Deep Dive into Germany's Intralogistics Market: TAM, SAM, VAM Insights

25-Oct-2024

Introduction

The Germany intralogistics market is poised for substantial growth, reflecting a dynamic landscape driven by technological advancements and robust industry players. As per NMSC, the market was valued at USD 4.0 billion in 2023 and is projected to reach USD 7.9 billion by 2030, growing at a CAGR of 10.2% from 2024 to 2030.

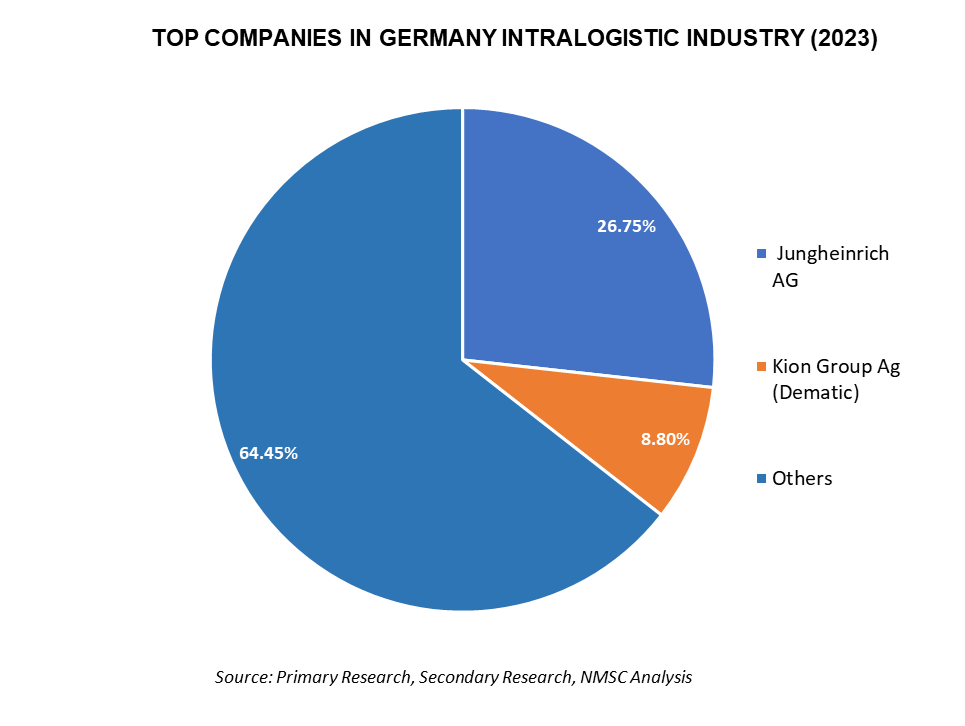

This growth trajectory is underpinned by the formidable presence of industry giants such as Kion Group, Jungheinrich AG, KNAPP Group, Schwingshandl, Xproma,Klinkhammer Intralogistics GmbH, Viastore Systems, AM Logistic Solutions, among others. These players are recognized as leading integrators specializing in automated intralogistics systems and dynamic automation projects.

They offer comprehensive services including software development, project implementation, and maintenance, specifically tailored to meet the unique needs of clients. This strategic flexibility enables companies in the market to effectively navigate the competitive landscape, positioning themselves as pivotal contributors to Germany's evolving intralogistics sector.

For a detailed market share analysis of Germany intralogistics market, you can purchase our latest report at: https://www.nextmsc.com/germany-intralogistics-market/request-sample

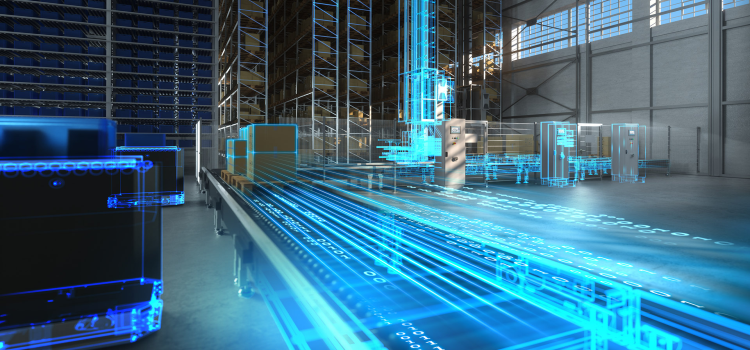

The industry is characterized by its innovative approach to integrate advanced technologies such as artificial intelligence (AI), robotics, and IoT to optimize supply chain processes and enhances operational efficiency. These leading companies continuously invest in research and development to create cutting-edge solutions that address the complex demands for modern intralogistics. The emphasis on automation and digitalization improves productivity, reduces operational costs, and enhances accuracy in inventory management.

NMSC conducted an extensive analysis includes total addressable market (TAM), serviceable addressable market (SAM), and verified addressable market (VAM) to accurately gauge the market potential of Germany's intralogistics industry. This involved employing primary and secondary research methodologies to assess factors such as market demand trends, competitive dynamics, customer preferences, technological advancements, and regulatory influences. This analysis provides insights into how companies leverage strategic initiatives to expand within the dynamic landscape of the German intralogistics industry.

Analysis of TAM in the Germany Intralogistics Industry

NMSC conducted a comprehensive analysis of the total addressable market (TAM) for intralogistics products and services in Germany. Estimating the TAM at USD 4.0 billion. The report highlights diverse revenue opportunities across various industry segments.

NMSC experts have meticulously examined the hardware, software, and services offered by major companies in the sector. The hardware segment, encompassing AS/RS systems, industrial robots, mobile robots, conveyor systems, and sortation systems, forms the backbone of intralogistics infrastructure, enabling efficient and automated material handling processes.

The software segment includes critical components for optimizing operational efficiency and system integration, such as warehouse management systems (WMS) and warehouse control systems (WCS). These solutions enhance real-time visibility, inventory management, and process automation, driving higher levels of coordination and productivity within intralogistics operations.

Furthermore, the services segment includes maintenance, consulting, and integration services tailored to meet the unique needs of each client. These services ensure the reliable operation of intralogistics systems, provide expert advice on logistics process optimization, and customize solutions to align with specific client requirements.

By leveraging comprehensive market sizing and industry insights, TAM estimation not only underscores the strategic market position of these companies but also highlights potential growth avenues within Germany's dynamic intralogistics sector. This structured approach provides a solid foundation for strategic decision-making and future market expansion initiatives.

Through thorough analysis, NMSC helps companies in understanding the competitive landscape, identify important opportunities, and improve their products and services. By focusing on innovation, technology integration, and customer-centric solutions, Germany's intralogistics industry is positioned as a global leader, setting benchmarks for efficiency and effectiveness in material handling and logistics.

|

Key Market Players |

TAM of Germany Intralogistics Market in 2023 (USD Million) |

SAM of Germany Intralogistics Market in 2023 (USD Million) |

VAM of Germany Intralogistics Market in 2023 (USD Million) |

|

Xproma |

4,001.5 |

2107.1 |

1799.9 |

|

Schwingshandl |

4,001.5 |

XY |

XY |

|

SCIO Automation GmbH |

4,001.5 |

XY |

XY |

|

DAMBACH Lagersysteme GmbH & Co. KG |

4,001.5 |

XY |

XY |

|

HEBER Fördertechnik GmbH & Co. KG |

4,001.5 |

XY |

XY |

|

Klinkhammer Intralogistics GmbH |

4,001.5 |

XY |

XY |

|

Viastore Systems |

4,001.5 |

XY |

XY |

|

AM Logistic Solutions |

4,001.5 |

XY |

XY |

|

Bito-Lagertechnik Bittmann GmbH |

4,001.5 |

XY |

XY |

|

Inther Group |

4,001.5 |

XY |

XY |

|

Kion AG |

4,001.5 |

XY |

XY |

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/germany-intralogistics-market/inquire-before-buying

Study of SAM in the Germany Intralogistics Industry

SAM, a subset of TAM, represents the portion of the Germany intralogistics market that companies can realistically target and serve with their existing capabilities and product offerings. This estimation offers a practical perspective on the achievable market size, taking into account companies' current market presence, product portfolio, and operational capabilities.

Product Offerings: Companies within the Germany intralogistics sector specialize in diverse hardware solutions such as automated storage and retrieval systems (AS/RS), mobile robots, conveyor systems, and sortation systems. However, the extensiveness of software offerings varies among companies in the market. Some provide comprehensive solutions such as warehouse management systems (WMS) and warehouse control systems (WCS), while others focus on specific intralogistics software solutions.

End User Industries: These companies cater to various sectors including logistics, food and beverage, retail, e-commerce, pharmaceuticals, automotive, chemicals, and airport operations within Germany. However, some companies, such as Xproma, focus primarily on logistics, food and beverage, retail, and e-commerce sectors, limiting their penetration into industries such as automotive, chemicals, and mining due to specific product capabilities and market strategies.

Examining of VAM in the Germany Intralogistics Industry

Based on NMSC's analysis, companies within the Germany intralogistics sector exhibit varied product offerings. While many specialize in a broad spectrum of hardware solutions such as automated storage and retrieval systems (AS/RS), automated guided vehicles (AGVs), conveyor systems, and sortation systems, not all provide comprehensive solutions as overhead conveyors or shuttle systems within the AS/RS category. Some companies may not have tailored intralogistics solutions for cleanroom operations, which restricts their market penetration in specific industrial environments.

Market coverage among the companies in Germany intralogistics sector includes logistics, small-scale retail industries, and occasionally broader sectors including automotive, pharmaceuticals, chemicals, airport operations, and mining within Germany. However, the extent of their VAM in the German intralogistics sector varies depending on their product capabilities and strategic market approaches.

This detailed analysis offers insights into specific market segments that companies in the Germany intralogistics industry can effectively target and serve. It emphasizes current strengths while identifying opportunities for expansion and specialization within Germany's dynamic intralogistics landscape. For example, Xproma GmbH specializes primarily in AS/RS systems, but faces limitations in handling high payload capacities and does not offer a comprehensive range of AGVs or autonomous forklifts. Additionally, within the AS/RS category, Xproma GmbH lacks offerings such as overhead conveyors or shuttle systems, and does not provide solutions tailored for cleanroom operations. Understanding these dynamics is crucial for companies to optimize their market strategies and capitalize on growth opportunities within Germany's evolving intralogistics landscape.

Conclusion

NMSC's assessment begins with a thorough evaluation of each company's current market standing, focusing on their strengths in hardware solutions and operational capabilities. By analyzing market trends such as increasing automation adoption and technological advancements in intralogistics, NMSC identifies strategic growth opportunities for companies. The analysis also includes a review of competitor strategies and industry benchmarks, revealing avenues for enhancing competitiveness through product diversification and technological innovation.

Strategic Recommendations for Enhancing Market Position of Germany Intralogistics Industry:

-

Diversification of Product Offerings: The companies can expand beyond hardware solutions to include comprehensive intralogistics software such as Warehouse Management Systems (WMS) and advanced analytics tools. This approach will enhance operational efficiency and appeals to customers seeking integrated solutions.

-

Targeting Untapped Industries: The key players within Germany intralogistics sector can develop specialized solutions for industries currently underserved, such as pharmaceuticals, automotive, chemicals, airport operations, and mining. This strategic expansion broadens market reach and reduces dependency on limited sectors.

-

Enhancement of Technological Capabilities: The companies can invest in research and development to improve existing AS/RS systems for handling higher payloads, and introduce new products such as Automated Guided Vehicles (AGVs) and autonomous forklifts. Innovations in intralogistics technologies strengthen competitiveness and attract technologically savvy clients.

-

Strategic Partnerships and Alliances: The companies present in the Germany intralogistics industry have the opportunity to forge partnerships with complementary businesses or technology providers, harnessing synergies to reach new customer segments. These collaborations expedite market penetration and enrich service offerings by pooling expertise and resources.

By implementing these strategic initiatives, informed by rigorous market analysis and industry insights, companies operating in the Germany intralogistics sector can effectively address current challenges, capitalize on emerging opportunities, and solidify their positions as key players in a competitive market landscape.

ABOUT THE AUTHOR

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography. The author can be reached at info@nextmsc.com

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography. The author can be reached at info@nextmsc.com

Add Comment

Related Blogs

Deere and Company Leading The Lawn Care Products Market With Around 11.2 percent Share- Know The Reason Why

According to Next Move Strategy Consulting report the global...

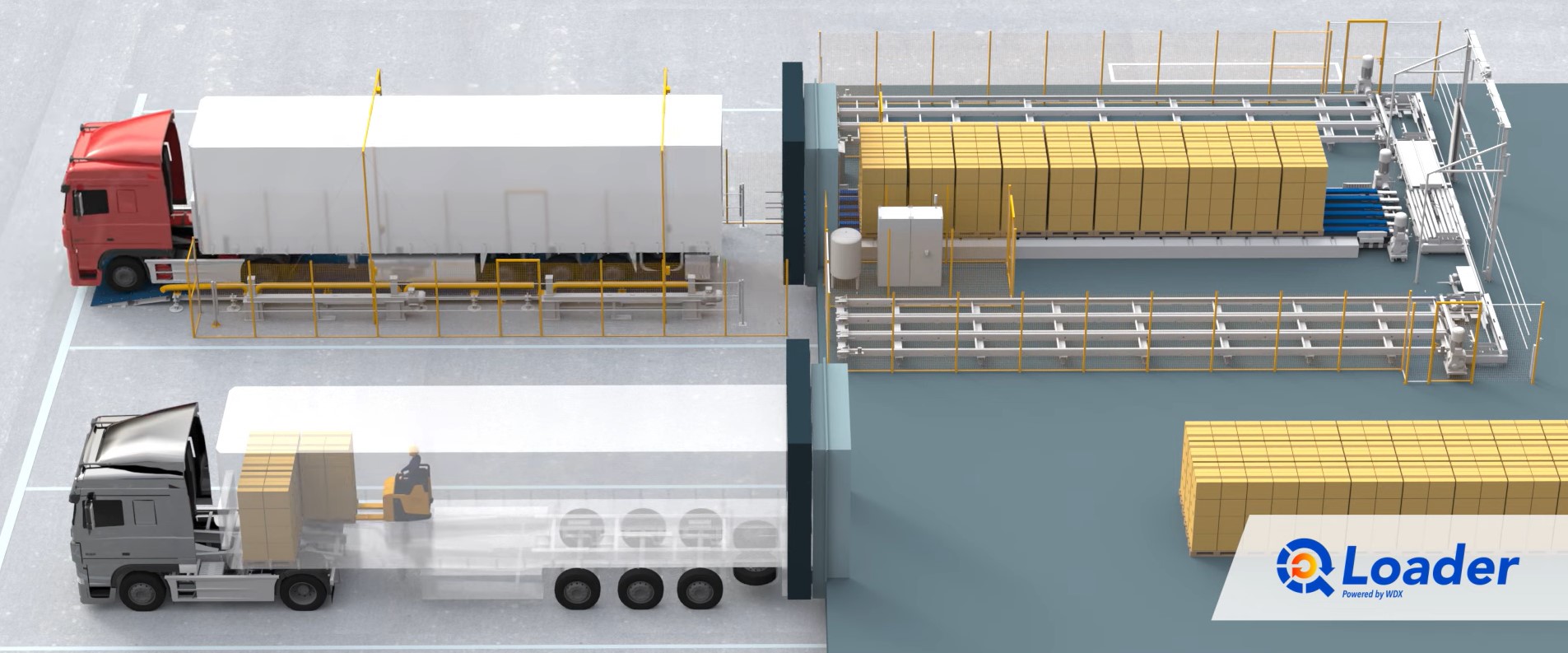

Revolutionizing Logistics: The Automated Truck/Trailer Loading System Market's Latest Trends and Developments

Introduction The global logistics industry is in the mids...

Smart Building Solutions: Transforming Commercial HVAC Systems with IoT

In today's dynamic commercial real estate landscape, the...