Video Game Market in Spain

Spain’s market is expanding rapidly, supported by high digital adoption, growing mobile gaming popularity, and vibrant esports communities. Developers are increasingly focusing on cross-platform and cloud-based games, enabling seamless play across devices, while rising smartphone penetration and social media integration drive in-game purchases and interactive engagement. Government support for startups and creative industries encourages the development of indie games and innovative content. Urban gamers are fueling demand for immersive and multiplayer experiences, with tournaments and events further promoting awareness and adoption. Spain’s advanced digital infrastructure, 93% of the population has access to very high-capacity fixed networks combined with policies supporting AI, cloud computing, and other disruptive technologies, positions the country as a leading Southern European market for video gaming innovation.

Video Game Market in Asia Pacific

The Asia-Pacific video game market is witnessing rapid growth due to increased investment in game development studios, rising disposable incomes, and urban lifestyle trends. Governments across the region are supporting tech incubators and creative hubs, fostering innovation in AR/VR and AI-driven gaming. China’s market benefits from regulatory encouragement for esports and professional gaming leagues, while Japan’s growth is fueled by cultural affinity for RPGs, simulation games, and iconic franchises. South Korea emphasizes competitive gaming infrastructure and government-backed esports programs, whereas Australia invests in interactive gaming events and local content creation. India is witnessing strong adoption of cloud-based multiplayer and social gaming communities, positioning the region as a global innovation hub.

Video Game Market in China

China’s video game market, the largest globally, is experiencing rapid growth, fueled by mobile gaming, PC esports, and console adoption. With over 1 billion 5G subscribers by the end of 2024, high smartphone penetration and widespread online multiplayer engagement are driving revenue expansion. Government-backed initiatives support game development, esports, and AI- and cloud-based gaming innovations. VR/AR content and interactive live streaming are particularly popular among younger demographics. While regulations on gaming hours and content influence consumption patterns, urban, tech-savvy populations continue to adopt immersive, innovative gaming experiences. Rapid 5G infrastructure deployment and the transition to 5G-Advanced further enhance connectivity, positioning China as a global leader in gaming innovation and digital entertainment.

Video Game Market in Japan

Japan’s market is experiencing steady growth, underpinned by a highly urbanized population and widespread digital adoption. As of early 2024, the country had 104.4 million internet users, representing 84.9% internet penetration, driving demand for console, PC, and mobile gaming. The market benefits from strong consumer engagement, a rich gaming culture, and continuous innovation in game design, VR/AR integration, and AI-driven experiences. Subscription-based and cloud gaming platforms are gaining traction, enhancing accessibility and broadening the player base. Additionally, revenue growth is supported by in-game purchases, downloadable content (DLC), and competitive esports tournaments, which are increasingly popular among younger demographics. High disposable incomes, technological sophistication, and evolving entertainment preferences position Japan as a mature yet progressively expanding segment in the global video game ecosystem.

Video Game Market in India

India’s video game market is expanding rapidly, driven by widespread smartphone adoption, low data costs, and increasing digital literacy. Mobile gaming dominates revenues, supported by social media integration, online multiplayer titles, and in-game monetization. Growth is further fueled by esports tournaments, influencer marketing, and rising investments in gaming startups. Government initiatives promoting digital entertainment, app development, and creative industries encourage innovation. Urban youth and gamers in tier-2 and tier-3 cities are increasingly adopting online and cloud-based gaming platforms. Mobile penetration is high, with approximately 97.6% of urban youth and 96.8% of rural youth (ages 15–29) using mobile phones for personal calls or internet access, highlighting the vast potential for digital gaming adoption across demographics.

Video Game Market in South Korea

South Korea is a global leader in esports and competitive gaming, driving strong demand for PC, console, and mobile games. Growth is fueled by advanced internet infrastructure, high smartphone penetration, and cultural enthusiasm for multiplayer and online games. Investment in VR/AR experiences, cloud gaming, and AI-powered game features attracts younger consumers. Government support for gaming studios, esports leagues, and innovation hubs strengthens industry expansion. South Korea’s tech-savvy urban population ensures high engagement with interactive and competitive gaming content, making it a model market in Asia-Pacific.

Video Game Market in Australia

Australia’s market is growing steadily, driven by adoption across console, PC, and mobile platforms. Around 59% of the population plays games on mobile devices, supported by powerful smartphones and 5G networks that enable near-lag-free experiences comparable to consoles. Subscription-based and cloud gaming services are increasingly popular, while high broadband penetration and urbanized populations facilitate online multiplayer gaming and esports participation. Developers are introducing VR/AR and immersive content to attract diverse gamers. Government initiatives supporting creative industries, gaming competitions, and development grants foster local innovation. Rising engagement with streaming platforms and influencer-led content further drives market expansion, positioning Australia as a leading technology-driven gaming hub in the Asia-Pacific region.

Video Game Market in Latin America

Latin America’s gaming market is growing due to expanding mobile internet access, affordable smartphones, and rising interest in free-to-play and casual games among younger demographics. The region is also witnessing growth in console gaming, especially in Brazil and Mexico, fueled by increasing disposable incomes and brand loyalty toward popular franchises. Additionally, local game development studios and indie game communities are emerging, supported by government incentives and digital startup initiatives, driving innovation and creating region-specific gaming content that resonates with local players.

Video Game Market in the Middle East & Africa

The Middle East & Africa market is driven by rapid urbanization and smartphone penetration, government-backed initiatives for digital entertainment, and the rise of cloud gaming platforms to overcome hardware limitations. Growth is further supported by increasing esports engagement in countries like UAE, Saudi Arabia, and South Africa, and investments in VR/AR gaming experiences. The expansion of tech hubs and gaming incubators encourages local game development, while rising disposable income and high social media usage facilitate adoption of both mobile and console games across urban populations.

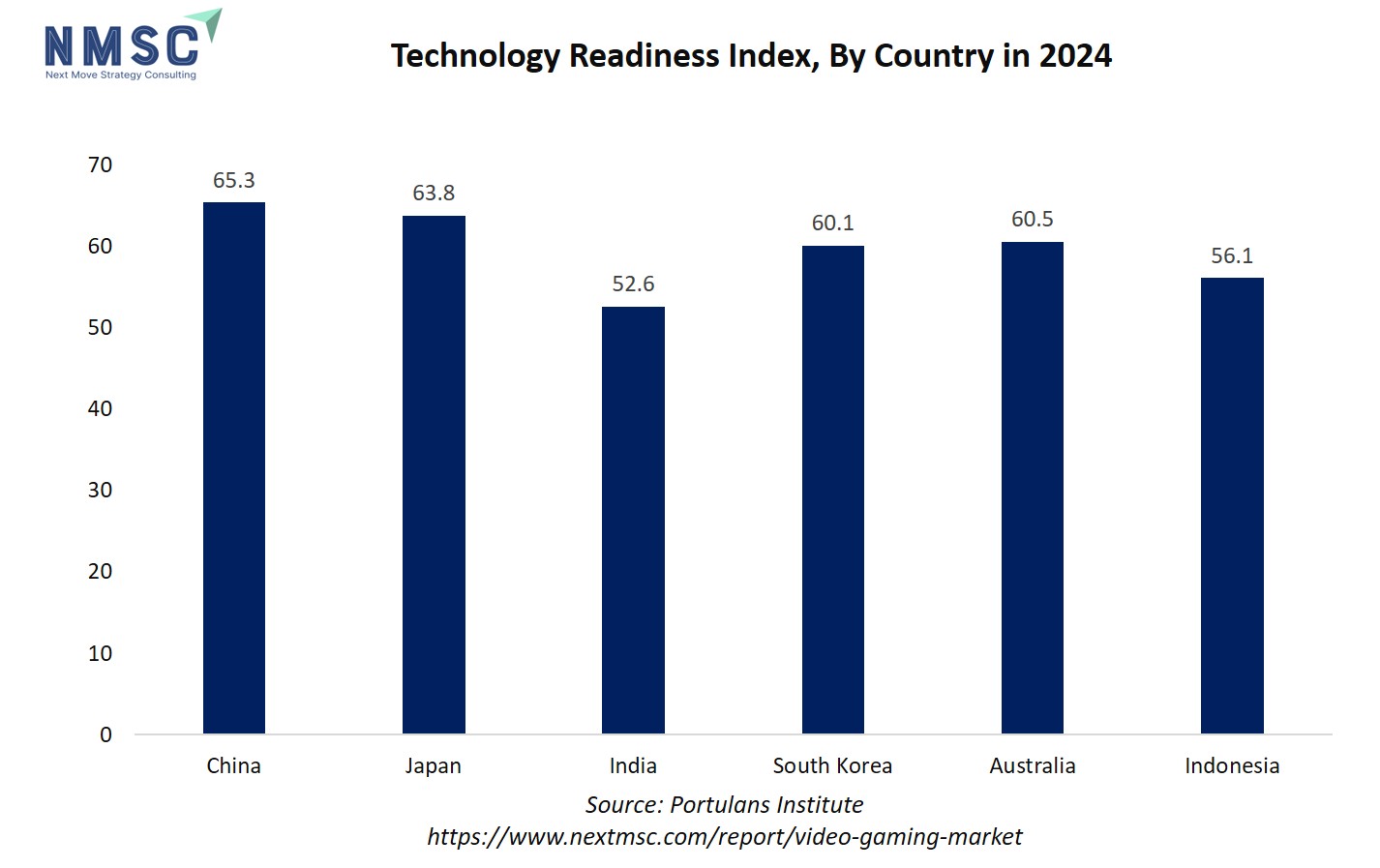

The Technology Readiness Index directly impacts video game market growth by identifying the most fertile grounds for expansion; countries like China, Japan, and South Korea, with their high readiness, represent mature, innovation-driven markets that are hubs for game development, esports, and early adoption of cutting-edge technologies like cloud gaming and VR, while nations with significant populations and improving scores like India and Indonesia represent the next massive frontier for user acquisition, primarily in mobile gaming, as better infrastructure and digital literacy unlock their vast potential for market growth.

Competitive Landscape

Who are the Leading Companies in the Video Game Industry and How are They Competing?

The global video game market is increasingly shaped by both established multinational giants and innovative niche players, including Sony Interactive Entertainment Inc., Nintendo Co., Ltd., Activision Blizzard, NetEase Games, Electronic Arts Inc., Take-Two Interactive Software, Inc., Ubisoft Entertainment SA, Bandai Namco Entertainment Inc., Square Enix Co., Ltd., Sega Corporation, Konami Digital Entertainment Co., Ltd., Capcom Co., Ltd., Epic Games, Inc., Nexon Co., Ltd., and CD PROJEKT S.A. These companies compete through product innovation, expanding portfolios with console, PC, mobile, cloud-based, and online multiplayer games, and by offering live-service models, in-game purchases, and subscription services. They leverage digital marketing, esports partnerships, and online platforms to engage players and strengthen loyalty. Studios also focus on cross-platform accessibility, regional customization, and continuous content updates, ensuring sustained engagement and monetization. By emphasizing immersive experiences and community-driven content, these companies continue to shape the global gaming landscape and respond to evolving player preferences.

Innovation and Adaptability Drive Market Success

In the video game market, innovation and adaptability remain key drivers of growth, shaping competitive dynamics and allowing companies to stand out in a rapidly evolving landscape. Sony’s unveiling of the PlayStation 5 Pro in September 2024, featuring enhanced graphics and performance, highlights how innovation and adaptability are key drivers of success in the market. By upgrading hardware capabilities and responding to evolving consumer expectations, Sony demonstrates its ability to adapt to market trends, enhance user experience, and maintain competitive leadership. Such product innovation not only attracts new players but also strengthens loyalty among existing users, reinforcing the company’s position in a rapidly evolving gaming ecosystem.

List of Video Game Companies

-

Sony Interactive Entertainment Inc.

-

Nintendo Co., Ltd.

-

Activision Blizzard

-

NetEase, Inc. / NetEase Games

-

Electronic Arts Inc.

-

Take-Two Interactive Software, Inc.

-

Ubisoft Entertainment SA

-

Bandai Namco Entertainment Inc.

-

Square Enix Co., Ltd.

-

Sega Corporation

-

Konami Digital Entertainment Co., Ltd.

-

Capcom Co., Ltd.

-

Epic Games, Inc.

-

Nexon Co., Ltd.

-

CD PROJEKT S.A.

What are the Latest Key Industry Developments?

-

In October 2025, Sony released Ghost of Yōtei, an action-adventure game set in 17th-century Japan. This launch highlights Sony’s focus on diversifying its game portfolio and delivering immersive, culturally rich experiences to players. By introducing new high-quality titles, the company not only engages existing gamers but also attracts new audiences, reinforcing its competitive position in the global market. Such strategic releases showcase how leading developers leverage innovative content and storytelling to drive player engagement, support digital monetization, and sustain long-term growth in an evolving gaming landscape.

-

In March 2025, Electronic Arts (EA) released F1® 25, developed by Codemasters, marking a significant addition to its racing game lineup. This launch demonstrates EA’s focus on delivering high-quality, immersive gaming experiences while capitalizing on the popularity of sports and racing titles in the global market. By offering updated features, realistic gameplay, and enhanced graphics, EA engages both existing fans and new players, reinforcing its competitive position in a dynamic gaming landscape where franchise continuity and innovation are key drivers of player engagement and revenue.

-

In February 2025, Take-Two announced the launch of Sid Meier’s Civilization® VII, the latest installment in its iconic strategy game series. This release underscores Take-Two’s commitment to strengthening its game portfolio and delivering high-quality, engaging experiences to a global audience. By continuing a beloved franchise, the company reinforces player loyalty while attracting new gamers, reflecting a broader trend in the market where established titles and franchise expansions drive engagement and revenue growth. Strategic launches like this highlight how leading publishers leverage innovation within proven IPs to maintain competitiveness and meet evolving player expectations.

What are the Key Factors Influencing Investment Analysis & Opportunities in Video Game Market?

Investment in the video game market continues to be shaped by evolving consumer demand, technological innovation, and the growing prominence of digital platforms. Funding trends indicate a strong interest from both venture capital and strategic investors in companies that offer cloud gaming, mobile games, esports, and live-service models. Investors are increasingly prioritizing scalable business models, franchise potential, and recurring revenue streams, which influence valuations and drive strategic acquisitions. The focus on innovation and content diversification enhances the attractiveness of companies that deliver immersive experiences and adapt to changing player preferences.

Certain regions and segments are emerging as key investment hotspots, particularly in markets with high digital penetration and expanding gaming communities. Opportunities exist in mobile and online gaming, cross-platform experiences, and esports infrastructure, where early investment capture significant growth potential. Strategic partnerships, IP expansions, and technology-driven offerings further create avenues for investors to maximize returns while participating in the evolving global gaming ecosystem.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) provides a comprehensive analysis of the Video Game Market, covering historical trends from 2020 through 2024 and delivering detailed forecasts through 2030. Our study offers global, regional, and country-level insights, including quantitative projections, key growth drivers, challenges, and investment opportunities across all major segments of the market.

Report Scope

|

Parameters |

Details |

|

Market Size in 2025 |

USD 337.85 Billion |

|

Revenue Forecast in 2030 |

USD 612.26 Billion |

|

Growth Rate |

CAGR of 12.98% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Rising household disposable income driving market growth. Global rollout of 5g accelerating video game market growth |

|

Countries Covered |

33 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Device Type

-

Smartphones

-

PC and Laptops

-

Consoles

-

Home Consoles

-

Handheld Consoles

-

Hybrid Consoles

-

By Platform Type

-

Online Games

-

Cloud-based Games

-

Multiplayer Online Games

-

-

Offline Games

-

Single Player Games

-

Local Multiplayer Games

-

By Game Genre

-

Action

-

Adventure

-

Role-Playing

-

Simulation

-

Strategy

-

Sports

-

Puzzle and Casual

-

Others

By Monetization Model

-

Premium Games (Paid)

-

Free-to-Play Games with In-Game Purchases

-

Subscription-based Games

-

Advertising-based Games

By Age Group

-

Children (Below 12)

-

Teenagers (13–19)

-

Adults (20–39)

-

Older Adults (40+)

By End User

-

Individual Consumers

-

Competitive Players and Esports Participants

-

Institutional Users

-

Educational Institutions

-

Gaming Cafes and Arenas

-

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on the market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Video Game Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst