Role of Top Giants in Revolutionizing the Payment Industry With BNPL

07-Oct-2024

According to the Next Move Strategy Consulting analysis, the global buy now pay later (BNPL) market is experiencing rapid growth, with its value estimated at USD 146.16 billion in 2023. This market is projected to expand nearly sevenfold over the next decade, reaching approximately USD 725.37 billion by 2030. This growth trajectory is primarily driven by the increasing popularity of online shopping, as consumers seek more flexible payment options to manage their purchases. Additionally, the surge in e-commerce sales, particularly in consumer electronics and retail goods, is fueling the demand for BNPL services. As more consumers embrace digital shopping experiences, the convenience and accessibility of BNPL options are becoming integral to the online retail landscape, further accelerating the market's expansion.

BUY NOW PAY LATER MARKET OVERVIEW

The buy now pay later market consist of financial services that enable consumers to purchase goods and services immediately but pay for them often with very less interest. This market includes various fintech companies that offer BNPL options to assess creditworthiness and manage payments. These companies enter in partnership with retailers to integrate BNPL solution at the point of sale. The increase in the popularity of online shopping and the expanding e-commerce sales of consumer electronics and retail goods are credited for the expansion boom. According to the International Trade Administration (ITA), the global B2B e-commerce market is projected to reach USD 36 trillion by 2026 as compared to USD 24 trillion in 2023 that’s an increase of 50%.

The integration of artificial intelligence (AI) allows BNPL providers to construct real time models that enhances the decision-making performance. Several market players are developing unique AI based models to accelerate consumer market penetration. For instance, in January 2022, Temenos launched industry’s first AI-driven BNPL banking service on the temenos banking cloud.

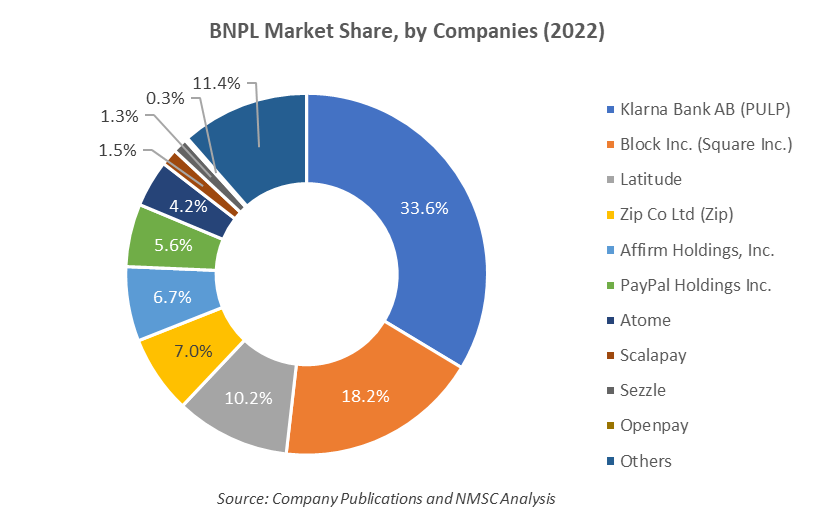

Leading companies in BNPL industry includes Affirm Holdings, Inc. Atome, Block Inc. (Square Inc.), Klarna Bank AB (PULP), Latitude, Openpay, PayPal Holdings Inc., Sezzle, Scalapay, Zip Co Ltd (Zip), and others.

For the latest market share analysis and in-depth buy now pay later (BNPL) industry insights, you can reach out to us at: https://www.nextmsc.com/buy-now-pay-later-market/request-sample

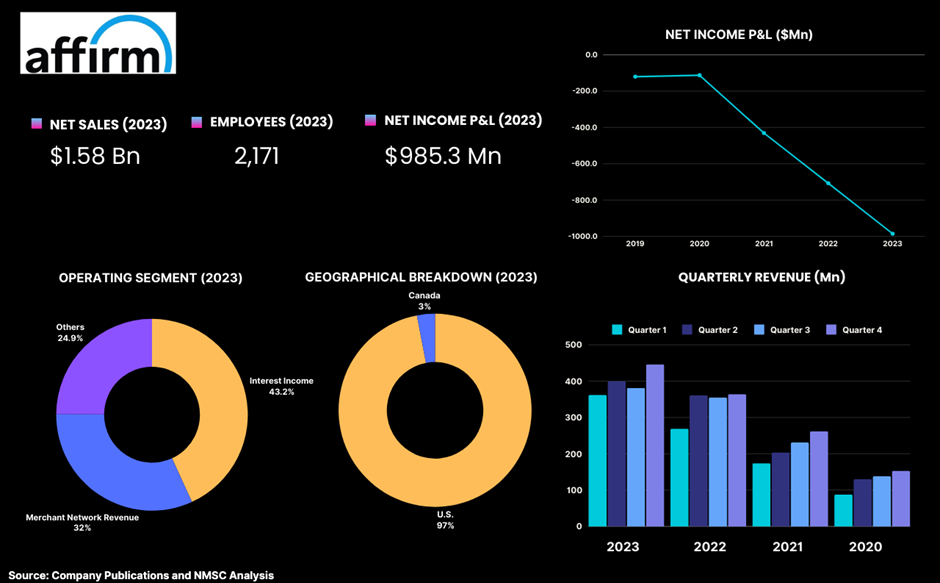

HIGHLIGHTS OF AFFIRM HOLDINGS, INC.

Affirm Holdings, Inc., founded by Max Levchin in 2012, stands as one of the prominent players in the financial technology sector, particularly renowned for its innovative approach to digital and mobile-first commerce. With a mission to enhance consumer spending through transparency and trust, Affirm's solutions are crafted to simplify financial transactions and support responsible spending. The company's operations are bolstered by a dedicated team of 2,171 employees, and it serves a broad consumer base of 36 million users and 254,000 active merchants as of June 2023.

In the fiscal year 2023, Affirm achieved a revenue of USD 1.58 billion, marking a robust 17.7% increase from USD 1.35 billion in 2022. This growth reflects the company's successful expansion in the digital payment space, despite facing significant net losses of approximately USD 985.3 million in 2023, compared to USD 707.4 million in 2022 and USD 441.0 million in 2021. The company’s financial performance was bolstered by a substantial rise in interest income, which reached USD 685.2 million in 2023, a 29.8% increase from USD 527.8 million in 2022. This indicates a growing demand for Affirm's financial products and services.

A key aspect of Affirm's recent advancements includes the introduction of two new payment options in June 2024, pay in 2 and pay in 30. These features are designed to provide consumers with greater flexibility and ease in managing their payments. The Pay in 2 option allows users to split their purchase into two interest-free payments, while the Pay in 30 option offers the ability to pay the full amount interest-free within 30 days. These innovations underscore Affirm's commitment to meeting the evolving needs of its customers and enhancing the overall user experience.

With approximately 97% of its revenue coming from the U.S. market, amounting to around USD 1.54 billion, Affirm continues to reinforce its position as a leading player in the financial technology industry. The company’s focus on user-centric solutions and strategic growth initiatives illustrates its ongoing efforts to reshape the financial landscape and drive the future of digital commerce.

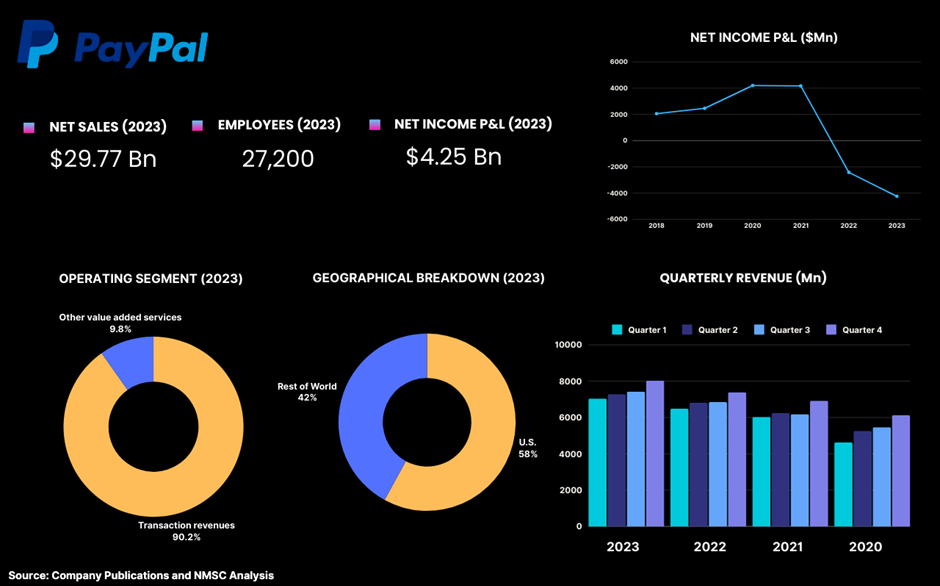

HIGHLIGHTS OF PAYPAL HOLDINGS INC.

PayPal Holdings Inc., founded in 1998 and headquartered in San Jose, California, stands as one of the trailblazers in the digital payments landscape, continuously reshaping the online transaction experience. Known for its innovative approach, PayPal has expanded its service portfolio to include Buy Now, Pay Later (BNPL) options, addressing the increasing consumer demand for flexible payment methods. This strategic move underscores PayPal's role as a leader in financial technology.

In 2023, PayPal achieved a revenue of USD 29.77 billion, reflecting its robust market presence and operational efficiency. The company’s operating income saw a significant increase, rising from USD 3.83 billion in 2022 to USD 5.02 billion in 2023, marking a 23.7% growth. PayPal’s business is segmented into Transaction Revenues and Other Value-Added Services, with Transaction Revenues encompassing fees from payment transactions and related services, and Other Value-Added Services covering interest and fees from loans, as well as gains from strategic investments.

Geographically, PayPal maintains a substantial presence both in the U.S. and internationally. In 2023, the U.S. market generated USD 17.25 billion, while international markets contributed USD 12.51 billion, highlighting PayPal’s extensive global reach and its ability to cater to diverse financial needs.

Despite these impressive figures, PayPal faced financial challenges, reporting net income losses of USD 4.24 billion in 2023 compared to USD 2.41 billion in 2022. These losses reflect the competitive pressures and the significant investments required to expand its service offerings and enhance technological infrastructure. With a workforce of approximately 27,200 employees, PayPal remains committed to its mission of democratizing financial services and providing a secure, inclusive platform for transactions worldwide.

In June 2022, PayPal further strengthened its position in the BNPL sector by launching Pay Monthly, a new service allowing customers to make purchases and pay in monthly instalments. This offering enhances PayPal’s competitive edge by providing a flexible alternative to traditional credit methods, aligning with evolving consumer preferences for manageable payment solutions.

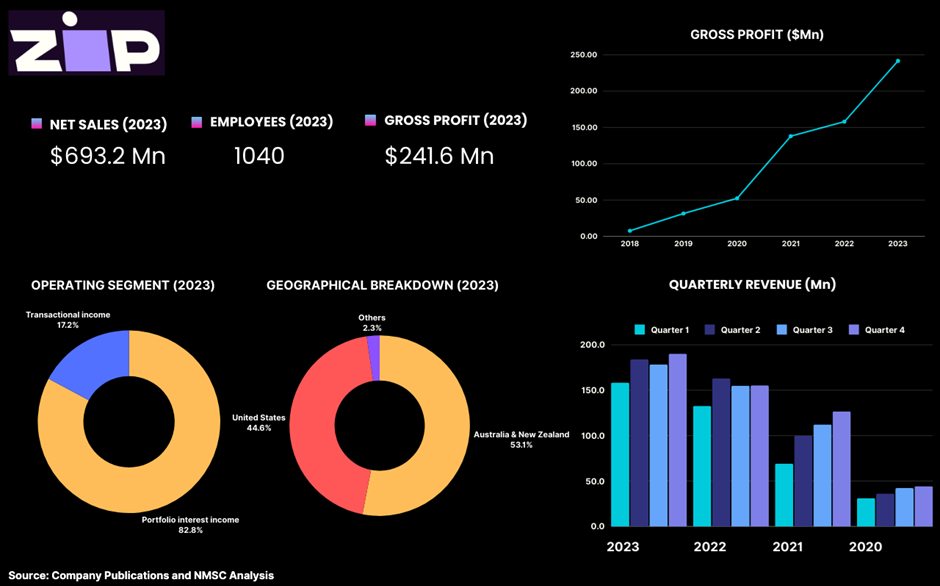

HIGHLIGHTS OF ZIP CO LTD (ZIP)

Zip Co Ltd, founded in 2013 and headquartered in Sydney, Australia, has established itself as one of the significant players in the BNPL sector. The company provides consumers with flexible payment options, enabling them to manage their purchases over time without the need for traditional credit checks. In 2023, Zip reported a robust revenue of USD 693.2 million, underscoring its strong market presence. The company's gross profit also saw considerable growth, rising from USD 157.9 million in 2022 to USD 241.6 million in 2023.

Zip’s operations are segmented into two main areas, portfolio interest income, which contributed USD 574.0 million, and transactional income, which added USD 119.1 million in 2023. Geographically, Zip's revenue is distributed across regions with USD 367.8 million coming from Australia and New Zealand, USD 309.4 million from the United States, and USD 15.9 million from other areas, reflecting its substantial international footprint.

Despite its rapid growth, Zip maintains a lean workforce of approximately 1,040 employees, which supports its agility and focus on customer service. The company's innovative BNPL solutions have significantly enhanced conversion rates and driven increased sales for its merchant partners. As Zip continues to expand its global presence, it remains dedicated to fostering a fair and inclusive financial ecosystem, reinforcing its leadership in the BNPL market.

In August 2024, Zip announced that its BNPL service would soon be available as a payment option for U.S. merchants using Stripe. Currently, this service is accessible only to beta users in the United States. This strategic move is expected to further broaden Zip's market reach and integration within the U.S. financial landscape, positioning the company for continued growth and innovation in the BNPL sector.

HIGHLIGHTS OF SEZZLE INC.

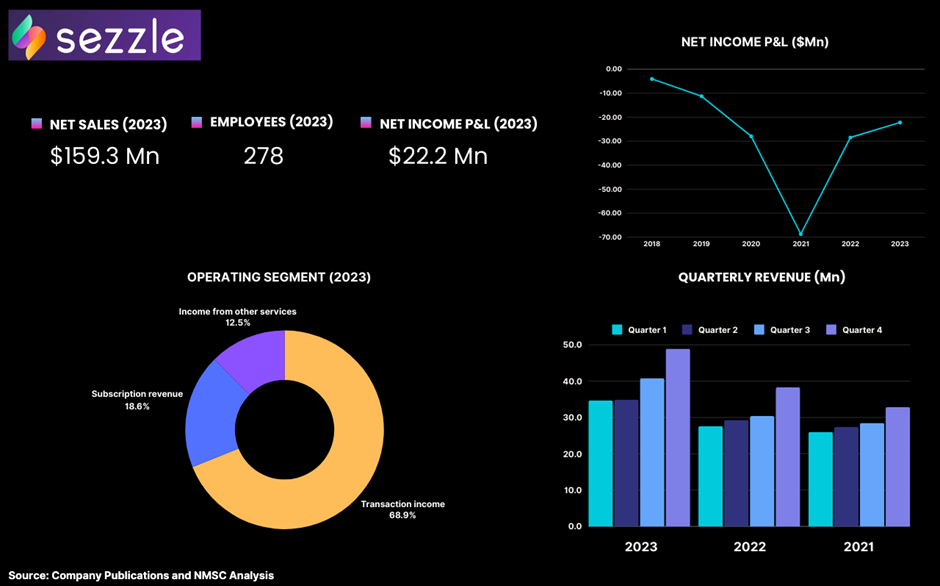

Sezzle Inc., one the pivotal players in the BNPL sector, made notable advances in offering flexible payment solutions. Established with the goal of providing consumers with alternative payment options, Sezzle achieved a revenue of USD 159.3 million in 2023, reflecting a significant increase from USD 125.57 million in 2022. This growth underscores the rising adoption of BNPL services, despite Sezzle experiencing net income losses which, while decreased from USD 28.43 million in 2022 to USD 22.20 million in 2023, indicate improved financial management.

The company's operations are segmented into transaction income, which brought in USD 109.73 million, subscription revenue at USD 29.71 million, and income from other services totaling USD 19.9 million. Sezzle's gross profit also saw a substantial increase, reaching USD 241.6 million in 2023, up from USD 157.9 million the previous year, demonstrating effective scaling and profitability.

With a workforce of 278 employees, Sezzle remains agile and focused on delivering enhanced customer experiences. Headquartered in Minneapolis, Minnesota, Sezzle has rapidly expanded its reach in the BNPL market, enabling consumers to make purchases and pay over time without traditional credit checks. This customer-centric approach has contributed to higher conversion rates and increased sales for its merchant partners.

In June 2024, Sezzle expanded its market presence by partnering with Vallarta Supermarkets, a grocery chain in California. This collaboration integrates Sezzle's BNPL services into Vallarta’s operations, allowing customers to manage grocery purchases more effectively by spreading payments over time, further solidifying Sezzle's position in the BNPL space.

HIGHLIGHTS OF BLOCK INC. (SQUARE INC.)

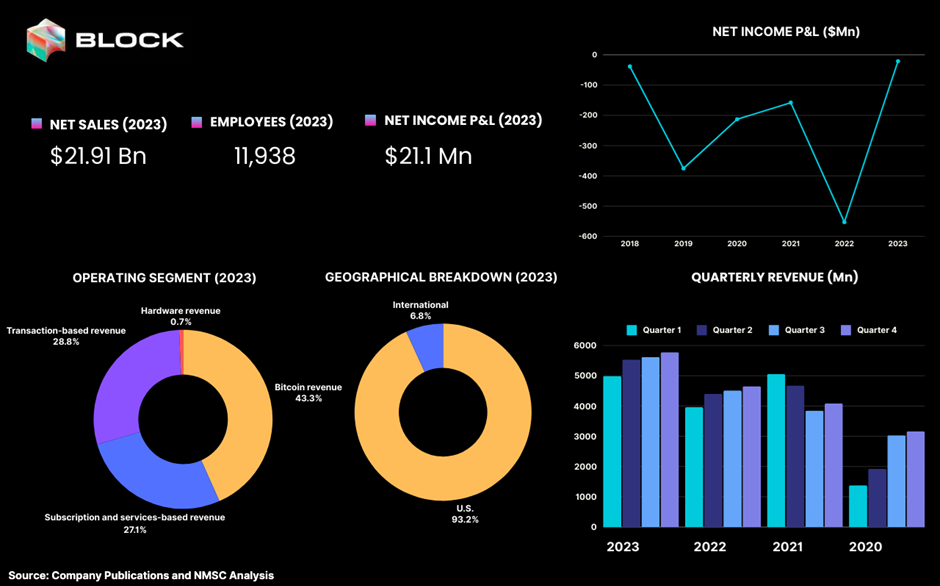

Block Inc. (formerly known as Square Inc.) has emerged as one of the prominent leaders in the financial technology sector, particularly within the rapidly expanding BNPL market. The company, founded in 2009 and headquartered in San Francisco, California, has built its reputation on providing innovative and user-friendly payment solutions. In 2023, Block Inc. reported a remarkable revenue of USD 21.91 billion, a significant increase from USD 17.53 billion in 2022. This growth trajectory underscores the company’s robust market presence and its ability to adapt to the evolving digital payments landscape. Despite the impressive revenue, Block Inc. recorded a net income loss of USD 21 million in 2023, a dramatic improvement compared to the losses of USD 553 million in 2022 and USD 158 million in 2021, indicating better financial management and operational efficiencies.

Block Inc.'s diverse revenue streams are divided into several key segments. The transaction-based revenue, which is a core part of the business, contributed USD 6.31 billion. Subscription and services-based revenue, a segment that has seen significant growth due to the increasing demand for digital financial services, added USD 5.94 billion. Additionally, the company’s hardware revenue amounted to USD 157 million, while its Bitcoin revenue stood out as a major contributor, generating a substantial USD 9.4 billion. This diverse revenue mix highlights Block Inc.'s strategic approach to capturing multiple facets of the financial technology ecosystem.

Geographically, the company's revenue distribution in 2023 was predominantly from the U.S., which contributed USD 20.41 billion, reflecting its strong domestic market penetration. International markets also played a role in the company’s financial performance, adding USD 1.49 billion to the overall revenue. Block Inc.’s gross profit saw a significant increase as well, reaching USD 7.5 billion in 2023, up from USD 5.99 billion in 2022. This growth in gross profit is indicative of the company’s effective operational management and its ability to maintain a strong market position despite challenging economic conditions.

With a workforce of 11,938 employees, Block Inc. continues to push the boundaries of financial innovation, offering comprehensive solutions that cater to both businesses and consumers. The company’s integration of BNPL services, particularly through its acquisition of Afterpay, has further enhanced its offerings, providing consumers with flexible payment options that align with their financial needs. In June 2024, Block Inc. announced the addition of several new brands to its platform, expanding the reach of Afterpay. U.S. shoppers now leverage BNPL options to manage their purchases more effectively, especially in the face of rising consumer prices across various categories. According to surveys, 4 in 5 BNPL users rated these services as an effective solution to alleviate financial stress during the payment process, underscoring the value and impact of Block Inc.'s BNPL offerings.

As Block Inc. continues to evolve and innovate, it remains a formidable player in the fintech industry, committed to driving financial inclusion, supporting businesses, and offering technological solutions that meet the demands of a modern economy. The company’s ongoing efforts to expand its BNPL services and integrate new brands demonstrate its dedication to providing consumers with greater financial flexibility and convenience, solidifying its position as a leader in the digital payments space.

Have questions? Inquire before purchasing the full report: https://www.nextmsc.com/buy-now-pay-later-market/inquire-before-buying

SUMMARY OF BNPL SERVICES

Buy Now, Pay Later (BNPL) services have gained popularity due to their simplicity and ease of use, especially among younger consumers and those with limited credit access. For merchants, BNPL has become a valuable tool for boosting sales conversion rates, increasing average order values, and attracting a broader customer base. As per the analysis of Next Move Strategy Consulting, the rapid expansion of BNPL also raised concerns about consumer debt and financial health as these services encourage overspending and lead to financial difficulties. Despite the growth, the BNPL market is facing significant losses. These losses are primarily attributed to high default rates among users, rising operating costs, and increasing regulatory scrutiny. As consumers struggle with repayments, the profitability of BNPL providers has been impacted, leading to financial challenges within the industry. To counteract these losses, companies are taking strategic initiatives such as collaborations and new product introductions. For instance, partnerships with retailers and other financial institutions are being leveraged to expand market reach and improve service offerings. Additionally, companies are introducing new payment options, such as flexible installment plans, to attract more consumers and enhance repayment rates. These initiatives aim to stabilize the market and ensure the long-term sustainability of BNPL services in the global retail ecosystem.

ABOUT THE AUTHOR

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries such as FinTech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at info@nextmsc.com

Mrinal Deb is a dedicated and enthusiastic researcher with two years of experience. He has closely monitored several industries such as FinTech, ICT & Media, Robotics, and Electric Vehicles. He offers valuable perspectives and analysis and enjoys sharing his insights through article writing and blogging. Outside of his professional pursuits, he enjoys reading and staying informed about industry developments. The author can be reached at info@nextmsc.com

Add Comment

Related Blogs

IBM Corporation: Leading the Market with USD 61.86 billion Revenue and Advanced AI Innovations

Next Move Strategy Consulting forecasts a substantial rise i...

Navigating Vision: A Deep Dive into Eye Tracking Innovations

Introduction The eye tracking industry is thriving due to increased research...

How Modern Robot Software Pave the Way for Intelligent Machines

Introduction The field of robotics has undergone a remarkable revolution, evo...