IBM, Oracle, and Sap Lead The Charge in the Fraud Detection Market – Discover how

07-Oct-2024

The global fraud detection and prevention market was valued at USD 37.97 billion in 2023 and is expected to experience significant growth till 2030, as per the analysis by Next Move Strategy Consulting. The market is projected to nearly quadruple by reaching an estimated value of USD 117.01 billion by 2030. This growth is driven by increasing government initiatives to combat fraudulent activities and the frequency of cyber-attacks, and fraudulent activities. The integration of artificial intelligence (AI) into fraud detection systems is significantly enhancing the ability to identify and mitigate these activities in real time. Additionally, the rising adoption of digital payment systems and e-commerce platforms is fueling the demand for robust fraud prevention solutions, as businesses seek to protect their operations and customers from evolving risks.

Fraud Detection and Prevention Market Overview

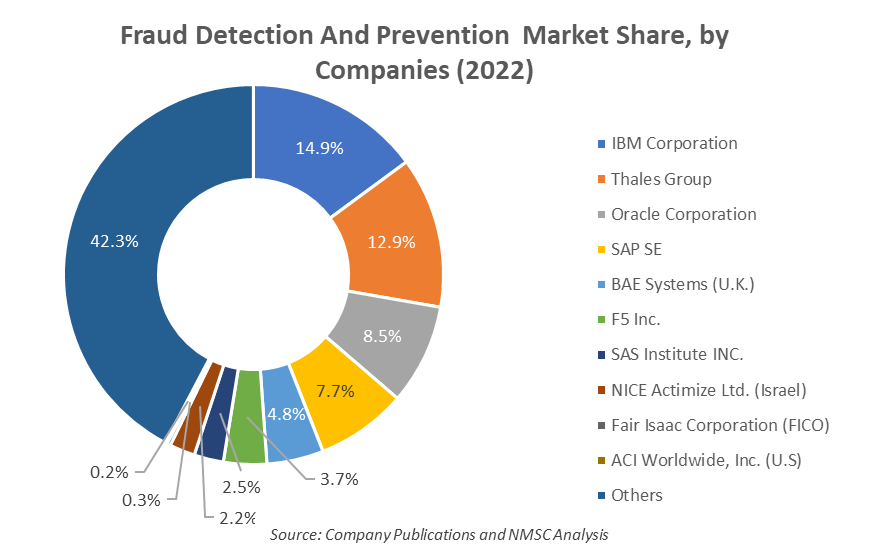

The fraud detection and prevention market involve a range of technologies, software, and services aimed at identifying and mitigating fraudulent activities across various sectors such as banking, insurance, retail, and healthcare. The key components include analytics tools, machine learning, AI, biometric solutions, and blockchain technology, which help in monitoring transactions and verifying identities. The market is majorly driven by increasing cybercrime as it necessitates the demand for more sophisticated and robust systems to detect and prevent fraudulent activities, ensuring the security and integrity of financial transactions and personal data. As per the International Monetary Fund report 2024, the financial sector suffered more than 20,000 cyberattacks that caused around USD 12 billion of losses over the past 20 years. Trends in this market include the integration of artificial intelligence (AI), cloud-based solutions, and the use of behavioural analytics to enhance detection accuracy and efficiency.Leading companies in fraud detection and prevention industry includes IBM Corporation, Thales Group, Oracle Corporation, SAP SE, BAE Systems (U.K.), F5 Inc., SAS Institute Inc., NICE Actimize Ltd. (Israel), Fair Isaac Corporation (FICO), ACI Worldwide, Inc. (U.S), and others.

For the latest market share analysis and in-depth fraud detection and prevention market, you can reach out to us at- https://www.nextmsc.com/fraud-detection-and-prevention-market/request-sample

HIGHLIGHTS OF IBM CORPORATION

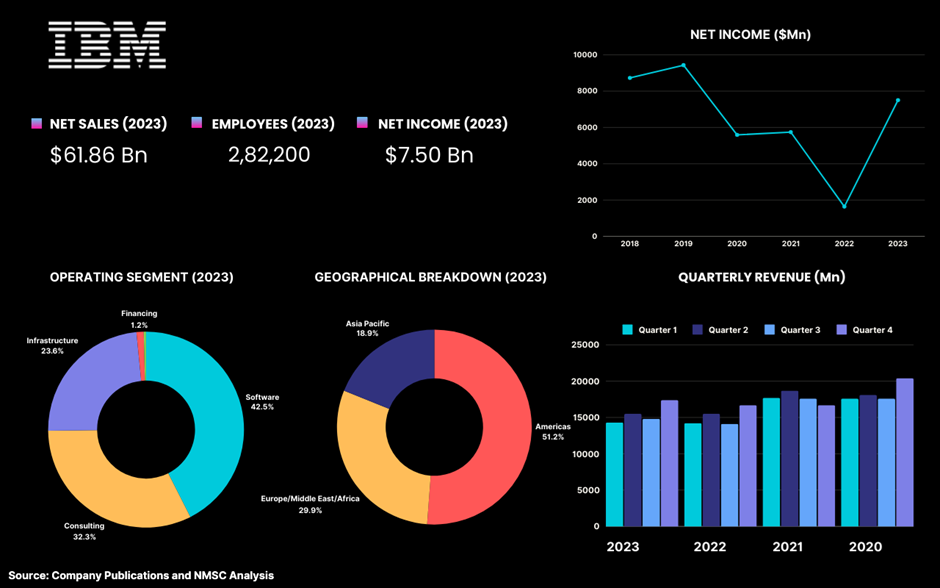

IBM Corporation, headquarter in Armonk, New York, United States, is one of the prominent global technology and consulting leader established itself as a key player in the fraud detection and prevention market. For 2023, IBM reported substantial revenue of USD 61.86 billion and achieved a significant net income of USD 7.50 billion, an increase from USD 1.63 billion in 2022. The company’s diverse operations are segmented into Software, which generated USD 26.30 billion, Consulting contributed USD 19.98 billion, Infrastructure accounted for USD 14.59 billion, Financing which brought in USD 741 million, and Other with USD 233 million.

Geographically, IBM’s revenue distribution highlights its global reach, USD 31.66 billion from the Americas, USD 18.49 billion from Europe/Middle East/Africa, and USD 11.70 billion from Asia Pacific. This broad geographic presence reflects IBM’s ability to cater to diverse markets and client needs worldwide. The company operates with a substantial workforce of approximately 282,200 employees, enabling it to leverage significant resources and expertise.

In 2023, IBM made considerable strides in expanding its capabilities through strategic acquisitions, purchasing nine companies. A notable acquisition was Appito, a suite of software that provides clients with deeper insights into their technology investments and the business value these investments deliver. This acquisition aligns with IBM's strategic focus on enhancing its fraud detection and prevention solutions, demonstrating its commitment to advancing technological offerings and delivering cutting-edge solutions to its clients.

IBM continues to leverage its extensive expertise in artificial intelligence, cloud computing, and analytics to drive innovation in the fraud detection and prevention market. The company’s robust solutions help businesses protect against evolving threats, enhance security measures, and optimize operational efficiency. Through its ongoing investments in technology and acquisitions, IBM remains at the forefront of developing advanced solutions to address the complexities of modern fraud and ensure comprehensive protection for its clients.

HIGHLIGHTS OF ORACLE CORPORATION

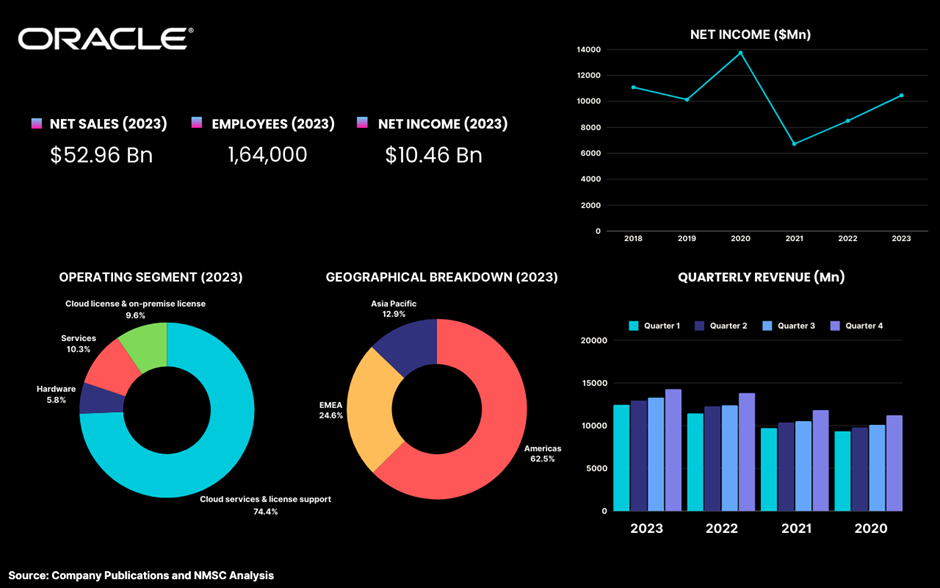

Oracle Corporation, headquartered in Austin, Texas, United States, stands out as one of the major global providers of enterprise software, with a strong emphasis on delivering advanced solutions for fraud detection and prevention. The company reported notable financial achievements in 2023, with revenue reaching USD 52.96 billion and a net income of USD 10.46 billion, marking a significant increase from USD 8.50 billion in net income from the previous year. Oracle's operating income also saw a growth, amounting to USD 15.35 billion in 2023, up from USD 13.09 billion in 2022. However, operating expenses increased to USD 37.60 billion from USD 36.86 billion, reflecting the company's continued investment in expanding its technology and service capabilities.

Oracle's operations are segmented into several key areas including cloud services and license support, which generated USD 39.83 billion, cloud license and on-premise license that contributed USD 5.08 billion, Hardware, which brought USD 3.06 billion, and Services, with USD 5.43 billion. This segmentation underscores Oracle's diversified portfolio, with a significant focus on cloud computing and enterprise solutions.

Geographically, Oracle's revenue distribution for 2023 highlights its global presence, USD 33.12 billion from the Americas, USD 13.03 billion from Europe/Middle East/Africa, and USD 6.80 billion from Asia Pacific. This broad geographic reach enables Oracle to serve a diverse client base and adapt to varying market demands across different regions.

The company's strategic acquisition of Cerner Corporation in 2023 marks a significant expansion into the healthcare sector, aiming to integrate Cerner's healthcare technology with Oracle's robust enterprise solutions. This acquisition enhances Oracle's capabilities in delivering advanced technology solutions, particularly in the realms of data management and fraud prevention, within the healthcare industry.

Operating with a substantial workforce of approximately 164,000 employees, Oracle leverages its extensive human resources and technological expertise to drive innovation and deliver comprehensive solutions to its clients. The company's strong emphasis on cloud computing, data management, and security solutions positions it as a leader in the fraud detection and prevention market, providing businesses with cutting-edge tools to protect against emerging threats and ensure operational integrity. Through its ongoing investments in technology and strategic acquisitions, Oracle continues to advance its position as a key player in the enterprise software industry, dedicated to enhancing digital security and supporting the evolving needs of its global clientele.

HIGHLIGHTS OF SAP SE

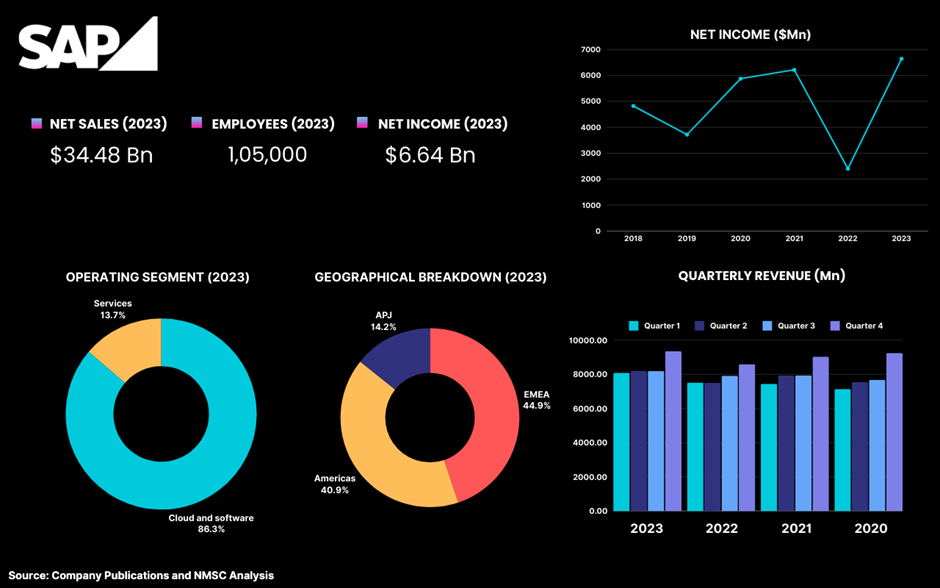

SAP SE, headquartered in Walldorf, Germany, is one of the global leaders in enterprise software with a significant presence in the fraud detection and prevention market. For 2023, SAP reported impressive financial performance, with revenue reaching USD 34.48 billion and net income climbing to USD 6.64 billion, up from USD 2.40 billion in 2022. This robust financial growth underscores SAP's strong market position and its effectiveness in delivering value through its comprehensive suite of solutions.

The company's operations are segmented into Cloud and Software, which generated USD 30.20 billion, and Services, contributing USD 4.28 billion. This segmentation highlights SAP's emphasis on providing a broad range of solutions, from cloud-based applications to enterprise software, catering to diverse business needs and driving innovation in areas like fraud detection and prevention.

Geographically, SAP's revenue distribution for 2023 reflects its expansive global reach, USD 15.47 billion from the EMEA region, USD 14.10 billion from the Americas, and USD 4.90 billion from APJ. This extensive geographic presence enables SAP to serve a wide range of industries and clients across different regions, adapting to varied market demands and enhancing its global footprint.

With a substantial workforce of approximately 105,000 employees, SAP leverages its large team to drive technological advancements and deliver high-quality services. In a notable strategic move, SAP and Francisco Partners (FP) announced on August 17, 2022, that FP would acquire SAP Litmos from SAP. This transaction is part of SAP's strategic realignment, allowing the company to focus more intensively on its core enterprise software and fraud prevention solutions while enabling FP to further develop SAP Litmos.

SAP SE remains a key player in integrating advanced technologies into its solutions, offering sophisticated tools and services for fraud detection and prevention. The company's expertise in cloud computing, data management, and enterprise software enables it to provide effective and innovative solutions to help businesses protect against evolving threats and ensure the integrity of their operations.

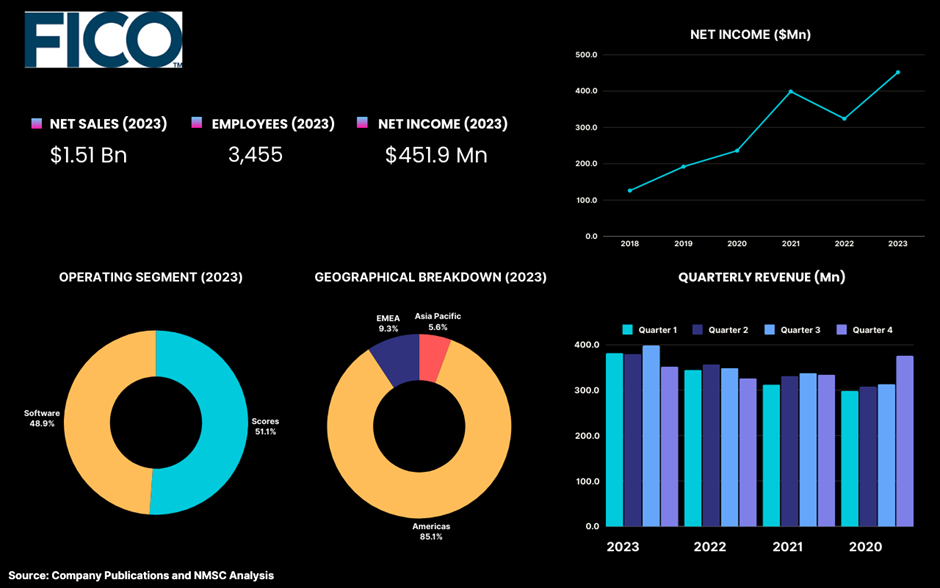

HIGHLIGHTS OF FAIR ISAAC CORPORATION

Fair Isaac Corporation (FICO), headquartered in San Jose, California, United States, is one of the leading enterprises in the fraud detection and prevention market. In 2023, FICO achieved impressive financial results, with revenue reaching USD 1.51 billion and net income rising to USD 451.9 million, a significant increase from USD 324 million in 2022. This financial performance underscores FICO's strong position in the market and its effective strategy in delivering valuable solutions.

FICO operates through two primary segments, Scores and Software. The Scores segment, which includes FICO’s well-known credit scoring products, generated USD 773 million in revenue. The Software segment, which includes a range of solutions for risk management and fraud prevention, contributed USD 739 million. These segments highlight FICO's dual focus on providing critical scoring systems and comprehensive software solutions.

The company's revenue distribution for 2023 reveals its extensive global reach. FICO generated USD 1.28 billion from the Americas, reflecting its significant market presence in North America and Latin America. Revenue from Europe, the Middle East, and Africa amounted to USD 140 million, while Asia Pacific contributed USD 85 million. This distribution demonstrates FICO’s ability to cater to diverse markets and adapt its solutions to regional needs.

Operating with a workforce of 3,455 employees, FICO has the resources and expertise necessary to support its extensive operations and continue driving innovation. The company's operating income for 2023 was USD 642.8 million, up from USD 542.4 million in 2022, indicating strong operational efficiency and profitability. FICO's total operating expenses increased to USD 870.7 million in 2023 from USD 834.8 million in the previous year, reflecting ongoing investments in technology and development.

FICO maintains a solid financial foundation with a USD 600 million unsecured revolving line of credit and a USD 300 million unsecured term loan, both secured with a syndicate of banks and maturing on August 19, 2026. This financial stability supports FICO’s strategic initiatives and operational flexibility.

As a pioneer in the field of predictive analytics and fraud prevention, FICO continues to lead with innovative solutions that help businesses manage risk, detect fraudulent activity, and enhance security. The company's strong financial performance, strategic investments, and global reach reinforce its position as a key player in the fraud detection and prevention market. FICO’s commitment to advancing technology and providing cutting-edge solutions ensures its ongoing leadership and influence in the industry.

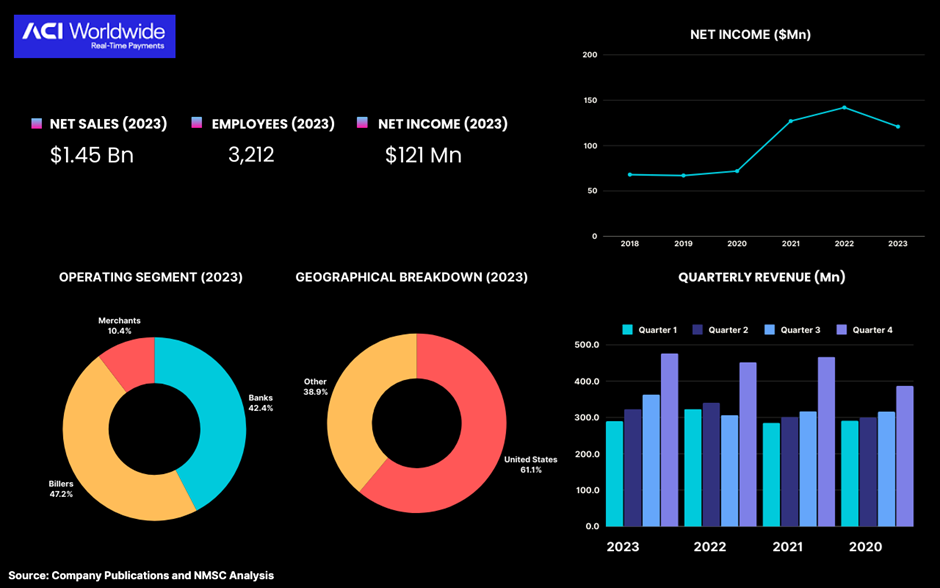

HIGHLIGHTS OF ACI WORLDWIDE, INC.

ACI Worldwide, Inc., headquartered in Naples, Florida, United States, is a significant player in the fraud detection and prevention market. The company reported revenue of USD 1.45 billion for 2023. Despite this strong revenue performance, ACI Worldwide experienced a slight decline in net income, reporting USD 121 million for 2023 compared to USD 142 million in 2022. The company's operating segments for 2023 include Banks, which contributed USD 616 million; Billers, generating USD 685.9 million; and Merchants, with USD 150.6 million. This segmentation highlights ACI Worldwide’s diverse client base and its focus on providing tailored solutions for various sectors within the payments ecosystem.

Geographically, ACI Worldwide’s revenue distribution in 2023 was substantial, with USD 887.1 million from the United States and USD 565.4 million from other international markets. This broad geographical reach underscores the company’s significant presence and influence in both domestic and global markets.

The company operates with a workforce of 3,212 employees, enabling it to effectively manage its operations and support its extensive range of services. ACI Worldwide's operating expenses for 2023 were USD 1.23 billion, up from USD 1.21 billion in 2022, reflecting ongoing investments in its technology and services to maintain its competitive edge.

ACI Worldwide continues to be a leader in providing advanced fraud detection and prevention solutions, leveraging its expertise to help businesses protect against fraudulent activities and enhance their security measures. The company's strong financial performance and global presence reinforce its position as a key player in the industry, dedicated to delivering innovative and reliable solutions in the rapidly evolving payments landscape.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/fraud-detection-and-prevention-market/inquire-before-buying

SUMMARY OF FRAUD DETECTION AND PREVENTION MARKET

In an era where digital transactions dominate, the fraud detection and prevention market stand as a crucial defense against financial misconduct. As technology evolves, so too do the tactics of fraudsters, making innovative solutions increasingly vital. With the market poised for explosive growth, driven by advancements in AI and machine learning, businesses must stay vigilant and adaptive. Embracing cutting-edge technologies and strategic partnerships will be key to outsmarting fraud and safeguarding assets in this high-stakes game.

ABOUT THE AUTHOR

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at mrinal.deb@nextmsc.com

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries, such as Tech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at mrinal.deb@nextmsc.com

Add Comment

Related Blogs

Navigating the Evolving Landscape of Fraud Detection and Prevention

Introduction In today's interconnected digital world,...

The Rise Of Cybercrime: What You Need To Know To Stay Safe

Introduction Cybersecurity is a critical issue for businesses and individuals...

Why Are Companies Focusing on Data Localization?

Since emergence of technology, the value of data has increased enormously which...