India’s Growing EV Charging Infrastructure: A Detailed Look at Charge Point Operators in 2023

25-Oct-2024

As India accelerates towards a sustainable and environmentally-friendly future, electric vehicles (EVs) have taken center stage. However, for this vision to materialize, a robust EV charging infrastructure is vital.

In 2023, Charge Point Operators (CPOs) have emerged as critical players in shaping the EV ecosystem by creating a network of charging stations across the country. Government initiatives such as FAME II, substantial investments, and the rapid surge in EV sales have combined to boost the growth of the EV charging market.

Here, we dive into the key drivers, restraints, and opportunities shaping the landscape of India's EV charging infrastructure, with a special focus on charge point operators and their contributions.

REASONS BEHIND THE GROWTH OF EV CHARGING INFRASTRUCTURE IN INDIA

The rapid increase in electric vehicle sales is a primary catalyst for the expansion of EV charging infrastructure. As EV adoption gains momentum across India, the demand for efficient and widespread charging solutions becomes more urgent.

The International Energy Agency (IEA) reports that electric car sales in India, alongside Thailand and Indonesia, tripled in 2022. India, in particular, saw a notable increase in Battery Electric Vehicle (BEV) sales, largely driven by government incentives under the Production Linked Incentive (PLI) scheme.

Tata, a prominent player in the Indian EV market, is leading this charge. Moreover, the escalating number of EVs has spurred the need for a more extensive and accessible charging network to cater to both personal and commercial EV fleets. This expansion is further supported by the rise of Electric Vehicle Supply Equipment (EVSE) startups, which are reshaping the electric mobility landscape in India.

AC VS. DC: A LOOK INTO THE INDIA EV CHARGING MARKET

The Indian electric vehicle (EV) market is evolving rapidly, with charging infrastructure playing a crucial role in its growth. A key aspect of this infrastructure is the distinction between AC and DC chargers, each serving a different purpose in the charging ecosystem.

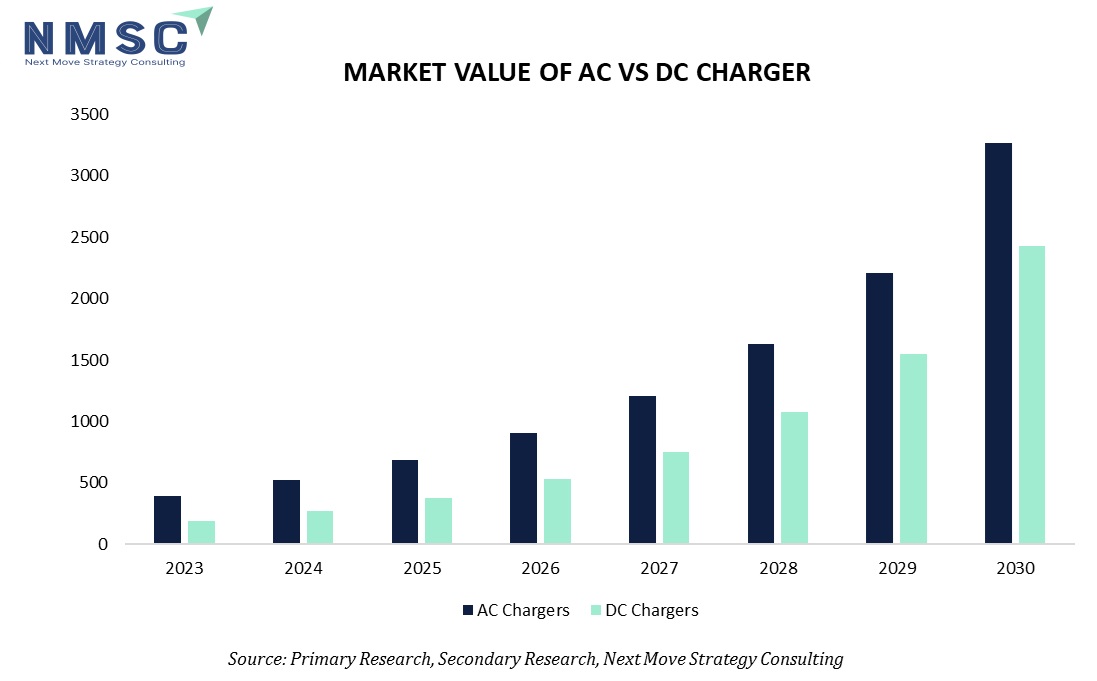

The Indian electric vehicle (EV) charging market is on a rapid growth trajectory, with the demand for both AC and DC chargers expected to surge from 2024 to 2030. This growth is fueled by rising EV adoption, favorable government policies, and technological advancements.

AC chargers are widely used for personal vehicles due to their compatibility with home and workplace charging, making them a convenient and cost-effective solution for daily use. In 2023, the market value for AC chargers stood at $397 million and is expected to grow as the residential and commercial sectors continue adopting EVs.

POWERING INDIA'S EV REVOLUTION: MARKET VALUE BY CHARGER TYPE 2023-2030 (USD MILLION)

For an in-depth analysis of charger types and their market value, access our full report: https://www.nextmsc.com/india-electric-vehicle-ev-charging-market/request-sample

On the other hand, DC chargers, known for their high-speed charging capabilities, are set to play a crucial role in meeting the demands of commercial EV fleets and long-distance travelers. With a market value of $191.5 million in 2023, DC chargers are poised for exponential growth in the coming years, driven by the expansion of public fast-charging infrastructure.

While both AC and DC chargers will serve complementary roles in creating a robust EV charging network across India, NMSC’s in-depth analysis indicates that DC chargers, due to their superior speed and efficiency, will experience significant growth in comparison to DC chargers as they become essential for high-speed charging, particularly catering to commercial fleets and long-distance travel requirements.

KEY CHARGE POINT OPERATORS (CPO) SHAPING INDIA’S EV CHARGING LANDSCAPE

As the number of EVs on Indian roads continues to rise, several Charge Point Operators (CPOs) have stepped up to meet the growing demand for public charging stations. Below is a detailed look at the major players and their contributions to India's charging network in 2023:

The list of CPOs highlights the diversity and scale of operations in the EV charging ecosystem. Companies like Tata Power, Ather Energy, and jio-bp pulse have become leaders in building the necessary infrastructure, contributing significantly to the growth of India's EV sector. Here is a detail list of CPO in India.

|

Sl No |

Company Name |

No of Public Charging Station |

Major Businesses |

Revenue in 2023 (USD Million) |

|

1 |

Adani Gas |

10 |

1.Piped Natural Gas (PNG) |

5 |

|

2 |

Ather Energy Pvt Ltd |

2000 |

1. Manufacturing of electric scooters |

10.73 |

|

3 |

Okaya |

XXX |

1. Manufactures EV Scooters Advanced EV Batteries |

XXX |

|

4 |

OLA |

XXX |

1. Manufacturing of EV Scooters |

XXX |

|

5 |

Plug & Go |

1 |

XXX |

0.1 |

|

6 |

Rajasthan Electronics and Instruments Limited |

216 |

Electronic instruments and systems manufacturing |

1.78 |

Source: Next Move Strategy Consulting

According to the Government of India, the count of public charging stations stands at approximately 12,000. However, through a comprehensive analysis of primary and secondary data obtained from company websites and assessing a total of 54 charge point operators, NMSC estimates the total count of public charging stations as of 2023 to be around 29,000.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/india-electric-vehicle-ev-charging-market/inquire-before-buying

CONCLUSION

India's electric vehicle revolution is gaining momentum, and the development of a robust EV charging infrastructure is at the heart of this transformation. With strong government backing, increasing EV sales, and innovative charge point operators leading the way, the future of India's EV ecosystem looks promising. As CPOs continue to expand their networks, the dream of sustainable mobility is closer than ever to becoming a reality.

ABOUT THE AUTHOR

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography. The author can be reached at info@nextmsc.com

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography. The author can be reached at info@nextmsc.com

Add Comment

Related Blogs

Siemens, Emerson and Honeywell: Powerhouses in the Distributed I/O Market

The Global Distributed I/O Market, valued at USD 3.52 billio...

How Kawasaki and Daihen are Shaping the Future of Wafer Handling Robotics

The Wafer Handling Robots Market, estimated at USD 1.60 bill...

Evaluating Japan’s 30,000+ Electric Vehicle (EV) Charging Stations Based on Various Parameters

Japan has been at the forefront of electric vehicle (EV) ado...