Unleashing the Power of Emerging Technologies in Insurance TPAs

19-Jun-2023

Introduction

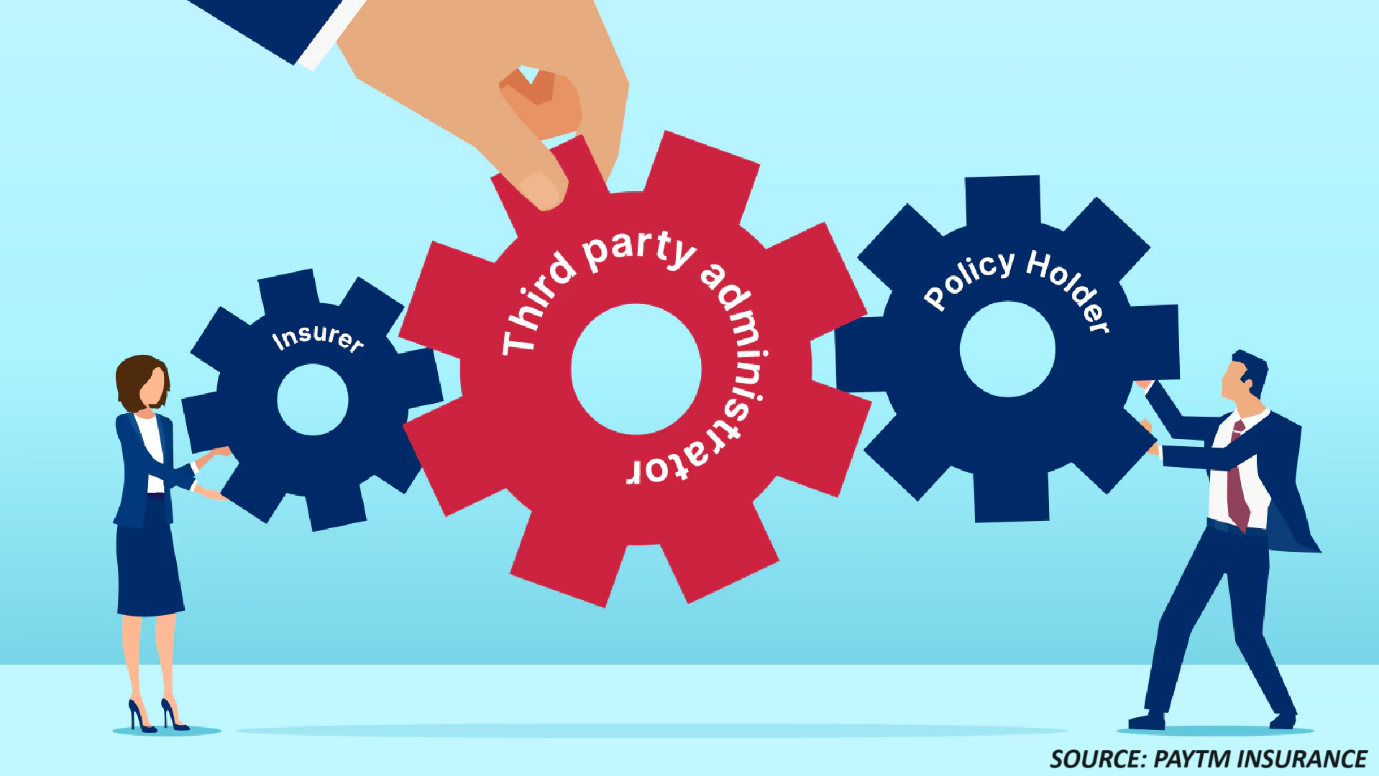

In today's fast-paced insurance sector, third-party administrators (TPAs) are instrumental in optimizing processes, boosting productivity, and ensuring top-notch customer service. The rise of cutting-edge technologies such as artificial intelligence (AI), blockchain, and predictive analytics presents unprecedented opportunities for TPAs to reshape the insurance landscape. Through this blog, we will delve into the transformative capabilities of these innovations and their profound implications for insurance TPAs. From automating routine tasks to enhancing data security and driving actionable insights, artificial intelligence (AI), blockchain, and predictive analytics are poised to revolutionize how TPAs operate. They will also enable them to deliver even greater value to insurers and policyholders alike. As the insurance industry embraces digital transformation, TPAs stand at the forefront of innovation, driving efficiency, agility, and excellence.

Artificial Intelligence (AI) - The Driving Force

AI is revolutionizing the insurance TPA industry by automating repetitive tasks, improving decision-making processes, and enhancing customer interactions. One of the notable advancements in this domain is MyHealthcare's recent launch of an AI-enabled enterprise ecosystem. This innovative platform offers hospitals and healthcare institutions a single-screen interface, integrating advanced AI-based Electronic Medical Records (EMRs) for outpatient, inpatient, and emergency care. Leveraging a robust and configurable workflow engine, the ecosystem aims to drive operational and process efficiencies across the provider network. Clinicians and hospital teams can now manage the patient care and hospital operations seamlessly through a task-based healthcare information management system.

Blockchain Technology - Ensuring Security and Transparency

Blockchain technology provides a decentralized and immutable ledger that ensures secure and transparent transactions throughout the insurance ecosystem. By utilizing blockchain, TPAs can potentially improve data integrity, streamline claims processing, and mitigate fraud risks. Insurers are increasingly interested in these technologies, owing to their potential to drive the revenue growth. For instance, revenues related to blockchain technology in the insurance sector are projected to surge from USD 425 million in 2022 to approximately USD 37 billion by 2030, representing a 70% annual revenue growth.

As per the Boston Consulting Group (BCG) research, nearly 60% of insurance firms are already investing in blockchain, with 80% of their C-suite executives recognizing its potential for enhancing efficiencies. This revenue growth is a part of a larger trend, with an expected USD 708 billion increase in revenue across different industries and regions with the implementation of metaverse and blockchain technologies. Smart contracts enable automated and self-executing agreements, facilitating quicker claim settlements and reducing administrative burdens. Furthermore, blockchain is expected to empower TPAs to strengthen regulatory compliance and cultivate trust among stakeholders.

Predictive Analytics - Anticipating Future Trends

Predictive analytics, which utilizes historical data and statistical algorithms to predict future trends, allows TPAs to make informed decisions and determine customer needs. By harnessing predictive analytics, TPAs can refine pricing strategies, detect emerging risks, and take proactive measures to mitigate losses. The insurance sector is adopting AI-driven analytics to expedite data-driven decision-making for Property & Casualty (P&C) carriers.

Insurity Analytics, powered by AI-driven insights, revolutionizes the decision-making process for carriers, providing real-time and reliable insights into their portfolio. This leads to enhanced segmentation and reduced loss ratios. Insurity Predict, a component of Insurity Analytics, bolsters predictive analytics and modeling capabilities, leading to significant improvements in loss ratios and streamlining the underwriting process. Insurity's analytics models leverage advanced AI and machine learning techniques to facilitate automation and offer superior decision support, enabling carriers to actively manage their business. Sophisticated data analytics methods, such as data visualization and sentiment analysis, enable TPAs to gain a deeper understanding of customer behavior and market trends. This assists them to stay competitive in a rapidly evolving industry.

Conclusion

In conclusion, emerging technologies are revolutionizing the insurance TPA industry, driving operational efficiency, enhancing customer experiences, and unlocking new opportunities for growth and innovation. By embracing AI, blockchain, predictive analytics, and other advanced technologies, TPAs can streamline processes, mitigate risks, and deliver value-added services to policyholders. As the insurance landscape continues to evolve, TPAs must stay agile, adaptable, and forward-thinking to remain competitive in a digital-first world.

About the Author

Shyam Gupta is a passionate and highly enthusiastic researcher with over four years of experience. He is dedicated to assisting clients in overcoming challenging business obstacles by providing actionable insights through exhaustive research. Shyam has a keen interest in various industries, including ICT & Media, Digital Transformation, and Telecoms & Internet. He consistently endeavors to deliver valuable perspectives in these areas. In addition to his research work, Shyam enjoys sharing his thoughts and ideas through articles and blogs. During his leisure time, he finds solace in the world of literature and art, often engrossed in reading and expressing his creativity through painting. The author can be reached at shyam.gupta@nextmsc.com

Shyam Gupta is a passionate and highly enthusiastic researcher with over four years of experience. He is dedicated to assisting clients in overcoming challenging business obstacles by providing actionable insights through exhaustive research. Shyam has a keen interest in various industries, including ICT & Media, Digital Transformation, and Telecoms & Internet. He consistently endeavors to deliver valuable perspectives in these areas. In addition to his research work, Shyam enjoys sharing his thoughts and ideas through articles and blogs. During his leisure time, he finds solace in the world of literature and art, often engrossed in reading and expressing his creativity through painting. The author can be reached at shyam.gupta@nextmsc.com

Add Comment

Related Blogs

The Digital Revolution in U.S. Insurance Industry

The U.S. insurance industry is undergoing a significant transformation driven by...

How Leading Players are Adapting to a Rapidly Expanding Insurance TPA Market

The insurance TPA market is experiencing strong growth,...

Adoption of Latest Technologies to Reshape the P&C Core Platform Industry

Introduction The property and casualty (P&C) insurance...

_Insurance.png)