Leading Companies Revolutionizing the Agriculture Robots Market

07-Oct-2024

The Agriculture Robots Market, valued at USD 8.78 billion in 2023, is set to surge to USD 22.49 billion by 2030, at a CAGR of 14.4% from 2024 to 2030. This remarkable growth is propelled by increasing automation, advancements in AI and machine learning, and a strong emphasis on sustainable agriculture.

AGRICULTURE ROBOTS MARKET OVERVIEW

The agriculture robots market is rapidly evolving, driven by the growing use of automation and advances in AI and machine learning. As farming becomes more high-tech, there is a rising demand for precision farming tools, autonomous vehicles, and advanced crop monitoring systems. Precision farming technologies helps to optimize planting and harvesting, while autonomous vehicles and drones reduce labor costs and boost efficiency. Additionally, sophisticated crop monitoring systems provide real-time insights into crop health and soil conditions. Looking ahead, future opportunities include further advancements in robotics and AI, integration with Internet of Things (IoT) for enhanced data analysis, and innovative solutions for sustainable agriculture. These trends create significant opportunities for companies to innovate and lead in transforming the agriculture sector.

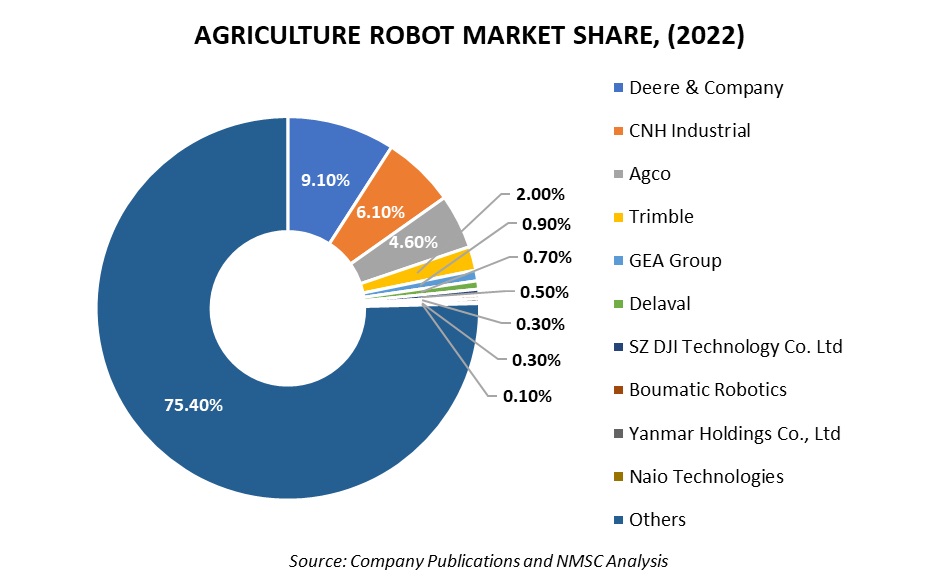

In the rapidly expanding agriculture robots market, several key players are making a significant impact through innovation and sustainability. Companies such as GEA Group, John Deere, AGCO Corporation, and Trimble Inc. are at the forefront, driving advancements with their cutting-edge technologies and extensive market reach. The ongoing contributions by these key players are shaping the industry's trajectory, setting new standards for automation, data integration, and environmental stewardship in the agricultural sector.

For the latest market share analysis and in-depth agriculture robots industry insights, you can reach out to us at https://nextmsc.com/global-agricultural-robots-market/request-sample

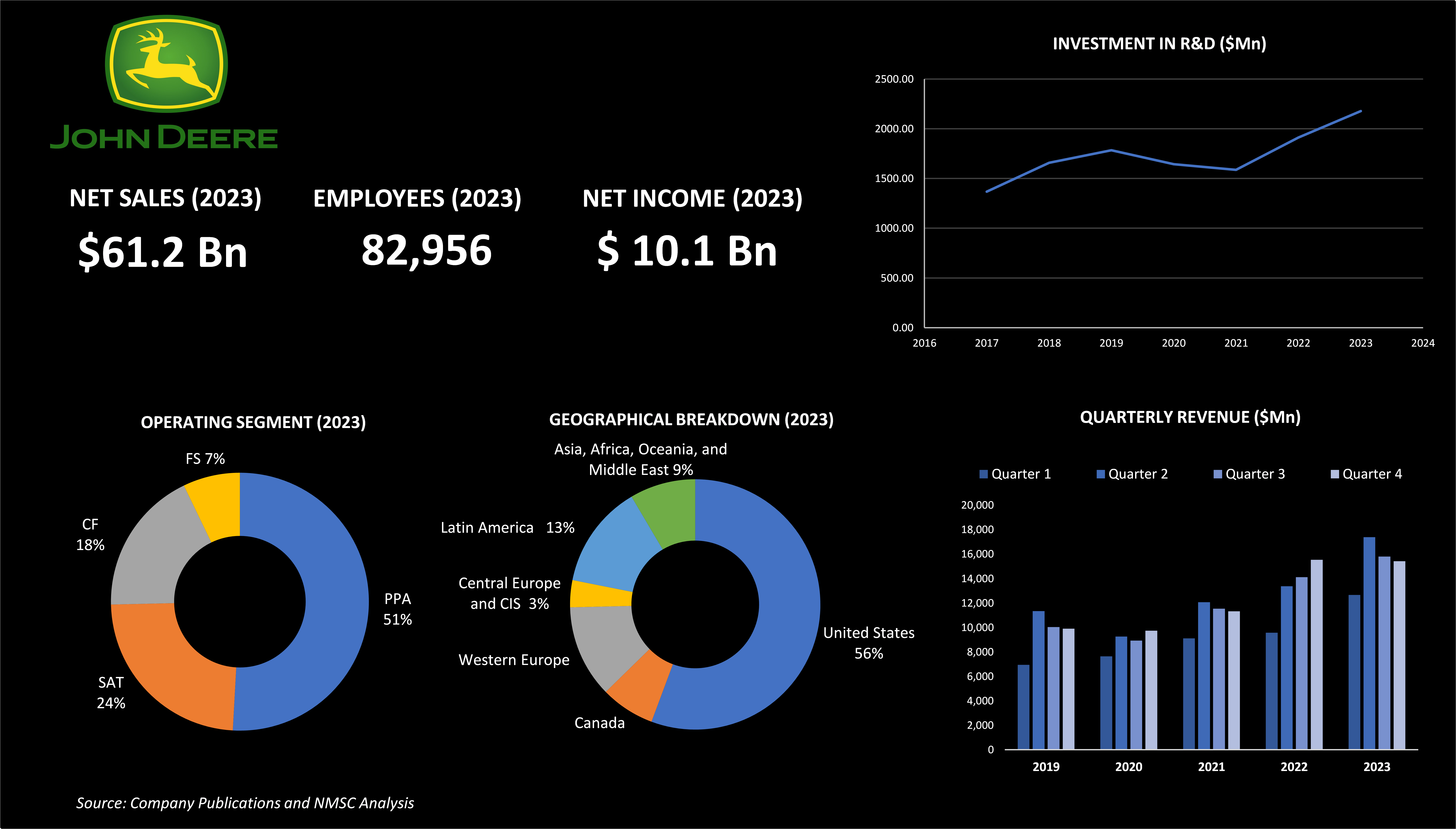

HIGHLIGHTS OF DEERE & COMPANY

Deere & Company also known as John Deere is one of the leading manufacturers of agricultural, turf, construction, and forestry equipment, reported remarkable financial results in 2023, with a revenue of USD 61.2 billion and a net income of USD 10.1 billion. The company operates through various segments, including production and precision agriculture (PPA), small agriculture and turf (SAT), construction and forestry (CF), and financial services. Deere & Company has significantly increased its research and development (R&D) spending, reflecting its dedication to innovation. In 2023, the company invested USD 2,177 million in R&D, a 14% increase from the previous year. This investment has led to significant advancements in agricultural robotics and precision farming technology, ensuring high performance and reliability for farmers.

Notably, in 2023, Deere & Company made strategic acquisitions to bolster its innovation capabilities. The acquisition of Smart Apply, Inc. and SparkAI Inc. aims to enhance the integration of smart technology in its products. The Smart Apply Intelligent Spray Control System, combined with GUSS Automation’s remote sprayer, is designed to improve productivity and optimize inputs for high-value crop customers. The company's commitment to advancing agricultural robotics is evident through its continuous focus on developing new technology solutions. Deere's strategies include leveraging smart technology and precision agriculture to provide farmers with real-time data and analytics, improving efficiency and sustainability in farming operations.

Additionally, in February 2022, Deere & Company acquired majority ownership in Kreisel Electric Inc., an Austrian pioneer in immersion-cooled battery technology. This acquisition strengthens Deere’s position in the electric battery market, supporting high-performance and off-highway applications. Despite strong financial performance, Deere & Company anticipates a decline in large agricultural equipment sales in North America, Europe, and South America in 2024. However, the company's diversified operations and strategic focus on innovation provide a solid foundation for continued growth and resilience.

Deere & Company's strategic acquisitions, commitment to R&D, and focus on integrating smart technologies position it well in the agriculture robotics market, ensuring ongoing leadership and growth in the industry. The company employs around 83,000 individuals worldwide, dedicated to delivering innovative solutions and maintaining high standards in agricultural equipment.

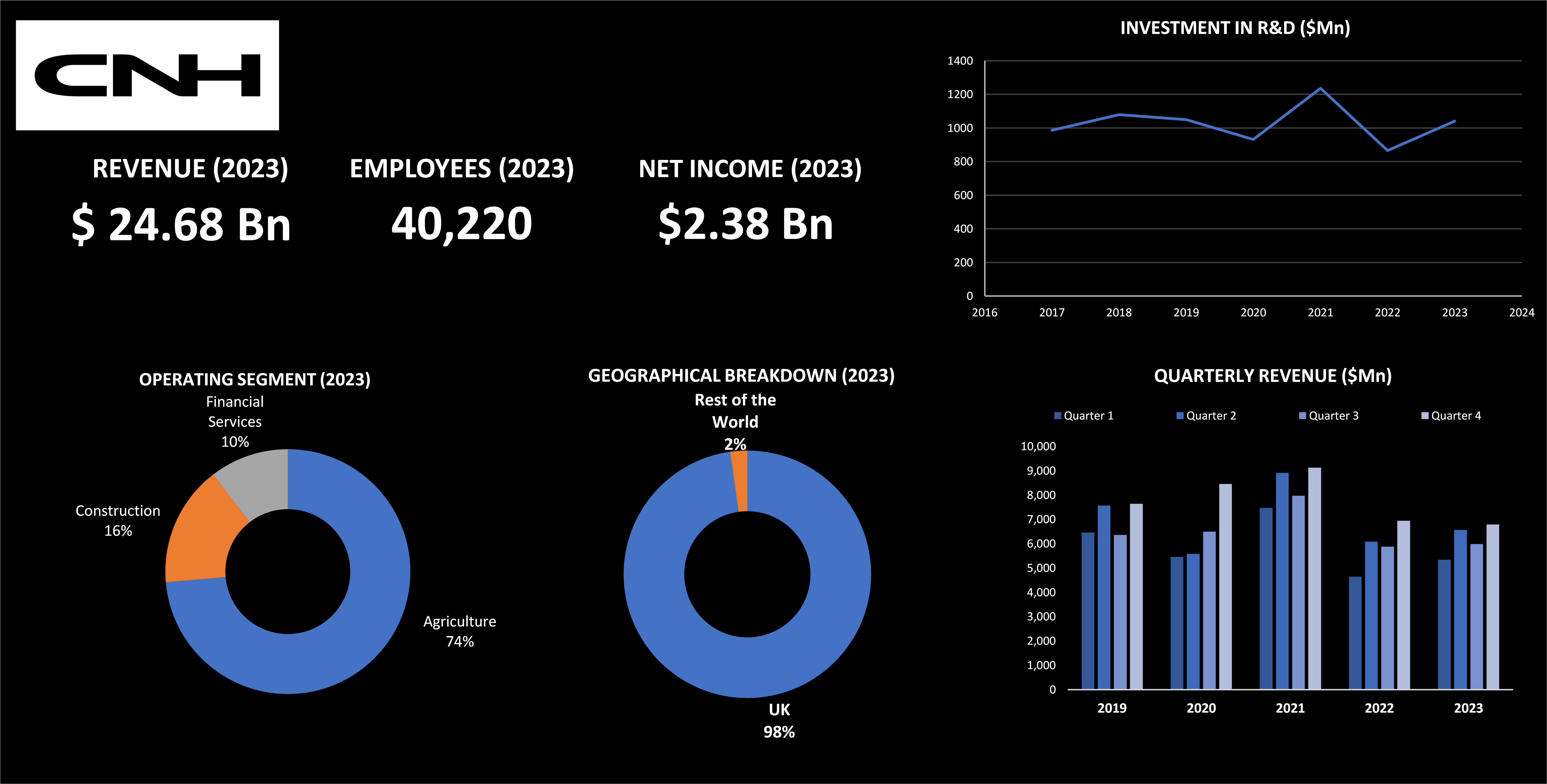

HIGHLIGHTS OF CNH INDUSTRIAL N.V.

CNH Industrial is a global leader in capital goods, focusing on designing, manufacturing, and selling agricultural and construction equipment. The company's commitment to innovation, sustainability, and customer satisfaction drives its success in various sectors. Through constantly improving its products and services, CNH Industrial meets the evolving needs of the agriculture sector. In 2023, CNH Industrial recorded revenues of USD 24.68 billion, marking a 4.8% increase compared to 2022. This growth demonstrates the company's robust market presence and effective business strategies. The company invested significantly in research and development, with expenditures rising from USD 866 million in 2022 to USD 1.041 billion in 2023, highlighting its dedication to technological advancement and product innovation.

Additionally, CNH Industrial operates in four primary segments such as agriculture, construction, financial services, and eliminations and other. In 2023, the company's revenues were geographically distributed with USD 24.139 billion coming from the UK and USD 548 million from the rest of the world. This extensive global footprint highlights CNH Industrial's ability to cater to diverse markets and maintain a strong international presence.

Furthermore, the company made several strategic acquisitions to enhance its capabilities and market position. In March 2023, CNH Industrial acquired a controlling interest in Bennamann for approximately USD 51 million. This acquisition aligns with the company's focus on sustainable solutions in agriculture. On May 16, 2022, the company acquired Specialty Enterprises LLC for approximately USD 50 million, which has been included in the agriculture segment, further strengthening its agriculture robots offerings.

As of December 31, 2023, CNH Industrial employed 40,220 people, including 11,891 in the U.S. and Canada. The company also engages consultants, independent contractors, and temporary and part-time workers. This diverse workforce supports CNH Industrial's operations and contributes to its ability to innovate and adapt in a rapidly changing industry. CNH Industrial's research, development, and engineering teams are crucial to the company's strategic growth. They focus on accelerating time-to-market for new products, leveraging specialization, and adapting to rapidly changing market conditions. This emphasis on R&D ensures that CNH Industrial remains competitive and at the cutting edge of technology.

Moreover, CNH Industrial is at the forefront of innovation in agricultural robotics. The company's advancements include developing autonomous tractors, precision farming equipment, and smart spraying systems. These technologies aim to improve efficiency, reduce labor costs, and enhance sustainability in agriculture, reflecting CNH Industrial's commitment to addressing global agricultural challenges through innovative solutions.

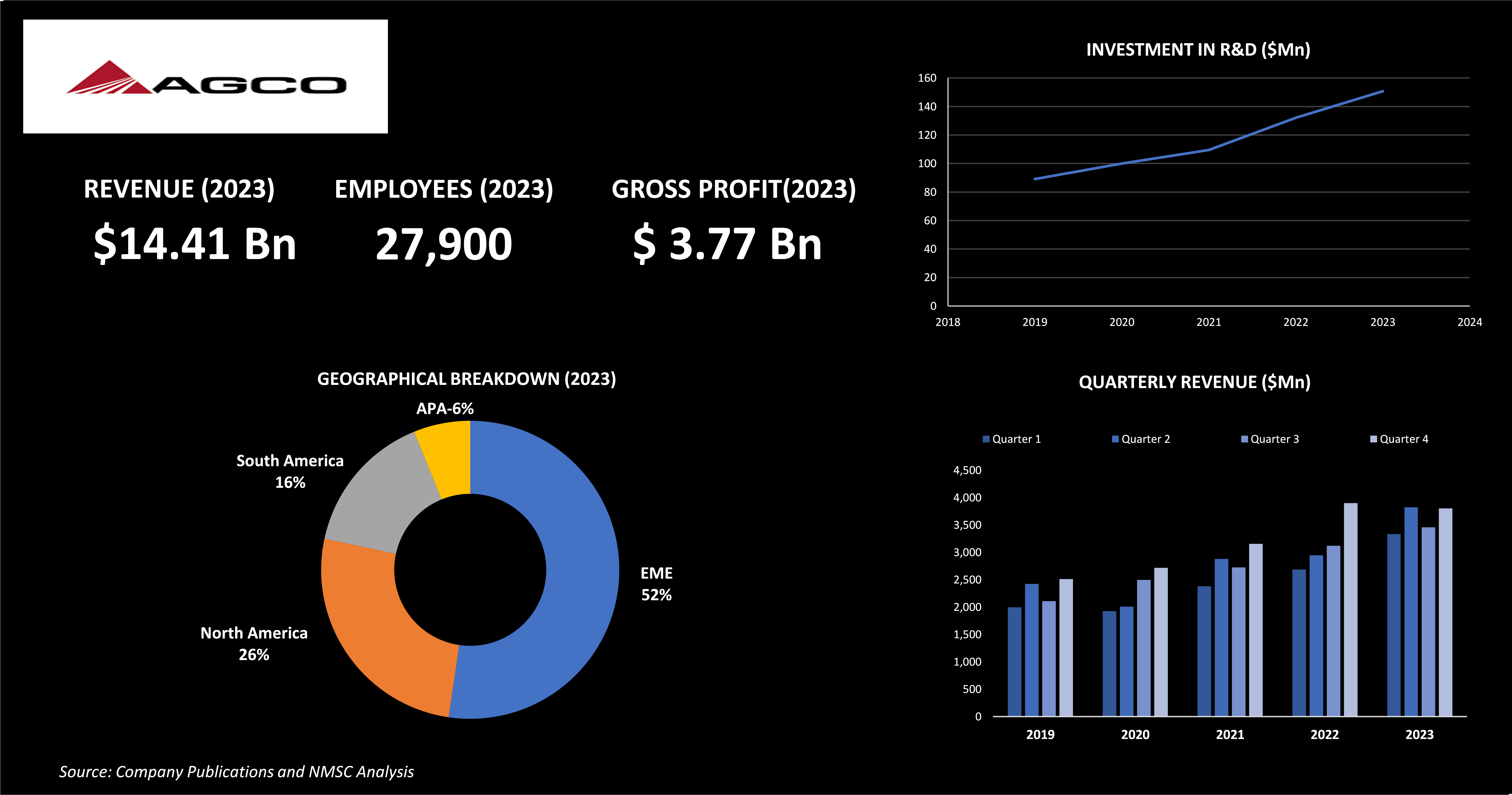

HIGHLIGHTS OF AGCO CORPORATION

AGCO Corporation is making significant advancements in the agriculture robots market by leveraging its extensive experience in agricultural equipment and technology. The company's innovative approach focuses on developing advanced robotic solutions that enhance farming efficiency and sustainability. Through integrating cutting-edge technologies, AGCO aims to provide farmers with precise, real-time data and analytics to improve crop yields and resource management. In 2023, AGCO reported consolidated revenue of USD 14.41 billion, a 13.9% increase from the previous year. The company's gross profit was USD 3.77 billion. AGCO's operations span globally, with notable revenue contributions from regions such as North America, South America, and EME (Europe, the Middle East, and Africa).

Additionally, the company’s commitment to innovation and expansion is highlighted by its strategic partnership with Trimble Inc. In September, 2023, AGCO entered into a Sale and Contribution Agreement with Trimble, leading to the formation of the Trimble Ag joint venture. This venture, in which AGCO holds an 85% interest, aims to integrate Trimble’s agricultural business with AGCO's expertise to advance precision farming technologies.

Despite the challenges posed by the cyclical nature of the agricultural industry, AGCO continues to invest in technology and innovation. The company's efforts are driven by a clear purpose to provide farmer-focused solutions that sustainably feed the world. AGCO employs approximately 27,900 individuals worldwide, fostering a diverse and inclusive workplace that supports employee well-being and development. Notably, in 2022, AGCO faced some financial setbacks due to the conflict between Russia and Ukraine, resulting in asset impairment charges of USD 36 million related to its Russian distribution joint venture. However, the company's overall growth trajectory remains strong, supported by strategic acquisitions and a focus on technological advancements.

Moreover, AGCO's dedication to research and development is evident in its ongoing efforts to enhance agricultural robotics and precision farming solutions. These innovations are designed to meet the evolving needs of farmers, ensuring that AGCO remains at the forefront of the agricultural technology market.

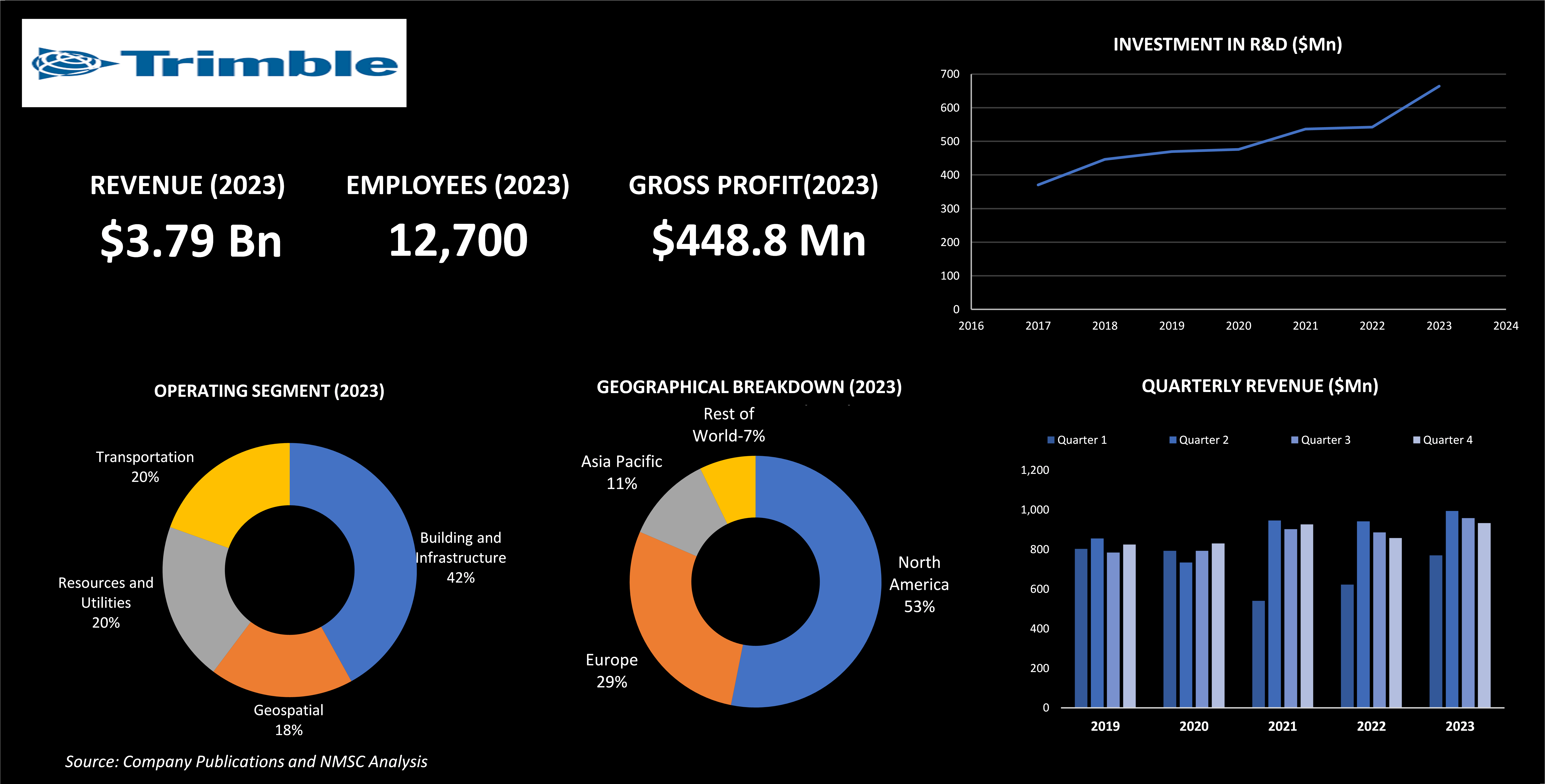

HIGHLIGHTS OF TRIMBLE INC.

Trimble Inc., a prominent player in the agriculture robots market, reported a gross revenue of USD 3.79 billion and a gross profit of USD 2.32 billion. The company employs 12,700 people and operates through several key segments that includes building and infrastructure, geospatial, resources and utilities, and transportation. Trimble is advancing the agriculture robots market by leveraging its expertise in geospatial technologies and automation to develop precision farming solutions. These innovations improve productivity and sustainability in agriculture by providing real-time data and advanced analytics.

Additionally, in 2023, the resources and utilities segment, that includes agriculture technologies, generated USD 769 million, reflecting Trimble’s strong presence and expertise in this field. Geographically, Trimble's revenue distribution includes significant contributions from North America, 53%; Europe, 28%; Asia Pacific, 11%; and the Rest of the World, 7%.In the U.S. alone, Trimble's total revenue was USD 1,855.2 million in 2023.

Furthermore, Trimble’s strategies for advancing the agriculture robots market include leveraging its expertise in geospatial technologies and automation to develop precision farming solutions. These innovations enhance productivity and sustainability in agriculture by providing real-time data and advanced analytics. For instance, in April, 2023, Trimble acquired TP Group Holding GmbH and Sixfold GmbH, owners of Transporeon, a leading cloud-based transportation management software platform. This acquisition, part of Trimble’s Transportation segment, aligns with their Connect and Scale strategy, aiming to optimize global supply chains.

The company’s focus on integrating cutting-edge technologies and expanding its product offerings reflects its commitment to driving efficiency and growth in the agriculture sector. This strategic approach ensures that Trimble remains at the forefront of technological advancements in agricultural robotics, supporting the evolving needs of farmers worldwide.

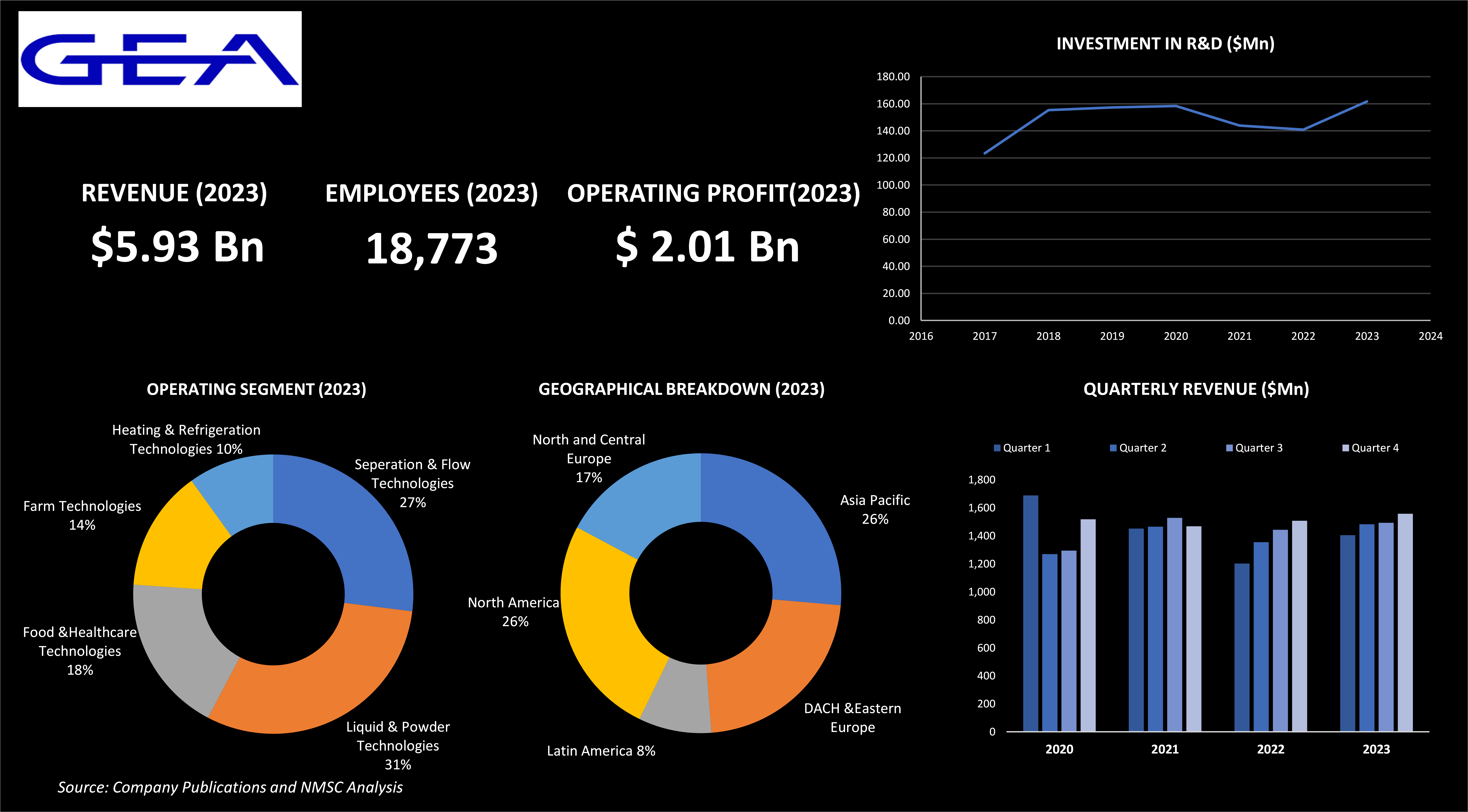

HIGHLIGHTS OF GEA GROUP

GEA Group, with a gross revenue of USD 5.93 billion and an operating profit of USD 2.01 billion, stands as a leading company in the agriculture robots market. The agriculture robotics offerings of the company, particularly in milking robots, have significantly contributed to its growth, showcasing its innovation in automating farming processes. The company employs 18,773 people and operates through several key segments such as separation & flow technologies, liquid & powder technologies, food & healthcare technologies, farm technologies, and heating & refrigeration technologies. Within these segments, GEA’s farm technologies division is particularly significant, focusing on advanced agricultural robotics such as milking robots that enhance farm efficiency and automation.

In terms of geographical reach, GEA has a strong presence across various regions. North America contributes 22% to its total revenue, while Latin America, Western Europe, and the Asia-Pacific region also play crucial roles in its global operations. In the latest strategic move, GEA acquired Centrifuges Unlimited Inc. on September, 2023, expanding its service capabilities in separators and decanters in North America and Canada. This acquisition, finalized on November, 2023, highlights GEA’s commitment to strengthening its position in the agriculture robotics sector.

GEA's strategies for the agriculture robots market include continuous innovation in robotics technology, enhancing automation solutions, and focusing on sustainable practices. The company’s commitment to expanding its product portfolio and geographic presence reflects its strategic approach to meeting the evolving needs of the agricultural industry and driving growth in this dynamic market.

Have questions? Inquire before purchasing the full report: https://nextmsc.com/global-agricultural-robots-market/inquire-before-buying

SUMMARY OF AGRICULTURAL ROBOTS MARKET

The agricultural robots market is rapidly growing due to advancements in automation technology, the need for operational efficiency, and the digital transformation of agriculture. Key players such as CNH Industrial, GEA Group, John Deere, AGCO Corporation, and Trimble Inc. are at the forefront of this innovation. CNH Industrial is notable for its contributions to agricultural automation and smart farming solutions. GEA Group specializes in automation for livestock management, while John Deere develops precision farming solutions with smart technologies and robotics. Additionally, AGCO Corporation advances agricultural robotics through strategic acquisitions and precision farming tools, whereas Trimble Inc. leverages geospatial technologies to enhance productivity and sustainability in farming. These companies invest heavily in research and development to meet the evolving demands of the agriculture industry. Moreover, the emerging opportunities in this market such as the integration of artificial intelligence, machine learning, and IoT technologies, are enabling more sophisticated, autonomous, and data-driven farming systems. These advancements drive global agricultural development and also open new avenues for optimizing resource use, reducing environmental impact, and enhancing overall farm management efficiency.

About the Author

Sukanya Dey is an ardent and deeply passionate writer who brings her creative flair and insightful perspectives to the forefront. She diligently conducts research to uncover actionable insights for her clients. Beyond her professional endeavors, she finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. To connect with this passionate writer, reach out to info@nextmsc.com

Sukanya Dey is an ardent and deeply passionate writer who brings her creative flair and insightful perspectives to the forefront. She diligently conducts research to uncover actionable insights for her clients. Beyond her professional endeavors, she finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. To connect with this passionate writer, reach out to info@nextmsc.com

Add Comment

Related Blogs

How Abb, Basler, and Teledyne Are Shaping the Future of Vision-Guided Robotics Industry

The vision-guided robots market is witnessing robust growth,...

The Top 10 Companies Shaping the Global Explainable AI Landscape

As reported by Next Move Strategy Consulting the global explainable AI market wa...

Top 10 Companies Operating in The Global Hospital Logistics Robot Industry

The global hospital logistics robots market size was valued...