Major Industry Leaders and Their Impact on the Automotive Robotics Market

09-Dec-2024

Automotive robotics market expected to experience rapid growth, surging from USD 13.5 Billion in 2023 to USD 22.67 Billion by 2030 with a CAGR of 7.6% from 2024-2030, driven by rising adoption of industry 4.0 and rapidly increasing labor cost across the world.

AUTOMOTIVE ROBOTICS MARKET OVERVIEW

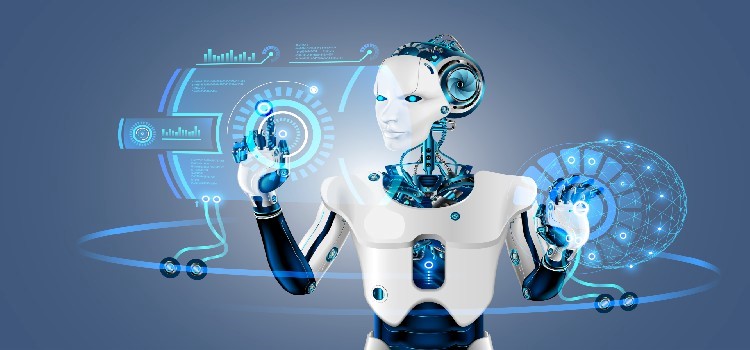

The automotive robotics market is experiencing significant growth due to advancements in technology and increasing demand for automation in manufacturing processes. Rising labor costs and the need for precision and efficiency in vehicle production are pushing automakers to invest in robotic systems. These robots enhance productivity, reduce errors, and improve safety in factories. Additionally, the push for electric vehicles (EVs) and the integration of AI and IoT in automotive manufacturing are further driving the adoption of robotics. Several companies in this market are developing innovative solutions to meet the evolving needs of the automotive industry, making robotics an integral part of modern car manufacturing.

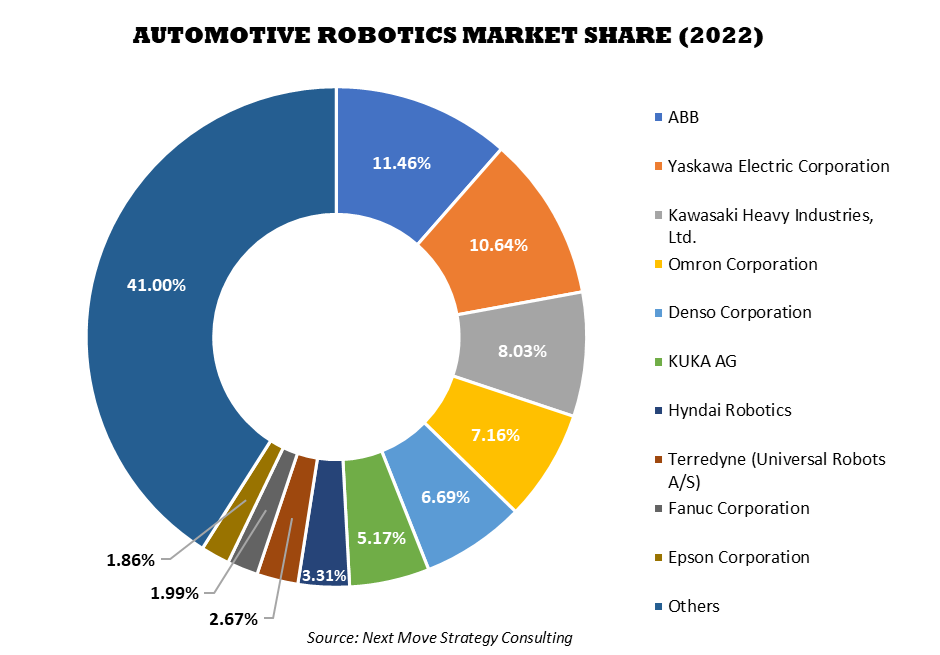

Within this growing market, several leading companies stand out for their innovation, market reach, and commitment to sustainability. Among them are ABB Ltd, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Omron Corporation, and Denso Corporation. These prominent players are contributing significantly to the industry's evolution by developing advanced technologies, expanding their global presence, and implementing sustainable practices. Their efforts are driving growth and setting new standards in the market, making them key influencers in the industry's future growth.

For the latest market share analysis and in-depth automotive robotics industry insights, you can reach out to us at: https://www.nextmsc.com/automotive-robotics-market/request-sample

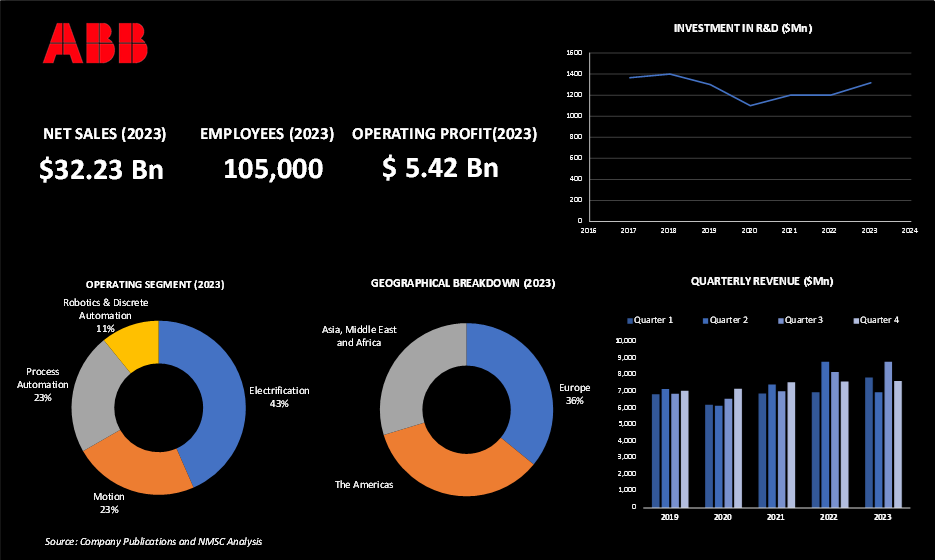

HIGHLIGTS OF ABB LTD.

ABB Ltd stands as a leading player in the automotive robotics market, offering advanced automation solutions that significantly enhance manufacturing efficiency and precision. The company’s comprehensive portfolio includes state-of-the-art robotics, integrated automation systems, and cutting-edge electrification solutions, tailored to meet the evolving demands of the automotive industry.

In 2023, ABB achieved a revenue of USD 32.23 billion, a 9% increase from the previous year, accompanied by an operating profit of USD 5.42 billion. This growth reflects the company’s strategic investments and expansions aimed at addressing the rising need for sophisticated electrification and automation technologies.

ABB's commitment to advancing the automotive robotics sector is underscored by its substantial investments in infrastructure and innovation. The company allocated USD 170 million to expand its operations across various U.S. sites, creating approximately 400 new jobs. In addition, a USD 280 million investment in a European robotics hub in Sweden will increase production capacity by 50%, reinforcing ABB's position as a leader in robotics and automation.

In 2023, ABB also introduced four new robot models and 22 variants, significantly expanding its robotics and discrete automation portfolio. These new additions enhance the performance, versatility, and coverage of ABB’s robotic solutions, catering specifically to the automotive industry's needs for greater automation and operational efficiency.

ABB's ongoing investment in innovation and capacity expansion not only strengthens its position in the automotive robotics market but also supports the industry's shift towards more sustainable and efficient manufacturing practices. The company’s focus on delivering advanced automation solutions reflects its commitment to driving the future of industrial automation and contributing to the industry's overall growth and sustainability.

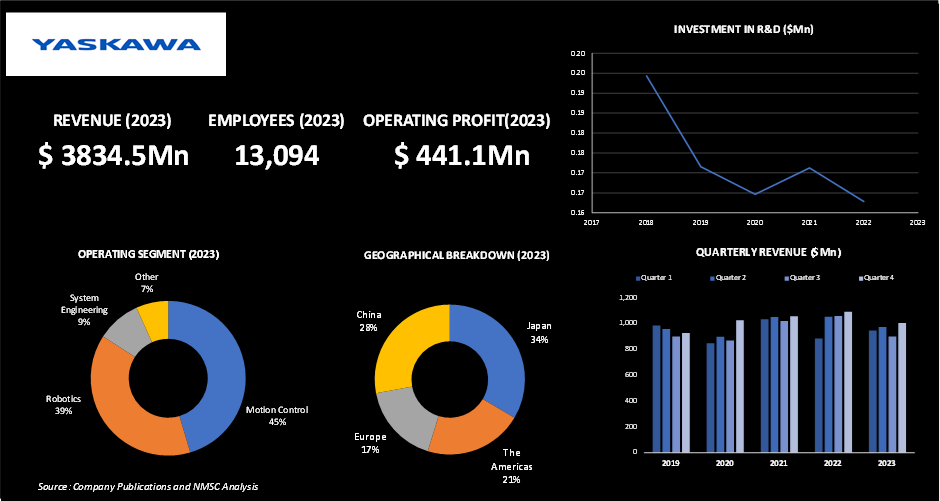

HIGHLIGTS OF YASKAWA ELECTRIC CORPORATION

Yaskawa Electric Corporation, is one of the key players in the automotive robotics market, reported a revenue of USD 3.83 billion in 2023, and operating profit stood at USD 441.1 million. YASKAWA Group is organized into three reportable segments, that are motion control, robotics, and system engineering.

Yaskawa experienced revenue growth despite general weakness in the automotive market and ongoing inventory adjustments in the semiconductor and electronic components sectors. This growth was partly fuelled by increased sales of painting-related projects for electric vehicles (EVs) in South Korea. The company's revenue boost was also supported by firm investments in Europe and the U.S. aimed at automating and upgrading production in response to rising labour costs and shortages.

However, overall demand in major markets such as Japan, China, and Europe were stagnant. In Japan, weak investment in automotive and semiconductor markets led to reduced demand. In China, despite initial strong demand in solar panel manufacturing, the overall market recovery slowed. Europe experienced a slowdown in manufacturing demand due to the economic downturn, although investment continued in EVs.

Additionally, in November 2023, Yaskawa launched the Motoman Next series, an industry-first adaptive robot platform designed to address social issues through advanced automation. This open platform aims to enhance flexibility and efficiency in automotive manufacturing, especially for EVs, by integrating sophisticated adaptive capabilities and automation solutions. The Motoman Next series represents a significant advancement in automotive robotics, aligning with the industry's growing emphasis on automation and innovation.

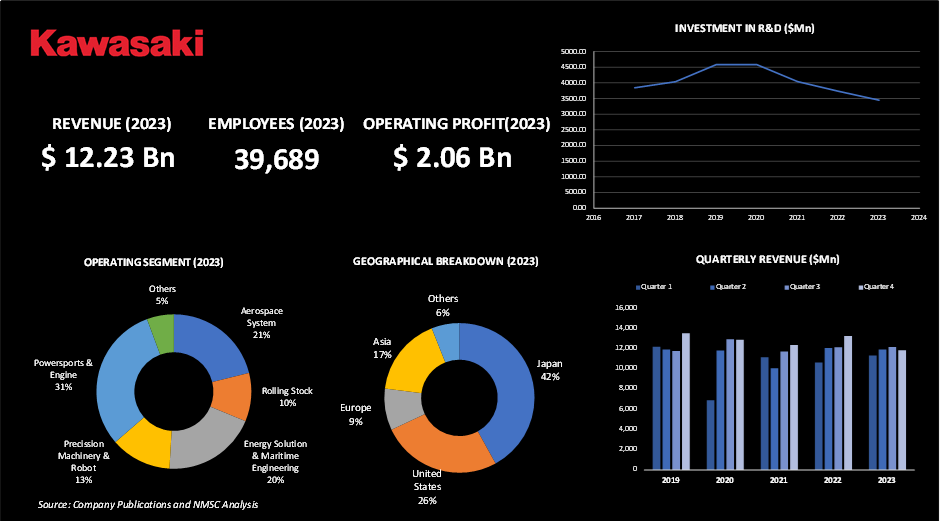

HIGHLIGTS OF KAWASAKI HEAVY INDUSTRIES, LTD.

Kawasaki Heavy Industries, Ltd., plays a pivotal role in the automotive robotics market, providing innovative solutions that enhance automation and efficiency in automotive manufacturing. The company’s advancements in robotics technology are designed to meet the evolving needs of the industry, particularly in streamlining production processes and improving operational flexibility.

Kawasaki Heavy Industries registered a revenue of USD 12.23 billion in financial year 2023, reflecting a 7% increase from the previous year. The company’s operating profit was USD 2.06 billion. With a global workforce of over 39,689 employees, Kawasaki is well-positioned to leverage its expertise in robotics to drive industry advancements.

In June 2024, Kawasaki Robotics introduced a new line of collaborative robots (cobots), which incorporate off-the-shelf tools to enhance flexibility and efficiency in various industrial applications. These cobots are designed to work seamlessly with human operators, offering significant improvements in production processes within the automotive sector. This development aligns with the industry's shift towards more adaptable and integrated automation solutions, reinforcing Kawasaki's role as a leader in automotive robotics innovation.

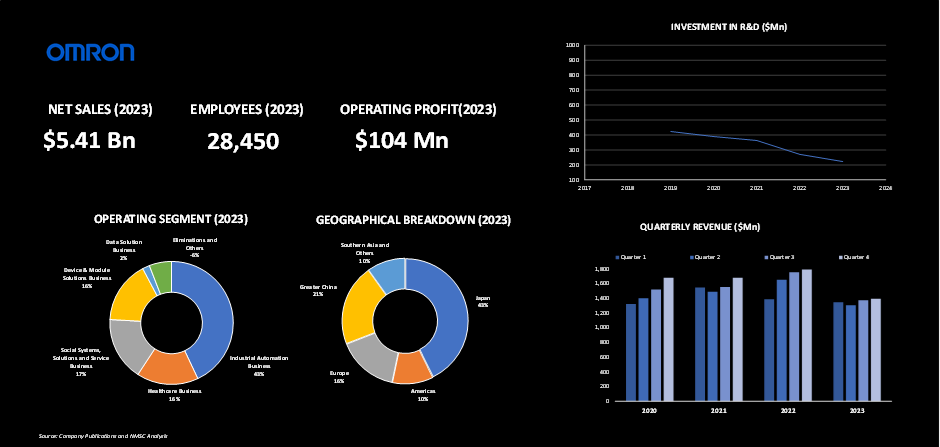

HIGHLIGTS OF OMRON CORPORATION

Omron Corporation is one of the significant players in the automotive robotics market, providing advanced automation solutions that enhance manufacturing efficiency and precision. In 2023, Omron reported a revenue of USD 5.41 billion and an operating profit of USD 104 million. The industrial automation business, which includes a substantial portion of Omron’s operations, accounts for 43% of the total revenue. The company operates 26 production sites worldwide, underscoring its extensive global footprint.

In the most recent fiscal year, Omron experienced a decrease in net sales, largely attributed to reduced demand for capital investment across the manufacturing industry and inventory adjustments by distributors. This decline affected the industrial automation business, which saw lower sales compared to the previous year. Despite these challenges, Omron continues to focus on enhancing its automation solutions and maintaining its position in the automotive robotics market.

The company remains committed to advancing automotive robotics through continued innovation and strategic investments in technology. Omron’s focus on enhancing automation processes is crucial in addressing industry demands and maintaining its competitive edge in the global automotive robotics market.

HIGHLIGTS OF DENSO CORPORATION

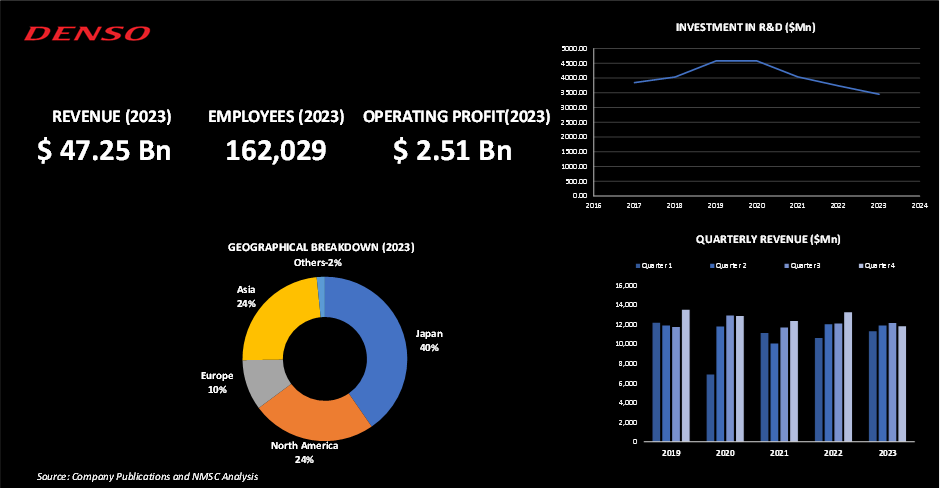

Denso Corporation, is one of the crucial players in the automotive robotics market, recognized for its innovative technologies and contributions to advanced automotive manufacturing. The company’s focus on robotics and automation aligns with its broader commitment to enhancing vehicle production efficiency and integrating cutting-edge technologies into automotive systems.

In 2023, Denso achieved a revenue of USD 47.25 billion and an operating profit of USD 2.51 billion. The company employs over 162,029 individuals globally, underscoring its extensive operational scale and workforce. The fiscal year ending March, 2024, saw revenue growth driven by the easing of semiconductor shortages, a recovery in vehicle production, and strong sales in electrification and safety products. Despite these gains, operating profit decreased compared to the previous year due to increased quality costs, although production volumes and exchange gains helped offset some of the impacts.

Denso's commitment to innovation is evident in its substantial investment in research and development (R&D). For the fiscal year ended March, 2024, the company allocated approximately USD 3.64 billion to R&D activities, with USD 3.21 billion of this amount spent in Japan. This significant investment reflects Denso's strategic focus on advancing global mobility and reinforcing its research capabilities, including efforts to enhance automotive robotics and automation technologies.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/automotive-robotics-market/inquire-before-buying

SUMMARY OF AUTOMOTIVE ROBOTICS INDUSTRY

The automotive robotics industry is rapidly evolving, driven by increasing demands for automation and efficiency in vehicle manufacturing. Key trends include the adoption of advanced robotic systems for tasks such as assembly, painting, and welding, which enhance precision and productivity. Companies are investing heavily in new technologies, including collaborative robots (cobots) and adaptive systems, to meet the needs of modern automotive production. Major players are expanding their capabilities through significant investments in infrastructure and innovation, focusing on sustainability and improving operational excellence. The industry's growth is fuelled by the need for more flexible, efficient, and environmentally friendly manufacturing solutions.

About the author

Saurav Sarkar is an accomplished researcher and writer with over three years of experience in conducting thorough research. His passion for exploring various subjects and delving into in-depth analysis has led him to develop a keen understanding of research nuances. He remains committed to staying current with the latest market trends, recognizing their impact on businesses and society. The author can be reached info@nextmsc.com.

Add Comment

Related Blogs

Tech Titans Transforming AI Robots: IBM, Intel, and Microsoft's Influence

According to Next Move Strategy Consulting, the AI Robots Ma...

UGVS and the Power Players: Genetal Dynamics, Qinetiq, and Boston Dynamics

According to Next Move Strategy Consulting, the UGV Mar...

The Era of Smart Living: Navigating the Home Automation Landscape

Introduction In today's rapidly advancing technologic...