Warehouse SCARA Robots Market by Components (Hardware (Controller, Arm, End Effector, Drive, Sensor), Software, and Services (Installation, Maintenance and Repair)), by Payload Capacity (Up to 5.00 KG, 5.01 KG to 15.00 KG, More than 15.00 KG), by Axis Type (3-Axis SCARA, 4-Axis SCARA, 5-Axis SCARA, Others), by Application (Material Handling, Assembling and Disassembling, and Others), and by Industry Vertical (E-Commerce, and Others)– Global Opportunity Analysis and Industry Forecast 2025-2030

Warehouse SCARA Robots Industry Overview

The global Warehouse SCARA Robots Market size was valued at USD 566.8 million in 2024 and is expected to be valued at USD 680.1 million by the end of 2025. The industry is further predicted to USD 1692.4 million by 2030 with a CAGR of 20% from 2025-2030.

The warehouse SCARA robots market growth is driven by the immense rise of e-commerce, labour shortages, and advancements in robotics technology. SCARA robots are increasingly adopted to meet the demand for faster order fulfilment and mitigate labour shortages. However, high initial investment and integration costs pose a challenge, especially for smaller enterprises. On the other hand, an opportunity lies in integrating AI and vision systems into SCARA robots, enhancing their capabilities in object recognition and autonomous navigation, leading to improved efficiency and expanded applications in warehouses.

Growth in E-Commerce Drives the Market Expansion

The explosive growth of e-commerce is undeniably a major catalyst for the expansion of warehouse robotics sector, including the warehouse SCARA robots market adoption. Retailers are under immense pressure to deliver goods faster and more efficiently than ever before. This surge in online shopping has created a need for automated solutions that handle the increased volume of orders and the demand for quicker turnaround times.

SCARA robots, known for their speed and precision in tasks like picking and packing, are proving to be valuable assets in meeting these demands within warehouse settings. For instance, the need for rapid order fulfilment driven by e-commerce is pushing retailers to explore and implement various forms of warehouse automation, including robotic solutions.

Labour Shortages and Rising Costs Fuel SCARA Robot Adoption

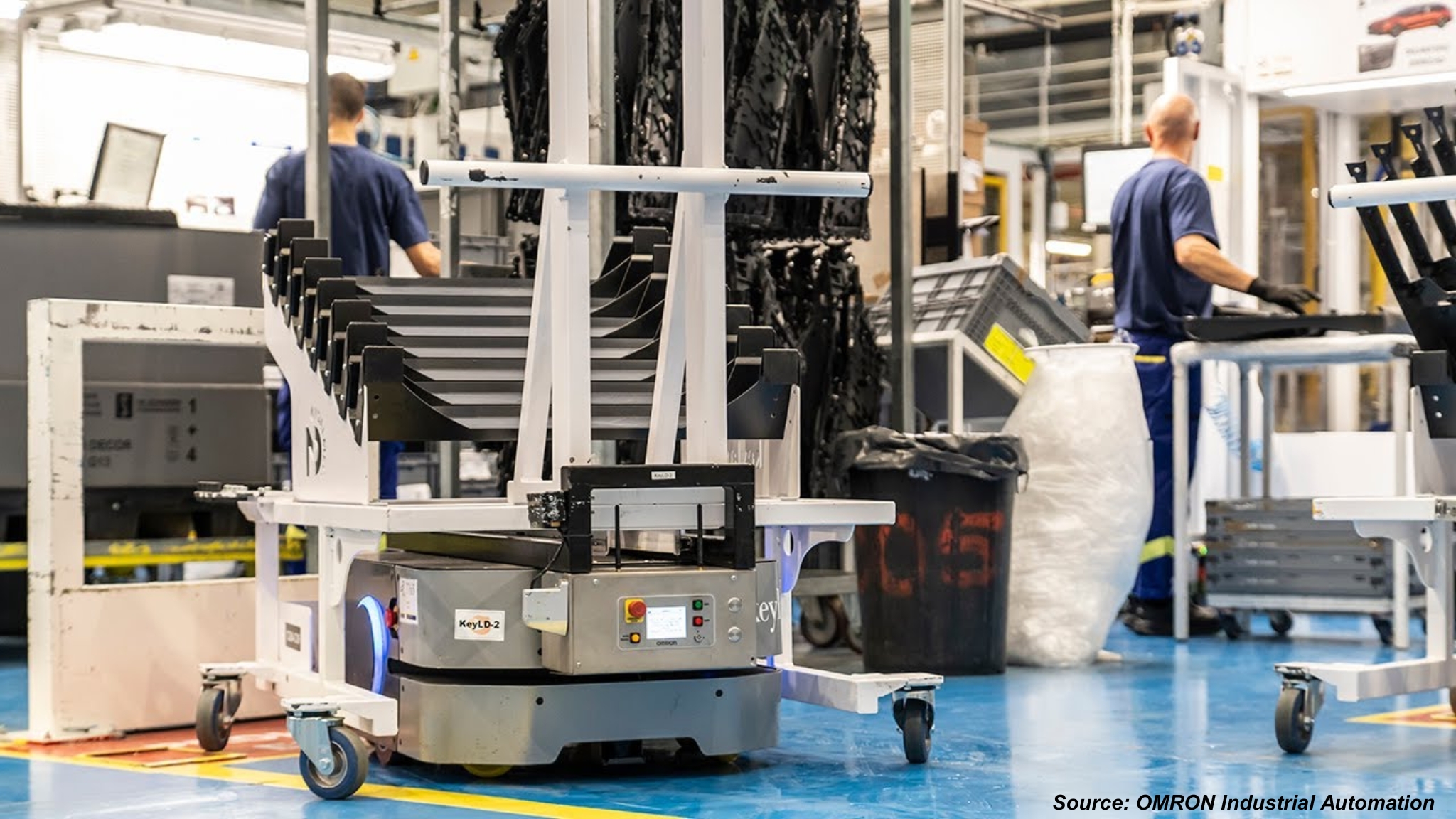

The increasing challenge of finding and retaining warehouse labour is another significant driver propelling the warehouse SCARA robots market demand. Automation offers a way to mitigate the impact of labour shortages and rising labour costs. Industrial robots, including SCARA types, perform repetitive and physically demanding tasks consistently and tirelessly, reducing the reliance on human workers for such activities. This not only helps in maintaining operational efficiency but also improves workplace safety and reduces errors. As the industrial robotics market continues to evolve, the ability of robots like SCARAs to augment or even replace human labour in specific warehouse tasks becomes increasingly attractive.

Advancements in Robotics Technology Fuels the Market Growth

SCARA robots have inherent characteristics that make them well-suited for various tasks within a warehouse environment, particularly pick-and-place and assembly operations. Their design allows for fast and precise movements in a horizontal plane, making them ideal for tasks like sorting, packaging, and light assembly of goods.

The established capabilities of these supply chain robots in manufacturing and assembly applications are now being leveraged to enhance efficiency and throughput in warehouse operations. Companies are recognizing the potential of these robots to streamline specific processes within the warehouse, contributing to overall productivity gains.

High Initial Investment and Integration Costs Hinders the Market

One of the significant restraints in the widespread warehouse SCARA robots market expansion is the initial investment required for the robots themselves and the associated integration costs. Implementing robotic systems involves significant upfront capital expenditure for hardware, software, and system integration. While the long-term benefits in terms of increased efficiency and reduced labour costs be substantial, the initial financial outlay a barrier for many companies, especially smaller and medium-sized enterprises. Overcoming this hurdle will be crucial for broader market penetration.

Integration of AI and Vision Systems Presents Significant Future Opportunities

A significant opportunity for key players in the warehouse SCARA robots industry lies in further integrating Artificial Intelligence (AI) and vision systems into these robots. By equipping SCARA robots with advanced AI algorithms and sophisticated vision capabilities, their ability to perform complex tasks such as object recognition, autonomous navigation within defined spaces, and handling a wider variety of items be significantly enhanced. This integration has the potential to expand the range of applications for material handling robots in warehouses beyond basic pick-and-place, leading to increased efficiency, reduced downtime through predictive maintenance, and improved overall production efficiency.

The future of warehouse robotics is closely tied to the intelligent automation enabled by AI and vision, and robotic warehouse systems are well-positioned to benefit from these advancements. For instance, In March 2023, ABB Robotics launched the IRB 930 SCARA robot, featuring AI-powered vision systems for precise object recognition and dynamic path planning. With three variants handling up to 22 kg payloads, it enhances efficiency in warehouse pick-and-place tasks.

Market Segmentation and Scope of the Study

The warehouse SCARA robots market report is segmented based on components, payload capacity, axis type, application, industry vertical, and region. By components, the market is categorized into hardware, software, and services. Hardware is further divided into controller, arm, end effector, drive, sensor. Service is divided into installation, maintenance, and repair. Based on payload capacity, it is segmented into up to 5.00 KG, 5.01 KG to 15.00 KG, and more than 15.00 KG. By axis type, the market is divided into 3-axis SCARA, 4-axis SCARA, 5-axis SCARA, and others. In terms of application, the market is segmented into material handling, assembling and disassembling, welding and soldering, dispensing, processing, and others. By industry vertical, it is classified into e-commerce, automotive, electronics and electrical, food and beverage, pharmaceuticals, metal and machinery, and others. Regional breakdown and analysis of each of the aforesaid segments include regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

The warehouse SCARA robots market share showcases distinct growth patterns across North America, Europe, Asia-Pacific, and the Rest of the World, each driven by unique regional developments and market trends. In North America, the boom in e-commerce and cutting-edge technological advancements fuel widespread adoption, with companies like Amazon deploying SCARA robots to streamline logistics operations, reinforcing the region’s strong market presence.

Europe, a leader in automation innovation particularly in Germany and the UK, prioritizes precision and collabourative robotics, as seen in ABB’s 2023 launch of the IRB 930 SCARA robot designed for efficient warehouse tasks. Asia-Pacific stands out as a global frontrunner, propelled by rapid industrialization in China and India, where cost-effective solutions like Epson’s GX-B Series accelerate automation in high-demand industries.

The Rest of the World, including Latin America and the Middle East, is gradually embracing the warehouse SCARA robots industry through growing investments in smart logistics, though challenges like limited infrastructure slow progress. These regional dynamics highlight the market’s diverse growth potential, with Asia-Pacific leading the charge in warehouse automation adoption.

Strategic Innovations Adopted by Major Key Players

Key players are strategically focusing on innovation and expansion to capture the significant warehouse SCARA robots industry growth potential. A prominent trend involves developing more sophisticated and adaptable SCARA robots through the integration of AI and IoT technologies, as suggested by discussions on future trends in warehouse robotics. For instance, the development of micro-SCARA robots by companies like Mecademic demonstrates a focus on addressing the need for automation in intricate tasks, potentially expanding the application scope within warehouses.

Major players like ABB are launching new SCARA robot models, such as the IRB 930, specifically designed to enhance pick-and-place and assembly operations, directly addressing the demands of the burgeoning e-commerce sector. FANUC is also actively involved in providing robotic solutions for warehouse applications.

Key Benefits

-

The report provides quantitative analysis and estimations of the warehouse SCARA robots market from 2025 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep dive analysis of the warehouse SCARA robots market including the current and future trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the warehouse SCARA robots market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the warehouse SCARA robots market study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Warehouse SCARA Robots Market Key Segments

By Components

-

Hardware

-

Controller

-

Arm

-

End Effector

-

Drive

-

Sensor

-

-

Software

-

Services

-

Installation

-

Maintenance and Repair

-

By Payload Capacity

-

Up to 5.00 KG

-

5.01 KG to 15.00 KG

-

More than 15.00 KG

By Axis Type

-

3-Axis SCARA

-

4-Axis SCARA

-

5-Axis SCARA

-

Others

By Application

-

Material Handling

-

Assembling and Disassembling

-

Welding and Soldering

-

Dispensing

-

Processing

-

Others

By Industry Vertical

-

E-commerce

-

Automotive

-

Electronics and Electrical

-

Food and Beverage

-

Pharmaceuticals

-

Metal and Machinery

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Fanuc Corporation

-

Stäubli International

-

DENSO Corporation

-

Mitsubishi Electric Corporation

-

OMRON Corporation

-

Seiko Epson Corporation

-

Mecademic Corporation

-

KUKA AG

-

YASKAWA

-

Yamaha Motor

-

Comau

-

Nachi-Fujikoshi

-

Delta Electronics

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 566.8 million |

|

Revenue Forecast in 2030 |

USD 1692.4 million |

|

Growth Rate |

CAGR of 20% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst