Automated Storage and Retrieval System (AS/RS) Market by Type (Unit Load AS/RS, Mini Load AS/RS, Vertical Lift Modules, and Carousels), by Function (Assembly, Distribution, Order Picking, Storage, and Others), and by End User Industry (Logistics, Food and Beverages, Retail and E-Commerce, Automotive, Chemicals, Pharmaceuticals, and Other Industries) – Global Opportunity Analysis and Industry Forecast 2024-2030

Industry: Construction & Manufacturing | Publish Date: 25-Oct-2024 | No of Pages: N/A | No. of Tables: N/A | No. of Figures: N/A | Format: PDF | Report Code : CM2407

Automated Storage and Retrieval System Market Overview

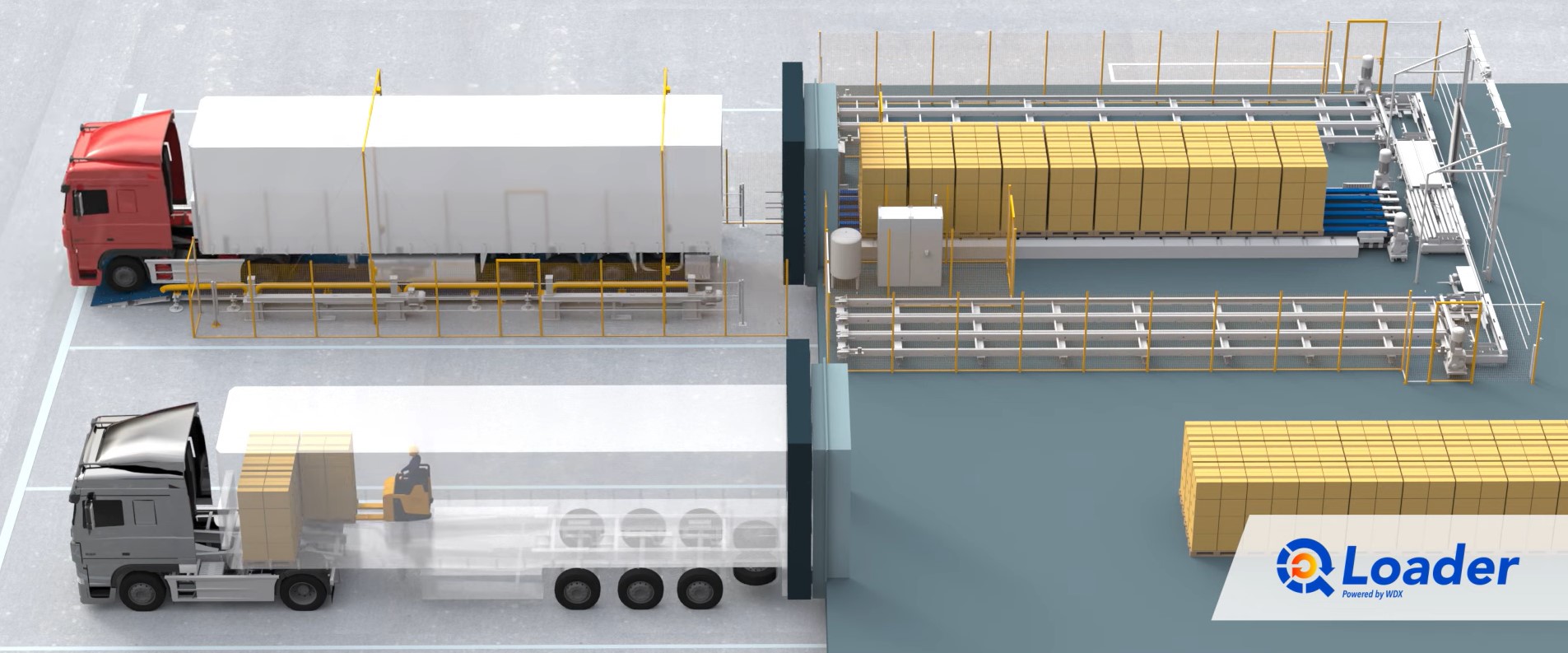

The global Automated Storage and Retrieval System (AS/RS) Market size was valued at USD 6.55 billion in 2023 and is predicted to reach USD 11.48 billion by 2030 with a CAGR of 8.1% from 2024-2030. The AS/RS System also called automated storage solutions is a computer and robot-aided system that is used to retrieve and place items in a specific location. This system is commonly used in warehouses, distribution centers, and manufacturing facilities for managing the inventory automatically with the help of technology.

ASRS utilizes multiple technologies such as intelligent picking robots and warehouse management software to automate the inventory management process. The system operates on certain pre-defined algorithms that are programmed into it. These algorithms allow the system to locate and retrieve items efficiently. Through the implementation of inventory control systems, companies can greatly increase storage space, streamline ergonomics, boost picking accuracy, and reinforce inventory management practices.

Market Dynamics and Trends

The automated storage and retrieval system market demand is experiencing strong growth due to the rapidly growing e-commerce industry across the globe that uses this system for enhancing warehouse operations and improving order processing efficiently.

As the e-commerce sector continues to expand to meet the demands of online consumers, investments in ASRS technology are projected to persist. The data from the International Trade Administration (ITA) predicts that the global B2B e-commerce sector will experience substantial revenue growth, projected to reach USD 5.5 trillion by 2027. This heightened growth underscores the importance of ASRS integration in supporting the expanding e-commerce ecosystem.

Additionally, the rising labor cost across the globe is further increasing the demand for automated solutions in various industries such as manufacturing and e-commerce. The data published by the U.S. Bureau of Labor Statistics predicts that the wages and salaries of private industry workers increased by 4.3% in December 2023.

The growing adoption of automated solutions helps in increasing the operational efficiency by performing tasks such as storage, retrieval, and order fulfillment, thereby reducing reliance on manual labor within the industries. Also, the increasing adoption of AS/RS in automotive industry to efficiently store and retrieve automotive components and parts within the manufacturing facilities and distribution centers is another factor boosting the market.

Data from the European Automobile Manufacturers (ACEA) states that the global production of motor vehicles reached 85.4 million units in 2022, an increase of 5.7% compared to the previous year 2021. This growing automotive production increases the demand for AS/RS for enhancing operational efficiency within the industry.

However, the implementation of AS/RS requires high initial investment which acts as barrier for small and medium-sized enterprises (SMEs) with limited budgets. On the contrary, the integration of advanced technologies, such as, AI and data analytics, into robot-assisted systems is expected to create ample opportunities for the automated storage and retrieval system market growth in the coming years.

By integrating these technologies into automated storage and retrieval systems, tasks such as precise picking, efficient packing, and automated transportation within warehouses can be achieved. This technological integration is also expected to empower ASRS to dynamically manage inventory by continuously analyzing historical and real-time data, thereby generating opportunities within the industry.

Market Segmentations and Scope of the Study

The automated storage and retrieval system market report is segmented on the basis of type, function, and end user industry, and region. On the basis of type, the market is divided into unit load AS/RS, mini-load AS/RS, vertical lift modules, and carousels. The unit load AS/RS segment is further segmented into fixed-aisle cranes and movable-aisle cranes. The mini-load AS/RS segment is further classified into cranes and shuttles. The carousel segment is again segmented into vertical carousels and horizontal carousels. On the basis of function, the market is categorized into assembly, distribution, order picking, storage, and others. On the basis of end user industry, the market is categorized into logistics, food and beverages, retail and e-commerce, automotive, chemicals, pharmaceuticals, and other industries. Geographic breakdown and analysis of each of the aforesaid segments include regions North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

North America dominates the automated storage and retrieval system market share and is expected to continue its dominance during the forecast period. This is due to the increasing adoption of AS/RS in the food and beverage industry in the region to enhance the operational efficiency, optimize inventory management, and meet the industry's growing demand for warehouse automation solutions.

For instance, in December 2023, Westfalia Technologies Inc., collaborated with Southern Glazer’s Wine & Spirits (SGWS) to implement unit-load ASRS technology in SGWS's newly expanded warehouse in the U.S. This partnership streamlines the storage and retrieval process of SGWS by implementing a reserve storage system for beer, wine, and spirit products, thereby improving overall operational performance.

Moreover, the growing e-commerce industry in the North American region which utilizes ASRS for enhancing order processing, reducing errors, and optimizing storage capacity is driving the market forward. The data published by the International Trade Administration (ITA) in 2023 states that the U.S. is experiencing rapid growth in the e-commerce industry, with a compound annual growth rate (CAGR) of 11.22%. ASRS enables e-commerce businesses to efficiently handle growing order volumes and facilitate efficient order fulfillment processes in the North American region.

On the other hand, Asia Pacific is expected to demonstrate a steady increase in the automated storage and retrieval system market trends, driven by the growing demand for efficient inventory management solutions to accommodate the rising pharmaceutical industry in this region.

According to data from the Indian Pharmaceutical Association (IPA), India's pharmaceutical industry is poised for significant growth, with projections indicating a market size of USD 130 billion by 2030. ASRS enables pharmaceutical companies to optimize inventory management, ensure product safety, and accelerate order processing, thereby increasing the demand for this system in the Asia-Pacific pharmaceutical sector.

Also, the growth of AS/RS in Asia Pacific region is fueled by the increasing production volumes in the manufacturing sector that drives the demand for efficient storage and retrieval solutions. According to the Government of India (GOI), manufacturing production in India witnessed a 1.20% increase in November 2023 compared to the same month in the previous year 2022.

ASRS systems play a crucial role in handling the vast production volumes by streamlining inventory management and accelerating order processing in the manufacturing sector. This enhances overall operational efficiency and productivity in manufacturing facilities across Asia Pacific.

Competitive Landscape

Various market players operating in the automated storage and retrieval system industry include Kardex Holding AG, Daifuku Co., Ltd., Murata Machinery, Ltd., SSI Schaefer AG, TGW Logistics Group, Kion Group AG, Mecalux, S.A., Beumer Group GmbH & Co. KG, Toyota Industries Corporation, and Westfalia Technologies Inc. These market players are adopting various partnership strategies and indulging in R&D activities to maintain their dominance in the market.

For instance, in December 2023, Daifuku Co., Ltd started operational testing of its newest high-speed, high-rise automated storage and retrieval system (ASRS). This system aims to accelerate product development and facilitate the testing of stacker cranes up to 40 meters in height, contributing to the company's ongoing development efforts.

Moreover, in September 2023, Kardex Solutions (a part of Kardex Group) partnered with Tompkins Robotics, a provider of innovative robotic automation solutions. The partnership aims to integrate Kardex’s AutoStore automated storage and retrieval system (ASRS) with Tompkins' tSort sortation system to achieve efficiencies and a faster return on investment.

Here is the list of AS/RS providers by the Leading Giants along with their specific performance:

|

Sl. No |

Company |

Intralogistics Solutions |

Performance/Specification |

|||

|

1 |

Vanderlande Industries B.V. |

Quickstore Miniload AS/RS |

Throughput of 250 dual cycle/hour (dc/h) per crane. |

|||

|

2 |

Autostore |

CarouselPort |

Max Bin throughput: 500 bin/h Mezzanine level |

|||

|

3 |

SSI Schaefer Ag |

SSI Lift & Run System |

safe vertical storage greater than 45 m high |

|||

|

4 |

Kion Group Ag (Dematic) |

Dematic Unit Load AS/RS |

60 loads in/out per hour. loads of up to 1,800 kilograms in and out of a secured rack structure - over 42 meters tall. |

|||

|

Dematic Mini-Load AS/RS |

60 loads in/out per hour. loads of up to 50 kilograms in and out of a secured rack structure - over 20 meters tall. |

|||||

|

5 |

Honeywell International Inc. |

Honeywell Intelligrated AS/RS Solutions |

Stores 20,000+ SKUs / 30 to 40% increase in throughput over traditional picking methods |

|||

|

6 |

Midea Group (Kuka Ag + Swisslog) |

Swisslog PowerStore |

Can be used in a wide range of environments, from -30°C in frozen food storage to 50°C. Throughput of up to 400 pallets per cell per hour. |

|||

Source: Company Publications and NMSC Analysis

For a detailed analysis of the AS/RS Market, you can purchase our customized report: https://www.nextmsc.com/germany-intralogistics-market/inquire-before-buying

Key Benefits

-

The report provides quantitative analysis and estimations of the automated storage and retrieval system market from 2024 to 2030, which assists in identifying the prevailing industry opportunities.

-

The study comprises a deep-dive analysis of the current and future automated storage and retrieval system market trends to depict prevalent investment pockets in the industry.

-

Information related to key drivers, restraints, and opportunities and their impact on the AS/RS market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porter's Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of the roles of stakeholders.

Automated Storage and Retrieval System Market Key Segments

By Type

-

Unit-Load AS/RS

-

Fixed-aisle Cranes

-

Movable-aisle Cranes

-

-

Mini-Load AS/RS

-

Cranes

-

Shuttles

-

-

Vertical Lift Modules (VLMs)

-

Carousel AS/RS

-

Vertical carousels

-

Horizontal carousels

-

By Function

-

Assembly

-

Distribution

-

Order Picking

-

Storage

-

Others

By End User Industry

-

Logistics

-

Food And Beverages

-

Retail And E-Commerce

-

Automotive

-

Chemicals

-

Pharmaceuticals

-

Other industries

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 6.55 Billion |

|

Revenue Forecast in 2030 |

USD 11.48 Billion |

|

Growth Rate |

CAGR of 8.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

KEY PLAYERS

-

Kardex Holding AG

-

Daifuku Co., Ltd.

-

Murata Machinery, Ltd.

-

SSI Schaefer AG

-

TGW Logistics Group GmbH

-

Kion Group AG

-

Mecalux, S.A.

-

Beumer Group GmbH & Co. KG

-

Toyota Industries Corporation

-

Westfalia Technologies Inc.

Speak to Our Analyst

Speak to Our Analyst